This article outlines the geology of the Idaho Cobalt Operation (ICO), an advanced project expected to start production by Q4 2021. Insights into the global cobalt supply chain as demand rises are also provided.

Introduction

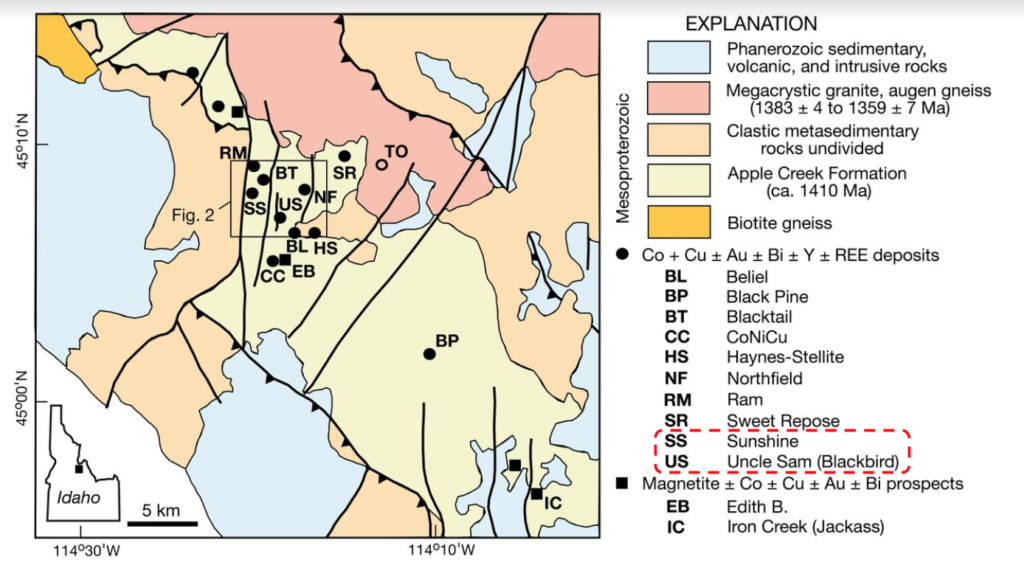

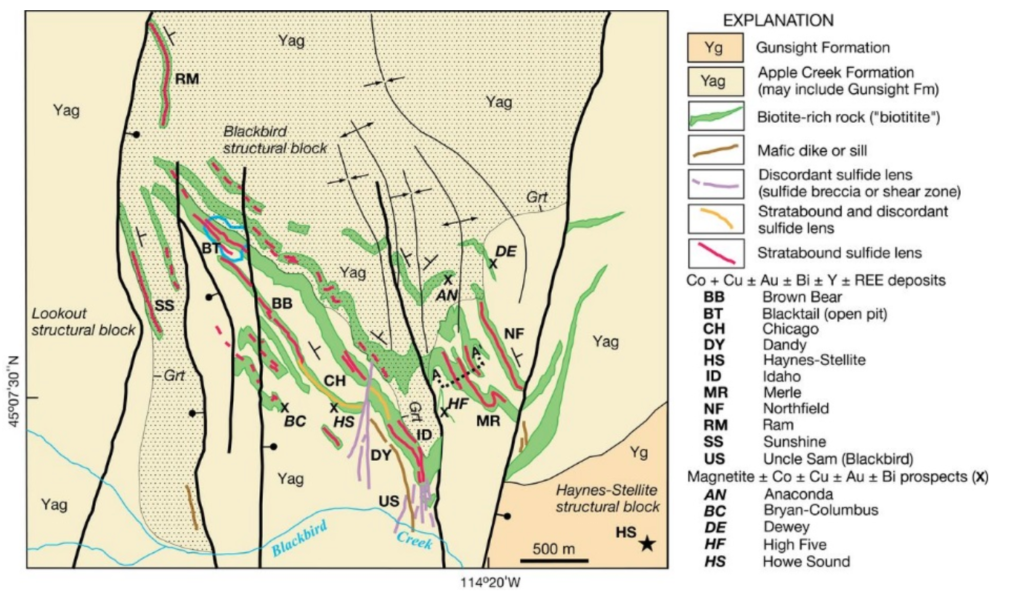

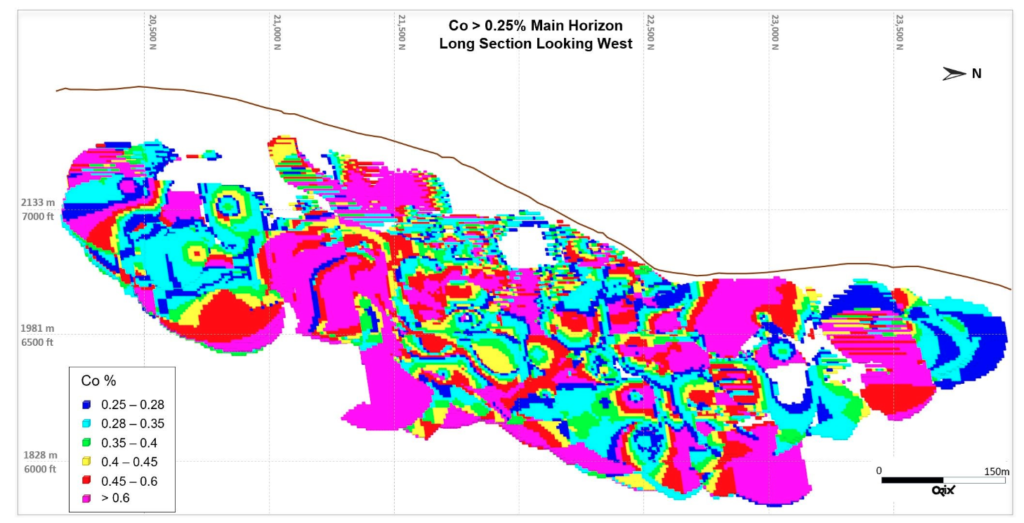

The Idaho Cobalt Operation (ICO) is located in the historic Idaho Cobalt Belt, approximately 40km west of Salmon, Idaho, in the United States. The project is owned by Australia-based Jervois Mining Limited (ASX:JRV, TSX-V:JRV, OTC:JRVMF, FRAC:IHS). Historical production in the district records ca. 2.4Mt of contained cobalt ore at 0.8% Co, 2.1% Cu, and 3ppm Au (Figure 1). The ICO deposits are classified as sediment-hosted, stratabound (confined to a single rock unit) copper-cobalt deposits with gold as a by-product. As of January 2020, measured and indicated mineral resources of 3.87 Mt at 0.59% Co were reported for the ICO deposits, making it the largest NI 43-101 compliant cobalt resource in the United States. The ICO represents not only the highest cobalt grade project active in North America but one of the highest cobalt grades in the world, with 5.77 Mt at 0.44 % Co, 0.69 % Cu, and 0.53 g/t Au using 0.15% Co cut-off.

Geological Overview

The Idaho Cobalt Belt comprises a 60 km long and up to 10 km wide northwest-trending district that hosts several Co-Cu±Au deposits related to metamorphosed mafic volcaniclastic rocks (Figure 2). The ICO includes the inactive Blackbird mine, and the Ram, Sunshine, and East Sunshine deposits, in addition to several prospects and exploration targets. Cobalt deposits in the ICO are geographically related to mafic rocks of the Apple Creek Formation.

The deposits were formed during a mafic volcanogenic-exhalative seafloor hydrothermal event (venting of ore-rich hydrothermal fluids) in Mesoproterozoic times (at ca. 1300 Ma). The remobilization of copper and, to a lesser extent, cobalt, in irregular amounts followed more recent metamorphic events that affected the belt. The Idaho Cobalt Belt is a unique and geologically complex deposit, and has previously been categorized as Sedimentary Exhalative (SedEx), Volcanogenic Massive Sulfide (VMS), and IOGC (Iron Oxide Copper-Gold). However, recent studies have classified the ICO deposit type as “Co-Cu-Au deposits hosted in metasedimentary rock”.

Mineralization

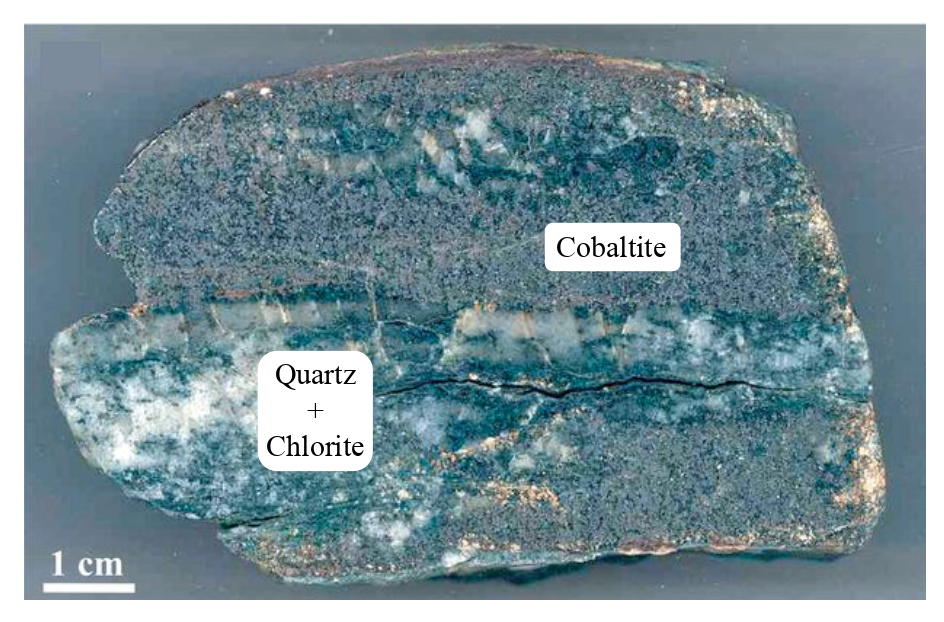

Stratabound mineralization at ICO occurs as ‘stratiform’ and vein-type orebodies (Figure 3). Stratiform deposits are ore deposits that are restricted to a single stratigraphic unit, form from a hydrothermal event, and closely resemble sedimentary rocks in appearance. The main ore minerals are cobaltite (CoAsS) and chalcopyrite (CuFeS2), with minor pyrite (FeS2), arsenopyrite (FeAsS), safflorite (CoAs2), and pyrrhotite (Fe(1-x)S). Gangue minerals (commercially worthless minerals) include quartz, biotite, chlorite, muscovite, garnet, tourmaline, apatite, and siderite.

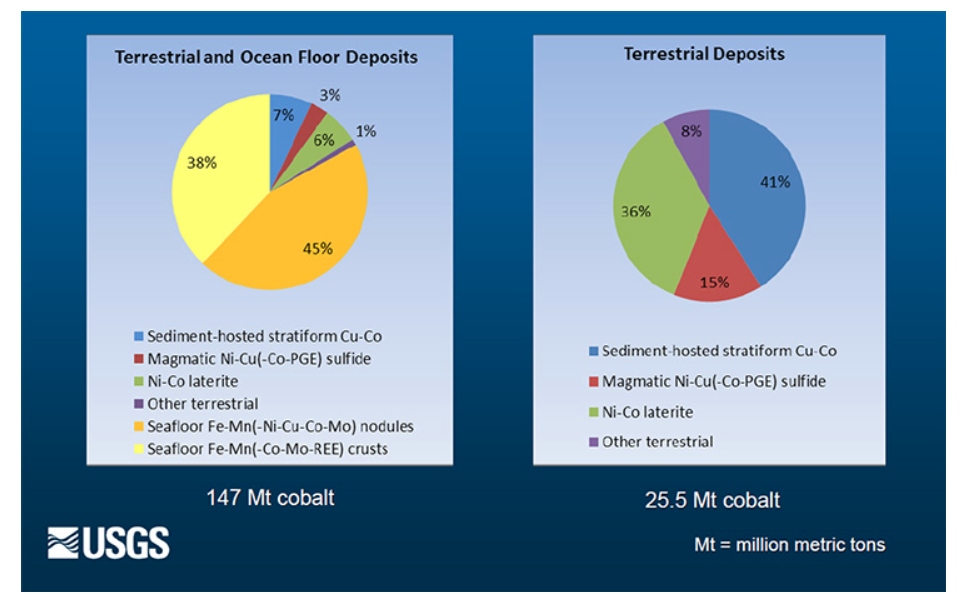

The ICO deposits exhibit an unusual enrichment of Co, Cu, Fe, As, Au, B, Bi, and light rare earth elements, combined with a depletion of Ni, Ag, Pb, and Zn. Major worldwide cobalt mines are associated with sediment-hosted deposits that, unlike the ICO, are characterized by high amounts of Pb and Zn. Other major sediment-hosted Cu deposits also contain Co, including the remarkable deposits of the Katanga province in the Democratic Republic of Congo (DRC) and the adjacent Zambian Copperbelt. The world’s only primary cobalt mine is Bou-Azzer, in Morocco, which is owned by Morocco-based Managem (CSE:MNG).

Implications for Mineral Exploration Worldwide

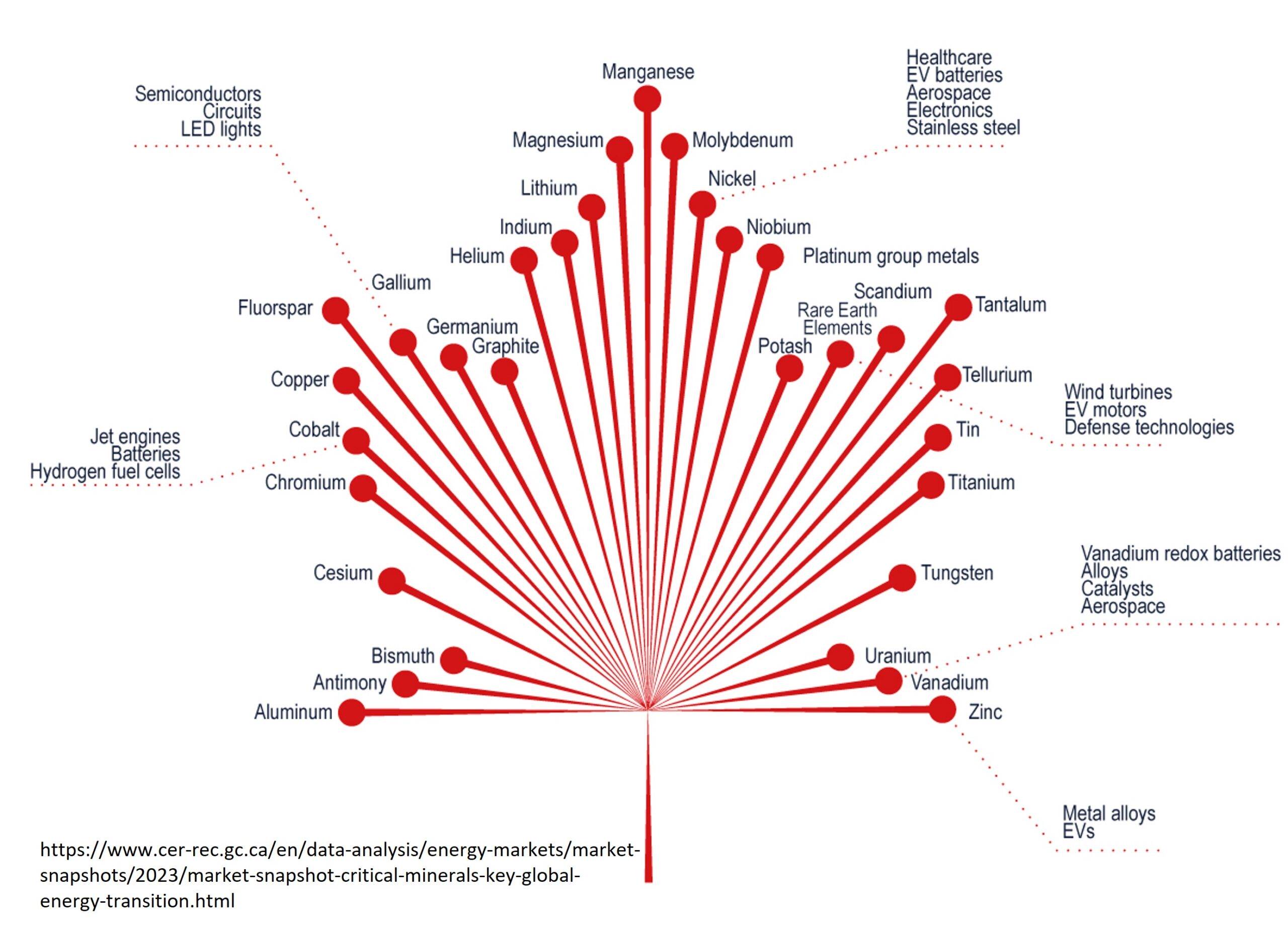

Often mined in tandem with nickel or copper, cobalt demand has increased in recent years mainly due to its use in electric vehicles (EV’s) and lithium-ion batteries, which typically require lithium, magnesium, and cobalt, among other metals. Cobalt in particular has become a matter of concern in the renewable energy industry, mainly due to mining conditions that often violate human rights and to the vulnerability of its fragile supply chain. Other uses of cobalt outside of battery purposes include superalloys, magnets, chemical catalysts, pigments, and cutting tools.While ion-battery demand is expected to keep rising sharply, ethical, low capital resources other than the ICO are rare.

In the US, additional cobalt resources include several deposits and prospects hosted in Alaska, such as the Bornite copper-cobalt deposit owned by Canada-based Trilogy Metals Inc. (TSX:TMQ; NYSE:TMQ) in the Ambler Mining District. According to a USGS study in the region, other similar carbonate-hosted copper targets likely present interesting cobalt potential. However, the US currently imports about 61% of its cobalt supply from overseas suppliers. The majority of that supply comes from recycled materials. Such dependence may lead to potential supply disruption and high prices during supply shortfalls.

In addition to typical sedimentary-hosted deposits, cobalt resources are also identified on the floor of deep seas. However, the mining feasibility of these deposits is still widely contested due to its potential environmental consequences and substantial costs.

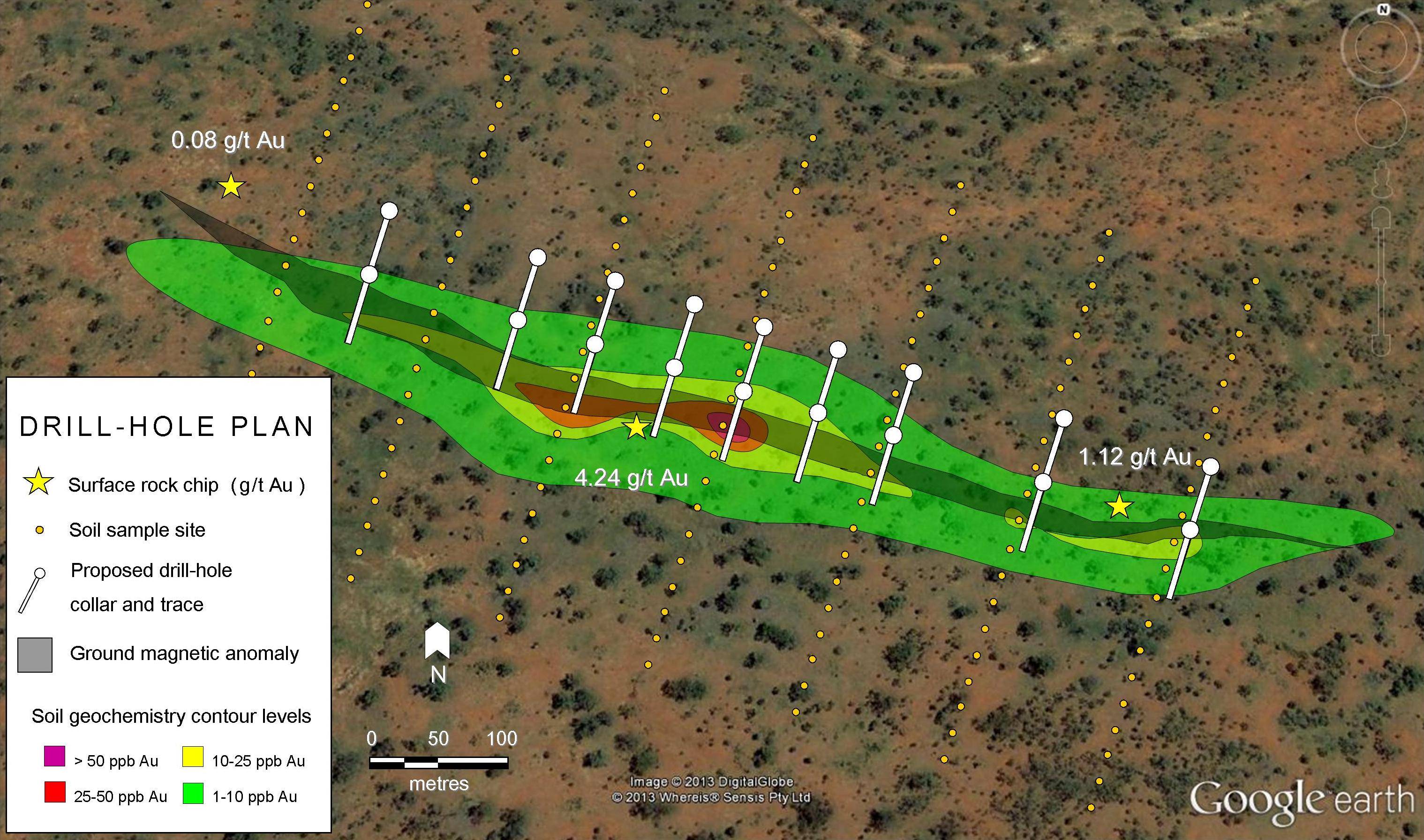

Exploration for ICO-like prospects and/or deposits worldwide may target areas at the vicinity of mafic rocks and/or early gabbroic sills and rapid sedimentary facies changes indicative of growth faults. The geochemical signature of the ICO deposit is typified by enrichment in Fe, As, B, Co, Cu, Au, and Mn, together with depletion in Ca and Na. In terms of geophysics, the sulfide lenses that typically characterize these deposits may be depicted either via electromagnetic or induced polarization methods.

Investor Takeaways

With the run for green energy in full swing, there is compelling evidence that demand for cobalt will keep growing as a prominent metal in the future. Cobalt has become more and more popular in the realms of the so-called ‘cleantech’ metals, such as copper, nickel, and zinc. However, the controversial engagement of child labour related to cobalt mining and socio-political concerns involved may endanger supply to meet the soaring demand.

While Tesla (NASDAQ:TSLA) and other companies are striving to reduce the amount of cobalt in rechargeable batteries, according to researchers and analysts, a cobalt-free battery scenario is far from reality. As a critical safety component in lithium-ion batteries, cobalt is unlikely to be cast out of lithium-ion batteries in a foreseen future. If the demand for cobalt continues to grow as predicted, the need for additional cobalt sources will be paramount.

Further Reading

Slack, J.F., Kimball, B.E., and Shedd, K.B., 2017, Cobalt, chap. F of Schulz, K.J., DeYoung, J.H., Jr., Seal, R.R., II, and Bradley, D.C., eds., Critical mineral resources of the United States—Economic and environmental geology and prospects for future supply: U.S. Geological Survey Professional Paper 1802, p. F1– F40 (pdf).

List of Companies Mentioned

Subscribe for Email Updates