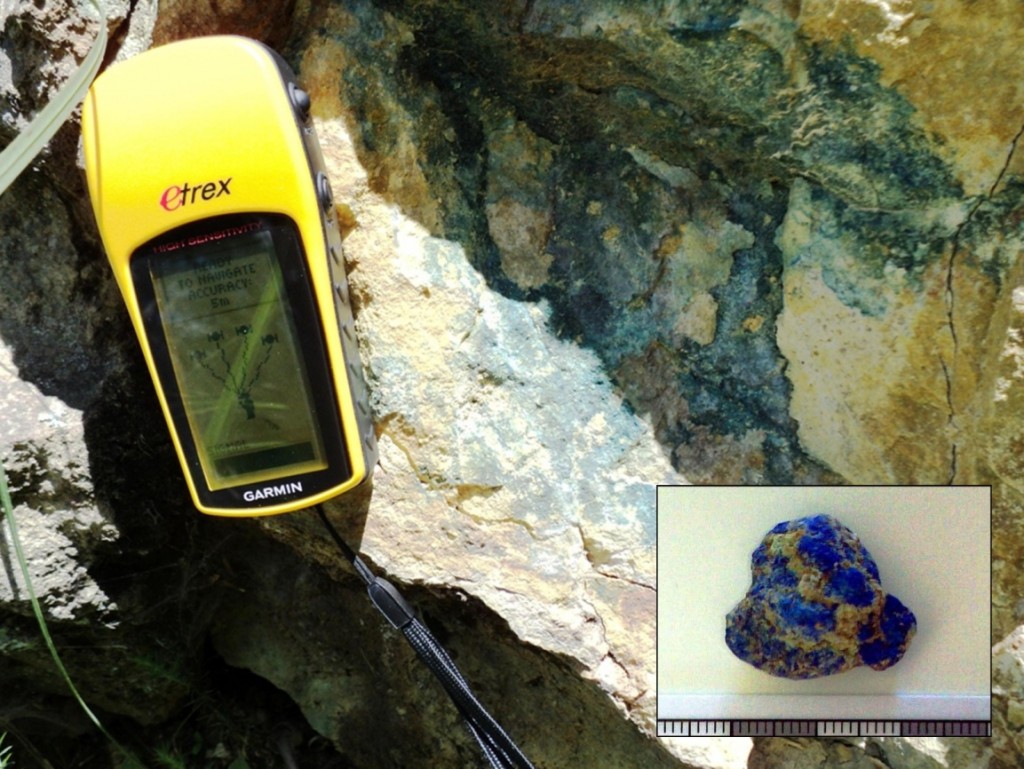

Although cobalt (Co) is well known for the blue dyes that bear its name, metallic cobalt is a lustrous silver-grey. Metallic cobalt is ferromagnetic (can be magnetized) and has a very high melting point of 1500 degrees Celsius. It is a critical ingredient in high temperature and wear-resistant strategic metals as well as high temperature magnets and rechargeable batteries. In particular, cobalt is a key ingredient in the production of lithium batteries.

Deposits

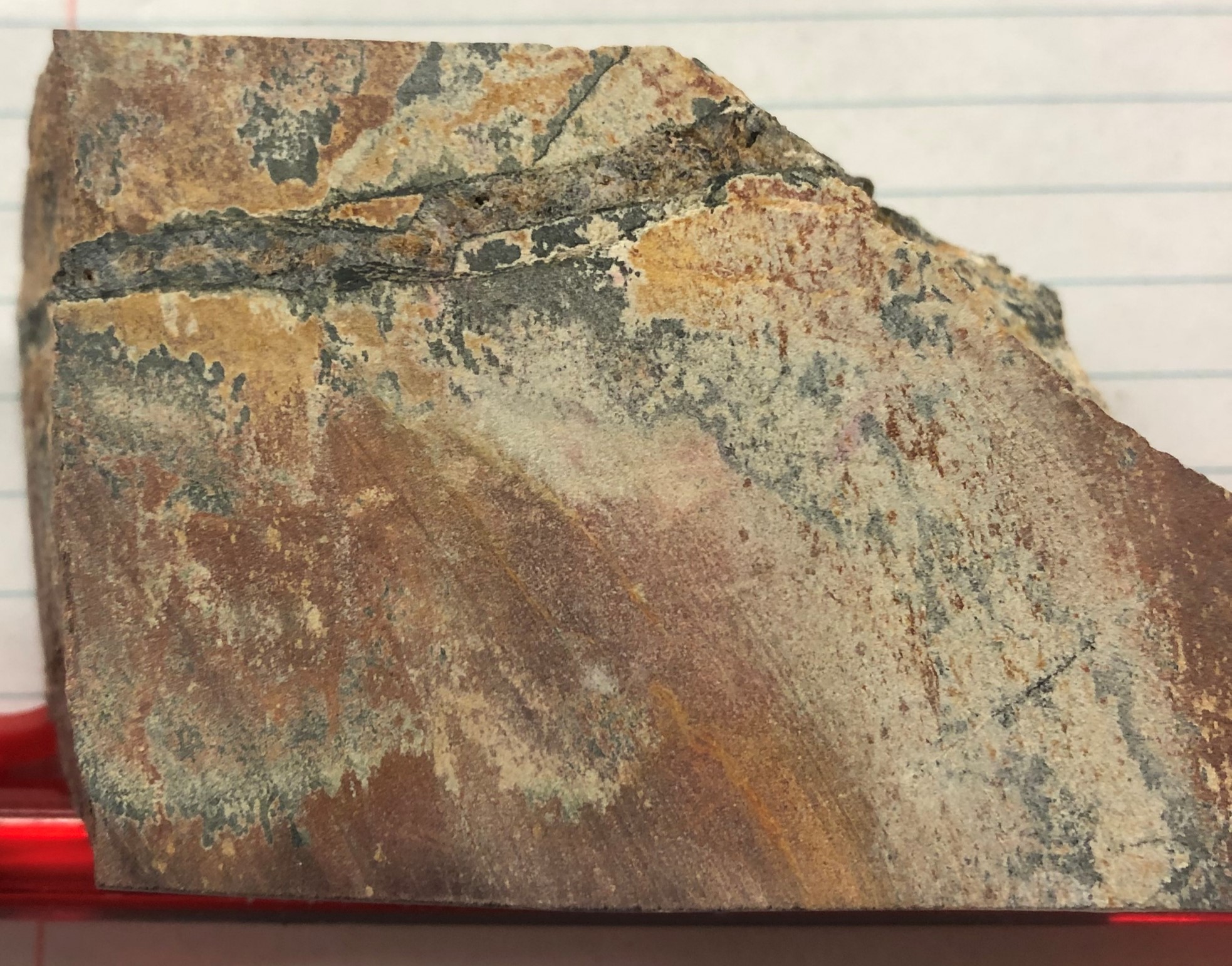

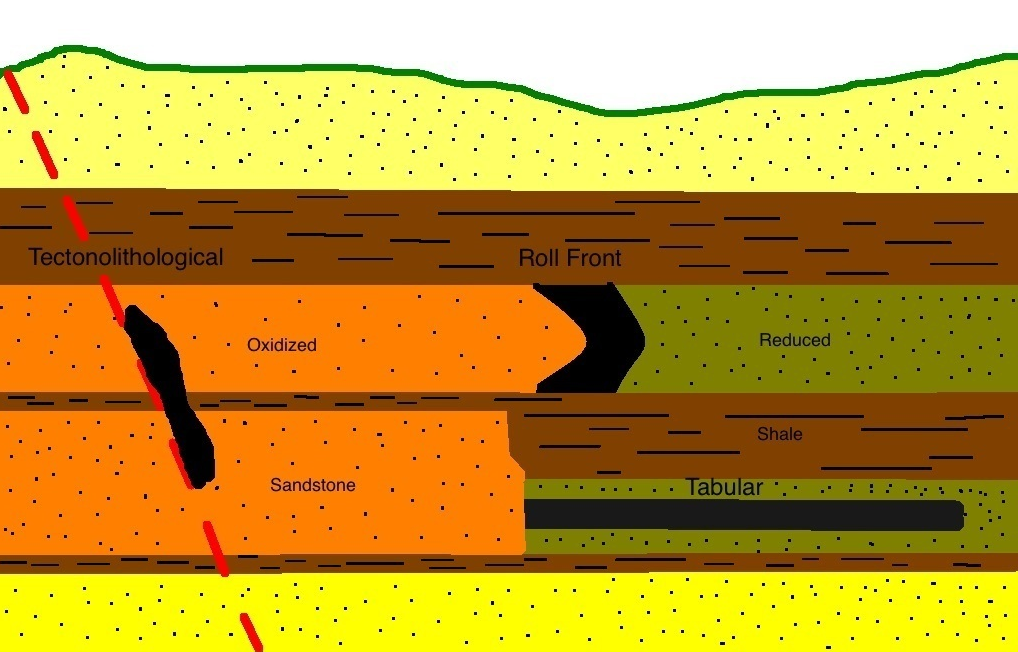

Since Cobalt rarely forms economic in concentrations it is typically recovered as a by-product from other types of deposits. Three main deposit types make up 97% of world cobalt production: The copper-cobalt deposits of the Central African Copper Belt, nickel laterite deposits such as those of Australia and New Caledonia, and magmatic nickel sulfide deposits like Sudbury and Norilsk. Of the three types, production from the copper deposits of Central African Copper Belt are by far the largest.

There are very minor deposits were Cobalt is the primary commodity but these only make up 3% of world-wide production. Hence the Cobalt market is a function of the Nickel and Copper markets as supply is determined by how much demand there is these markets. Artisanal mining of Cobalt is a significant source of production in the Democratic Republic of Congo but does not occur elsewhere.

Terrestrial deposits account for all production, but they are a small fraction of the total resource, as the largest concentrations of Cobalt are in seafloor Iron-Manganese nodules and crusts. Of 150 Million tonnes of known resources, seafloor resources account for 125 Million tonnes.

Processing

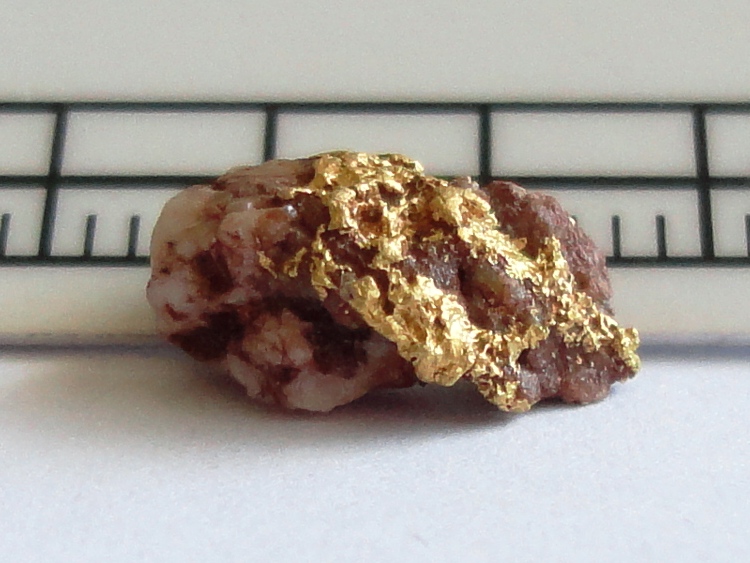

Like many metals, cobalt does not naturally occur in pure metallic form. It occurs primarily as minor sulfide minerals and arsenides in copper and nickel ores and requires substantial effort to liberate. In Cu-Co deposits where cobalt grades are relatively high a separate Cobalt circuit is used to remove the Cobalt from the Copper concentrate. Where not rich enough to have it’s own circuit, the Cobalt is recovered later during the smelting process either from the slag of Copper smelting or from electrolytic refining in Nickel processing.

Market

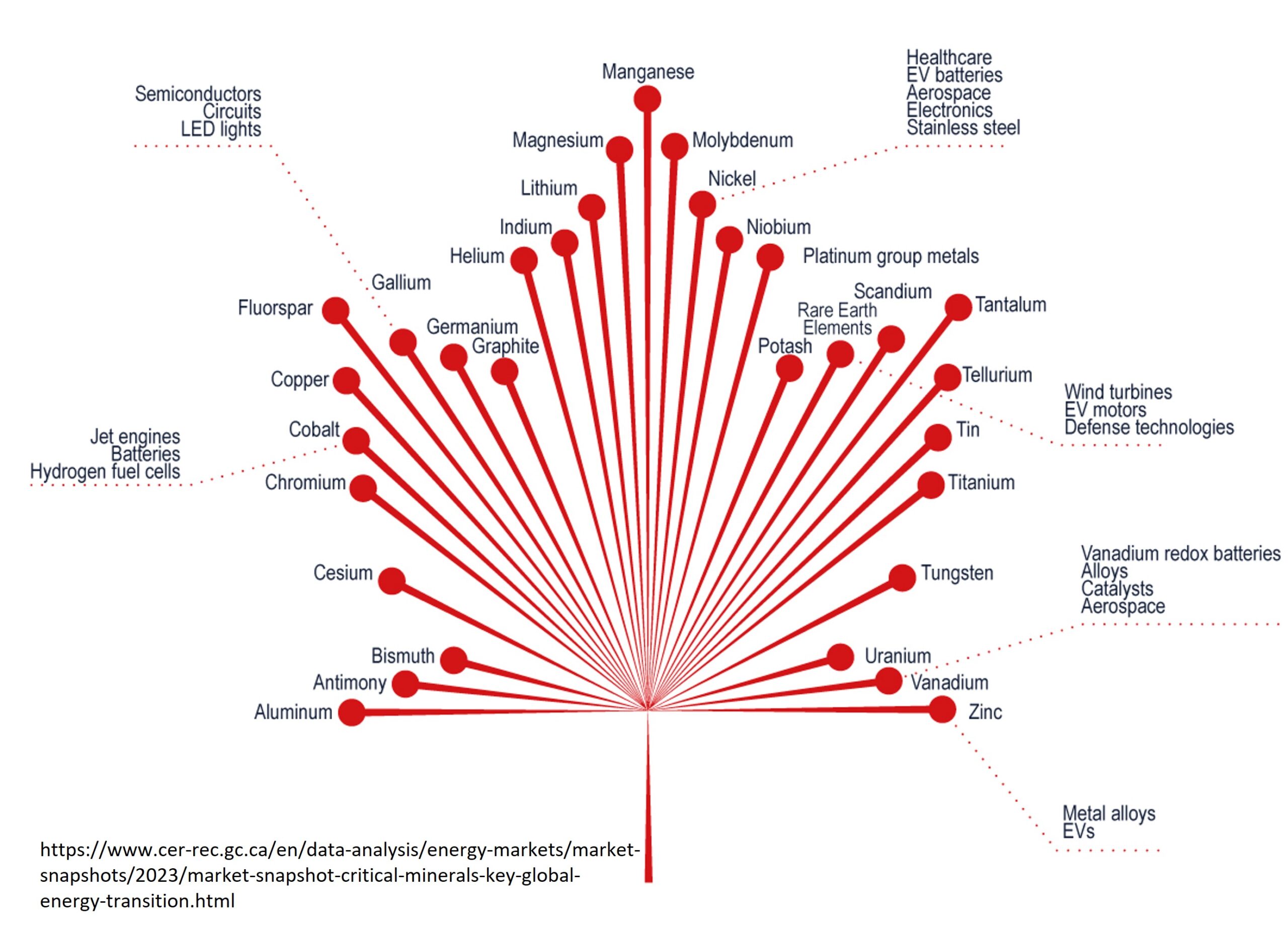

Cobalt has long been considered a strategic metal for it’s use in defense technology and aircraft, but it’s use in rechargeable lithium batteries has made it one of the “new strategic metals” along with lithium, rare earths, antimony and tungsten. As demand for electrical power storage increases so too will the demand for cobalt – at least until some new technology comes along.

While it’s anyone’s guess where the recent surge in cobalt prices will go, the long term outlook for Cobalt is considered very positive given its role in lithium ion battery technology. With the the rise of battery powered vehicles, cobalt consumption is expected to rise at 11.7% CAGR (Compound Annual Growth Rate).

Cobalt is not rare, but increased demand and prices may help previously uneconomic cobalt-bearing deposits suddenly look attractive.

Further Reading

- USGS Cobalt Conference 2015 Presentation (PDF)

- USGS Mineral Resources Program “Cobalt – For Strength and Color” (PDF)

- USGS Cobalt Commodity Report 2016 (PDF)

- NOAA “Deep-sea Mining Interests and Activities in the Western Pacific” (Link)

- Daily Metal Price: 5-Year Cobalt Chart

Subscribe for Email Updates