That’s the problem. Not every drill result is good. As investors we must evaluate public results with a critical eye and approach every mining company news release as questionable. Our investment depends on it.

For junior miners, especially those with early-stage projects, drilling represents a significant exploration expense. The results of a drill program can make or break a project and where management is concerned, those results should always be good.

That’s the problem. Not every drill result is good. As investors we must evaluate public results with a critical eye and approach every public release as questionable. Our investment depends in it. In this article we review a few items to watch out for when reviewing company drill results.

We’ve talked about reporting interval thickness and proper QA/QC programs before so those won’t be reviewed in this article, but you should familiarize yourself with those concepts as well.

Drill Highlights

This is a big one. Nearly every release will have highlights, but how significant are they? Do they add value to the project? Are they anomalous or continuous?

Consider this drill result:

| Drill Hole | From (m) | To (m) | Gold (g/t) | Thickness (m) |

| 1A | 61.50 | 69.00 | 20.50 | 7.50 |

| including | 66.50 | 68.00 | 96.90 | 1.50 |

This drill result includes a fantastic 96.90 g/t gold across a 1.5 meters interval with 20.50 g/t over 7.5 m.

Is this good? It depends.

One of the problems is that the highlight skews our average grade up significantly for the full interval. We can remove the highlight and calculate the grade of the remaining 6.0 meters as follows:

First we multiply our intervals by our grades:

7.50 m x 20.50 g/t = 153.75 (larger interval) 1.50 m x 96.90 g/t = 145.35 (highlight)

Then we take the difference between the two:

153.75 - 145.35 = 8.40

Calculate the remaining interval length:

7.50-1.50 = 6.00 m

And divide our meter-grade difference by the remaining drill interval:

8.40 / 6.00 m = 1.40 g/t

So what we really have is 1.5 meters of 96.90 g/t gold and 6 meters of 1.4 g/t! By all accounts the published result appears misleading, but it may not be. Consider the following scenarios:

- This is a narrow vein hosted gold deposit (like an epithermal gold deposit) and the high grade zone is continuous through several drilled intervals. The low grade zone may be an alteration halo that could be used track deposit continuity and target higher grade zones. It may also be above the cut-off grade especially in an open pit mining scenario. In this case it is a perfectly legitimate and positive result.

- This could be an isolated “nugget effect” anomaly. Not within a continuous zone and not found elsewhere. In a very early stage exploration project this could be a target worth following up on. In a more advanced project the result may be meaningless.

There are a number of other scenarios which may apply, but all of them involves understanding the nature of the deposit and, at least to some degree, the project geology. Of course, it’s also quite possible that the results were intended to be misleading. This is sometimes referred to as “grade smearing” and happens more often than we’d like to think.

Aside from taking a look at the highlights, the reader should ask themselves a few other important questions:

Cut-Off Grades

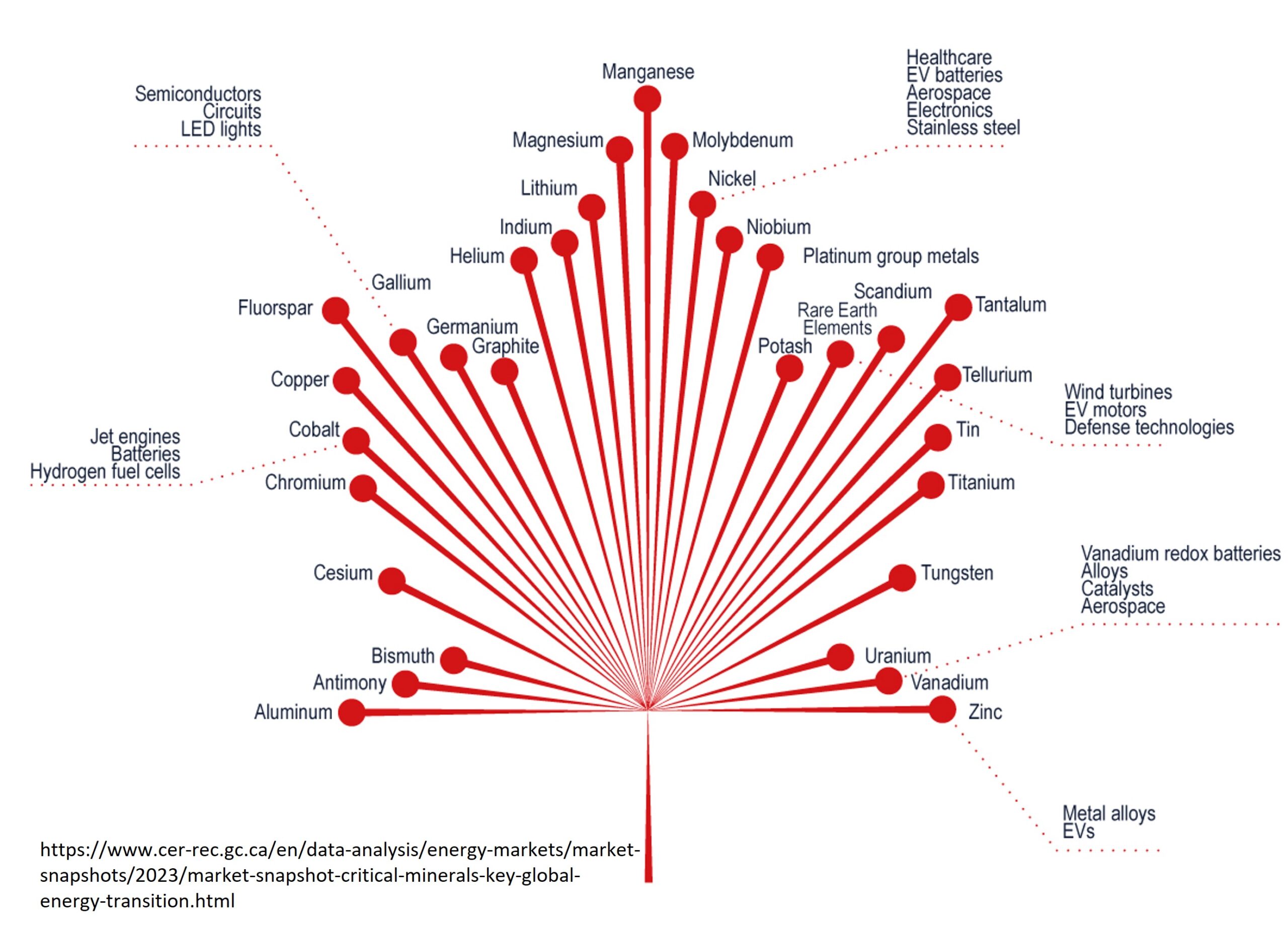

Is the result within the cut-off grade for the deposit? Or if the cut-off grade is unknown, is it above a cut-off grade for comparable deposits? In large homogeneous open pit copper-gold porphyry deposits or Carlin-trend style gold deposits, very low grades are typical. In underground mines, much higher grades are generally required. Companies will sometimes choose overly optimistic cut-off grades based on market-high commodity prices and highly favourable recovery rates. When times get even moderately tough for commodities these cut-off grades can become completely useless.

Grade Equivalents

Speaking of recovery rates, it is common especially in multi-commodity deposits to report assay results as a grade equivalent, or “Eq”. This is most common in copper porphyry deposits and can allow the reader to compare the combined value of the various commodities. Consider the following example:

| Drill Hole | From (m) | To (m) | Width (m) | Cu % | Mo % | Au g/t | Ag g/t | Cu Eq. % |

| B1-100 | 6.5 | 37.0 | 30.5 | 0.37 | 0.037 | 0.55 | 1.43 | 0.92 |

In this example the company is telling us the the total grade of the sample is 0.92% copper if all the accessory metals were converted to copper. The problem with these calculations is that they generally assume a 100% recovery rate for all of the accessory metals and use current market prices for the conversion. The market prices that are used can significantly impact the Eq calculations. In this example from a few years ago the company used $2.50/lb copper, $1200/oz gold, $15 silver, and $10/lb molybdenum. These are reasonably conservative calculations, but the issue here is they have undervalued the value contribution of the copper which gives the gold a greater weight in the calculations.

If we change the copper price to $3.50/lb and keep all other values the same our CuEq goes down to 0.76% which is significantly less interesting and we’re still assuming a 100% metal recovery rate. This is because the value contribution of the copper is higher, making the accessory metal contributions less important.

Suppose the economics were a little more robust. Let’s use 2024 metal prices with $4.93/lb copper, $2389/oz gold, $29.58 silver, and $31.40/lb molybdenum. We end up with a CuEq of 1.01% which is more similar to our first example. This calculation uses relative price equivalents so the higher price of everything removes the overweighting of any individual contributor. Eq calculations can be useful as apples-to-apples comparisons, but be mindful of the variables. The point is that these numbers can be easily manipulated and, unlike a straight grade calculation, will continuously fluctuate with the market.

While it’s true that published data is often massaged by over-eager public relation teams and can at worst be the intentionally misleading efforts of a desperate company, news releases can also be an excellent source of information on up-and-coming projects. With a critical eye and a bit of research smart investors can find the gems and identify the dead-ends.

Subscribe for Email Updates

Pingback: High Grades from San Gold’s Mine. Is Profit Around the Corner? | Geology for Investors

Great article, thanks! Bookmarked for ongoing reference 🙂