A company covered by this site in the past has released a new resource. It was:

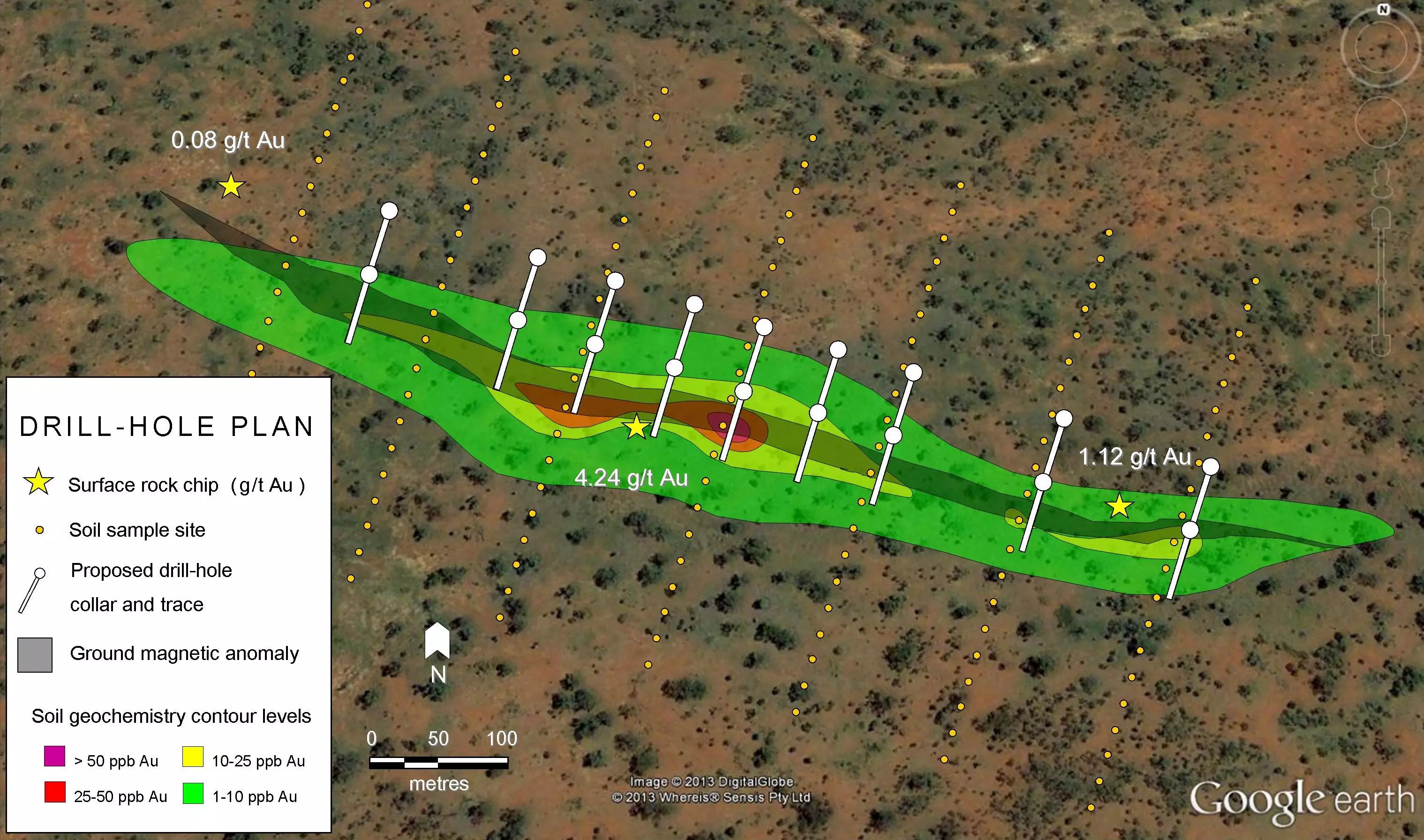

- 281,059 AuEq oz in the indicated category (1.21 Million tonnes (“Mt”) grading 7.23g/t AuEq at 3.5g/t AuEq cut-off)

- 319,675 AuEq oz in the inferred category (1.64 Mt grading 6.18g/t AuEq at 3.5g/t AuEq cut-off)

That’s a lot to unpack for an investor! There are two important things to pay attention to: the quality of the resources and the cut-off grade. Right now, I’d like to focus on what the numbers on the left hand side are; 7.23g/t AuEq at 3.5g/t AuEq cut-off. First number is the average grade of the deposit and the second is the cut-off grade. What is the cut-off grade? In simple terms everything above the cut-off grade is ore, everything below is waste. In essence, it is the core determinate when defining an ore body. It will determine all of the critical parameters, such as the grade of the deposit, the size of the deposit and the amount of metal produced from the deposit. Get it right and you can take it to the bank. Get wrong and the mine becomes a large pit in the ground where money and dreams are shoveled in by a Komatsu P&H 9020C.

You might think that such a critical element would be subjected to the utmost of regulatory scrutiny, however the key regulatory bodies do not provide much detailed guidance. Both the CIM and NI 43-101 provide guidance for general assumptions but only stipulate that they are tested against a “reasonable prospect of eventual economic recovery”. This has lead to issues in the past where in commodity bull markets, cut-off grade has dropped dramatically as metal prices rose. This led to rapid inflation of deposit size and more than one investor has been left with a “low grade pig” as they are charmingly known.

More pertinently even in quality deposits, getting cut-off grade right is of critical importance. If cut-off grade is set too low, then there is overcapacity and equipment meant for a 40,000 tonne a day mine, is expensively underused at 20,000 tonnes a day. Moreover, mines are expected to last a certain number of years, to pay off their capital costs, and return capital to shareholders. By setting cut-off grade too low, what was ore is now re-classified as waste and tonnage evaporates. Hence the mine life is shortened leaving someone, or everyone out of pocket. If cut-off grade is set too high then there is undercapacity and bottlenecks in production. This has two negative impacts a) it is very expensive to upgrade milling and mining capacity at a later date, and b) the mine suffers “paper losses” as it is unable realize its full potential by selling the quantity of metal that it could have. This is extremely costly in times of rapid metal price appreciation. Still, it is better to have a higher than lower cut-off grade, as a higher cut-off grade will extend the life of the mine, and if there is a business case, capacity can be added.

So using the example above, we can assume that 3.5g/t AuEq is the calculated minimum ore grade necessary to operate productively given all the geologic, environmental and economic variables present at its location. So why is the AuEq grade so much higher than the cut-off? Since it is an arbitrary number and not the actual assayed grade of the deposit, it includes all the tonnage greater than 3.5 g/t AuEq. In gold deposits this can run into the hundreds or thousands of grams higher than the cut-off grade, leading to a much higher average grade. From the project quoted above, there are some extraordinary intervals of gold mineralization.

It should be noted that cut-off grade is not a static concept applied across all types of deposits. It is affected by royalties, style of mining (underground vs open pit), type of deposit, dilution and need for mill feed among many other variables. Within mining professionals there is a lively debate as to what costs should be included in cut-off grade and what costs should be left out.

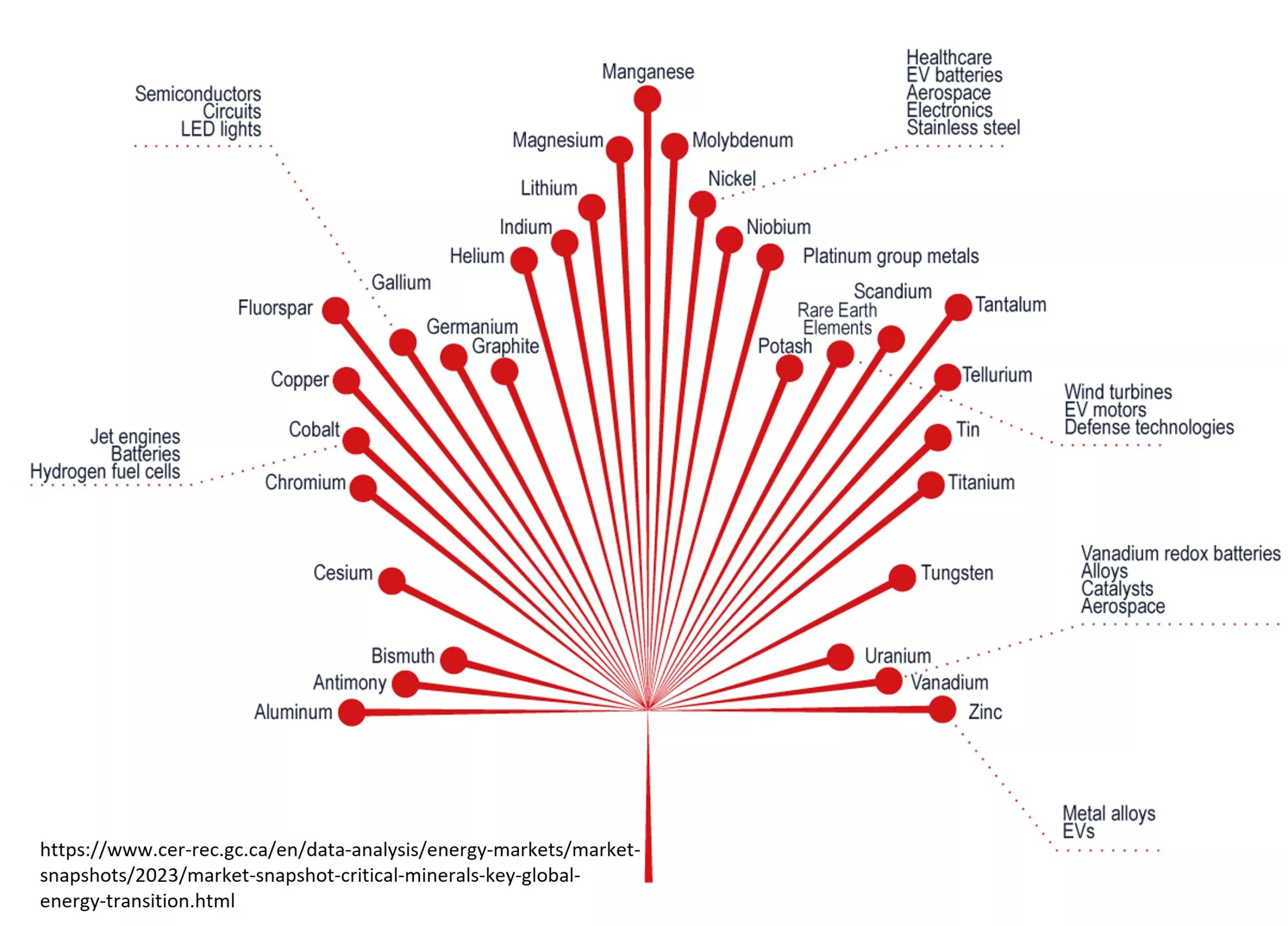

A few tricks can useful for determining what is a reasonable. Where is it? Up north in the Yukon and the like, 5 g/t gold or equivalent would be a safe bet. Further south and closer to infrastructure you can get a bit more for a bit less with mines like Copper Mountain in BC using a 0.18% – 0.2% copper cut-off. Down in Nevada on the heap leach, mines can make do with 0.1 g/t gold cut-off. Does it make sense for the deposit? 0.1 g/t gold makes sense for an oxide gold deposit in Nevada, less so for Tintina style gold deposit in Alaska. Likewise, 0.5% copper would be an extremely high cut-off for a porphyry copper deposit (outside of Escondida) . Finally does it look like they have done their homework? Establishing cut-off grade is a process not single event. A cut-off grade is proposed, and then the parameters of the deposit are calculated, and tested against economic scenarios. If it fails the process is started again with a different cut-off grade. In some cases it may never work.

In summary, cut-off grade is one of the most important, yet least understood variables for making an investment decision. It determines how much, and how long the mine will make money for and whether the mine will ever make any money at all. It definitely repays the attention given to it.