Having a basic understanding of the orebody modeling and the mine optimization methods used can help investors determine how much effort a company places into the quantification of risk to manage their assets.

This article briefly describes some aspects of geological and technical risk analysis in mine planning projects. A full account is beyond the scope of this article, as the full breadth of this intricately complex topic is the combined effort of many research papers and books.

What makes a mining project profitable?

Notwithstanding global macro-economic drivers for particular minerals at a given point in time, the key concept in mining is the extraction of material from the earth that leads to a profit. It follows that whatever material extracted and processed for this purpose is generally called the ore. Starting with simple terms, the principal profit equation in any mining venture is:

Profits = Revenues – Costs

Profits = Units of Material sold x Price/unit – Units of Material sold x Cost/unit

The price is typically set by others through the effect of global supply and demand. What differs from project-to-project is the mining engineering team’s ability to effect price per unit costs. This is done through a better understanding of the deposit as well as the use of site-specific innovation to improve the extraction process. Innovation, in this context, serves to describe the different strategies used to define and extract ore. Technology is only important in a site-specific context; otherwise, it can be assumed that it does not take very long for everyone to have the same ‘new’ technology.

Cost reduction through safe and environmentally responsible practices is taken extremely seriously today. If it is not done from an ethical standpoint, it is in large part respected given the negative effect that a poor social media image can have on shareholder investments and the company’s future. From a socio-economic point of view, these terms are tied together:

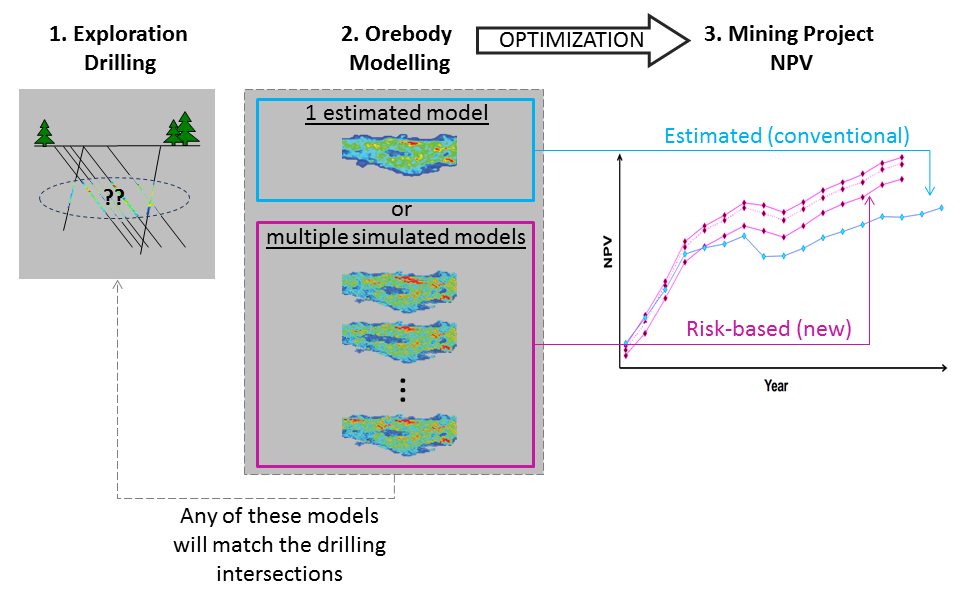

An orebody model represents a quantified understanding of a mineral deposit in three-dimensional space. In a mining venture, the orebody will be discretized into a group of blocks, which are used to define an optimal mining sequence of extraction by way of an optimization process. Note that the decision to mine a deposit is based on relatively limited drilling information (compared to the entire deposit) provided by the exploration and planning phases – i.e. the conclusion of a feasibility study.

Orebody Modeling: Understanding the Origin of the Risk

The orebody model and the blocks that represent it are the starting input for the optimization process. Typically, drilling information used to construct an orebody model will comprise less than 5% of the total volume of the deposit. For this reason, geostatistical estimation methods, combined with geological modeling/interpretation, have commonly been used to model the spatial distribution of mineral grades between drilling locations and within the mining blocks representing a deposit. However, despite their current use, it should be known that these estimation techniques are not capable of using the drillhole data to reproduce the in situ variability of the deposit grades.

What does this mean? Using a simplified block model below, it means that any estimation process, such as kriging or inverse distance weighting, will have a smoothing effect on the modeled data such that an estimate for the ‘ ? ’ block will result in a value between 1 and 5 but never 1 or 5. If we consider these numbers as representing mineral grades, we are left with a model that consistently under-represents important information about high-grade blocks. In other words, the effect of this smoothing, starting at the orebody model, has considerable implications through the mining production optimization process and the subsequent financial return expectations of the project. Furthermore, estimated models do not provide any quantification of uncertainty in the mineralized ore, leading to an uncertain input supply variable for mine production scheduling. This is an important factor in any investment decision.

Optimization: Innovation in the extraction process

Optimization in mine planning refers to the forecasting, maximization, and management of cash flows from a mining venture resulting from the extraction of the orebody. The objective of the optimization is to maximize the total NPV of the mine plan. Optimization is a necessary tool of any financially efficient mining operation.

Traditional optimization techniques will assume that the orebody model provided represents a perfect reconstruction of the subsurface deposit. As the block model example showed, estimation techniques effectively smooth out the block model values destroying high value blocks. For this reason, so-called traditional optimization techniques cannot generate optimal extraction schedules, since they are not considering the high value blocks.

Within the last 15 years, a new modeling and optimization framework has been developed to address the smoothing effect of estimation techniques and to improve the quantification of risk in the mining industry. Within this framework, a number of equally probable orebody models are simulated to fit the available data by representing the actual and unknown spatial distribution of grades. Through multiple equally probable orebody models, mine planning teams can gauge the sensitivity of their mine designs, on short- and long-term scales, to geological uncertainty. By extension, it becomes possible to choose mining scenarios that lead to higher financial rewards.

Risk-based mine planning and optimization refers to an operational framework capable of integrating uncertainty through multiple, equally likely scenarios within an optimization method to simultaneously evaluate high value outcomes. A risk-based (or stochastic) optimizer is able to evaluate a group of blocks by simultaneously using all combinations of economic values of the blocks in the group (note that more than one orebody model is being used, thus a given block has a distribution of possible values).

While detailed information about mining projects is confidential, a lot of useful information is often included in a company’s publicly available Technical Reports. As an investor, a basic understanding of the type of orebody modeling and the mine production optimization methods used is enough to see how much effort a company places into the quantification of risk to manage their assets. In the long term, this has a direct influence on value return to shareholders.

Further Reading

Dimitrakopoulos, R. (2011). Stochastic optimization for strategic mine planning: a decade of developments. Journal of Mining Science, 47(2), 138-150.

Godoy, M. C. and Dimitrakopoulos, R. (2004) Managing risk and waste mining in long-term production scheduling. SME Transactions 316: 43-50

Hustrulid, William A, Kuchta, Mark, & Martin, Randall K. (2013). Open Pit Mine Planning and Design, Two Volume Set & CD-ROM Pack: CRC Press.

Subscribe for Email Updates

Pingback: Resource Clips

Pingback: Resource Clips