In the early days of mining there were no standards for the reporting of mineral assets. Companies, or individuals, would usually take grades observed in drill core and using some clever geometry extrapolate them to define a deposit. This usually involved a large amount of guesswork and errors in the tens of percents were not uncommon. This was an investor’s nightmare, as companies would generally pad their numbers along the way. Over the past 50 years some of the more developed nations have implemented reporting standards that can be used across the board. An example of which are the guidelines set out by the Society for Mining, Metallurgy and Exploration (SME) in the United States. Over the past two decades work has been done to harmonize an internationally accepted standard for mineral asset reporting. In 1994 the Committee for Mineral Reserves International Reporting Standards (CRIRSCO) was formed. The committee is a grouping of representatives of organizations that are responsible for developing mineral reporting codes and guidelines in most parts of the world (Australia, Asia, Canada, Chile, Europe, South Africa and the USA). Upon inspection of the list one would notice the absence of China, Russia and India. These countries use similar, but in most cases more elaborate classification schemes.

The difference between a resource and reserve basically boils down one thing: a feasibility study.

Not included in the classification, but often mentioned is a mineral occurrence. Usually an occurrence is synonymous with a prospect or a “showing”. The term itself does not have any real economic meaning, although the mineral occurrence is generally a mineral of economic interest. An occurrence is often mentioned in a report because of the prospect of finding a larger amount of the mineral in close proximity to the occurrence. It would suggest further exploration in the area.

The reporting standards implemented by CRIRSCO require that report estimates be carried out by a “Competent Person”, also referred to as a “Qualified Person”. This person must be an accredited professional with at least five years experience in the activity, commodity and situation being reported on. This is generally a geologist or engineer with significant experience in mineral exploration, mineral project assessment or mine development.

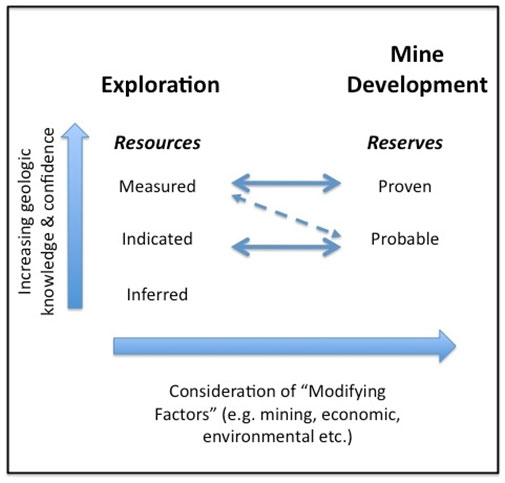

The terminology used to define mineral assets is divided into 2 major groups: Resources and Reserves.

Mineral Resources

A Resource is a concentration of a minerals that has a reasonable prospect of economic extraction. Its location, grade, quantity and continuity are reasonably known from specific geological knowledge and evidence. Essentially, a prospect is not a Resource until enough work has been done to demonstrate a good understanding of the mineral occurrence, and the quantity and quality show the potential make it an economic play. Within the Resource category there are a few more specific sub-categories.

An “Inferred Resource” is one that is based on limited sampling and is based on reasonably assumed, but limited information. Samples might include those from outcrops, trenches, pits or drill holes. Previous geological maps may allow for reasonable assumptions about the size and scope of the resource.

An “Indicated Resource” is a Resource whose quantity, grade (quality), shape, size and continuity can be more confidently reported. Larger and more closely spaced samples have more reliably established the characteristics of the resource to the point where preliminary economic viability and resource extraction calculations can be made.

A “Measured Resource” represents the highest level of geologic knowledge and confidence in a Resource. The Resource characteristics are well established through detailed and reliable exploration work. Economic and technical factors can be more confidently applied. Mine and production planning can give more detailed estimates of economic viability.

It should be noted that with many projects, a combination of confidence levels and Resource level classifications may be used. A company may target a primary deposit as its “Measured Resource”, but have reasonable evidence of an “Inferred Resource” in the vicinity of the main deposit or “along the trend” of the primary project area.

The decision of which term should be used lies in the hands of the Competent Person preparing the report.

Mineral Reserves

The difference between a resource and reserve boils down one thing: a feasibility study. At the very least a preliminary, or “pre-feasibility” study must be completed which takes into account the “Modifying” non-geological factors. These include technical factors include mining, processing, metallurgy. They also include mine planning, economic planning, environmental and community related factors. (See our article on mining project location)

A Reserve is Probable when economic extraction CAN BE justified. A Reserve is Proven when economic extraction IS justified. This distinction is generally based on the geologic knowledge and as with Resources many projects include a hybrid classification (eg. “Proven and Probable”).

It’s important to note that the arrows are two-sided, this means that not only can resources and reserves be upgraded to reserves but the reverse can also be true. Sometimes reserves are downgraded when information pertaining to modifying factors is flawed or turns negative. This can happen quickly when commodity prices turn South.

When evaluating projects and companies pay particular attention to the variable modifying factors, particularly the break-even commodity price used in determining economic feasibility. A break-even price that’s near to a recent market high might be a risky investment. In addition, since many companies may lump “proven and probable” or “inferred and indicated” together, be sure to get the breakdown. How much is proven? How much is probable?

Lastly, understand that all of this information comes from people that provide it. Ultimately you’re relying on the judgement of the Management team and its Competent Person.

Subscribe for Email Updates