So why is the share price so low? Quite simply, San Gold has been consistently losing money and all that gold in the ground is worthless if you can’t turn a profit from mining it. It’s not all bad though. The company has set a target of positive free cash flow by the end of 2013 and losses have been narrowing.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and may include opinions or points of view that may not be shared by the owners of geologyforinvestors.com or the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text. Please view the full release here.[/box]

WINNIPEG, MANITOBA–(Marketwired – Nov. 4, 2013) – San Gold Corporation (TSX:SGR)(OTCQX:SGRCF) today provided updated drilling results from its underground drilling program on 26 Level of the Rice Lake Mine.

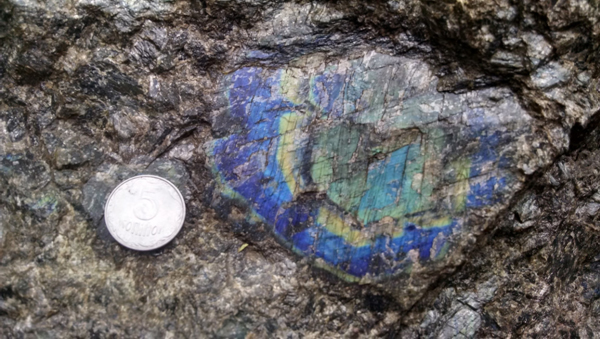

[box type=”note” align=”aligncenter” ]San Gold’s Rice Lake mine is a low to moderate grade underground gold mine located in eastern Manitoba, Canada near the Ontario border. The deposit is fairly typical of gold deposits along the Canadian shield: structurally controlled, quartz-vein-hosted gold mineralization within an Archean-aged (2.5+ billion years) greenstone belt. We’ve included a location map below. [/box]

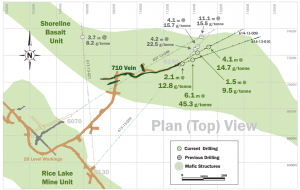

Initial results, obtained from the newly established 6140 drill station located approximately 1,170 metres below surface at the eastern extent of the 710 zone, demonstrate robust grades and widths that are accessible from new 26 level development. These zones are located immediately to the hanging wall of the 710 zone and appear to be part of the 007 system at depth. Highlights of this drilling include drill hole 614-13-010 which returned 45.3 g/tonne over 6.1 metres and drill hole 614-13-009 which returned 14.7 g/tonne over 4.1 metres.

The 6140 drill station was established earlier this year in closer proximity to the 710 HW region to follow up on drill hole 613-13-039 which returned 22.5 g/tonne over 4.2 metres and 15.7 g/tonne over 4.1 metres (reported April 24, 2013) and drill hole 607-12-048 which returned 15.1 g/tonne over 11.1 metres (reported November 26, 2012). The Company is planning additional drilling this year to follow up on these results.

“The high-grade region identified in the 710 vein hanging wall represents another important zone discovered as a result of ongoing exploration of the Shoreline Basalt Unit at depth. These results have been obtained within 100 metres of existing infrastructure and can be developed rapidly and with minimal capital expenditure,” said Ian Berzins, San Gold’s President, CEO and Chief Operating Officer.

Highlights of the preliminary drilling from the 6140 drill station are as follows:

| Hole Number | Zone | From (m) |

To (m) |

Core (m) |

Grade† (gpt) |

Depth (m) |

|

| 614-13-009 | 710 HW | 72.2 | 73.6 | 1.5 | 9.5 | 1173 | |

| 710 HW | 98.6 | 102.7 | 4.1 | 14.7 | 1173 | ||

| 614-13-010 | 710 HW | 19.2 | 21.3 | 2.1 | 12.8 | 1172 | |

| Including | 19.5 | 20.1 | 0.6 | 37.0 | |||

| 710 HW | 51.1 | 57.3 | 6.1 | 45.3 | 1172 | ||

| Including | 52.1 | 53.6 | 1.5 | 99.1 |

| † Assay values are capped at 102.8 g/tonne (3 oz per ton). |

[box type=”note” align=”aligncenter” ]As we’ve discussed previously, it’s important to look at the grade of the larger intervals outside the drill highlights as a narrow high grade interval can often skew the average grade up substantially. However, in an operating mine this is not always helpful since minimum block size will be mined anyway. Nonetheless, Sangold’s grades look reasonably good under closer scrutiny.

In hole 614-13-010, the residual grade for the 6.1 meter interval is an impressive 27 g/t. The smaller 2.1 meter interval has a less impressive residual grade of just over 3 g/t which is slightly below the mine’s cut-off grade. The results from hole 614-13-009 show decent intervals that are above the mine’s average resource grade of just over 8 g/t.[/box]

The 710 HW zone is located at the eastern extent of known mineralization at 26 Level of the Rice Lake mine and remains open to the east and northeast. It was identified as part of the Company’s ongoing structural analysis to refine the Company’s exploration model. This analysis has already yielded numerous new targets within lesser known, near-surface structures (reported September 26, 2013).

[box type=”note” align=”aligncenter” ]We’ve included a diagram of the drilling below. Note that drilling is within the underground mine at the 26 level. [/box]

This program was carried out by San Gold mine geologists under the supervision of Michael Michaud, P.Geo., the Qualified Person for San Gold under National Instrument 43-101 who has reviewed and approved this news release. Underground drill core samples are assayed on site in the Company’s assay lab using the fire assay method with an AA and gravimetric finish. San Gold’s quality control and assurance program includes the insertion of standards, the retention of pulps and rejects, and spot checks utilizing independent labs including Accurassay Laboratories of Thunder Bay, ON and Acme Analytical Laboratories Ltd in Winnipeg, MB.

About San Gold

San Gold is an established Canadian gold producer, explorer, and developer that owns and operates the Rice Lake Mining Complex near Bissett, Manitoba. The Company employs more than 420 people and is committed to the highest standards of safety and environmental stewardship. San Gold is on the Toronto Stock Exchange under the symbol “SGR” and on the OTCQX under the symbol “SGRCF”.

[box type=”note” align=”aligncenter” ]At the time of writing, San Gold’s share price is a dismal $0.14. This is down from around $1.00 last year and it’s all time high of nearly $5.00. If one considers the current value of the proven reserves that San Gold has in the ground their value is around $0.25 per share. If you include the probable reserves, the value increases to around $1.00 per share. While all of the miners are suffering from the commodity downturn, San Gold has been particularly hard hit.

So why is their share price so low? Quite simply, San Gold has been consistently losing money and all that gold in the ground is worthless if you can’t turn a profit from mining it. It’s not all bad though. The company has set a target of positive free cash flow by the end of 2013 through cost-reductions and production improvements – and losses have been narrowing. Can they do it? The end of the year is right around the corner so we’ll soon find out. [/box]

[toggle title=”We’ve skipped some of the boilerplate. You can read it in here.” state=”close”]

Cautionary Note

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release includes certain “forward-looking statements”. All statements, other than statements of historical fact included in this release, including, without limitation, statements regarding forecast gold production, gold grades, recoveries, cash operating costs, potential mineralization, mineral resources, mineral reserves, exploration results, and future plans and objectives of the Company, are forward-looking statements that involve various risks and uncertainties. These forward-looking statements include, but are not limited to, statements with respect to mining and processing of mined ore, achieving projected recovery rates, anticipated production rates and mine life, operating efficiencies, costs and expenditures, changes in mineral resources and conversion of mineral resources to proven and probable mineral reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual events or results to differ from those reflected in the forward-looking statements.

There can be no assurance that forward-looking statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, among others, the actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of precious metals, as well as those factors discussed in the section entitled “Other MD&A Requirements and Additional Disclosure and Risk Factors” in the Company’s most recent quarterly Management’s Analysis and Discussion (“MD&A”). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

[/toggle]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]