Overview

The Donlin Gold Project is an intrusion-related gold deposit in southwest Alaska, USA. It is currently in the late feasibility stage of development and is 50/50 owned by NovaGold (TSX:NG) and Barrick Gold (TSX:ABX).

Regional Geology

The Donlin Project is located in the southwest arm of what is known as the Tintina Gold Belt, or Tintina Gold Province (TGP). The TGP is a 1200 km (745 mi) long and 200 km wide (125 mile) belt bounded by two large fault systems and extending across the Yukon and Alaska.

More locally, the project itself is located in what is known as the Kuskokwim basin, a back-arc continental margin basin made up of sedimentary and volcanic rocks of varying ages.

Deposit Geology

Gold mineralization occurs in both small discontinuous veinlets (<1 cm wide) and less commonly as disseminated (dispersed) sulfides within the older sedimentary and volcanic host rocks of the area. The gold is primarily hosted within the matrix of Arsenopyrite, an iron-arsenic sulfide and pyrite, an iron sulfide.

The deposit is young by geologic standards being less than 65 million years old. (Compare that to the deposits of Northern Ontario or South Africa which are billions of years old.) Gold mobilization and concentration are believed to be associated with hydrothermal activity caused by the nearby granitic intrusions.

Discussion

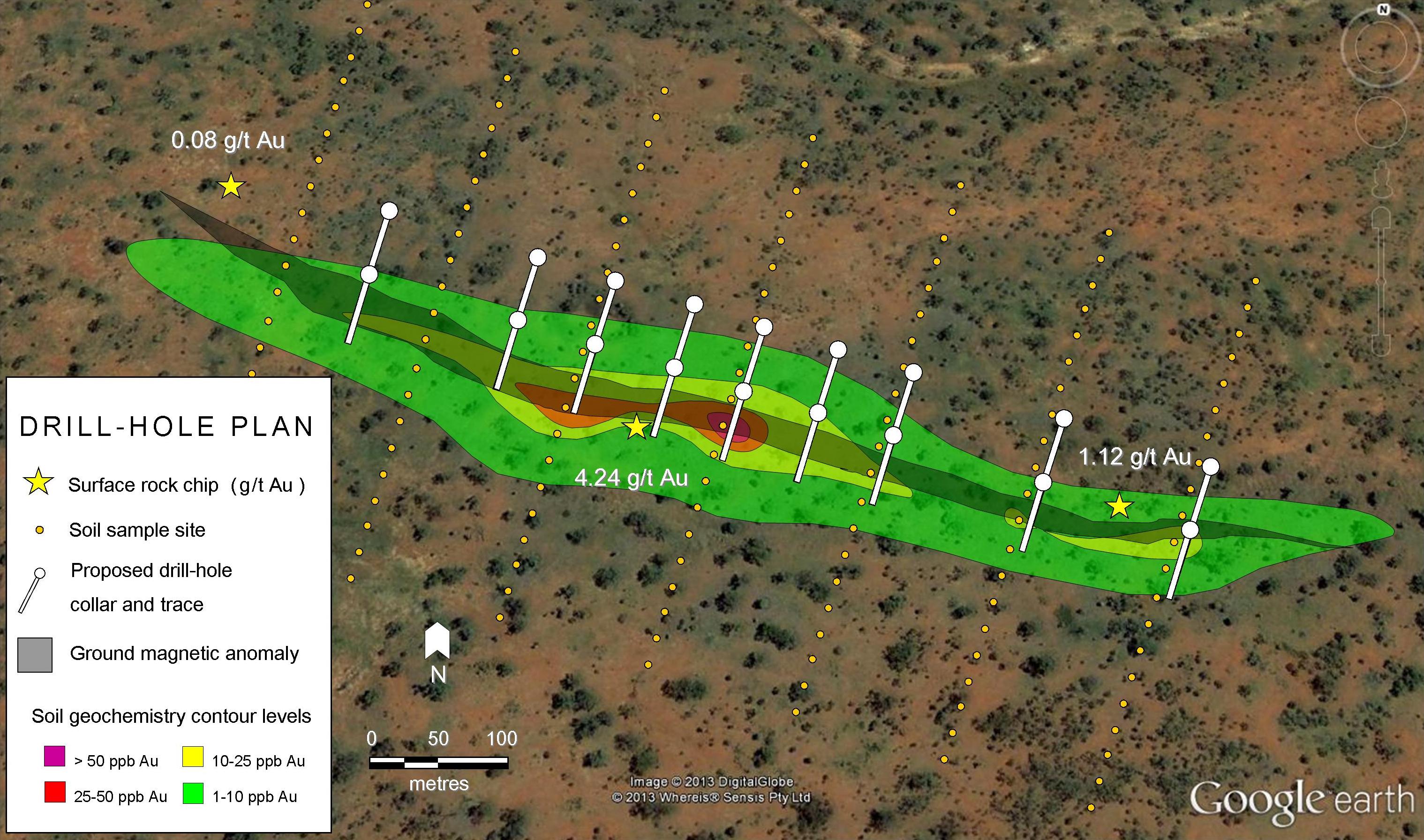

The Donlin Project is a good example of a late stage project ready for development. There has been more than 1.2 million feet of core drilled on the site along with numerous geophysical and geochemical and geological studies over more than 25 years.

The most recent feasibility study identifies 7.7 Million Tonnes of Proven Reserves at 2.32 grams per tonne gold along with 497 Mt of Probable Reserves at 2.08 g/t. While these grades don’t sound particularly great for a gold mine, they are quite good for the open pit gold mine that NovaGold is proposing. Given the geology of the area, it is not unreasonable for them to predict that the reserve may increase as production commences. The project is located in a mining-friendly and politically stable jurisdiction and appears to have the support of local stakeholders.

The biggest risk to the project’s success is cost. Doing anything in the North is very costly. Opening and running the mine will be extremely expensive. According to the feasibility study, the price of Gold will need to stay at or above $1200/oz in order for the project to remain economically viable.

Further Reading

Nova Gold Press Release Reviews

NovaGold (Corporate Site)

Barrick (Corporate Site)