While we still remain reliant on fossil fuels, there is tremendous momentum towards renewable energy in many countries. Increasingly, our homes and businesses are powered by solar panels and wind turbines. Nearly every year, new records are set for the amount of renewable energy power capacity added to global power grids. Similarly, electric vehicles are being adopted rapidly and replacing their gas-powered fore-bearers. Within the next decade, there is expected to be an estimated 125 million electric vehicles on the roads, getting people and materials where they need to go without any gas or oil involved.

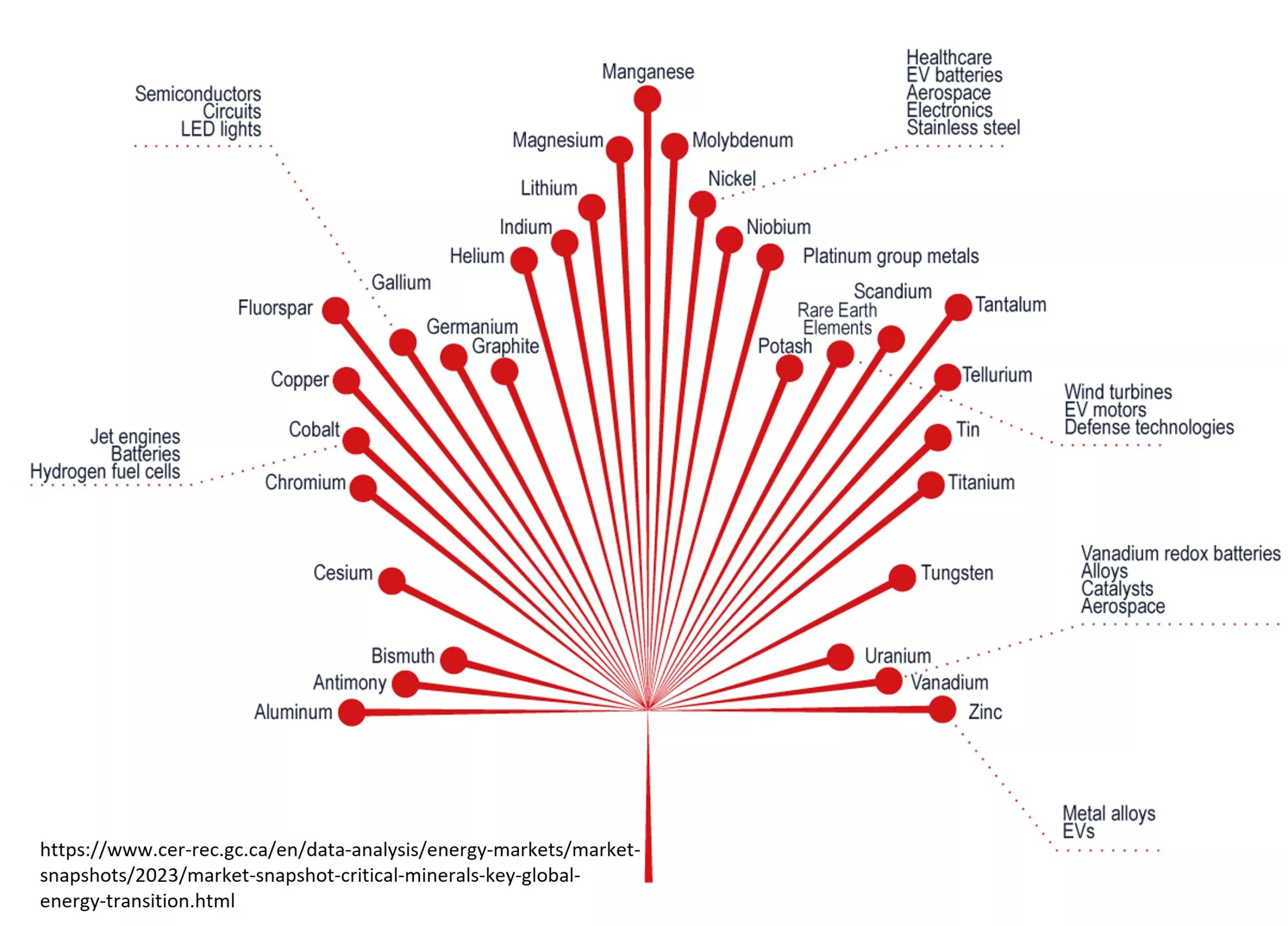

However, this green revolution will not run on bamboo; instead, it will require robust supplies of minerals, some of which can be difficult to obtain, to ensure that we can effectively harness the energy we need. For example, minerals like lithium and cobalt are critical to the battery technologies that power electric vehicles and other devices. Rare earth elements (REE’s) like neodymium are key components of the magnets found in wind turbines. Even solar panels require a variety of uncommon elements that can make production, purchase and adoption more difficult if supply issues drive up material prices. As nations increasingly move to a renewable energy economy, they will have to ensure they have the raw materials required to do so readily available.

Adapting to a Changing Resource Demand

As new technologies come online and older tech is upgraded to meet modern needs, it is expected that the demand for raw materials will change. With this comes both opportunity and uncertainty, especially as new technologies are developed and older or transitional technologies are retired.

Consider the electric vehicle: Current EV’s require lithium, graphite, cobalt, copper, titanium, aluminium, boron and manganese. One would expect an steady increase in the need for these materials, especially less-common elements such as cobalt and lithium. Will that be the case? It partly depends on the ability of markets to provide a stable supply of the these materials at a reasonable cost. This is a difficult challenge for explorers and miners since the pace of technological change is quick and mining projects typically take years to develop.

Solar panels are another example of uncertainties facing raw materials suppliers in the new economy. Research is ongoing and it’s hard to say where the needle will stop. Currently, the most popular solar panels primarily use silicon in their manufacturing, but there is a race to develop new and more efficient solar cell technologies. Metals such as gallium, indium and cadmium are used in thin film solar cells. Researchers working with Perovskite (CaTiO3) Solar Cells are using alkai metals such as cesium and rubidium to improve efficiency. Other solar cell research includes the use of carbon nanotubes, complex organics and hybrids of existing technology such as silicon cells gallium arsenide cells and thin film technology. Confused yet? Further complicating the picture for mineral explorers is that many of these elements do not occur in primary deposits, but as accessories in larger deposits of more common metals.

Widening the Supply Bottlenecks

While the resource requirements of the new energy economy are not quite settled, one challenge that nations must consider is the narrow supply chains of materials which we already know are critical to renewable energy technologies. Rare earth elements (REE’s) are a prime example of this. Despite the fact that rare earth element deposits are fairly common worldwide, China controls 95% of worldwide REE production and is the world’s major supplier of commercial quantities of these elements. Identified deposits exist in many other places, but China’s strategic over-production of these resources makes it all but impossible for other projects to be economically viable. If China opted to limit supplies of these materials – as a result of an escalating trade dispute or diplomatic row – the renewable energy economy could be threatened. To ensure ready access to these strategic materials, countries should strive to make their mineral supply chains more resilient. In order to diversify supply chains, a significant increase in exploration-stage investment and strategic resource development is needed.

Policies that encourage domestic and overseas exploration and mining of rare earth elements may also be considered; in some cases, promoting these activities could bolster other foreign policy objectives. For instance, Afghanistan reportedly has significant deposits of lithium and rare earth elements. Policies that promote investment in Afghan mining activities could improve global supply chains while simultaneously supporting and stabilizing a beleaguered Western ally facing stark security and economic challenges.

Of course, REE’s are not the only elements that will be required to power the green economy. Cobalt is another element (currently) required in modern electric vehicles and world-wide production is concentrated in the Democratic Republic of Congo where there has been widespread public criticism about working conditions for miners in the region. New and diversified supplies of cobalt could help stabilize markets and promote ongoing commercial use.

Other policies, such as establishing national stockpiles, recycling, and increased research and development funding could help ensure the world is less beholden to another nation’s control of rare earths and other critical materials.

Urban Mining and Improved Recycling

While recycling has been increasingly adopted around the world, critical minerals are nonetheless lost to use due to humans discarding them post-consumption. Electronics like phones, computers and mobile devices are a perfect example of this. In the United States alone, more than 150 million phones are discarded each year. Used phones and other electronics are loaded with materials critical to a renewable energy economy, including rare earths, copper, silver, platinum, and palladium. We must become smarter and adopt policies that minimize the loss of these critical materials in the consumption process.

Additionally, we should consider greater adoption of activities to recover discarded materials, such as urban mining. Urban mining, the recovery of metals, electronics and other valuable components from current recycling stations and old dumps, is an increasingly important and even lucrative activity. In some cases, urban mining may be the only way to get significant quantities of materials needed to power renewable energy technologies. For example, europium and terbium, rare earth elements critical for electronics production, are available now almost exclusively through recycling and urban mining efforts. Governments should enact and promote policies that incentivize and make it easier to responsibly recover valuable minerals and other materials that are critical to renewable energy technologies.

Lastly, it may seem more of a consumer rights issue, but the recent push towards the “Right to Repair” is another critical component of the green economy and strategic resource recovery. Simple features like software or memory upgrades, and removable batteries in modern technology could go a long way in reducing the loss of strategic materials from the supply chain.

Responsible Mining

While mistakes of the past and modern social license issues can make it difficult, if not impossible, to open a mine in developed nations, mines in less developed or frontier economies are not free from scrutiny. Public backlash against child labour practices and poor working conditions by unscrupulous cobalt miners in the Democratic Republic of Congo (DRC) has prompted Tesla to announce a move away from using cobalt in it’s next-gen batteries. Ford recently announced a plan to keep DRC cobalt out of its supply chain. Similar scrutiny has been brought against miners and suppliers of tin, tungsten and tantalum in the DRC and elsewhere in Africa. Even in less hostile areas, pollution and unsafe mining practices has led to unnecessary deaths and environmental degradation. Countries pursuing greater reliance on renewables should also promote more ethical and sustainable mining practices at the same time.

Parting Thoughts – Mine Deep to Go Green

We are on the cusp of a renewable energy revolution. Mass adoption of wind, solar and other clean energy technologies will transform our economies and reduce the impact our use of carbon has had on the planet. However, in order to move away from fossil fuels, we will need greater and more reliable supplies of critical materials like rare earth elements and other minerals. Investments made in these areas will help ensure that the transfer from fossil fuels to renewables is smooth, and our future is cleaner and more prosperous.

Further Reading

- Critical Mineral Resources of the United States—Economic and Environmental Geology and Prospects for Future Supply. USGS. (Full PDF)

- Global EV Outlook 2018: International Energy Agency

- National Center for Photovoltaics

- Perovskite Solar Cell Research: MIT 2019

- Metals Production Requirements for Rapid Photovoltaics Deployment: MIT 2015

- Global Witness Conflict Minerals Campaign: Website

- Elon Musk Warns That Tesla’s Cobalt Use Is Heading Toward Zero: Bloomberg

Subscribe for Email Updates