It’s rare enough to discover a completely new deposit, never mind a new gold (Au) camp in a tier-one jurisdiction. The Dixie Project, recently acquired by Kinross Gold for an eye-watering $1.8 billion, may prove to be just such a discovery.

The Dixie Project

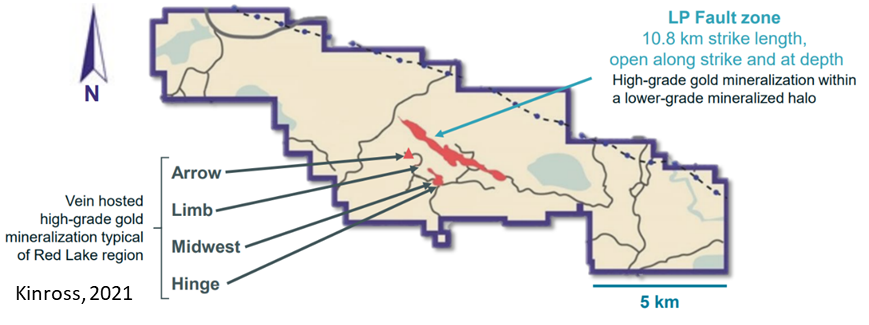

The Dixie Project is a 91 Km2 property located 25 Km southeast of the prolific Red Lake, Ontario, Canada Au camp. The project has no published resource estimate; Kinross, however, estimates the LP Fault Zone to contain 8.5 Moz of high-grade Au, with the possibility of several million more ounces contained within the Hinge, Limb, and Midwest satellite deposits. The property has excellent access to infrastructure, being located near a major highway, and gas and power lines. The nearby town of Red Lake has been Au-mining town for over 100 years, making the region highly favorable from a regulatory and mining expertise perspective.

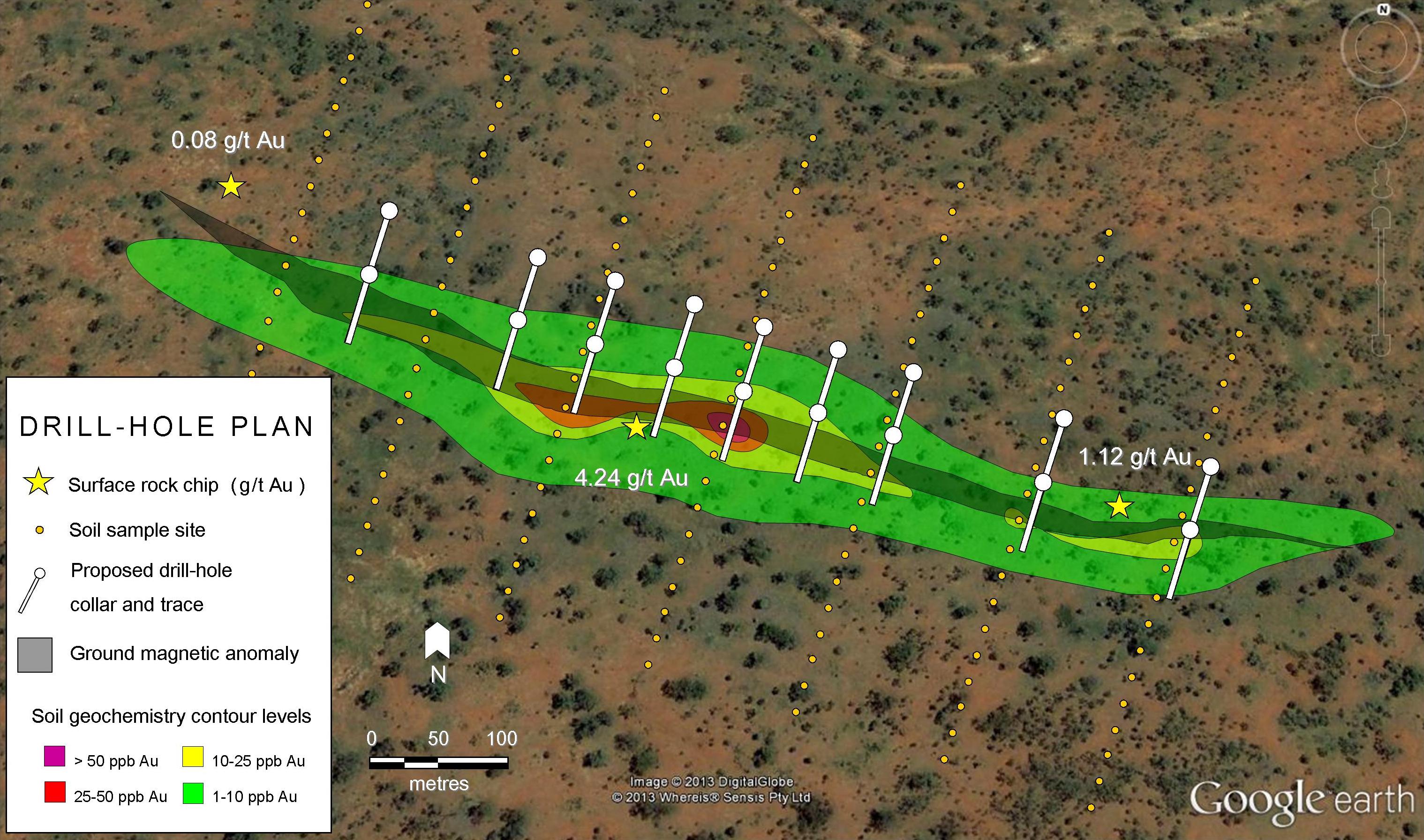

Gold was discovered on the Dixie property in the 1940’s, however exploration was hampered by thick overburden, and more serious exploration didn’t begin to ramp up until the late 80’s. Several companies had moderate levels of success drilling the area between 1988-2015, but the project’s true potential wasn’t recognized until it was acquired by Great Bear Resources in 2017. Great Bear was extremely successful in using a combination of geophysics and more than 340 km of drilling to locate multiple high grade Au deposits on the property. A few of the many drilling highlights include 194 g/t over 2m, 31 g/t over 4.6 m, and 27 g/t over 16.3 m, results made all the more spectacular by their shallow depth (~50m, 70m, and 125m, respectively).

By 2021 it was clear the project had potential for multiple high-grade Au mines, and it began to attract serious interest from several major Au producers. Kinross ultimately made the bold decision to acquire Great Bear for $1.8 billion in cash and stock, giving it 100% ownership of the project. The deal closed in February 2022. Paying such a high price for a project without an official resource estimate was viewed as risky and was not well received by the market: Kinross’s stock dropped by 10% the following day.

Big Plans

This year, Kinross has budgeted $50-60 million for 200 000 meters of infill drilling aimed mainly at defining a planned open pit at the LP Fault Zone, as well as finding extensions for deeper (~700 m) high-grade ore bodies and exploring the satellite deposits. While much work remains to be done, Kinross envisions mining the LP Fault Zone via an open pit which would transition to underground operations once a depth of 350-400 m had been reached. This would ultimately produce ~8.5 Moz Au at 3.5-4 g/t (open pit) and ~8 g/t (underground). A tentative timeline would see a preliminary economic assessment by 2023, followed by a feasibility study and construction, with production possible by 2029.

Kinross intends to build the infrastructure, including a 10-15 000 t/day mill, to cutting-edge technological and environmental standards, and is exploring using an all-electric or hydrogen-powered vehicle fleet. The company hopes to leverage the property’s infrastructure access to keep total development costs under $1 billion. Satellite deposits have the potential to eventually be developed into their own mines, making the Dixie Project a mining camp in its own right.

Geology

The geology of the Dixie property is still not well understood. It contains three types of mineralization: Au-bearing silica-sulfide replacement in Limb Zone, Au-bearing quartz veining in Hinge Zone, and disseminated Au in a high-strain zone in the LP Fault Zone.

Mineralization in the Hinge Zone is concentrated in quartz veins hosted in basalt. These veins follow the axial trace (the hinge or apex) of a large fold structure.

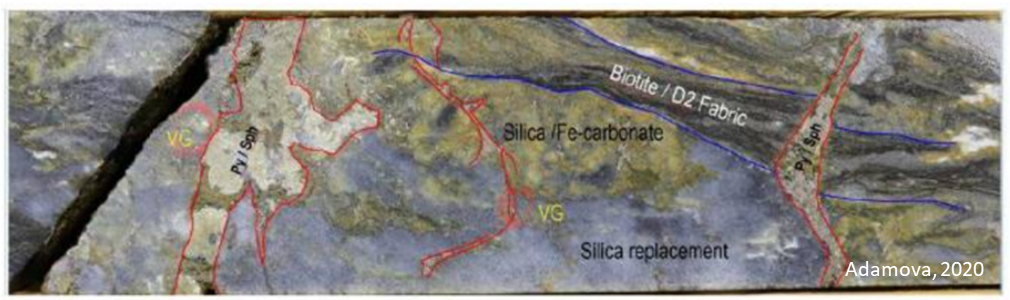

Mineralization in the Limb Zone is strongly associated with the contact between basalt and a layer of metasedimentary rock and appears to be related to a shear structure. Visible Au is found with sulfide minerals, mainly iron-sulfides such as pyrite and pyrrhotite, and quartz (silica) which replace some of the original minerals.

Mineralization in the LP Fault Zone, which comprises the majority of known ore, occurs within a 4 km long, 500 m wide zone of highly strained and deformed rocks. Gold, together with variable amounts of sulfides, is found disseminated (dispersed) in felsic volcanic rocks near the contact with metasediments. Some of the Au is found in less deformed quartz veins, indicating multiple episodes of mineralization. Some of the Au may have been remobilized due to metamorphism and deformation of the primary deposit. Mineralization in all three prospects is steeply dipping, and open at depth.

The Dixie mineralization has been compared to both the nearby Red Lake Au camp and the Hemlo, Ontario, Au deposit. The Red Lake deposits are considered orogenic (AKA greenstone) deposits, which form when rocks, especially basalts, are metamorphosed under moderate pressure and temperature in ancient mountain-building events. These conditions cause the rocks to ‘sweat’, releasing Au-bearing fluids which migrate and form Au-bearing quartz and carbonate veins which are often concentrated along geologic structures such as faults, folds, and shear/strain zones.

The origin of Au in Hemlo is controversial. It is most often considered to be an orogenic deposit; however, it has a number of unusual attributes that don’t fit with this model easily. Gold is found disseminated in felsic volcanic rocks instead of veins in basalt, and feldspar alteration and significant amounts of metals such as molybdenum, vanadium, and silver are present. Other models, such as epithermal, volcanogenic massive sulfide, skarn, and porphyry style deposits have also been proposed, but all of these have their own problems. One of the main reasons Hemlo is so difficult to understand is because it has been metamorphosed to such a high temperature that some of the ore minerals may have begun to melt and remobilize, obscuring many of the deposit’s original features.

Great Risks and Golden Rewards

Comparisons to Red Lake, which has produced 24 Moz Au, and Hemlo, which has produced 21 Moz, say a lot about Dixie’s potential. With millions of ounces of high-grade Au near surface, the LP Fault Zone alone could prove to be a world-class deposit. Throw in the satellite deposits and the possibility of undiscovered deposits on such a large and historically under-explored property and it’s easy to see why Kinross was so eager to acquire it.

Many things could still go wrong for Dixie, though. Several companies operating in the Red Lake area, such as Rubicon (now defunct) and to a lesser extent Pure Gold Mining, have struggled to turn promising drill results into profitable mines in recent years. While Red Lake’s Au-bearing veins may be high-grade, they are erratic and difficult to trace over long distances. They have also often been truncated by faults, including infamous ‘black line’ faults, which may displace ore bodies by 100’s of meters and are so thin they may be almost impossible to spot in drill core. If infill drilling finds the LP Fault deposit to be as discontinuous as those in Red Lake, then viable resources could prove much lower, and mining more complex and less profitable, than expected.

The lack of a complete understanding of the area’s geology could also reduce the effectiveness of efforts to find new ore bodies and extend existing ones. From the available information, it seems likely that Dixie may have been an orogenic Au deposit similar to Red Lake, which was then deformed in a strain zone similar to what may have occurred at Hemlo. This may have helped to create the unusual style and high grade of the LP Fault Zone by remobilizing and concentrating the original ore. Such a complex history could make for unpredictable geology and challenging mining.

The regional geology has not yet been studied in detail, and it’s unclear how widespread mineralization is. Modest exploration programs on neighboring properties held by BTU Metals and Dixie Gold Company (not to be confused with the Dixie property/project) has so far not led to any significant discoveries.

Investor Takeaways

With millions of ounces of high-grade Au near the surface, the Dixie Project has the potential to become a world-class Au mine, perhaps even a whole new camp. Despite this promise, it is still too early to be sure how much of this ore will ultimately prove economically viable, and it will be many years before the project enters production.

Kinross took a gamble spending so much on a project too new to have a resource estimate, but their ambitious plans for the property suggests they’re confident it will pay off in a big way. The infill drilling and preliminary economic assessment expected to be completed over the next year or two will likely tell the tale.

Companies Mentioned

- Kinross Gold http://kinross.com/ (website)

- Pure Gold Mining https://www.puregoldmining.ca/ (website)

- BTU Metals https://www.btumetals.com/ (website)

- Dixie Gold Company https://www.dixiegold.ca/ (website)

Resources

- Adamova, A. (2020): Technical Report on the Dixie Property Red Lake, Ontario https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00024202 (online report)

- Kinross (2021): Acquisition presentation https://www.kinross.com/Acquisition-of-Great-Bear-Resources-Ltd/ (online presentation)