Outline

As the world shifts to a green economy, the rush for commodities that can power this transition gains momentum. One commodity is set to play an essential role in developing alternative energy sources: lithium. So, before diving into lithium stocks, it’s a good idea to look at the most important sources of lithium. The next two articles will provide the basics of the two major types of lithium deposits: hard rock and brine.

Introduction

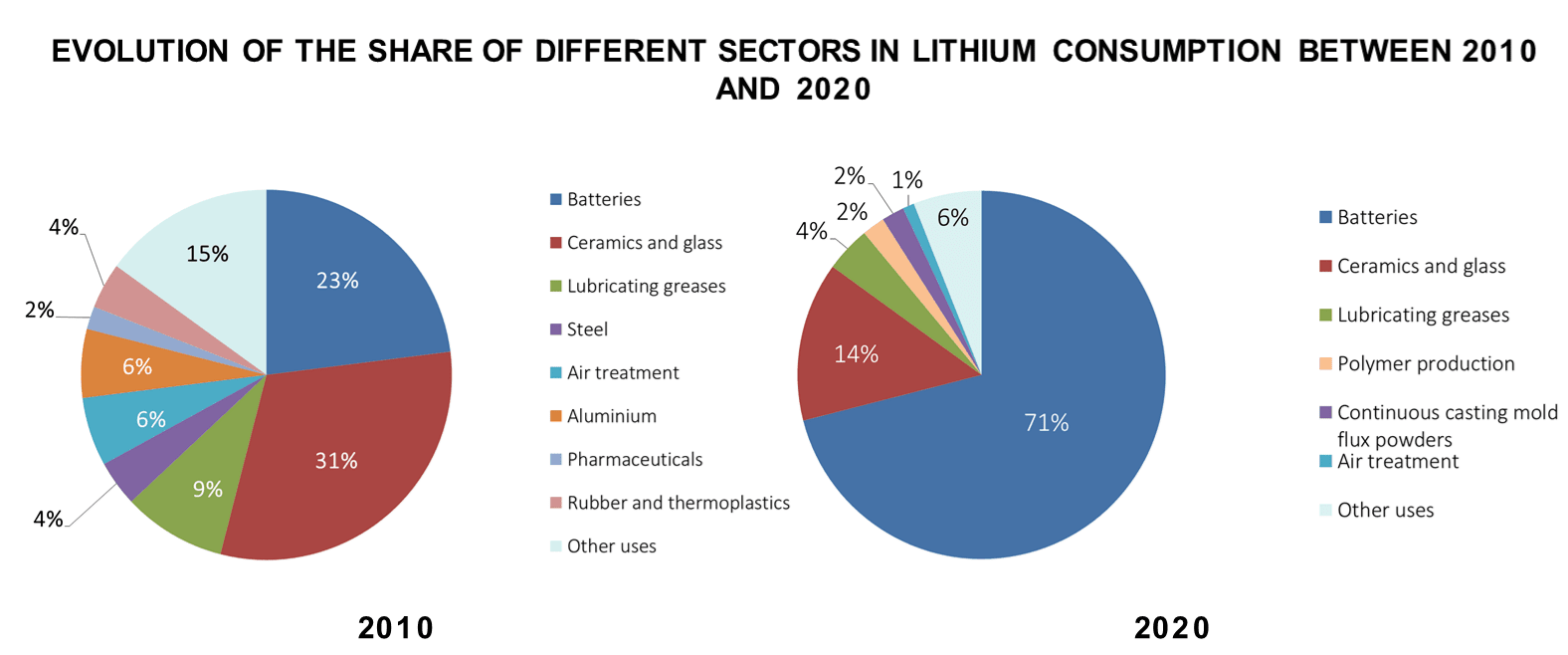

Lithium is a soft, silvery metal with highly reactive and flammable properties. Under standard temperature and pressure conditions, lithium is the lightest metal and the lightest solid element. Some of the common uses of lithium include (i) rechargeable battery for electric vehicles, mobile phones, laptops, and cameras; (ii) alloys with aluminum and magnesium to improve their strength and make them lighter; (iii) glass and ceramics (lithium oxide); (iv) high temperature lubricant (lithium stearate); (v) medical drugs to treat depression (lithium carbonate), and (vi) storage of hydrogen used as fuel (lithium hydride). Lithium applications has been changing in the past years, with most of its current use allocated to the production of rechargeable batteries (Figure 1).

Largely driven by the electric vehicle (EV) market, lithium demand is estimated to increase more than 25% per year until 2028. To meet demand, significant investment to explore and find new sources of lithium will be required in the coming years. Current lithium supply derives from two main deposit types: brines and pegmatites (aka hard rock). This article focuses on the second type, herein referred as hard rock lithium deposits.

Hard Rock Lithium Deposits

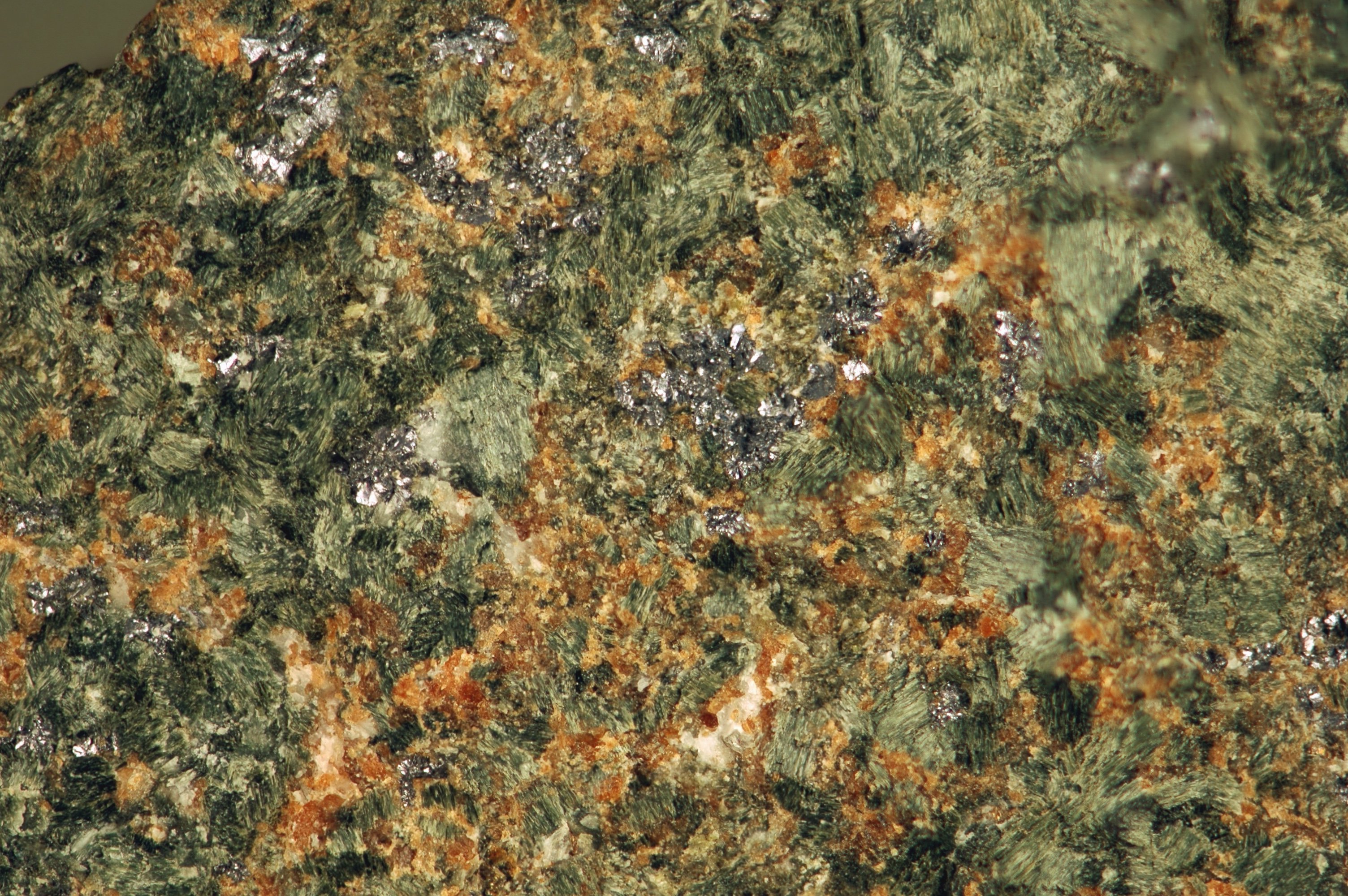

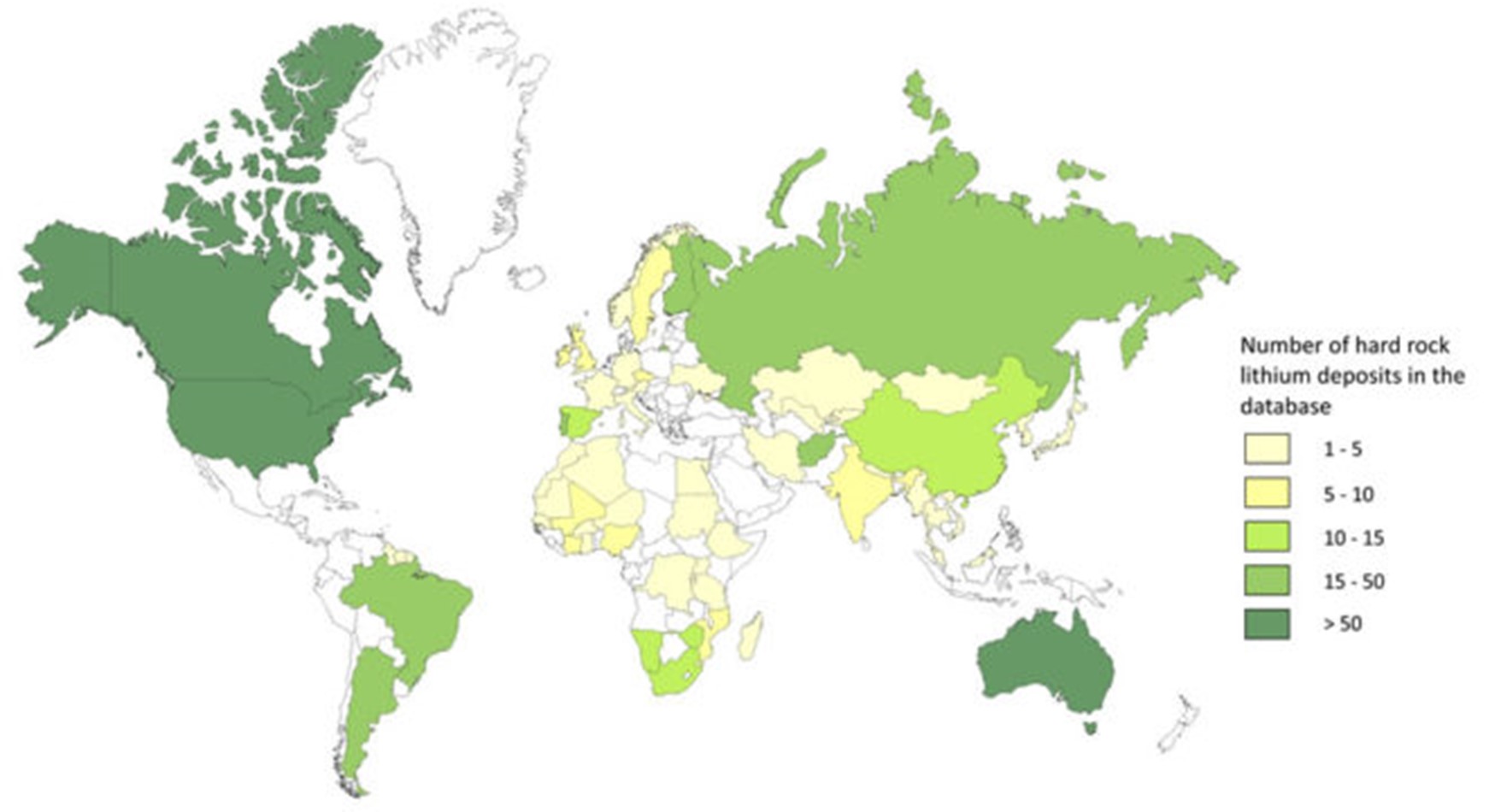

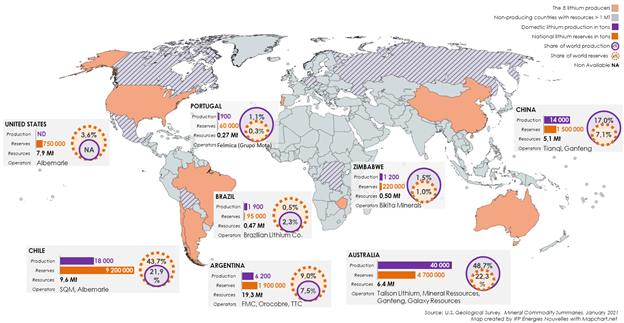

Lithium from hard rock deposits is incorporated in minerals hosted in pegmatite intrusions. Pegmatites are coarse-grained intrusive rocks that are formed during the final stages of the crystallization of a magma. Lithium-Cesium-Tantalum (LCT) pegmatites, a compositionally defined subset of pegmatites, make up 25% of the world’s lithium production, most of the world’s tantalum production, and all of the world’s cesium production. Lithium in LCT pegmatites commonly occurs as spodumene, but it is also present in other lithium-bearing minerals such as petalite and lepidolite. Hard rock lithium deposits are evenly distributed around the globe, but lithium production from this deposit type is concentrated in a few places including Australia, Canada, and China (Figure 2).

Australia hosts the Greenbushes, operated by Talison Lithium, a JV between China-based Tianqi Lithium (SZSE:002466) and US-based Albemarle (NYSE:ALB). Other prominent hard rock lithium deposits include Tanco, in Manitoba, owned by China-based Sinomine Resource Group Co. Ltd. (CNY: SHE:002738); Bikita, in Zimbabwe, privately owned by Bikita Minerals; and the Piedmont Lithium Project in North Carolina, owned by the Australia-based Piedmont Lithium (NASDAQ:PLL).

Mineralization

LCT pegmatites form in the internal part of orogenic belts, which form from collisional plates. Orogenic belts are elongated regions of land characterized by deformation and significant metamorphism. Peak times of LCT pegmatite formation at ca. 2640, 1800, 960, 485, and 310 Ma (million years ago) relate to times of mountain formation known as collisional orogeny and supercontinent assembly – when most or all Earth’s continental blocks formed a single large landmass.

LCT pegmatite bodies have various forms such as tabular dikes (sheet of rock that cuts through pre-existing rocks), tabular sills (intrusive sheet of rock emplaced between layers of pre-existing rocks), lenticular (lens-shaped) bodies, and irregular masses. LCT pegmatites can be spatially and genetically related to other granitic intrusions, but there is not always clear evidence of these relationships. LCT pegmatites are usually hosted in metamorphosed sedimentary or metamorphosed volcanic rocks.

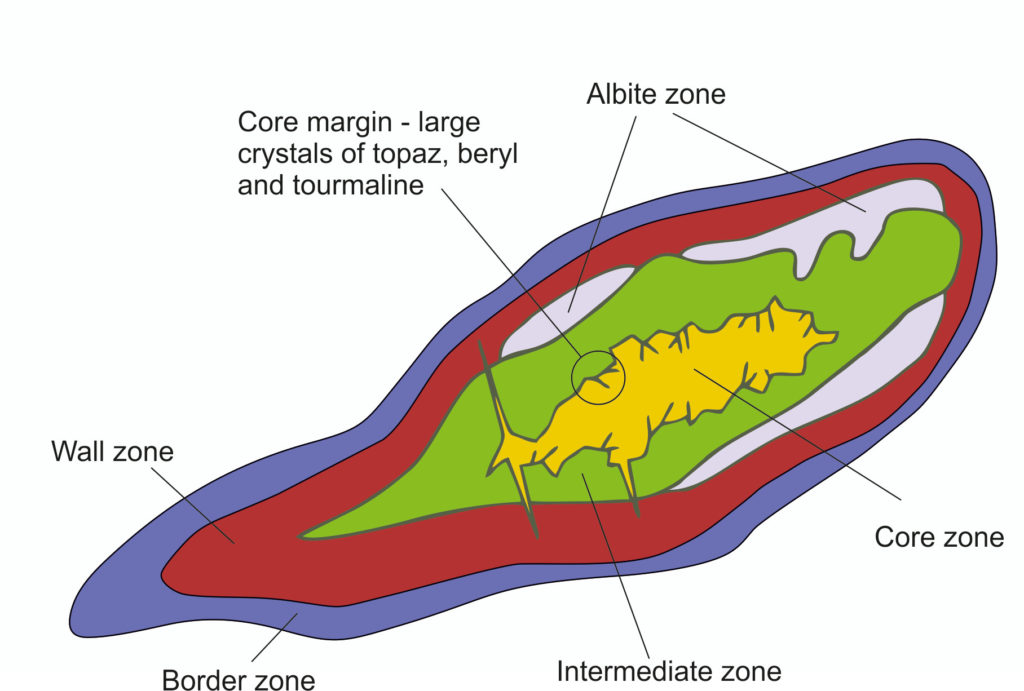

Most LCT pegmatites have a distinctive mineralogical and geochemical zoning pattern. This zoning is characterized by four concentric zones: border, wall, one or more intermediate zones, and core (Figure 3). Li, Cs, and Ta are generally concentrated in the intermediate zones. The prime lithium ore mineral – spodumene – can have up to 7% lithium oxide content by weight.

Lithium Extraction and Processing

Hard rock lithium deposits are generally mined by the open pit method. Blocks of mineralized pegmatite are crushed, milled, and then sent to flotation cells, where ore minerals are separated. At about a concentration of 5-7% LiO2, ore is sent to a plant to be chemically processed to produce lithium carbonate.

Examples of Hard Rock Lithium Deposits

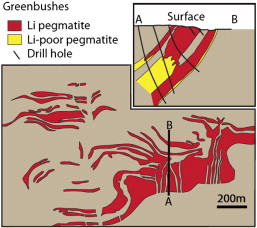

The world’s largest hard rock lithium deposit, the Greenbushes in Western Australia, has been mined for tantalum and lithium. The deposit is made up of a set of syntectonic pegmatite intrusions that are zoned, although these zones are not concentrically distributed (Figure 4). Proven and probable reserves of 86.4Mt at 2.35% Li2O are estimated for the Greenbushes mine.

Another important mine in Western Australia is Mt. Cattlin, owned by Australia-based Galaxy Resources (ASX:GXY). As of December 2020, Mt. Cattlin had mineral resources estimated at 12.0Mt at 1.3% Li2O and ore reserve of 8.0 Mt at 1.1% Li2O. Galaxy holds a diverse portfolio that includes the James Bay project in Quebec, Canada. James Bay is a shallow, roughly flat-lying set of pegmatite intrusions that form an irregular belt (ca. 2km-long, 500m-wide). The project has a projected mineral resource of 40.3 Mt at 1.4% Li2O.

Quebec is also home to one of the world’s largest high purity lithium deposits – the Rose lithium-tantalum project, owned by Canada-based Critical Elements (TSX.V:CRE, OTCQX:CRECF). With reserves of 26.8 Mt at 0.96% Li2O Eq. or 0.85% Li2O and 133ppm Ta2O5, the Rose project is expected to start production in 2022.

Arcadia, in Zimbabwe, is the 7th largest hard rock lithium deposit in the world. The project is the flagship of Australia-based Prospect Resources Limited (ASX:PSC, FRA:5E8). Mineralization in Arcadia consists of stacked pegmatite intrusions that extend for up to 3km down plunge (Figure 5). As of 2019, Arcadia was estimated to contain mineral reserves of 37.4Mt at 1.22% Li2O.

Lithium Carbonate vs. Lithium Hydroxide

Lithium carbonate and lithium hydroxide, the two main lithium materials currently traded on markets, have different selling prices according to regional markets. In recent years, lithium hydroxide has become the preferred battery-grade material, as lithium hydroxide battery cathodes have better storage capacity and longer life cycles. However, the default unit for measuring lithium reserves, resources, and production (including lithium hydroxide) is based on a metric ton of lithium carbonate equivalent (LCE). This is because lithium carbonate was traditionally used in batteries, and because lithium carbonate is the first chemical extracted in the lithium mining production chain. It is important to note this, because one metric ton of lithium content is not the same as one metric ton of lithium hydroxide, which is also different from one metric ton of LCE. So, caution is needed when evaluating potential investment assets.

Lithium Outlook

Despite a 5% decrease in global lithium production in 2020 due to the impact of the pandemic, the lithium market is forecast to substantially grow in the next few years. The development of new projects and brine pools are set to provide an increased output of the global lithium production to keep up with the EV industry (Figure 6). According to Benchmark’s market forecast, in 2021, demand for lithium carbonate is expected to increase by 23% year-on-year, with lithium hydroxide demand up by 33% year-on-year.

Companies Mentioned

- Talison Lithium (website)

- Tianqi Lithium (website)

- Sinomine (website)

- Bikita Minerals (website)

- Piedmont Lithium (website)

- Galaxy (website)

- Critical Elements (website)

- Prospect Resources Limited (website)

Further Reading

- Mineral Deposit Model for Lithium-Cesium-Tantalum Pegmatites – USGS (pdf)

- Global lithium resources: relative importance of pegmatite, brine, and other deposits (Kesler et al., 2012)

Subscribe for Email Updates