Demand for lithium (Li) has never been higher and is almost certain to continue rising. This demand has led to the development of many new Li projects in recent years, but those of the James Bay camp are among the most exciting. Several advanced projects and prospective mines are under development and with hundreds of early stage projects there’s still a lot of ground to be covered.

Lithium Mania

Lithium is a moderately rare element which has the distinction of being the lightest metal on the periodic table. For many years Li has been used in industrial lubricants, high-end glass and ceramics, and, more curiously, in certain psychiatric medications. Although its effectiveness in treating conditions such as bipolar disorder has been known for decades, no one is certain how a simple metal is able to change how the brain functions.

The main use of Li today, however, is in Li batteries; Li’s combination of low density and high charge capacity makes it indispensable in high performance batteries. Unlike other battery metals such as cobalt there is little possibility to substitute Li for more available materials. This rapidly rising demand for Li has triggered a massive global rush for Li, and with much of the world’s Li supply controlled by China, western governments have been keen to develop more secure supplies closer to home.

Lithium is mined from two types of deposit: Li brines, salty groundwaters which can be pumped to the surface and evaporated to concentrate Li, and hard-rock pegmatites, where Li becomes concentrated in the latest-cooling dregs of magma in a larger igneous system. While brines are cheap and easy to mine, hard-rock deposits tend to be purer, allowing them to command a premium. Many Li pegmatites also produce byproduct tantalum (Ta), a rare metal renowned for its strength and resistance to heat, which typically provides a small boost to the economics.

District Geology

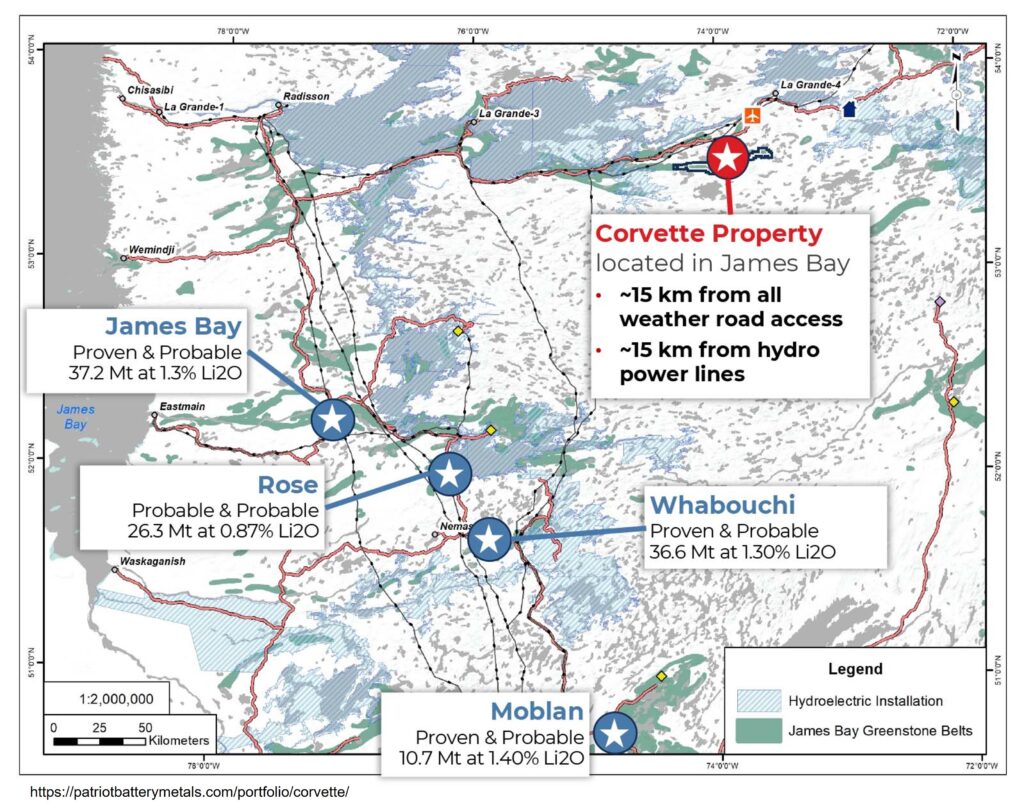

The James Bay Li district covers a rather large area in far northern Quebec, Canada. Despite its remote location, the area contains significant road and electrical infrastructure to support the La Grade hydroelectric dams, which produce a large chunk of northeastern North America’s electricity.

Lithium exploration in the area began in earnest with establishment of the Rose Lithium-Tantalum project in 2005, and has steadily intensified over the last two decades, leading to several advanced exploration and planned mines. There were nearly 400 exploration projects in the area in 2021. It’s no coincidence that most of these are located close to the region’s highways, the area is sparsely populated and much of it remains severely underexplored. To facilitate the development of new mines in the area the Quebec government has partnered with the Grand Council of the Cree, who represent most of the region’s inhabitants, to build hundreds of kilometers of roads, power lines, railroads, and even a deepwater port.

Lithium in the James Bay camp is found in pegmatites which contain the mineral spodumene (LiAl(SiO3)2. Some also contain Ta in the form of tantalite (Fe,Mn)Ta2O6.

Rose Lithium-Tantalum

The Rose Lithium-Tantalum Project is 100% owned by Critical Elements Lithium Corporation. It’s located about 40 km north of the Cree village of Nemaska. The indicated resources are estimated at 31.5 Mt at 0.91% Li2O and 148 ppm Ta2O5, with inferred resources of 2.7 Mt at 0.77% Li2O and 141 ppm Ta2O5. Probable reserves stand at 26.3 Mt at 0.87% Li2O and 138 ppm Ta2O5. Mineralization consists of stacked lenses of spodumene pegmatite dykes occurring near surface. Mining plans call for an open pit approximately 1,620 m long, 900 m wide, and 220 m deep with a strip ratio of 7.3:1. It is expected to produce 1.61 Mt/year over a 17 year mine life.

The mine has cleared federal and provincial environmental reviews, with initial construction expected to begin in late 2023. The project has an after-tax NPV of 1.915 billion, with after-tax IRR of 82.4% and Capex of $357 million.

James Bay Lithium

The James Bay Project, not to be confused with the James Bay lithium camp, is 100% owned by Allkem Galaxy Lithium, and is located adjacent to the Billy Diamond Highway about 130 km east of the community of Eastmain. Its mineral resources are estimated at 40.3 Mt at 1.4% Li2O, with proven and probable ore reserves of 37.2 Mt at 1.3% Li2O. Mineralization occurs as irregular spodumene-bearing pegmatite dykes up to 60 m wide and 200 m long and remains open to the north and east. The ore is near surface, allowing for open pit mining at a low strip ratio of 3.7:1. The mine received federal approval in January 2023 and is expected to produce 330 kt/year of ore over an 18 year mine life. The project has a pre-tax NPV of $1.42 billion and IRR of 45.8%, with a Capex of $244 Million.

Whabouchi

The Whabouchi Project is located about 30 km east of the Nemaska community and is 100% owned by Nemaska Lithium, a 50/50 partnership between Investissement Québec and Livent Corporation. The site can be accessed via an all-weather gravel road. The mine is partially built; however construction was paused in 2019 due to a lack of financing. Construction of both the mine and the company’s Bécancour processing plant has recently restarted, with Investissement Québec preparing to invest an additional $250 million in the project. The mine is expected to open in 2025, with the processing plant to open the following year. Nemaska recently signed an 11-year contract to supply Ford with Li-hydroxide.

Proven and probable reserves stand at 36.7 Mt at 1.3% Li2O, with 24 Mt to be mined via open pit and the remainder by underground methods. Mine life is estimated at 33 years.

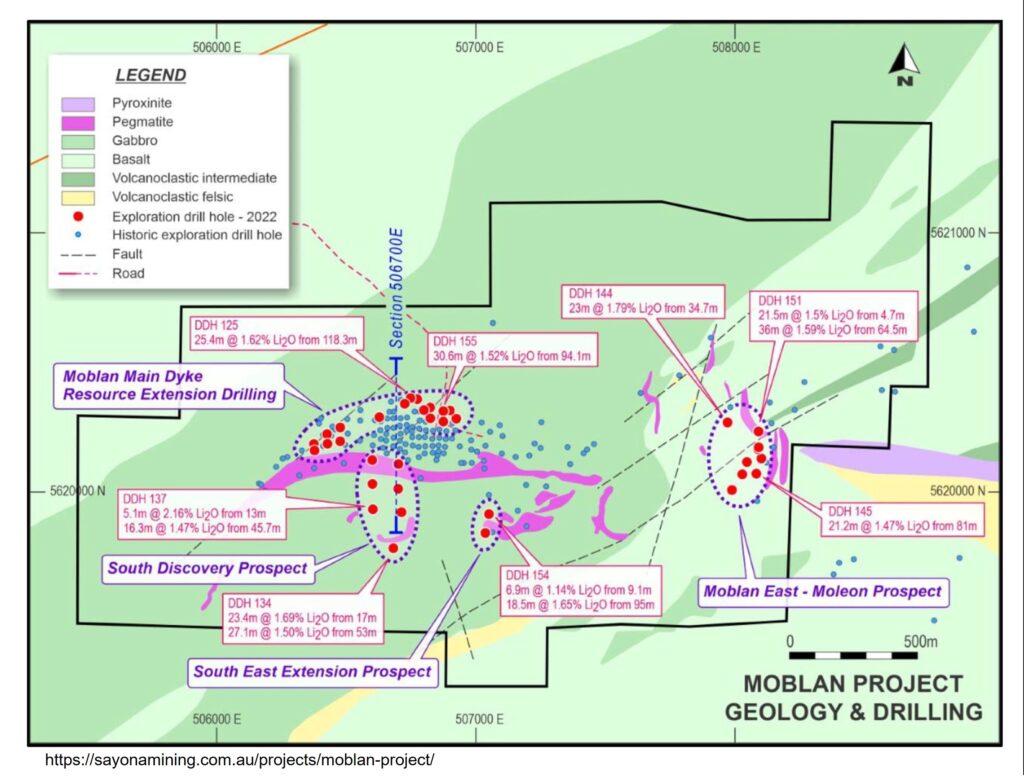

Moblan

The Moblan Project is 60% owned by Sayona Mining Limited and 40% by SOQUEM Inc, a wholly owned subsidiary of Investissement Québec. Since acquiring the project in 2021 Sayona has conducted extensive drilling, boosting the project’s measured and indicated (M+I) resources from 12.0 Mt at 1.4% Li2O, plus 4.1 Mt at 1.33% Li2O of inferred resources to a whopping 49.8 Mt at 1.15% Li2O of M+I and 20 Mt at 1.15% Li2O inferred. There’s also an opportunity for mining a somewhat smaller resource at a higher grade, with potential M+I of 41 Mt at 1.31% Li2O and 10 Mt inferred at 1.31% Li2O. Proven and probable reserves are 10.7 Mt at 1.4% Li2O, although these are likely to increase. Moblan represents one of the largest undeveloped Li resources in North America.

Building off this success, which is so recent Sayona has yet to update its website, Sayona has fast tracked an aggressive drilling program, with 60000 m planned. The project is currently undergoing a prefeasibility study, with results expected shortly.

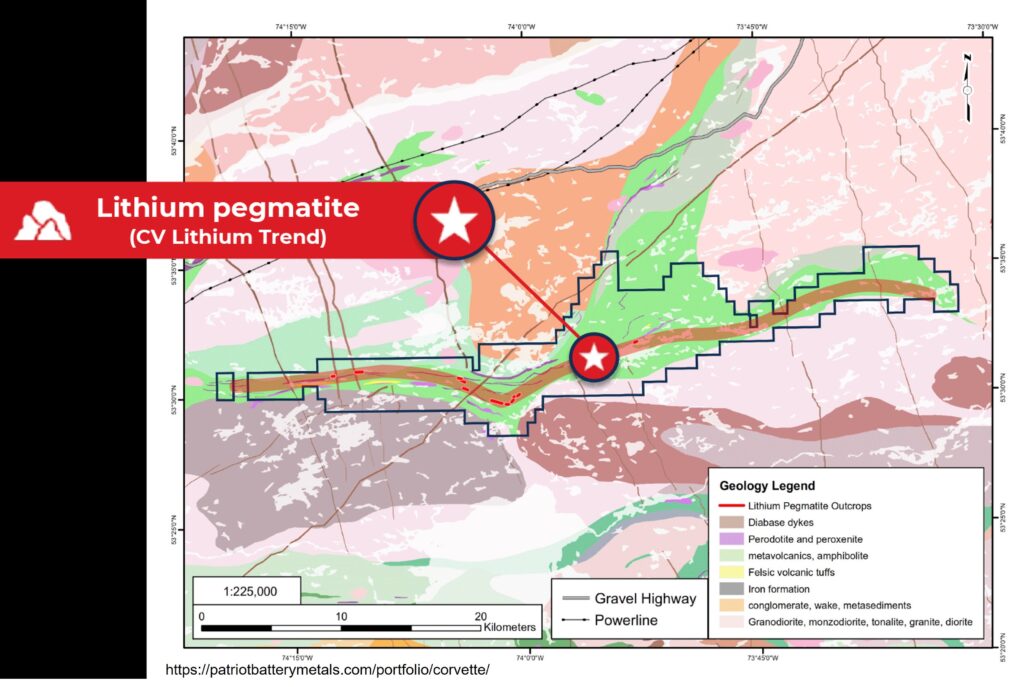

The Corvette Property

The 2017 discovery of the Corvette Property, far to the northwest of previous discoveries, triggered a staking rush in the area. This 212 km2 land package, 100% owned by Patriot Battery Metals, is located about 15 km south of road and power line infrastructure built to support the area’s hydroelectric dams. The property hosts the CV Lithium Trend, a ~50 km long corridor which contains over 70 spodumene-bearing pegmatite outcrops in six clusters, with over 20 km of the trend still largely unexplored.

Only two of the pegmatite clusters have been drilled so far, CV-5 and CV-13. CV-5 is the largest and most heavily drilled cluster, and boasts several impressive drill intercepts including 1.65% Li2O and 193 ppm Ta over 159.7 m and 3.01% Li2O and 160 ppm Ta over 40.7 m. A mineral resource for the property has yet to be estimated.

As with others in the district, Li is hosted in spodumene pegmatites, which form prominent white ridges on the property. Spodumene, as well as many other common pegmatite minerals, is typically bright white and resistant to erosion, making the outcrops easily spotted through the region’s sparse subarctic forests.

With so much land and many promising targets yet to be seriously evaluated, a great deal of work remains to be done on the Corvette Property. So far Patriot has heavily focused on the CV-5 cluster; given the excellent surface exposure of the pegmatites and highly promising drill results there’s been little need to look elsewhere.

The neighboring Jarnet Project, 100% owned by Arbor Metal Corporation, appears to host an extension of the Li mineralization trend, with drill results up to 0.93% Li2O and 114 ppm Ta2O5 over 146.8 m.

Investor Takeaways

The James Bay Li camp hosts hundreds of exploration projects, four of which, Rose, James Bay, Whabouchi, and Moblan, are advanced. The Corvette Property is a more recent discovery which demonstrates that this vast, remote area still holds the promise of more major discoveries. Lithium in the James Bay camp is found as spodumene pegmatites, many of which are large and near surface, making for relatively easy mining. Crucially, the Quebec government and most local communities are strongly supportive of Li mining, and are making major investments in regional infrastructure, and in some cases such as Moblan, the mining companies themselves. Assuming Li prices remain high, James Bay is poised to become a major Li producing district within the next few years.

List of Companies Mentioned

- Patriot Battery Metals https://patriotbatterymetals.com/portfolio/corvette/ (website)

- Allkem Galaxy Lithium https://www.allkem.co/projects/james-bay (website)

- Critical Elements Lithium https://www.cecorp.ca/en/ (website)

- Sayona Mining https://sayonamining.com.au/projects/moblan-project/ (website)

- Nemaska Lithium https://nemaskalithium.com/en/ (website)

- Arbor Metals https://arbormetalscorp.com/jarnet-lithium-project/ (website)