Uranium

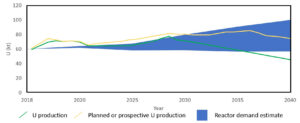

With an increasing global interest shift away from fossil fuel energy production, nuclear power has become an appealing option with an energy density that is several orders of magnitude greater than carbon sources. Uranium is dominantly used for energy production, and another application is high-density alloys used for weapons and armour, radiation shielding, inertial guidance systems and aircraft counterweights. With the long-term projected increase in uranium demand (Figure 2), Australia-based Deep Yellow Ltd.’s (ASX: DYL) operations in Namibia may play an important role in supplying the energy needs of the future.

Uranium Mining in Namibia

Originally, uranium was mined within western countries until the increasing environmental and health regulations drove companies to explore elsewhere. The lower cost of labour and looser regulations in Africa led to a uranium rush in these countries, paving the path for Namibia to rise to prominence as the fourth largest producer of uranium, with 284,000 tonnes of reserves and 142,000 tonnes produced up to 2019.

Uranium production in Namibia began with the opening of Rio Tinto’s Rössing mine in 1976. Rössing remained the only active uranium mine in the country until 2006, when Paladin Energy Ltd. opened the Langer Heinrich mine. Further exploration and development has resulted in the opening of Orano’s Trekkopje mine in 2010 and China General Nuclear Power Group’s Husab mine in 2015.

Despite the closures of the Langer Heinrich and Trekkopje mines due to poor market conditions in 2013 and 2018, respectively, exploration and development of uranium deposits continues. Production on the Etango (Bannerman Mining Resources) and Norasa (Forsys Metals) deposits are expected to start in 2025 or later.

Uranium mining in Namibia isn’t all positives. Ore grades can be as low as 0.01%, which is more energy- and water-intensive and produces more waste than deposits with higher grades of 0.1-1.1% (such as those in Canada and Australia). Acid heap-leaching is used to offset the cost, but this increases the environmental impact. Other challenges include isolation, aridity, low water supply and periodic power shortages.

However, if you can look past the low uranium grades, it’s easy to see why Namibia became a uranium giant. Some benefits Namibia offers include low population density (and thus decreased health concerns), stable business environment with relatively low corruption, good public opinion, and low royalties and environmental regulations. Furthermore, the Namibian government maintains warm relations with the mining industry and has sought to alleviate the challenges faced by miners in the region. In 2007, the Namibian government called a ten-year moratorium on granting new exploration licenses to provide time to improve its environmental regulation and infrastructure. The moratorium was lifted in 2017. Again, on November 18, 2020, the Namibian government suspended applications for mining permits until August 17, 2021 to review the procedures and requirements of those applications.

Geological Background

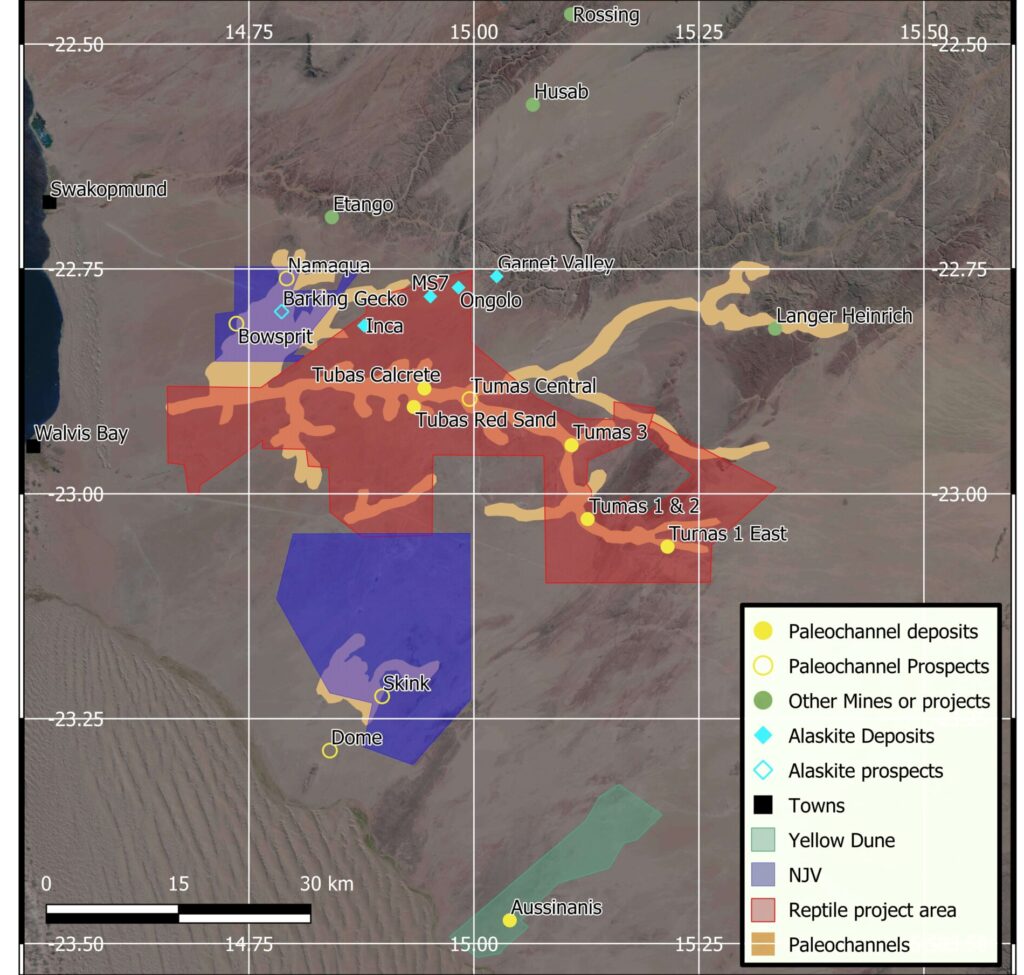

Deep Yellow’s projects are located in the Erongo region of Namibia around current river terraces of the Namib Desert. The geology of the area consists of a granitic-gneissic basement overlain by Damaran Supergroup metasedimentary rocks intruded by igneous rocks (granites, granodiorites and alaskite), and covered by fluvial and aeolian Namib Group sediments. Exploration has indicated three deposit types:

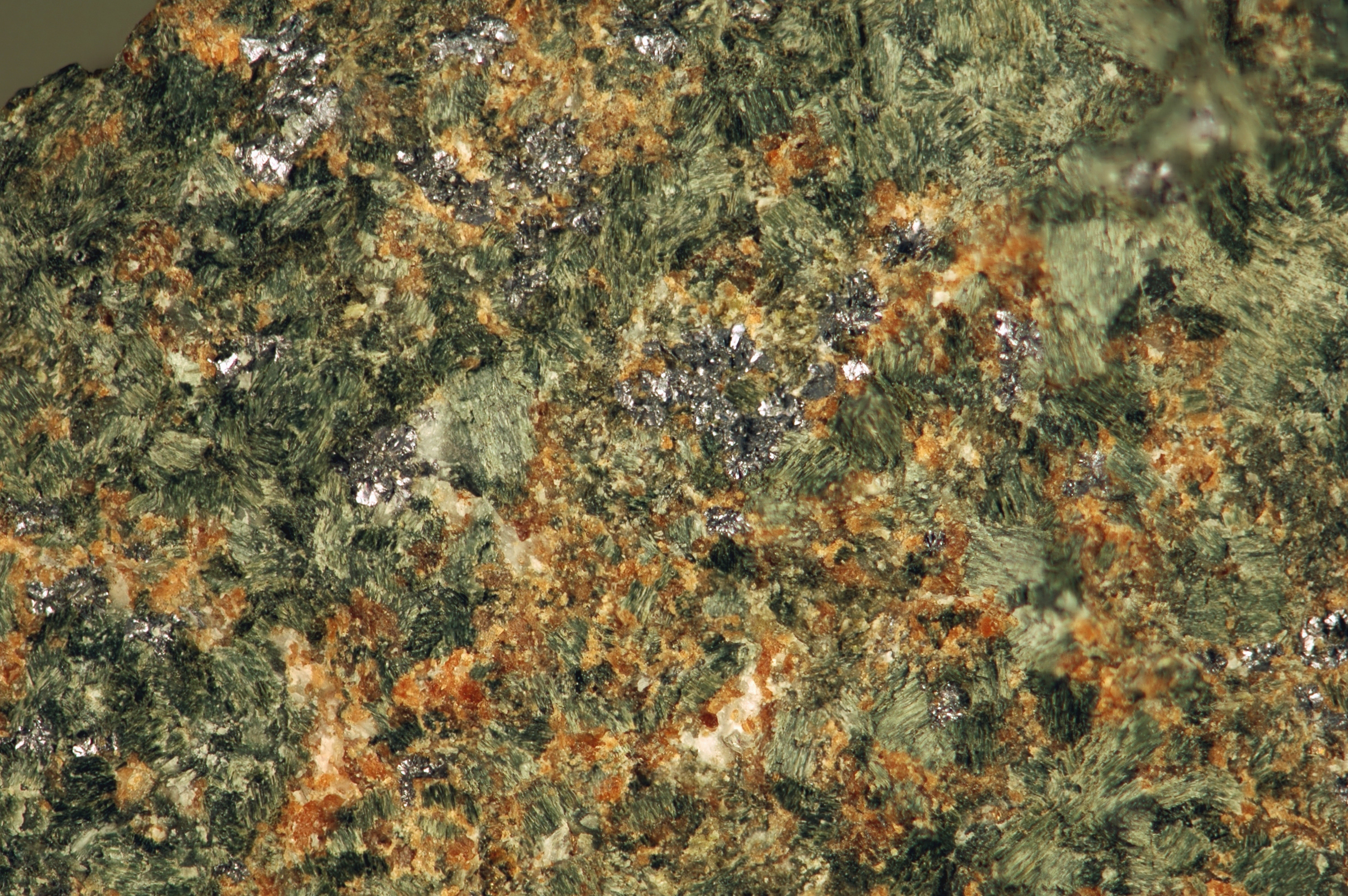

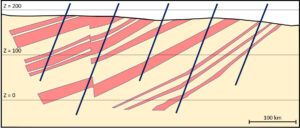

- Alaskite-hosted deposits are sheets of leucogranites (light-colored igneous rocks) with mineralization occurring as disseminations and veins.

- Paleochannel-fill uranium deposits consist of an ancient valley filled with sediments where uranium was later deposited. These deposits formed from the leaching of uranium from uranium-rich granitic rocks by groundwater. Uranium was transported along deep paleochannels which become choked with sediment from flash-flooding, creating a trap for uranium deposition.

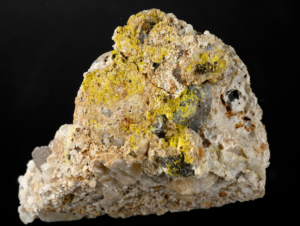

- Calcrete uranium deposits are uranium- and calcium-rich crusts in soil that formed when uranium was leached from underlying granitic basement rocks in subsurface waters. Uranium was drawn upwards by soil-suction processes and evaporation left behind a uranium-rich calcite crust.

For an in-depth description of uranium deposit types, read our Introduction to Uranium Deposits article.

Deep Yellow Ltd. Projects Overview

Deep Yellow has two active projects in Namibia: Reptile (100% stake) and Nova Joint Venture (NJV) (65% stake), in the Namib Naukluft National Park. Deep Yellow first gained access to the Reptile project in 2006 when the company acquired control of what is now Reptile Uranium Namibia (Pty) Ltd. In 2016, Deep Yellow entered into an agreement with Japan Oil, Gas and Metals National Corporation to participate in the NJV with a 65% stake. In that same year, the company considered the Yellow Dune project uneconomic due to the lack of further exploration potential and market conditions.

Reptile

The Reptile Project contains paleochannel, calcrete and alaskite uranium deposits occurring along the Tumas river in western Namibia. The main focus of the Reptile Project is on the paleochannel and calcrete mineralization of the Tumas and Tubas discoveries. Here, uranium occurs as the mineral carnotite (a uranium vanadate) hosted by carbonate-cemented sandstones, conglomerates, and poorly consolidated sands in narrow paleochannels. Currently, the Tumas and Tubas deposits contain 96.2 million pounds of U3O8 at an average grade of 292 ppm. Alaskite mineralization occurs in a 30 by 10 km area known as “Alaskite Alley” which contains the bulk of the known basement resources, including the Ongolo and Inca deposits with a combined total resource of 45.1 Mlb U3O8 at 420 ppm.

The company has reported an increase to the project’s resources by about three times in the last three years of exploration, resulting in an average exploration cost of about 11.5 ₵/lb to date. In the last year, Deep Yellow has completed a scoping study (SS) and a pre-feasibility study (PFS) on the Tumas 3 deposit. Although the PFS is still being reviewed by the board, the company states the outcomes are positive and corroborate the results of the SS, which estimated a 20-year mine life, minimum annual production of 2-3 Mlb of U3O8 at a cash cost of 30 USD/lb, and capital expenditures (CAPEX) around 130 M USD per 1Mlb/year plant design. Moreover, metallurgical testing indicates greater than 92% recovery of uranium.

The second phase of drilling at the Tumas 3 deposit was completed in December 2020. The results include 70 drill holes, of which 60% contains greater than 100 ppm eU3O8 over 1m and 30% greater than 200 ppm. The results provide evidence that the Tubas and Tumas deposits are connected, providing further exploration targets. This is outside of the remaining 50 km of the paleochannel Deep Yellow is exploring to add 30-60 Mlb of resources to the project. Exploration of Alaskite Alley is set to continue to increase the project’s resources.

With the PFS completed for the Tumas 3 deposit, Deep Yellow only needs to wait for the completion of the environmental impact assessment (EIA) before progressing towards an environmental clearance certificate and later, a mining license application in March/April 2021 to begin pre-development activities.

NJV

Work on NJV is currently focused on exploring both basement and paleochannel uranium mineralization at the Barking Gecko Prospect. Drilling in December of 2020 occurred where areas of thick uranium mineralization were identified. Results indicate 1-2 m intersections with eU3O8 concentrations up to 171 ppm. Because some drill holes did not intersect expected targets, the geology and drilling program were reevaluated, with drilling continuing in the beginning of February 2021.

Future Outlook: Deep Yellow’s Plans For 2021 And Beyond

Based on the projected increase in demand for uranium and the Namibian government’s expectation to produce 7200-9800 tonnes annually up to 2045, mining companies such as Deep Yellow appear to be poised for long-term success. To date, Deep Yellow’s exploration has progressively defined potentially economic uranium deposits and in the process, has identified more exploration targets. However, there are risks and challenges involved with mining in Namibia.

In the short-term, low uranium prices and the COVID-19 pandemic has limited exploration in the area and caused many mining operations to reduce production to a minimum. In the long-term, the benefit of the low regulation and cost of mining in Namibia is also the industry’s vulnerability. Although public opinion of uranium mining is mostly positive with local populations, there is concern about its negative impacts to health and tourism. If either of these areas were adversely affected, it could spark public resistance and outrage to uranium mining, and in turn, lead to progressively stricter regulation on the industry.

Nevertheless, Deep Yellow’s projects remain attractive potential sources of uranium, especially in light of the company’s exploration successes.

Further Reading

- Uranium resources, production and demand (pdf)

- Sociopolitical environment of Namibian uranium mining (article)

- Geopolitical shift towards uranium mining in Namibia (article)

- Namibian uranium (website)

- Uranium mineralization in Namibia (article)

- Uranium in South Africa and South West Africa (Namibia) (article)

- NUA, 2019 (pdf)

- Surfical uranium deposits (pdf)

- Namibia’s November2020 to August 2021 suspension of mining applications (website)

Companies Mentioned

- Deep Yellow (ASX: DYL) (website)

- Reptile Uranium Namibia (Pty) Ltd

- Paladin Energy Ltd. (OTCMKTS:PALAF) (website)

- Forsys Metals (TSE:FSY) (website)

- Bannerman Resources (ASX:BMN) (website)

- Rio Tinto (NYSE:RIO) (website)

- Orano (website)

- China General Nuclear Power Group (website)

- Japan Oil, Gas and Metals National Corporation (website)

Subscribe for Email Updates