While there’s a good chance that the property would have been worth a whole lot more a few years ago, having a regional mine operator on your side is never a bad idea. With a good cash position the company will be able to properly explore and advance their remaining properties.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

TORONTO, ONTARIO–(May 9, 2014) – Alexandria Minerals Corporation (TSX VENTURE:AZX)(FRANKFURT:A9D)(PINKSHEETS:ALXDF) is pleased to report on preliminary results from the recently completed, down-hole Induced Polarization (“IP”) Survey on its Akasaba property. Survey results yielded several strong targets on both the main Akasaba Mine Trend and the nearby parallel North Zone, adding to high priority drill targets in preparation for this summer’s drill program.

[box type=”note” align=”aligncenter” ]

As we move forward into 2014’s exploration season, we’ll be paying special attention to the data that companies are using to justify their summer programs. While it’s worth reminding ourselves sometimes that previous work is no guarantee of future success, a logical and methodical approach to planning a summer program can make or break a junior mining company and its stock price. This is especially true in our current market where success is often met with apathy, but misses result in brutal punishment from the markets. Now more than ever, it is critical for companies to ensure they have sufficient data to help plan their exploration program. In this case, Alexandria Minerals has used the break between their winter and summer drill programs to gather additional data on deeper drill targets using down-hole IP.

Alexandria’s Akasaba property is a one of many gold properties along the “Cadillac Break”, a large regional fault and part of an even larger fault system that hosts numerous gold “camps” and mines across the provinces of Quebec and Ontario in Canada. The Akasaba property has been subject to sporadic exploration activities since the 1940 and in the early 60’s was briefly mined by Falconbridge. Alexandria has held the property since 2007. In January 2014, after publishing an updated and expanded resource for the property, the company sold it’s “west zone” Akasaba properties to Agnico-Eagle for $5 Million. Agnico Eagle currently owns 9% of Alexandria.

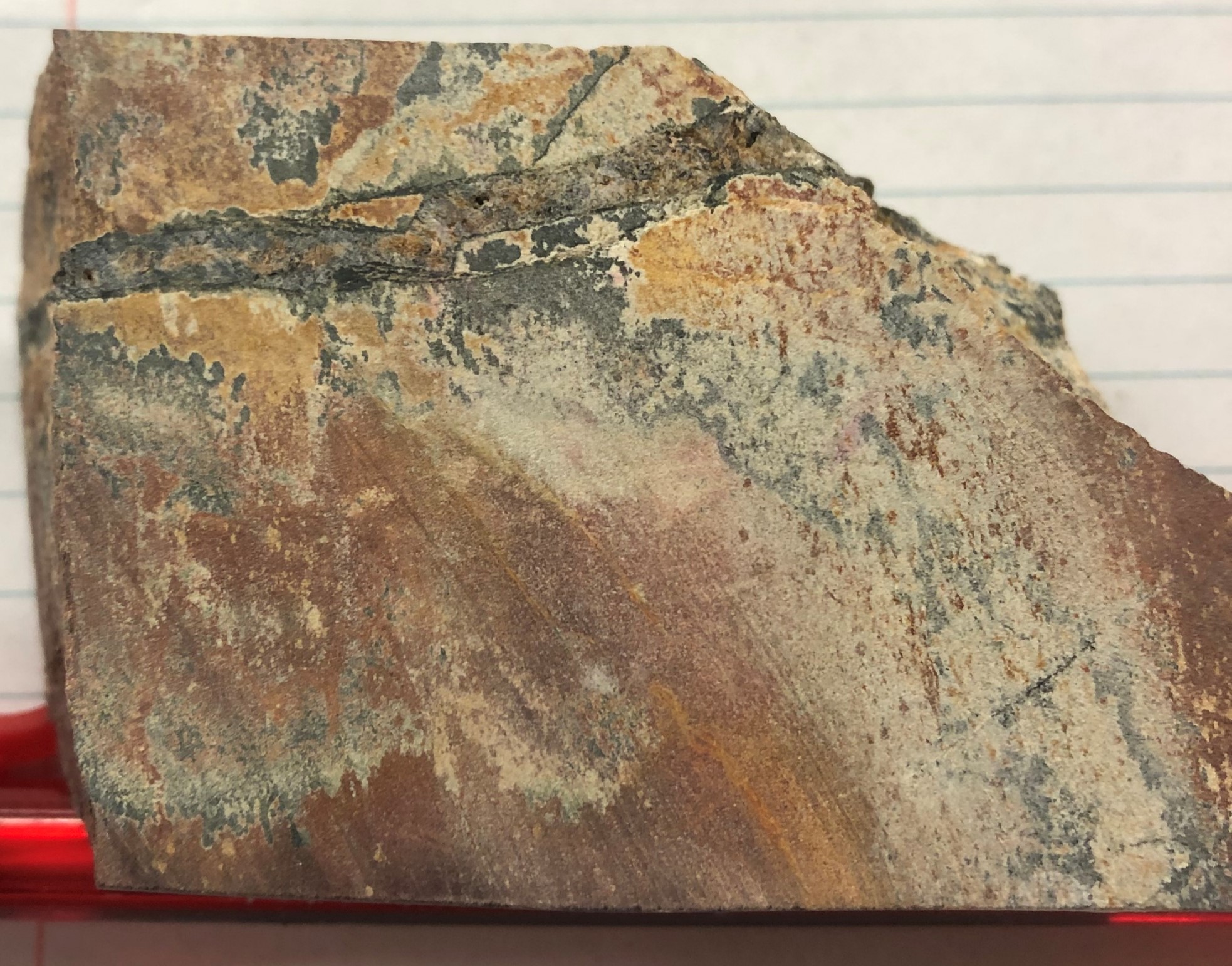

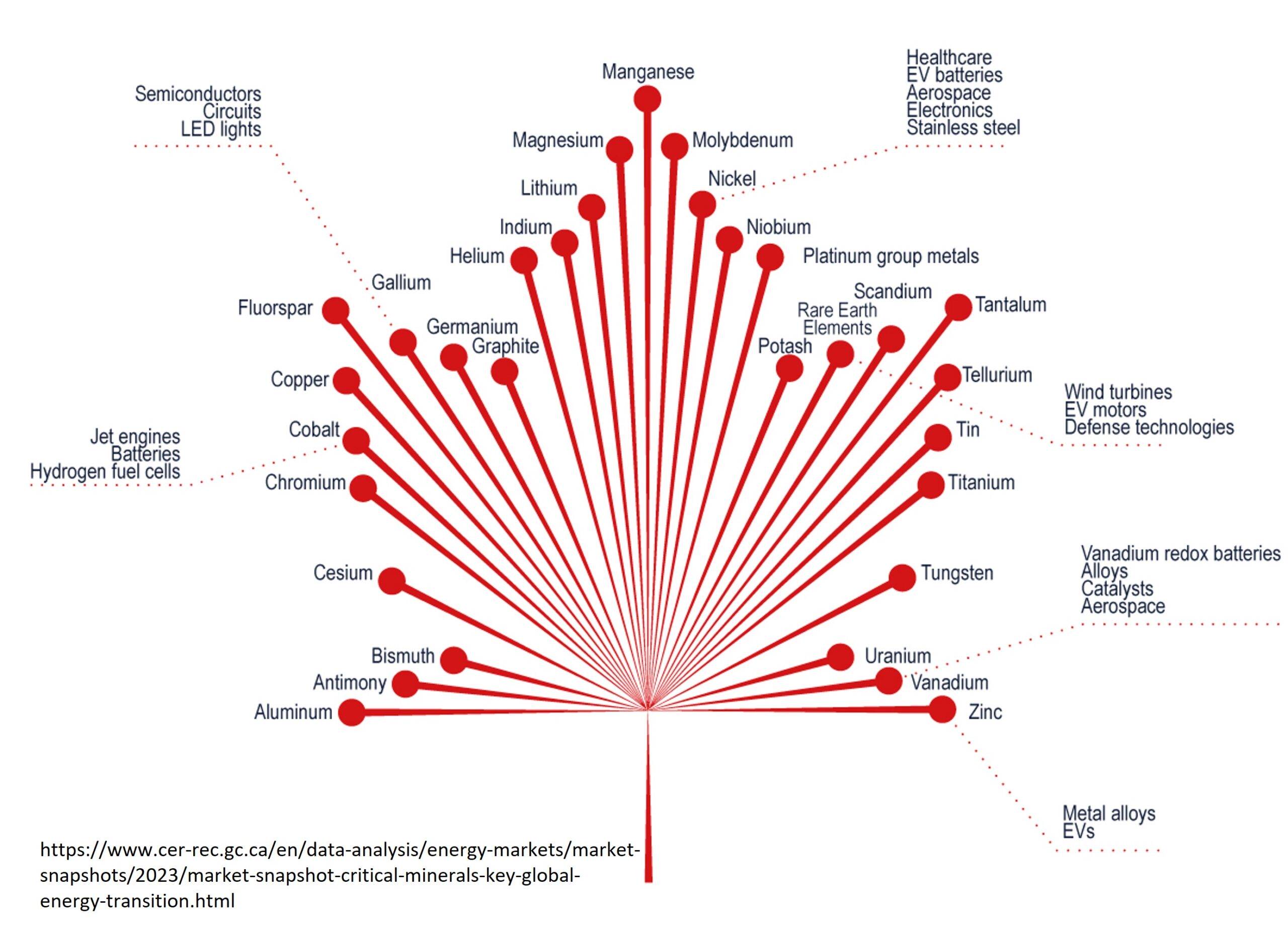

This particular news reports the results of a “down-hole IP survey” on property which will be used to help plan summer drilling. While gold mineralization cannot be directly detected using IP geophysics, the method is most useful in detecting dispersed (or disseminated) sulfide mineralization and to a lesser extent, small sulfide mineral lenses within the bedrock. Sulfide minerals including pyrite and pyrrhotite (both iron sulfides) are associated with the gold mineralization on the property. The property also hosts copper, zinc and silver which likely indicate that the deposit may have formed as part of a VMS (Volcanic Massive Sulfide) system which was later subject to regional metamorphism and structural deformation.

[/box]

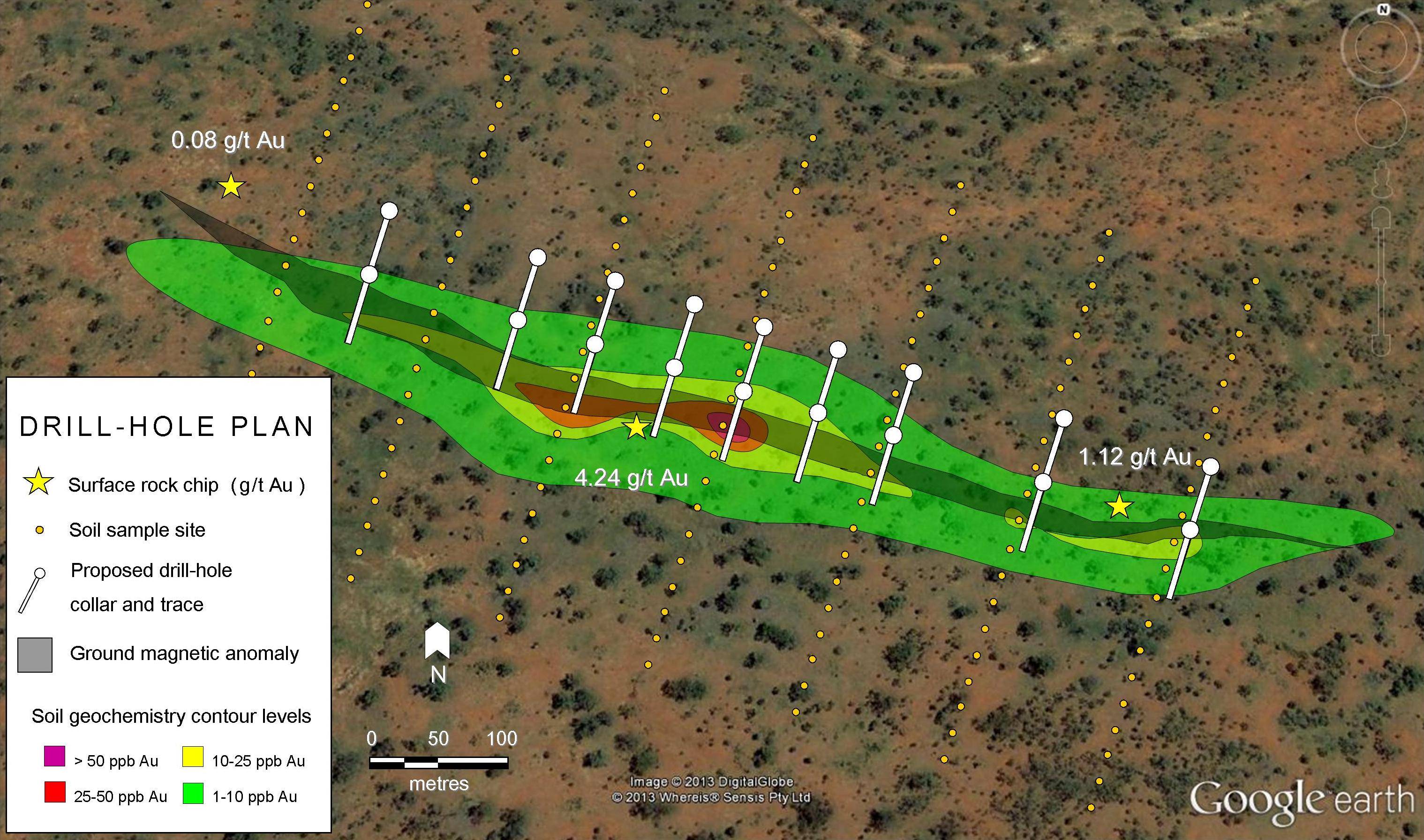

The principal geophysical targets on the main Akasaba and North Zones are up to 400m long along strike, open to the east, and open at depth. The anomalies, located below and to the east of the Akasaba Current Resources, are similar to those intersected by previously completed gold-bearing drill holes that contain 11.35 g/t Au over 6.0 m, 6.19 g/t Au over 5.05 m, and 4.69 g/t over 5.00 m.

survey.

Eric Owens, President and CEO, stated “These are very encouraging results, and we are looking forward to testing these targets with drill holes. Through geophysical surveys and this past winter’s drilling, we have generated several strong targets for this summer’s 10,000 m drill campaign in an effort to build on our existing gold resources. We are still awaiting further geophysical results and drill assay results, which should provide further targets for testing.”

The borehole geophysical (Hole-to-Hole Resistivity/IP) survey was conducted during the winter by Abitibi Geophysics. The survey was designed to investigate potential targets at depth around the Akasaba Current Resources. The survey used a conventional induced polarization technique, with a borehole-to-borehole array based on 19 pairs of holes. Once all the data combinations are collected, a 3D inversion uses all the readings simultaneously in order to estimate the location and volume of the anomalies. Validation of the geophysical results are provided by past Alexandria drill hole assays, which show excellent correlation between well mineralized gold-bearing zones and strong Induced Polarization anomalies.

[box type=”note” align=”aligncenter” ]

While most geophysical surveys are performed at ground level or from the air, a “down-hole” survey makes use of existing drill holes to increase the penetration depth of the survey result beyond what could be achieved using a surface or airborne survey. The instruments are lowered down pairs of drill holes to create a powered circuit that essentially turns the rock into a huge low voltage battery. The IP response is essentially the rock’s ability to hold a charge.

The above diagram is a very low resolution digital map for one specific area covered by the survey. It doesn’t really help the reader other than to perhaps demonstrate that the survey actually happened. The true final product will be a 3D compilation of the entire survey area and will give the company some direction for deep drill targets. The company is telling us that they have identified some hot targets below their current resource.

[/box]

Elsewhere, the Company is awaiting assay results from the recently completed 4,000 m drill program on its Sleepy project, located 12 km east of the Akasaba project.

Program design, management, and Quality Control/Quality Assurance are governed by Alexandria’s exploration group of which Philippe Berthelot, P.Geo, is the Company’s Qualified Person. Mr. Berthelot has reviewed the results in this press release. All exploration work on the property is conducted under the direct supervision of Emilie Batailler P.Geo and Philippe Berthelot. The QA/QC program is consistent with NI 43-101 and industry best practices and has been previously addressed in the NI 43-101 Technical Report on the Cadillac Break properties (February 2008) as well as in subsequent NI 43-101 reports found on the Company’s website or on www.sedar.com.

About Alexandria Minerals Corporation

Alexandria Minerals Corporation is a Toronto-based junior gold exploration and development company with one of the largest portfolio of properties along the prolific, gold-producing Cadillac Break in Val d’Or, Quebec. Global gold resources are distributed between three projects on its Cadillac Break Property package, Akasaba, Sleepy, and Orenada. The Company is currently focused on advancing its Akasaba project. Agnico-Eagle Mines Ltd., with two producing gold mines in the region, owns roughly 10% of the Company.

[box type=”note” align=”aligncenter”]

At $0.08 per share the company stock price is sitting at a 52 week high and about double what it was a few months ago. This is no doubt due to its recent infusion of cash from the Agnico-Eagle deal. While there’s a good chance that the property would have been worth a whole lot more a few years ago, having a regional mine operator on your side is never a bad idea. With a good cash position the company will be able to properly explore and advance their remaining properties and continue to build investor value.

[/box]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]

Subscribe for Email Updates