Introduction

Molybdenum (Mo, Atomic number 42) is a silvery grey metal, notable for its extremely high melting point (2623°C). It has many uses in the aerospace, military and petroleum industries, with other minor specialty uses. It is an essential trace element for animals and plants, though too much of it is toxic.

Deposit Styles

Molybdenum mineralization typically occurs in porphyry deposits and specifically in association with porphyry copper deposits. These porphyry deposits range along a continuum from “Classic” Arizona/Chilean style copper-molybdenum (Cu-Mo) deposits where copper is the dominant commodity to molybdenum-only porphyry deposits to molybdenum-tungsten (Mo-W) porphyry deposits. Other styles of mineralization include tungsten- molybdenum skarn deposits but these make up a volumetrically insignificant amount of the total resource.

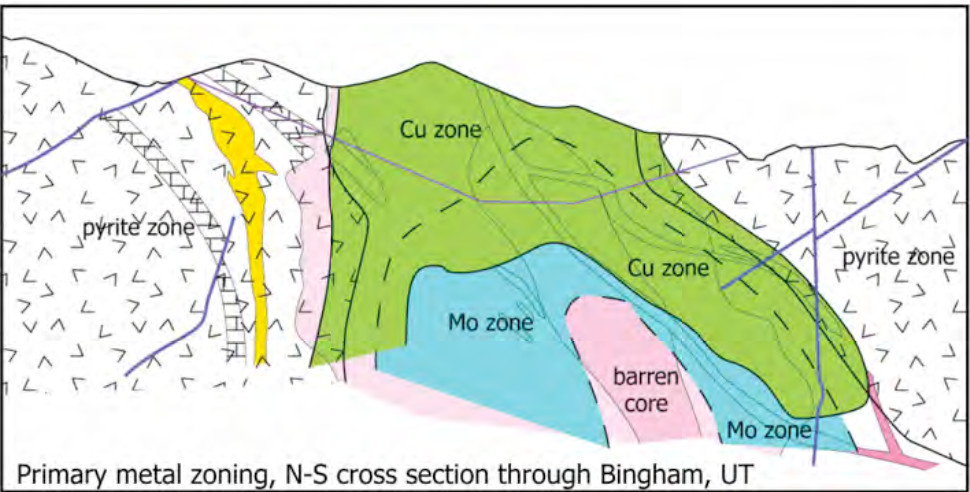

In addition to copper and tungsten these molybdenum rich porphyry deposits can have appreciable amounts of silver, lead and zinc mineralization. Porphyry Cu-Mo, Mo and Mo-W deposits are associated with what is known as the calc-alkaline trend of igneous rocks, which are granodiorites, granites and quartz monzonites intrusives, and dacite-rhyolite extrusives. In molybdenum only porphyry deposits, the host is a quartz stockwork, adjacent to or forming a ring around the mineralizing intrusive rocks. The mineralization is concentrated in the potassic alteration zone, with little economic mineralization found in the propylitic or sericitic zones. In some Molybdenum porphyry’s such as the high silica Climax-Henderson type, the sericitic micas are enriched in flourine. When copper is the dominant mineralization, molybdenum mineralization is found mainly in deeper levels of the deposit closer to the intrusive core.

The grades of porphyry molybdenum deposits vary from 0.2% to 0.01%, depending on the style of mineralization and whether it is a byproduct.

Refining & Processing

The processing of Molybdenum is fairly straightforward. Like most sulfides, the ore is crushed in a mill, ground into a powder, mixed with reagent, aerated and then put into a flotation cell, where gangue is separated from the Molybdenum, and a concentrate is produced. Most concentrates are 85-92% Molybdenite (MoS2) purity and it can either be processed into “tech oxide” (MoO3, 57% Mo) or into pure Molybdenum powder. Rhenium (Re), one of the rarest metals in the world, may also be recovered as a by-product of Molybdenum recovery and is one of the main sources of that element.

Market

The market for Molybdenum is dominated by production from China, Chile and the USA which produce 206,000 of the 267,000 tonnes of global production. The remainder is produced by Canada, Peru, Armenia and Mexico, and several other countries. The primary production is from either Molybdenum porphyry deposits or as a byproduct of copper porphyry deposits. From 2000 to 2010 the Molybdenum market was characterized by extreme volatility with prices rising from under $5 per pound to over $45 per pound and then dropping to $9 a pound in 2008. The market has stabilized since then with prices rising to $16 in 2010 and then slowly drifting down to $4.70 in 2014. Recently prices have risen back to $7 on the recovery of oil prices which drives demand from the biggest user of Molybdenum hardened steel, the Oil and Gas industry. As with most commodities China is playing an increasingly dominant role, with demand for Molydenum expected to grow by 4.5% through 2025.

It should be noted that despite the lack of substitutes, the molybdenum market is quite small and is subject to supply shocks. When new Copper porphyry deposits are commissioned production of molybdenum is typically a small fraction of total production and producers will continue to produce it regardless of price. There is little incentive to cut production to balance the market. Hence for pure molybdenum producers there is always the chance of being priced out if enough copper mines are making money off the copper. Supply shocks occur as molybdenum mines are shut down and restarted en mass.

Subscribe for Email Updates

The market has stabilized since then with prices rising to $16 in 2010 and then slowly drifting down to $4.70 in 2014.

It was Q4-15 that prices bottomed out. Not 2014.