Most junior miners focus their efforts on advancing a single project, but after acquiring Millennial Lithium, Lithium Americas is poised to become a major player in three promising lithium (Li) projects.

Company

Lithium Americas (TSX and NYSE ticker LAC) is a Canadian-based junior mining company focused on producing battery-grade Li carbonate, a product which is increasingly required for the production of electric vehicle batteries. Despite not having any operating mines, Lithium Americas has a market cap of $1.7 billion and three operations on two continents.

Projects

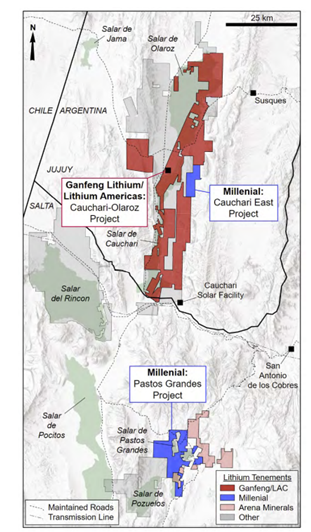

Lithium Americas’ main project is the Caucharí-Olaroz Li brine project in the Lithium Triangle of Jujuy province, Argentina. This area already hosts several major Li brine operations and has good access to supporting infrastructure such as roads, electricity, and natural gas pipelines. Lithium Americas owns 44.8% of the project, with their partner Ganfeng Lithium owning 46.7%, and Jujuy Energia y Mineria Sociedad del Estado, a company owned by the Government of Jujuy province, controlling the balance.

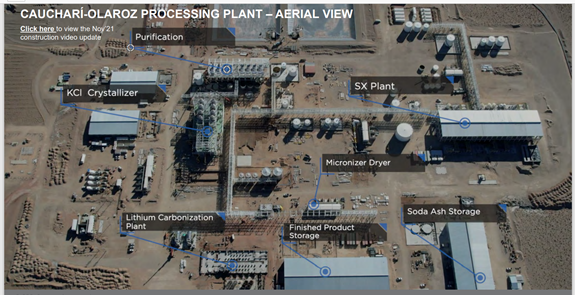

Caucharí-Olaroz is one of the largest Li resources in the world, with proven and probable reserves of 1.1 billion m3 of brine at 607 mg/L for 1.952 Mt of Lithium Carbonate Equivalent (LCE). Measured and indicated resources are 6.3 billion m3 brine at 592 mg/L, for 19.853 Mt LCE. Inferred resources comprise an additional 1.5 billion m3 brine at 592 mg/L for 4.723 Mt LCE. Stage 1, which is nearly finished construction, will produce 40000 t/year Li carbonate, with stage 2, which is expected to begin construction in mid-2022 and reach production in 2025, ramping up to 60000 t/year. The project is fully funded and expected to enter production in mid-2022. Mine life is estimated at 40 years.

Lithium brine deposits form in closed continental basins where hot spring or volcanic waters leach Li out of rocks and sediments. Lithium-bearing brines are pumped to the surface and left to evaporate under the desert sun for months until a Li concentrate can be collected and sent to a process plant for refining. This method requires an arid climate to allow for efficient evaporation.

Thacker Pass, Nevada, is the largest Li deposit in the United States, and is 100% owned by Lithium Americas. It is a Lithium-clay deposit, with Li hosted in clay sediments and rocks within the McDermitt Caldera, a now extinct supervolcano associated with the Yellowstone hotspot. Following the last eruption 16 million years ago, hot volcanic waters percolated through the surrounding volcanic rocks, leaching Li from the rocks into the caldera lake, where it was eventually deposited as thick layers of Li clay. Tectonic uplift eventually caused the lake to drain, leaving the sediments exposed near the surface.

Proven and probable resources at Thacker Pass are 179 Mt at 0.33% Li for 3.19 Mt LCE. Measured and indicated resources stand at 1153 Mt at 0.22% Li for 13.7 Mt LCE, with inferred resources of 392 Mt at 0.21% Li (4.4 Mt LCE). The project is expected to produce 30000 t/year of battery-grade Li carbonate, with expansion to 60000 t/year being complete after 3.5 years. Production will be from open pit mining, with a waste-to-ore ratio of 1.6:1. Total mine life is estimated at 46 years.

The Thacker Pass Mine received fast-tracked approval from the Bureau of Land Management in January 2021, this, however, has been appealed in court, and construction has been put on hold pending a final ruling. A decision is expected in Q1 2022. Two lawsuits filed by environmentalists and local indigenous groups against the project have already been dismissed. Assuming a favorable ruling, construction is expected to begin in the first half of 2022.

On November 17, 2021, Lithium Americas signed a definitive purchase agreement to acquire all outstanding shares of Millennial Lithium, giving the company ownership of Millennial’s Cauchari East property and flagship Pastos Grandes project. The acquisition followed a lengthy bidding war, which ultimately saw Lithium Americas outbid Chinese battery manufacturing giant Contemporary Amperex Technology Limited (CATL), a company with nearly 150 times Lithium Americas’ market cap. The deal is still subject to approval by Millennial shareholders and regulators, and is expected to close in January, 2022.

Millennial’s properties, both of which are 100% owned by Millennial, are Li brine deposits located in Argentina’s Lithium Triangle near the Caucharí-Olaroz project.

Millennial’s flagship asset is the Pastos Grandes, which has proven and probable reserves of 734 153 000 m3 of brine at 439 mg/L, representing 0.943 Mt LCE. Measured and indicated resources comprise another 4.2 Mt LCE, with inferred resources of 0.798 Mt LCE. Mine life is estimated at 40 years, with production ramping up to 24000 t/year of battery-grade Li carbonate over 6 years. The Li carbonate pilot plant is in operation and has already produced its first batch of 99.96% pure Li carbonate. Production is expected to begin in the first half of 2024.

Lithium Americas also owns 18% of Arena Minerals, which owns 65% of the adjacent Sal de la Puna lithium brine project.

Li Outlook

Lithium is used a variety of products, such as glass, aluminum alloys, and pharmaceuticals, however it is the rapidly increasing demand for electric vehicles that is driving an equally rapid rise in demand for the Li their batteries require. While many companies are trying to move towards technologies that are less dependent on scarce metals such as cobalt, the superior charge-to-weight ratio of Li makes it all but indispensable for most designs for the foreseeable future.

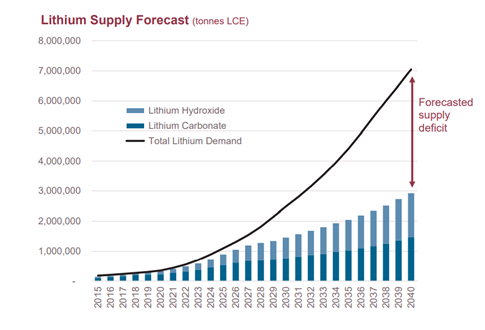

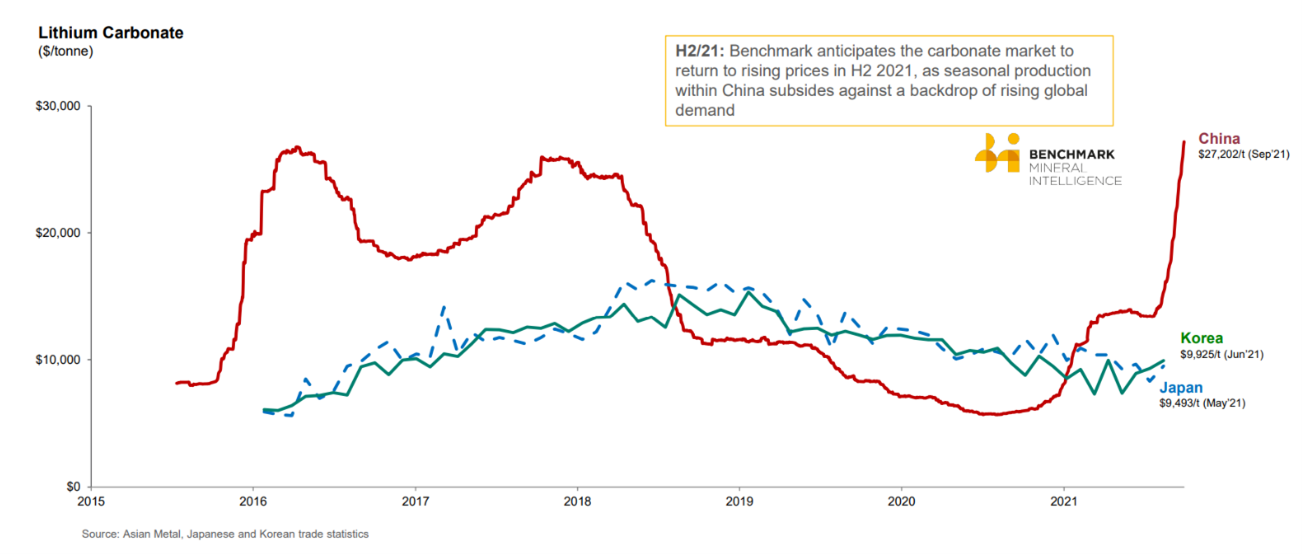

Demand for Li is expected to increase 400-500% by 2025, with a significant supply shortfall forecast despite enormous increases in production. Each of the ~200 Li battery “gigafactories” which are being built around the world consumes the entire annual output of an average Li mine. These factories can be constructed in less than a third of the time required to develop a mine. While Li prices vary by region and product, the price of battery-grade Li carbonate in China, the main consumer, has risen more than 150% this year.

Concerns over potential Li shortages have led to it being designated a critical element, with both governments and companies increasingly competing to secure supplies of the materials required to build sustainable energy infrastructure.

Investor Takeaways

2022 could be a make-or-break year for Lithium Americas. If the deal for acquisition of Millennial closes as expected and the Thacker Pass project receives regulatory approval it will be on the fast track to becoming a major Li producer. If either of these fail to materialize, it would likely be a major blow to the company. Barring unforeseen events, the acquisition of Millennial seems likely to close shortly after the new year. The approval of Thacker Pass is less certain, previous rulings, however, have favored the company.

Pursuing three large projects at once is a bold strategy for a junior miner, but so far it appears to be paying off. With a portfolio of large, low cost, high production Li projects entering production over the next three years, Lithium Americas is poised to become one of the largest Li producers in the world. With Li demand increasing sharply for the foreseeable future, Lithium Americas future looks bright.

Companies Mentioned

- Lithium Americas https://www.lithiumamericas.com/ (website)

- Millennial Lithium https://www.millenniallithium.com/ (website)

- Ganfeng Lithium http://www.ganfenglithium.com/news_en.html (website)

- Jujuy Energia y Mineria Sociedad del Estado http://jemse.gob.ar/ (website)

Resources

- Millennial Lithium (2021): Corporate Presentation. Retrieved from: https://www.millenniallithium.com/_resources/presentations/corporate-presentation.pdf?v=0.709 (pdf)

- Lithium Americas (2021): Corporate Presentation. Retrieved from: https://www.lithiumamericas.com/_resources/presentations/corporate-presentation.pdf (pdf)

Subscribe for Email Updates