There’s a fair bit of geology in this release and not a lot of hard numbers, but for us this is the best sort of news: We get a glimpse into a company’s rationale and methodology at an early stage in the exploration process.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. [/box]

VANCOUVER, BC–(Marketwired – October 23, 2014) – Columbus Gold Corporation (TSX VENTURE: CGT)(OTCQX: CBGDF) is pleased to report the identification of five new drill targets, which suggest the potential for district scale, at its 100% controlled Eastside gold discovery in Nevada. Assays results from the newly identified targets have yielded anomalous to 24 g/t gold in outcrop and float samples.

[box type=”note” align=”aligncenter” ]

The last time we talked about Columbus Gold was back in September when they reported drill results from their flagship Paul Isnard Project in French Guiana. Exploration on that project is currently funded by Nordgold who is pursuing a 50.01% interest in the project. In addition to Paul Isnard, Columbus has 17 projects in Nevada and two in Arizona. This release deals with some recently identified exploration targets on their Eastside Property in southwestern Nevada.

[/box]

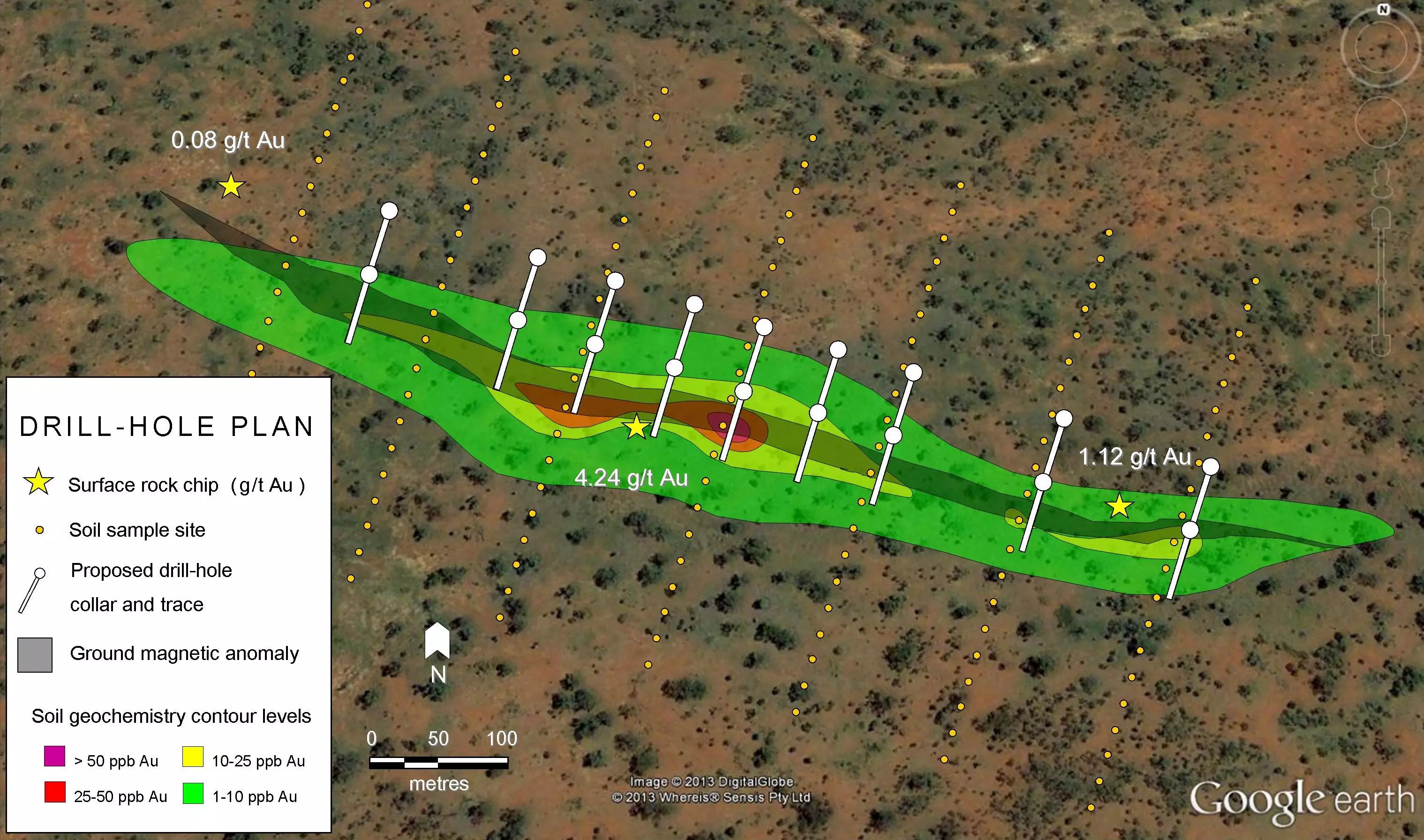

The Original Target at Eastside hosts a large area of shallow oxide gold mineralization still open to the south that measures about 1,600 meters long and up to 600 meters wide (5,280 ft by 1,980 ft). Columbus is in the process of permitting a program at the Original Target that will include 14,455 meters (47,700 ft) of new drill roads and 175 drill sites that can be used for multiple drill holes. Commencing in January 2015, Columbus plans to drill 64,400 meters (212,500 ft) in 250 rotary holes [along with 2,576 meters (8,500 ft) in 10-12 core holes for detailed metallurgy] with the aim of completing an initial resource calculation at Eastside in late 2015. As part of the 250 rotary hole drill program, 15-25 holes are planned to test two of the five new targets: New Target 1 and New Target 4.

[box type=”note” align=”aligncenter” ]

Columbus has a fairly large drilling program planned for Eastside which includes 250 RC drill holes and about a dozen diamond drill core holes for more detailed analysis of the geology and mineralization. As we’ve discussed before, RC drilling is good for fast, cheap shallow holes where the primary interest is assay values. Drill core drilling is more expensive, but gives better detail regarding the structural geology, mineral relationships, textures and other data that may help geologist better understand the nature of the deposit. RC drilling is typically used in Nevada, where finely disseminated gold is hosted in shallow, soft rock environments.

[/box]

Columbus Gold geologists have completed geologic mapping which now extends over the entire 46.4 km2 (17.9 miles2) Eastside claim block at a scale of 1:6000. This mapping has identified 41 separate rhyolite domes, which Columbus knows to be important for controlling gold mineralization at Eastside. The domes range from 100 meters to 1,000 meters in diameter (328 ft to 3,280 ft). Hydrothermal alteration has been identified in, or near, about half the domes. Dozens of faults have been identified and mapped throughout the claim block, mostly trending north and northeast.

[box type=”note” align=”aligncenter” ]

A “rhyolite dome” is the rock left behind from the slow eruption of a thick lava from a volcano. Rhyolite is a volcanic rock of a composition similar to granite. The company has identified dozens of these domes on the property and at least some of these domes appear to be associated with gold mineralization. A number of faults have also be identified. Faults can act as channels for metal-bearing hydrothermal fluids.

[/box]

Areas with hydrothermal alteration, particularly silicification and quartz veining, have been mapped, and sampling of all these altered areas is in progress with 2,700 samples collected so far. Based on results received to date, Columbus believes the following 5 new targets are worthy of drilling, with New Target 1 and New Target 4, which are located outside of the Original Target area, for priority drilling in 2015.

[box type=”note” align=”aligncenter” ]

The company has also mapped areas with veining and direct evidence of hydrothermal activity and alteration. While not all hydrothermal systems are associated with economic mineralization, they are a good place to start when prospecting for gold. It looks like they are already planning to drill some of these areas, but sampling of the targets is not complete.

[/box]

New Target 1

Surface sampling of outcrop and float define New Target 1, which is a 2 km (1.25 mi) long gold anomaly along a northerly structural zone. On its north end the anomaly coincides with the west-dipping margin of rhyolite domes. To the south the gold values are in andesite, along northerly faults that either vertical or dip to the west. Gold values are associated with silicification, argillization, and quartz/adularia stockworks and are hosted in both rhyolite and andesite.

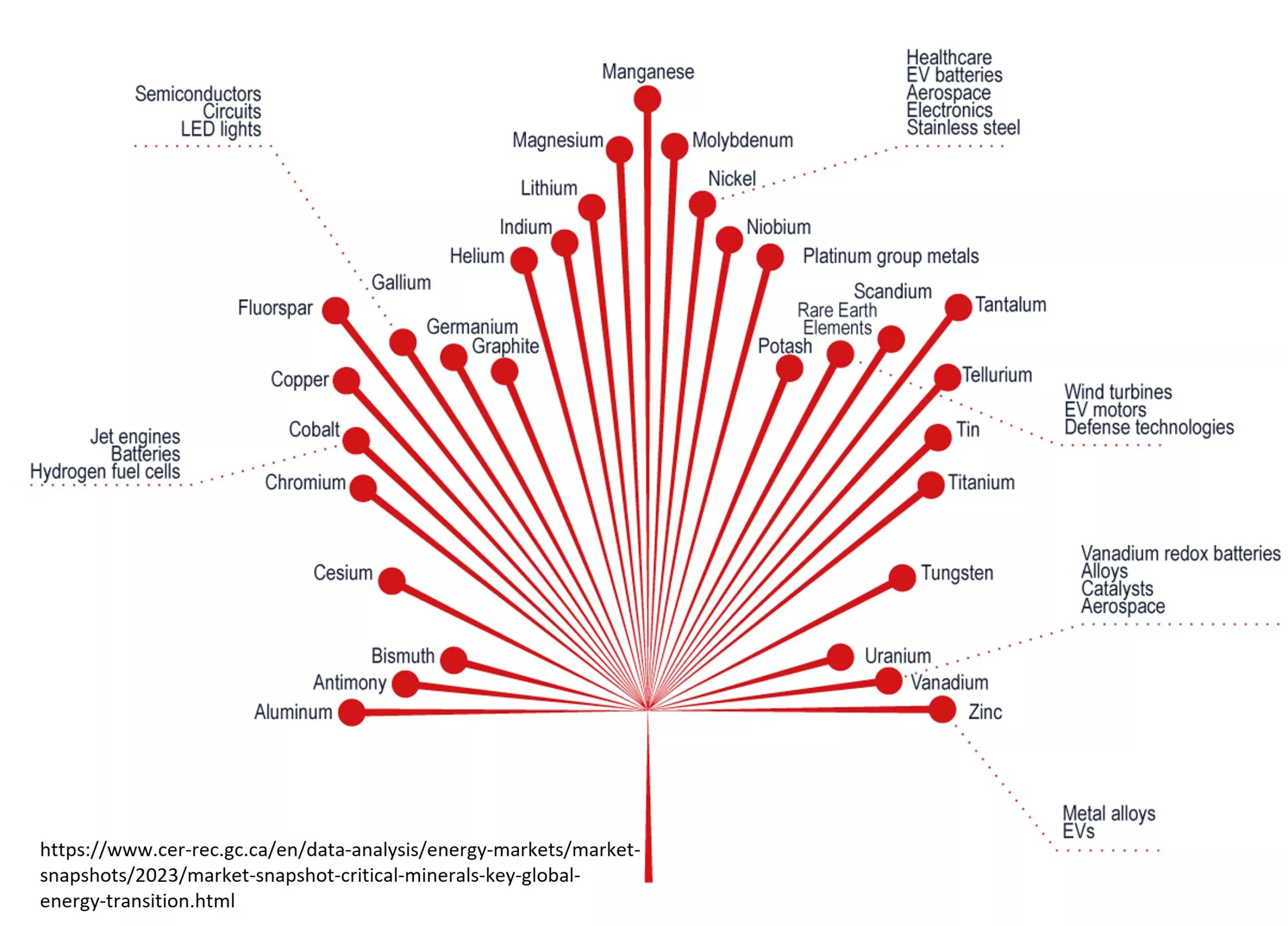

About 175 outcrop and float samples have been collected in New Target 1 with gold values ranging from anomalous to 12.3 g/t gold. Twenty eight of the samples assay greater than 0.5 g/t gold. Trace elements coinciding with the gold anomaly are arsenic (0-335 ppm), antimony (0-38 ppm), silver (0-93 ppm), and molybdenum (0-2688 ppm).

This anomaly has not been drill tested, however it will be targeted with drilling commencing in 2015. This very long anomaly has the potential to host gold and silver mineralization of significant size.

[box type=”note” align=”aligncenter” ]

Andesite is another type of volcanic rock. Gold values appear to be associated with hydrothermally altered volcanic rocks: The “silicification, argillization, and quartz/adularia stockworks” that the company describes are all evidence of hot fluid movement through the rocks.

[/box]

New Target 2

New Target 2 is a 1 km (0.62 mi) long anomaly. The northernmost end of New Target 2 is 500 meters (1,640 ft) south of the southernmost drill hole in Columbus’ 2013 drilling at the Original Target, and is likely a southern extension of the Original Target. New Target 2 is associated with silicification of rhyolite tuffs along the western margins of a series of rhyolite domes. Eighty (80) float and outcrop samples have been collected in New Target 2 yielding anomalies in gold (anomalous to 0.6 g/t gold), arsenic (0-600 ppm), antimony (0-19 ppm), and molybdenum (0-32 ppm). Silver values in surface sampling are negligible in New Target 2, much as they are in the Original Target.

New Target 2 has not been tested by drilling.

[box type=”note” align=”aligncenter” ]

Another target featuring altered volcanic rocks. A “tuff” is a rock that is basically hardened volcanic ash, but the key here is the “silicification”: Silica-rich (and hopefully metal-bearing) fluids moving through the rock will leave behind some of the silica resulting in a hardening or “silicification” of the volcanic host rock and high silica minerals such as quartz. Float samples are pieces of loose surface rock which may or may not be sourced from the immediate area are are considered less important than outcrop samples which are chipped directly from the bedrock.

[/box]

New Target 3

Sampling is just beginning at New Target 3. Two initial samples yielded significant values – one ran 24 g/t gold and 354 ppm silver, and the second ran 1.04 g/t gold and 23 ppm silver. Both samples were of narrow veins (about 1 foot wide) cutting altered dacite and dacite tuffs. The veins have banded quartz, with some bands of quartz replacing calcite. Argillic alteration and iron-staining are common in the area.

Detailed sampling is currently in progress. New Target 3 has not been tested by drilling.

[box type=”note” align=”aligncenter” ]

Dacite is yet another volcanic rock, but really all were worried about at this point is the evidence of hydrothermal veining.

[/box]

New Target 4

New Target 4 is a geophysical target located just 150 meters (492 ft) north of the Original Target drilled by Columbus in 2013, in an area thought to have 2 to 10 meters (6.5 to 33 ft) of gravel cover. CSAMT geophysical data indicates the presence of a buried rhyolite dome, likely the same as the rhyolite domes 200 meters (656 ft) south which are known from Columbus 2013 drilling to host significant gold mineralization. The buried rhyolite dome appears to be at least 200 meters (656 ft) in diameter and its top likely lies 50 – 75 meters (164 – 246 ft) below the surface.

This target is on trend with important gold-hosting structures to the south and presents an excellent target for drilling. New Target 4 has not been tested by drilling; Columbus intends to drill New Target 4 in 2015.

New Target 5

New Target 5 is about 8 km (5 miles) south of the Original Target drilled by Columbus in 2013. Forty samples indicate a geochemical anomaly about 2 km (1.25 mi) long and up to 0.75 km (0.47 mi) wide. The anomaly has coincident gold (anomalous to 1.05 g/t), arsenic (0-464 ppm), antimony (0-240 ppm) and molybdenum (0-69 ppm). Two surface samples contained significant silver, one 24 ppm and the other 93 ppm silver.

The anomaly is located in silicified rhyolite tuffs bordering a complex of several rhyolite domes. Northerly structures are common in the area and seem to control the silicification. The overall geology and alteration are the same as that found in the Original Target. New Target 5 has not been tested by drilling.

[box type=”note” align=”aligncenter” ]

Targets 4 and 5 are more of the same, except that target 4 was identified as a buried rhyolite dome from a CSAMT survey. It’s nice when an exploration target is exposed at the surface, but when your targets are buried it’s time to bring out the geophysics.

In the end, we’ve learned that Columbus has a number of prospective targets that exhibit similar characteristics to known gold-bearing systems on their property. Follow-up sampling, careful mapping and drill-hole planning will likely be the next step for some of these targets. For others it appears that this is already in progress.

[/box]

Infrastructure

Eastside has outstanding infrastructure for mining and processing; the project is 32 km (20 miles) west of Tonopah, Nevada, and lies 9.7 km (6 miles) north of paved highway US 95, the main road route from Las Vegas to Reno. A good gravel road, maintained by Esmeralda County, leads from the highway through the claim block. A major power transmission line passes through the claim block. The drilling area is on the east flank of the Monte Cristo Range and a portion of the claim block extends well into the adjacent flats which would provide excellent operating sites. The valley is known to have shallow water available in the same aquifer which provided water for milling the Tonopah ores in the early 1900’s. The area is high desert with sparse vegetation, and year-round drilling is possible.

Andy Wallace is a Certified Professional Geologist (CPG) with the American Institute of Professional Geologists and is the Qualified Person under NI 43-101 who has reviewed and approved the technical content of this press release. Mr. Wallace is a director of Columbus Gold and the principal of Cordilleran Exploration Company (Cordex), which is conducting exploration and project generation activities for Columbus Gold on an exclusive basis.

[box type=”note” align=”aligncenter” ]

There’s a fair bit of geology in this release and not a lot of hard numbers, but for us this is the best sort of news: We get a glimpse into a company’s rationale and methodology at an early stage in the exploration process.

Columbus is currently trading at $0.43 (TSX-V), midway between their 52 range of $0.23-$0.63.

[/box]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]