After fifteen drill holes, it’s starting to look like a repeat of the discovery hole is not meant to be. Still, the company has pulled together a low grade inferred resource and learns with every hole.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

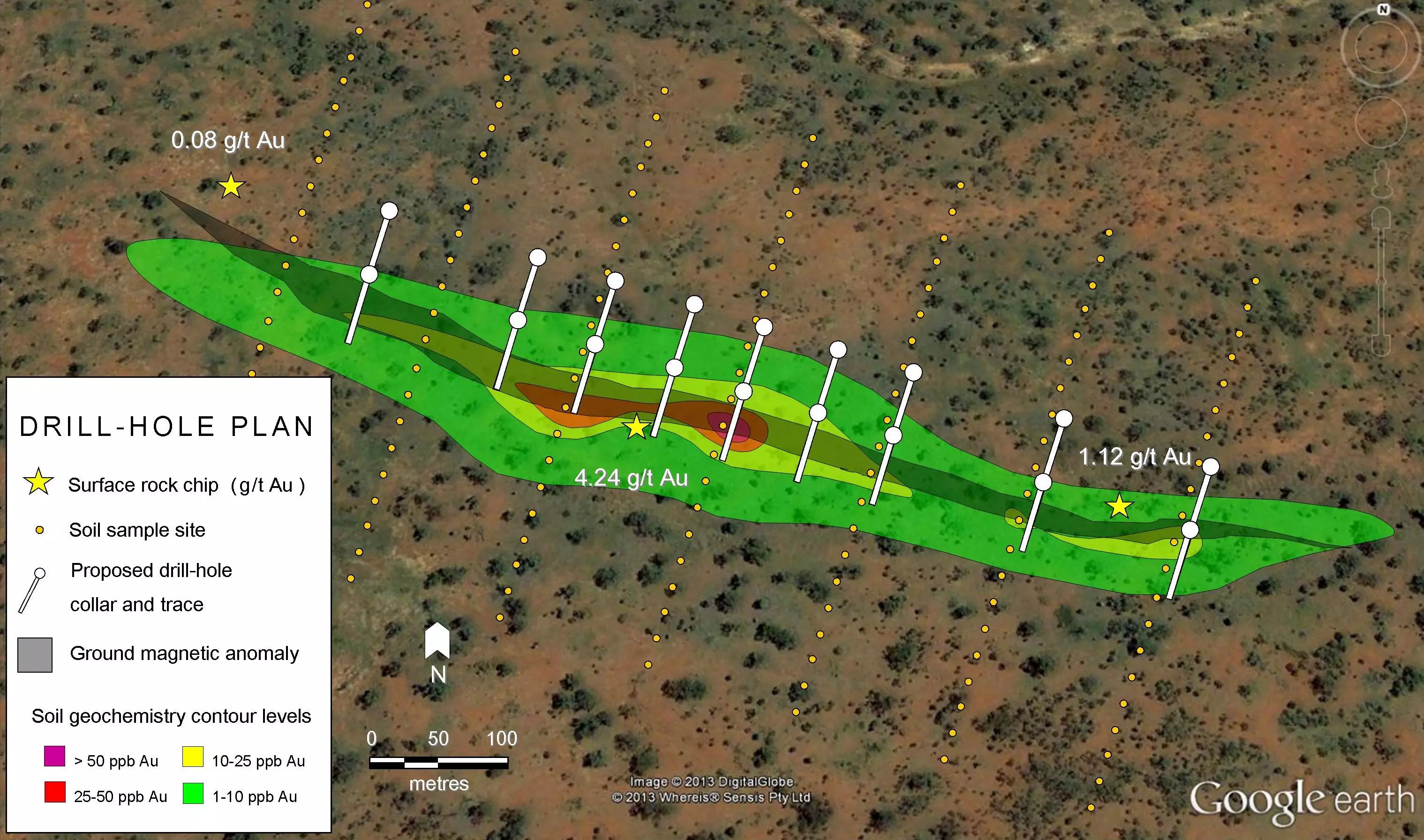

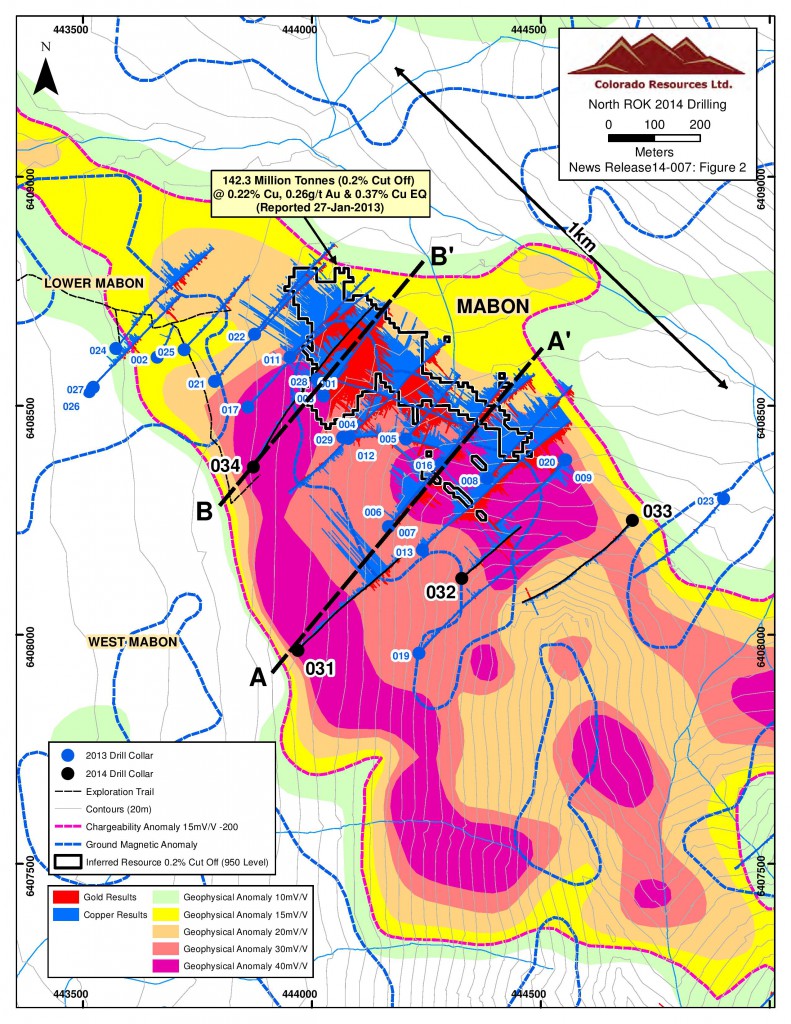

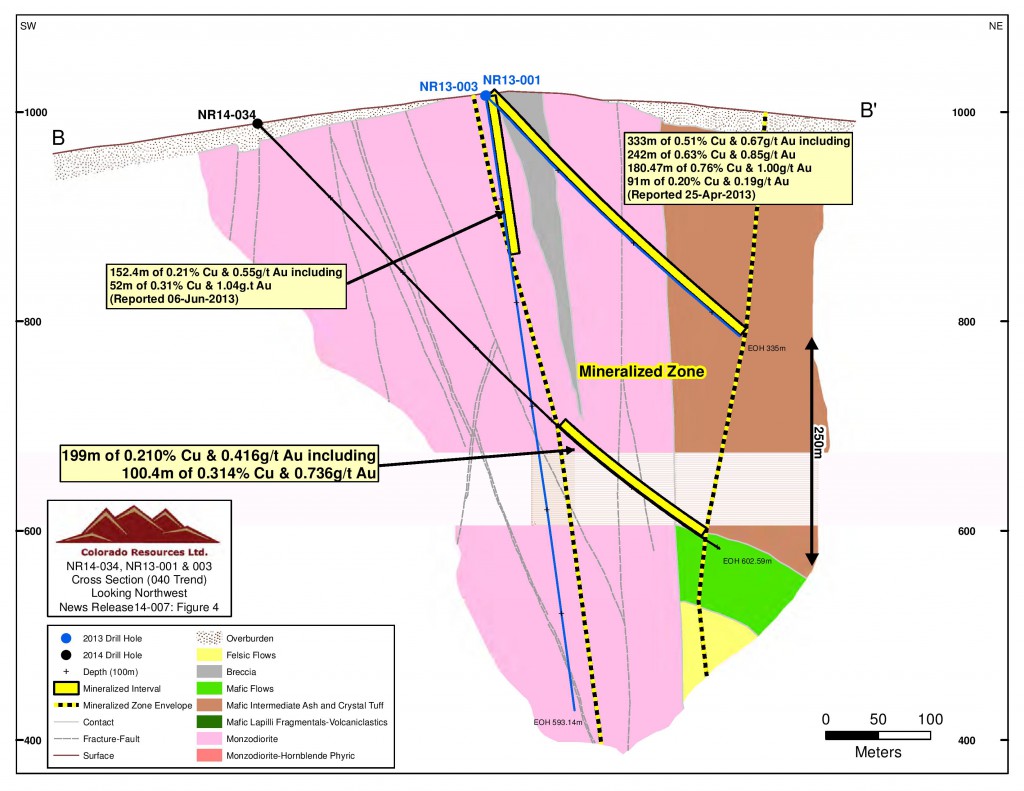

WEST KELOWNA, BRITISH COLUMBIA–(Marketwired – July 8, 2014) – COLORADO RESOURCES LTD. (TSX VENTURE:CXO) (“Colorado” or the “Company”) is pleased to announce the results of 5 diamond drillholes totalling 2191 m on the North ROK claims. The 2014 Phase I drill program followed the recommendations of the NI 43-101 report to target the expansion of the known inferred resource and drill tested kilometre scale geophysical anomalies that cluster around the existing inferred resource. The location of the 2013 and 2014 drill collars are illustrated on Figures 1 and 2, and the 2014 drill results are compiled in Table 1. All mineralized intervals are drill indicated widths as the precise orientation of the mineralized zone relative to the drillhole orientation has not yet been conclusively defined.

[box type=”note” align=”aligncenter” ]

The last time we reported on Colorado Resources, we were a bit disappointed (as I’m sure they were) with the results of follow-up drilling to their discovery hole (NR-13-001) of 242m at 0.63% copper and 0.85 g/t gold. After fifteen drill holes, it’s starting to look like a repeat of the discovery hole is not meant to be. Still, the company has pulled together a low grade inferred resource and learns with every hole. This news outlines their most recent drill results.

Colorado completed a inferred mineral resource estimate in January and has the resource pegged at 142.3 million tons at 0.22% copper and 0.26 g/t gold. At current prices this equates to a CuEq of 0.38%. Compare that to the nearby Red Chris which has about 300 million tonnes grading at 0.53% CuEq. Porphyry Copper Deposits are known for their high tonnage and low grades, but these numbers aren’t quite where they need to be.

Its also worth noting that inferred mineral resources represent the lowest level of confidence in resource reporting and the company is quick to point out that no economic assessment can be made on based on the current estimate.[/box]

| NORTH ROK CU-AU PORPHYRY SYSTEM – REPORTED DRILL RESULTS TO DATE (Table 1) | |||||||||

| Hole | Collar Azimuth |

Dip | Total Depth (m) |

From (m) |

To (m) |

Interval (m) |

Cu % |

Au g/t |

*Cu EQ % |

| NR14-030 | 40 | -45 | 303.3 | No Significant Results | |||||

| NR14-031 | 40 | -45 | 450.5 | 308.5 | 388.9 | 80.4 | 0.442 | 0.124 | 0.520 |

| NR14-032 | 40 | -65 | 415.8 | 277.4 | 415.8 | 138.4 | 0.111 | 0.088 | 0.167 |

| includes | 293.7 | 332.6 | 38.9 | 0.265 | 0.238 | 0.415 | |||

| NR14-033 | 220 | -65 | 419.1 | No Significant Results | |||||

| NR14-034 | 32 | -45 | 602.6 | 379.5 | 578.5 | 199.0 | 0.210 | 0.416 | 0.473 |

| includes | 424.5 | 560.5 | 136.0 | 0.267 | 0.564 | 0.623 | |||

| includes | 448.5 | 548.9 | 100.4 | 0.314 | 0.736 | 0.779 | |||

| * Cu EQ (copper equivalent) has been used to express the combined value of copper and gold as a percentage of copper and is provided for illustrative purposes only. No allowances have been made for recovery losses that may occur should mining eventually result. Copper equivalent calculations herein use metal prices of US $3.00/lb of copper and US $1,300 per troy ounce of gold using the formula CuEQ= (Cu%+(Au g/t x0.632). | |||||||||

[box type=”note” align=”aligncenter” ]

The results reported include the copper equivalent (CuEq). This is a calculation based on today’s commodity prices used to compare total commodity values in multi-metallic deposits. Copper equivalents are commonly used when comparing porphyry copper deposits since they may contain gold, silver, molybdenum and other metals in addition to copper.

Some of these results show nested drill highlights which can be somewhat hard to decipher, but essentially 3 of the 5 holes encountered copper/gold mineralization and of the 3 successful holes, 2 had intervals grading above 0.50% CuEq.

These results also represent the drilled intercept and do not necessarily reflect the true thickness of the mineralization. [/box]

The 2014 Phase I drill program succeeded in:

- Intersecting new mineralized zones at the West Mabon Zone, associated with 1.5 km long untested IP chargeability anomalies with DDH NR14-031 returning 80.4m of 0.124 g/t Au and 0.442% Cu. Current technical data indicates that unlike the sub-vertically dipping North ROK Main Zone, the West Mabon zone has an apparent 45 degree southwest dip (Figure 3) which creates significant exploration potential along the western margins of the IP chargeability over a distance of more than 1.5 km from DDH NR14-034 to the Edon mineral occurrence.

[box type=”note” align=”aligncenter” ]The company drilled an IP chargeability anomaly within its West Mabon Zone. Geophysical IP surveys are used to test for dispersed sulfide minerals, a characteristic of porphyry copper deposits. [/box]

- Demonstrating significant depth potential and continuity of gold-copper mineralization over 250 metres below mineralization in DDH NR13-001 with DDH NR14-034 returning 199 m of 0.416 g/t Au and 0.210% cu, including 100.4 m of 0.736 g/t Au and 0.314% Cu (Figure 4) . Copper – gold grades within selected intervals of both DDH NR14-034 and DDH NR13-001 approach that which would be permissive to bulk underground mining. The strength of these copper-gold mineralized zones are continuing to depths exceeding 400 m below surface.

[box type=”note” align=”aligncenter” ]Although these types of deposits typically form near the surface, mineralization can extend at depth and may require alternate mining methods. The world renowned Chuquicamata mine in Chile is an open pit mine, and has been for several decades. The operator is currently studying the feasibility of transitioning the mine from open-pit to underground.[/box]

- Defining the broad, deposit scale geometries and controls on mineralized zones. The presence of a second mineralized zone with a modest southwest dip, when linked to the vertically orientated Mabon Zone, may (i) significantly increase the preferred target area and net tonnage of mineralized rock and (ii) significantly decrease the overall strip ratio of any potential open pit development* (See Cautionary Note).

[box type=”note” align=”aligncenter” ]A strip ratio is the volume of waste rock needed to remove the equivalent volume of ore. Mining operations prefer to have low strip ratios so more ore is being processed by the mill rather than non-economic waste. Of course, it’s way to early to be discussing strip ratios.[/box]

- Southwest Dipping Mineralization Implications – The existence of a southwest dipping mineralized zone in the West Mabon area suggests that the results of drilling in the Edon occurrence area, DDH’s NR13-010, 13-15 and 13-18 may require re-evaluation. All of these drill holes were collared on 220° azimuths and drilled at -45° dips. These drill holes could have potentially missed southwest dipping mineralization similar to the newly discovered West Mabon Zone. Similarly, DDH NR13-012 which was drilled at an azimuth of 220°and a dip of -45°would not have been favorably orientated to intersect southwest dipping mineralization like the West Mabon Zone.

[box type=”note” align=”aligncenter” ] The company believes that based on their improved knowledge of the subsurface geology, past drilling may have missed the mineralized targets. This is entirely possible. In early stage exploration programs, every hole helps build knowledge and constant re-evaluation of the program is required.[/box]

- Testing of Other Areas – Drill testing of the North Mabon chargeability anomaly (DDH NR14-030) and tests of the extreme northeastern flank of the Mabon mineralized zone (DDH NR14-033) produced no significant results. A modest copper-gold intersection was obtained while targeting fault offset mineralization with DDH NR14-032 coring 38.9 m of 0.265% Cu and 0.238 g/t Au between 293.7 and 332.6 m.

Adam Travis, President and CEO of Colorado commented: “The results of the first phase of the 2014 North ROK drill program have greatly expanded the size of the currently known gold-copper mineralized zones, diversified the geometry of mineralized zones, established the continuity of higher grade gold-copper mineralization and introduced significant new potential into the North ROK project. Colorado Resource’s technical team is currently evaluating the results of the first phase of the 2014 North ROK exploration program with the intention of further testing this remarkable discovery”.

Qualified Person

Greg Dawson, P.Geo. is the Qualified Person as defined by National Instrument 43-101 who supervised the work program and preparation of the technical data in this news release.

QA/QC Statement

The samples were analyzed by Acme Analytical Laboratories of Vancouver, British Columbia. Copper values were first determined using the 1DX ICP-MS method which reports values as parts per million (ppm). Any samples containing greater than 10,000 ppm copper were assayed by the 7AR method, which reports values as percent copper. The gold results were determined using the G601 Fire Assay method which reports gold results in ppm and are equivalent to grams per tonne (g/t). The analytical results were verified with the application of industry standard Quality Control and Quality Assurance (QA-QC) procedures.

[box type=”note” align=”aligncenter” ]As usual, its good to make note of a company’s QA/QC process.[/box]

About Colorado

[box type=”note” align=”aligncenter” ]As of writing, Colorado Resources is trading at $0.22. It has a 52 week low of $0.145 and a high of $0.94.[/box]

Colorado Resources Ltd. is currently engaged in the business of mineral exploration for the purpose of acquiring and advancing mineral properties located in British Columbia and is also seeking opportunities in Southwest USA and Latin America.

Colorado’s current exploration focus is to continue to advance its North ROK property, located 15 km’s northwest of the Red Chris mine development, and to commence field work on its KSP property optioned from SnipGold, located 15 km’s along strike to the southeast of the past producing Snip Mine, both located in northern central British Columbia.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]

Subscribe for Email Updates