Introduction

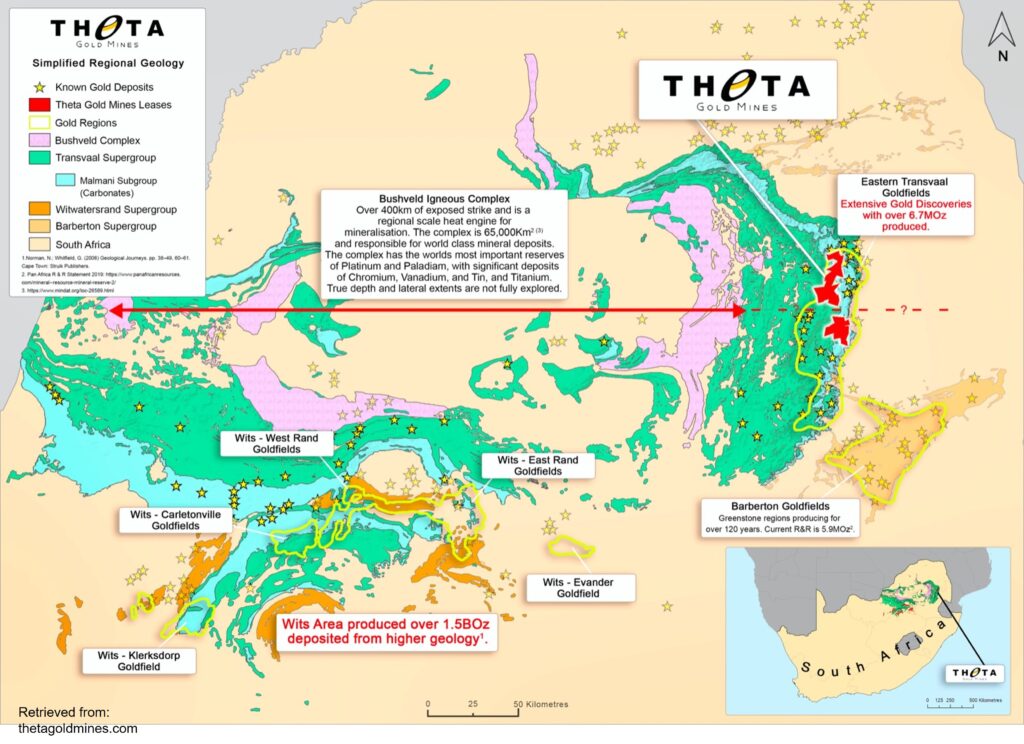

South Africa is famous for gold, with paleoplacer deposits of the Witwatersrand Basin having produced a large fraction of the world’s gold. The country’s first gold mines, however, were established 130 years ago in the Sabie-Pilgrims Rest Goldfield and produced gold from an entirely different type of deposit. Now an Australian company, Theta Gold Mines, has big plans to redevelop these historic high-grade mines.

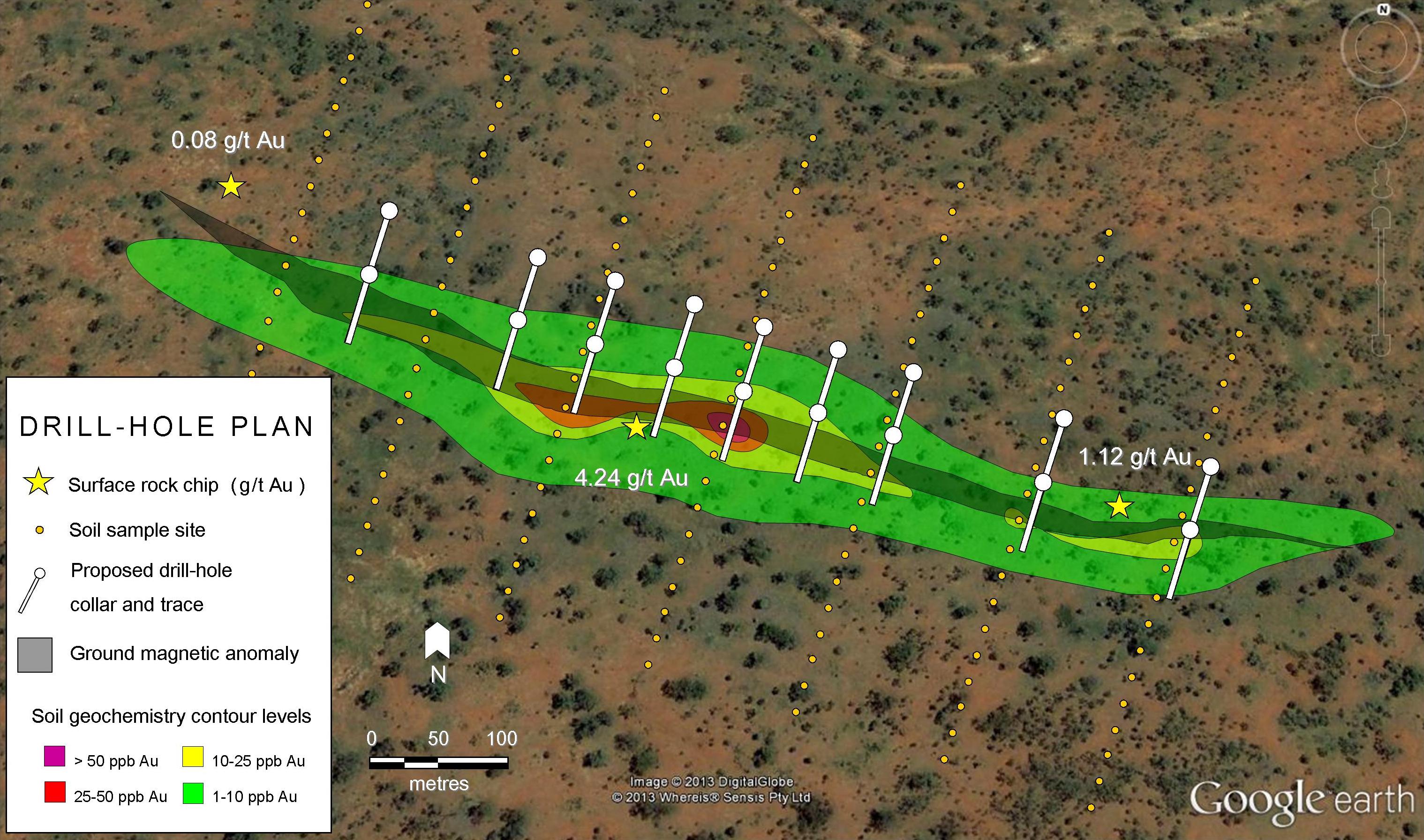

Project Overview

Theta’s PGME project area is centered on the town of Pilgrim’s Rest, 370 km northeast of Johannesburg. Theta ultimately hopes to develop as many as 43 historical gold mines, however the current feasibility study only covers the four mines: Beta, Frankfort, Clewer-Dukes Hill-Morgenzon (CDM), and Rietfontein. The Beta, Frankfurt, and CDM mines are only a few kilometers apart, while Rietfontein is about 10 Km to the south of the others. These four mines contain 1.24 Moz Au at 5.95 g/t, the project’s anticipated 87% recovery will make for 1.08 Moz of recovered Au. Of these resources, 0.56 Moz are indicated resources, while 0.68 Moz are classified as inferred.

Construction is slated to start in Q1 2023, with the first gold pour expected in Q2 2024. Combined, these mines are to produce up to 100000 oz/year. Life of mine is estimated at 12.9 years, however continued exploration is expected to extend this significantly, perhaps to 30 years or longer.

It should be noted that the above figures apply to the feasibility study’s ‘base case’, which includes measured, indicated, and inferred resources. The study also includes an ‘ore reserve plan’ which would only target the better-defined proven and probable ore reserves; in this case the total resource would be significantly lower at 0.56 Moz, with a mine life of 8.5 years.

Beta, Frankfort, and CDM will be mined via mechanized long-hole drilling, while Rietfontein will be mined via shrinkage stoping. Stope widths will be as little as 90 cm in order to minimize dilution. Ore from all four mines will be processed at the same metallurgical plant, which will have a modular design so as to process multiple streams of ore.

Capital costs for the first phase are estimated at 77 million USD, with the project forecast to generate a pre-tax NPV 10% of USD324 million and pre-tax Internal rate of return of 65%. Beta is the first mine slated to enter production, followed by Rietfontein, and finally CDM and Frankfort simultaneously. Beta and Rietfontein are being prioritized as they have higher grades. These deposits also contain the lion’s share (~80%) of the total resources.

Slightly longer-term plans call for using revenue generated from the first four mines to self-fund exploration and development of other mines, with expansion to six mines and production of 160000 oz Au/year by year five. Total resources across all of Theta’s mines are 6.1 Moz.

Geology

Theta’s properties are part of the Transvaal gold system, which is located on the eastern margin of the world’s largest igneous complex, the 1.98 billion-year-old Bushveld Intrusion. Gold mineralization in the region can be considered intrusion-related deposits, where gold-bearing hydrothermal fluids are given off by an intrusion before migrating into the surrounding rocks to be deposited in rich vein systems.

Gold deposits in the Sabie-Pilgrims Rest Goldfield, which host Teta’s properties, are hosted within shear zones in sedimentary rocks of the Transvaal Supergroup. Layers of carbonate rocks, mainly dolostone, within the Transvaal acted as chemical traps for mineralization by reacting with and neutralizing acidic gold-bearing fluids. Fracture systems created by off-shooting dykes also created structural traps for mineralization.

Gold in all four TGME mines is hosted in thin, sheet-like orebodies which are referred to as reefs. Reefs in the Beta, CDM, and Frankfort mines are nearly horizontal (dipping between 3° and 12°), veins in the sedimentary rocks, while the Rietfontein Reef is a near vertical vein filling a 1-3 m wide fracture in the granite underlying these sedimentary rocks.

The Beta Reef is a quartz-carbonate vein which ranges from 0-3 m wide, averaging 20-30 cm. It is hosted within dolomite of the Eccles Formation. Gold is mainly associated with pyrite, minor graphite/carbonaceous material, and trace chalcopyrite. The reef has been traced for at least 2 km along strike and 2.5 km down dip, to a depth of 550 m. Historic underground development extended at least 1.5 km down dip to a depth of 360 m.

In the Frankfurt Mine gold is hosted by the Bevetts Reef, a 0-2 m thick quartz-carbonate vein with sulfide (pyrite, chalcopyrite, arsenopyrite, and tetrahedrite) bands. The reef has been affected by duplex thrust faulting, which may have duplicated the reef into two stacked units and eliminated it entirely in others.

The Rho Reef, mined at CDM, is split into the upper and lower reefs, which are separated by 2 m of dolostone. The reef is cut by several faults, which locally displace the ore by a few meters. Historical sample, which comprises much of the data the mine plan is based on, only makes reference to one reef, and does not specify whether this is the upper or lower reef.

The Rietfontein Reef is a somewhat different style of mineralization, being a 1-3 m wide, sub-vertical quartz vein hosted mainly in hydrothermally altered granite. Gold is associated with pyrite and trace arsenopyrite, chalcopyrite and bismuth. The vein has been traced over a 16 km strike length, and mined over a strike length of 3 km to a depth of 320 m. The reef is open at depth.

Analysis

The PGME Project has some promising numbers, a substantial high grade gold resource at a relatively shallow depth, all with low startup and operating costs. Mill recovery is somewhat low for a modern operation, but that’s understandable given the intent to use one mill for four mines. A little more gold loss is probably a reasonable tradeoff for not constructing additional mills. The geology of the deposits appears fairly simple, with relatively continuous ore bodies traced across large areas. Mining these deposits, however, might not be as simple as it appears.

With the exception of the Rietfontein Reef, the ore bodies are nearly flat lying, a geometry which is notoriously difficult to mine without leaving some ore in the ground to support the roof. Opening four underground mines simultaneously is will almost certainly pose logistical challenges; considering how little of the ore is contained in the Frankfurt and CDM mines it’s surprising that Theta plans to extent itself so far for such a relatively small reward. Although the deposits are shallow, mining ore bodies which extend down dip for kilometers will still require trucking ore and equipment over long distances underground.

While the reefs are continuous, their thickness varies significantly, and in the Frankfurt Mine the reef may not be present at all in some places. The reefs are also very thin; dilution of the high-grade ore is likely to be an issue. The twenty to thirty cm average thickness of the Beta Reef is not a lot of ore, even with a tiny 90 cm stope. Even achieving such a narrow stope will be difficult; most underground workings are at least 2-3 m wide and few, if any, modern hard rock mines attempt <1 m stopes. Very few pieces of heavy machinery would even fit into such a small space.

Perhaps the most concerning aspect is the project’s reliance on historical data. Most of the data used for the feasibility study comes from historic drilling and underground sampling, which means that sampling procedures are not consistent. In fact, Theta admits it doesn’t know some details of how these samples were gathered and analyzed, or even, in some cases, where exactly they came from. In particular, it’s hard to understand how Theta can be confident about opening the CDM Mine without knowing something as basic whether the gold is in the upper or lower Rho Reef. They may be only 2 meters apart, but a few meters can really matter in underground mines!

This uncertainty is represented by the fact that only a tiny fraction of the project’s resources, less than 16 Koz, are in the highest confidence measured category; more than half are in the lowest confidence inferred category.

Conclusion

Theta’s plan to revitalize not just a single mine, but an entire goldfield is certainly bold. The high grade and low start-up costs are certainly attractive, but many things will have to go just right for such a complex project to pay off. Mining is a risky business, but the PGME project is riskier than most.

List of Companies Mentioned

Theta Gold Mines: https://thetagoldmines.com/ (website)