The Blackwater deposit is located 112km southwest of Vanderhoof, BC and 446 km northeast of Vancouver. The Blackwater deposit is defined as an “intermediate sulphidation” epithermal deposit. The property has been actively explored since the early 1970’s but it’s potential as a high tonnage, low grade deposit wasn’t recognized until 2009 by Richfield Ventures. This is not surprising since epithermal gold deposits are typically high grade, but small. Richfield Ventures along with SilverQuest Minerals and GeoMinerals were purchased by New Gold in 2011 in order to acquire the Blackwater project and the areas surrounding it. New Gold is the sole operator and has a 100% interest in the property. The project is currently in the Environmental Assessment pre-submission phase and the company plans on submitting their application sometime this year. A 43-101 compliant technical report to support a 2013 feasibility study filed in January 2014 estimates the measured and indicated resources of the deposit to contain 306.0 Million tons at 0.88 g/t gold and 5.8 g/t silver using a 0.4 g/t AuEq grade cut-off. AuEq, or gold equivalent calculations are commonly used for comparing gold-dominant poly-metallic deposits. In this estimate it is used as a minimum grade cut-off. The feasibility study has also outlined plans to stockpile lower grade material for future processing. The study suggested that the measured and indicated mineral resource of the stockpile would be 90.9 million at 0.3 g/t gold and 4.3 g/t silver tons cut off at 0.3 AuEq.

Regional Geology

The deposit is located within the Central Quesnel Belt along the eastern margin of a larger geological region known as the Intermontane belt. The Intermontane Belt formed during the early Jurassic (200-145 million years ago) as a series of oceanic volcanic arcs collided with the continental plate of what has became North America.

Deposit Geology

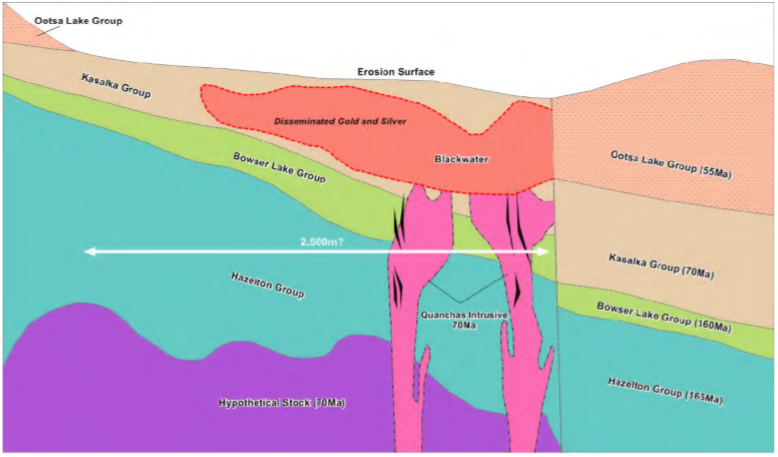

The Blackwater Deposit is hosted within a package of heavily altered volcanic rocks known as the Kasalka group. This group is comprised of volcanic breccias (broken up volcanic rock), rhyolitic tuff (volcanic rock that formed from fine volcanic ash) and andesite (volanic flows). The deposit is overlain by a younger volcanic package known as the Ootsa Lake Group. These rocks have been intensely altered by hydrothermal fluids. Mineralization throughout these heavily altered rocks occurs in very small (5-50 micron) dispersed grains of iron sulfide minerals such as pyrite and fine veinlets of “black sulfides” – a mixture of copper, zinc and iron metallic sulfides.

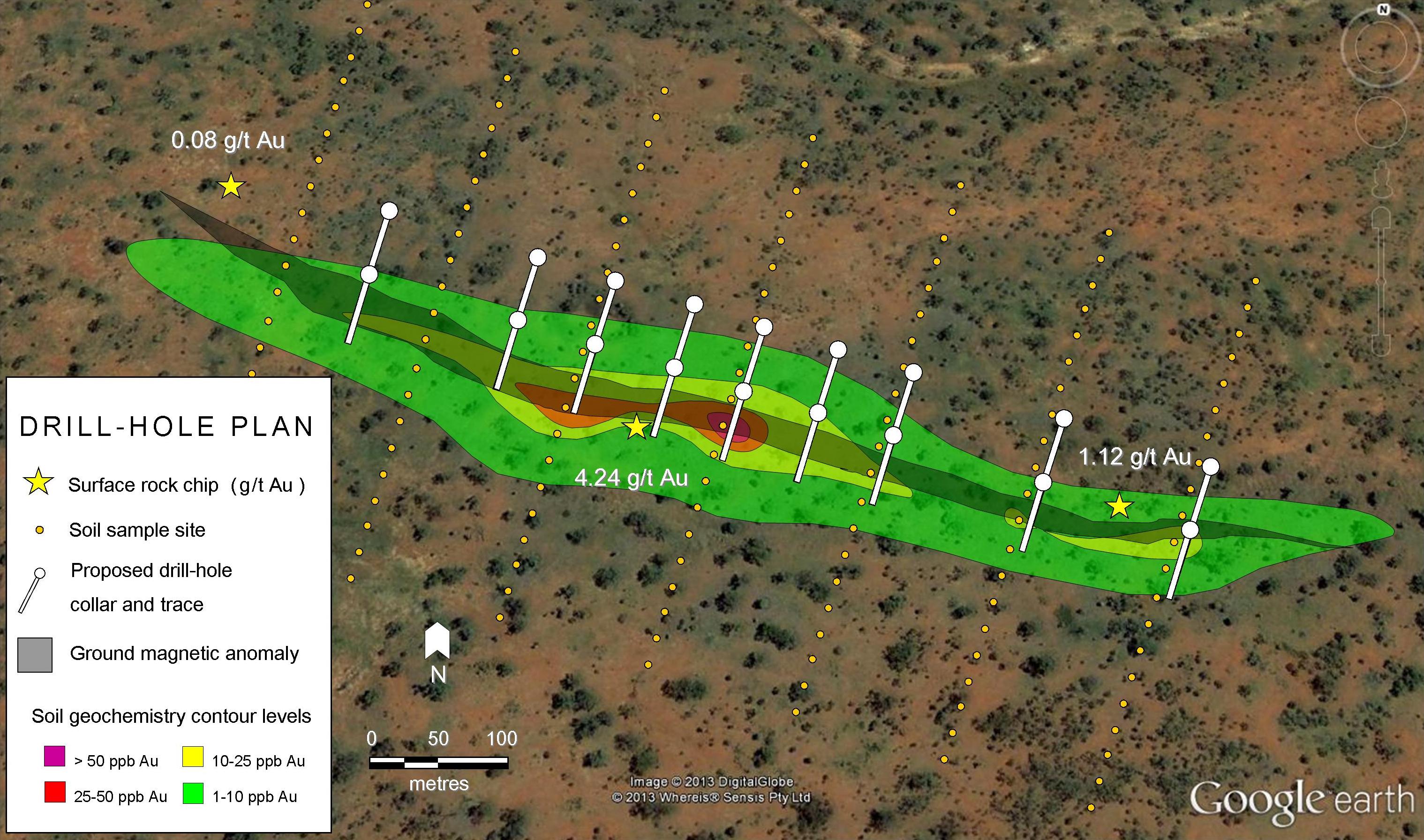

The property is covered in thick glacial till and has limited surface bedrock exposure. Previous explorers relied heavily on surface exploration methods such as soil and till sampling, and the initial discovery was based on a regional silt survey.

Discussion

Since gold and silver in epithermal deposits typically occurs as high grade veins, early work was focused on defining this type of occurrence. It took almost 40 years before someone realized that the deposit was not a typical epithermal deposit. While geologists like to classify mineral deposit occurrences, more often than deposits tend to defy classification. While we may like to argue about classifications, sub-classifications and “styles” used to describe deposits, the old prospector’s adage holds true: “Gold is where you find it.”

Given that epithermal deposits form near the surface, drilling can be done relatively cheaply. Reverse Circulation (RC) drilling is commonly used in these types of terrains to reach the bedrock for sampling. The majority of early exploration work on the Black Water property was completed through diamond drilling, but both diamond drilling and much cheaper RC drilling are being used for for continued exploration, infill drilling and definition drilling to define the extents of the deposit. This use of economic drilling methods may help the company expand and advance the project more quickly. Based on their most recent feasibility study, the project needs a $1300 gold price and a $22 silver price to be economic. Given that current prices for both metals are below these cut-offs, the company will most definitely need to keep exploring and keep costs down.

Pingback: Now that the Mosquitoes are Gone, Kapuskasing Gold Heads into the Bush | Geology for Investors