If the company were to gain access to the existing confidential feasibility study they could save a great deal of time and money. A new study could take up to two years and would come at a significant cost.

VANCOUVER, BRITISH COLUMBIA–(Marketwired – June 24, 2014) – VanadiumCorp Resource Inc. (TSX VENTURE:VRB) (the Company) is pleased to report that the first-ever Lac Dore NI 43-101 Technical Report is complete. The Report exceeds the usual requirement of a standard NI 43-101 technical report, in the sense it provides an extensive review of the metallurgy of vanadium extraction as well as a market outlook. Its author, Rejean Girard, President of IOS Geoscientifique Inc. (IOS), had access to completed works spanning more than 60 years, over 200 archived reports, which includes 8 different pre-NI 43-101 non-current resource calculations. The Lac Dore project has now reached a new level of compliance to achieve “advanced stage” status, significantly decreasing the timeline to production.

[box type=”note” align=”aligncenter” ]VanadiumCorp Resources is a “new” junior mining company hoping to tap into the emerging vanadium market. The company currently holds two vanadium properties near Chibougamau, Quebec; the Lac Dore Project and the Iron-T Vanadium Project.

VanadiumCorp is the most recent incarnation of a company that has been around in various forms for decades. In the 1980’s they were known as Homestead Resources. That turned into International Homestead Resources in the early 1990’s and Novawest from 1996-2008. They were Apella Resources after they acquired their first iron-titanium-vanadium property in 2008 and in 2012 they became PacificOre Mining. In September 2013 they changed their name again to VanadiumCorp Resources.

According to the company, the Lac Dore property has a 60 year history of exploration and this particular release deals with their completion of a NI 43-101 compliant technical report on the property.

Technical reports are often outsourced to consultants or firms that specialize in that type of work and have familiarity with the deposit type in question. Creating the report involves the compilation of all the knowledge available on a property including infrastructure, climate, historical work and the geological setting of the prospect. The result is designed to help outline a plan on how the company should (or should not) move forward with a project. These reports will often recommend further work such as mapping, drilling or geophysical surveys necessary to advance a project. The author of VanadiumCorp’s report suggests the company has sufficient historical material to move ahead and begin a mineral resource estimate.

[/box]

Mr. Girard, who has had intimate knowledge and experience of Lac Dore since 1997, refers to the Lac Dore Project as “one of the largest undeveloped primary sources of vanadium in the world” and “an advanced-stage project that can be quickly brought into development.” He concludes: “There is no doubt in the author’s mind that abundant resources are present and these resources shall be of sufficient quality, grade and quantity to justify an economically viable production of high-purity vanadium.”

[box type=”note” align=”aligncenter” ]

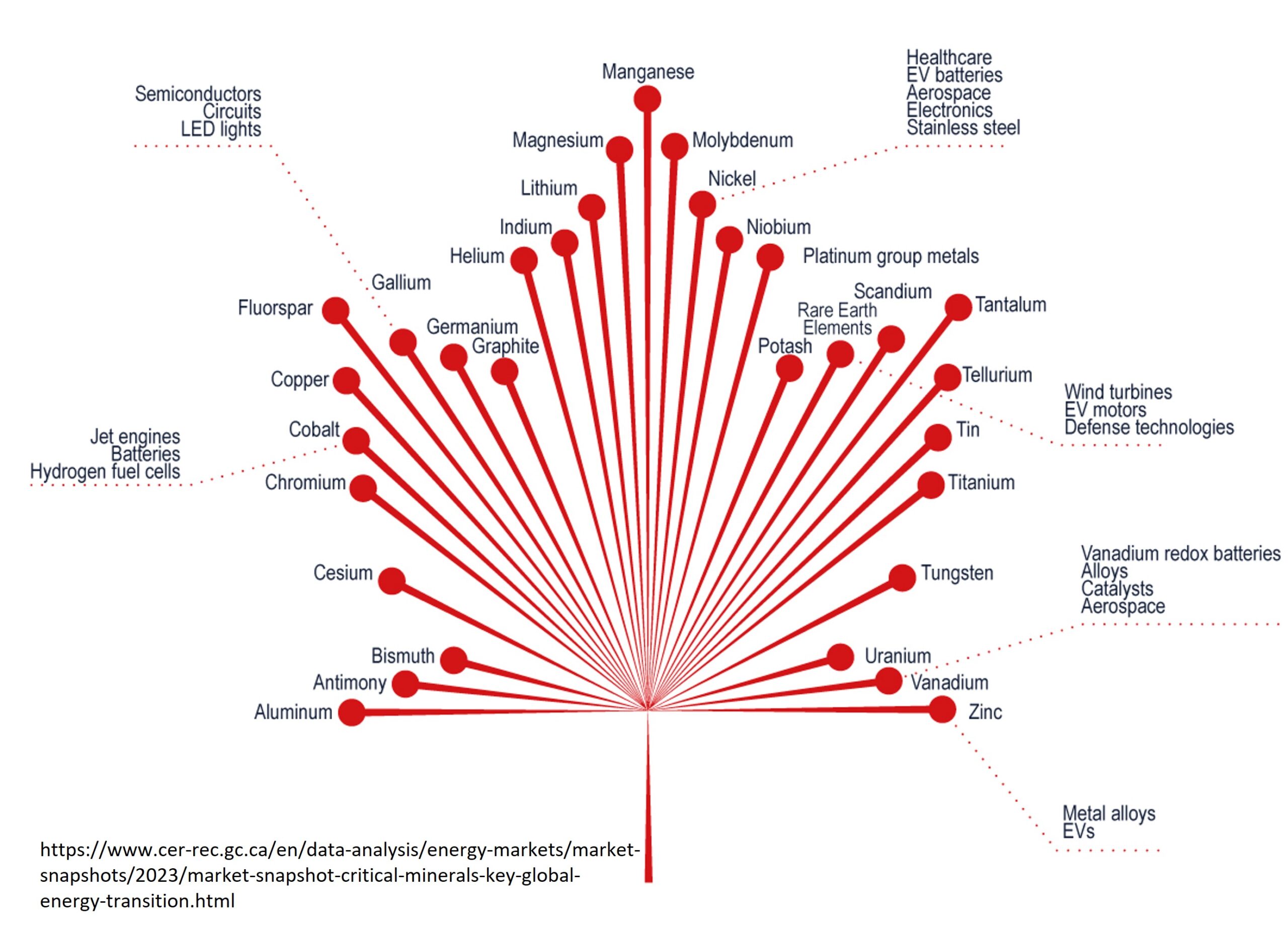

Vanadium (V) is a grey ductile metal primarily used to alloy with iron to create a stronger, harder steel. High quality steel used in high speed tools and surgical instruments may contain as much as 5% vanadium.

Newer, but not yet widely commercialized uses for vanadium involve batteries and power storage. Vanadium redox flow batteries (also called “flow batteries”) are a large-scale module power systems developed for long term power storage at a power-grid level.

China is the largest producer of vanadium followed by Russia and South Africa. It is this overseas monopoly that VanadiumCorp and a number of other North American junior’s hope to change. Other advanced North American vanadium companies include:

- Black Rock Metals. The privately held company has completed a feasibility study on their iron-titanium-vanadium property not far from VanadiumCorp’s Lac Dore project.

- American Vanadium (TSXV:AVC). Their Gibellini Project is located in Nevada, USA. The company is also the North American marketer for CellCube vanadium flow batteries manufactured by the German company, Guildmeister. They have completed a full feasibility study on the Gibellini Project and ultimately hope to integrate their vanadium flow battery marketing with primary vanadium electrolyte production at Gibellini.

[/box]

The Report enables the Company to proceed directly to resource calculations. No supplementary drilling is needed, years of expensive drilling campaigns to establish a resource are not required. The Report has unlocked all of the relevant past data and knowledge that is technically in the public domain but accessible to very few people. VanadiumCorp has authorized immediate claim expansion that facilitates preparation for eventual mine planning.

Highlights of the Lac Dore NI 43-101 report include:

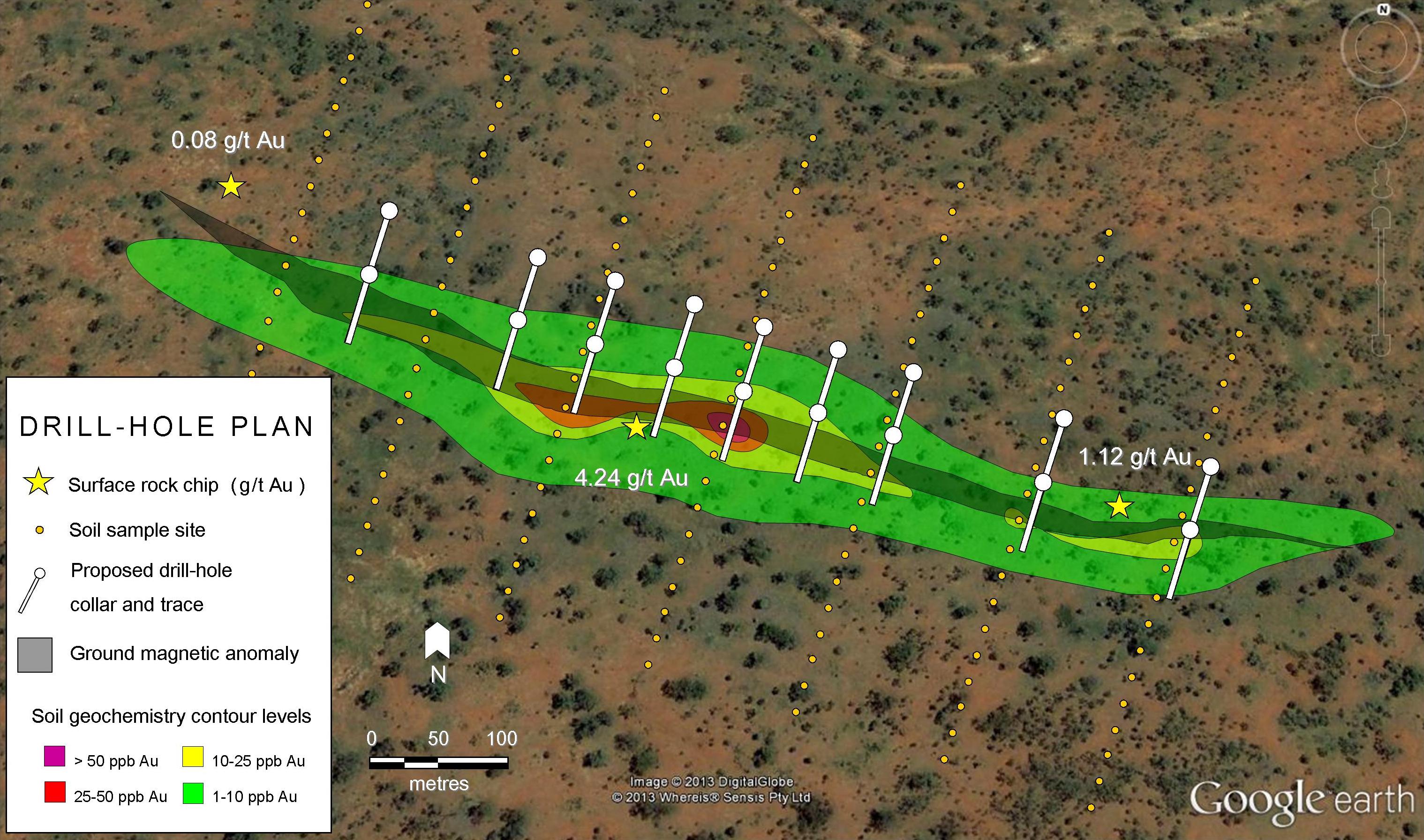

- 54 drill holes and 27 trenches with 3D modeling

- Vanadium concentrate grade averaging 1.2 – 1.4%

- 8 historic resource calculations, the two latest conducted on standards almost compatible to CIM guidelines, although they cannot be considered as current NI-43-101 compliant

- Over 200 reports dealing with exploration, drilling, metallurgy and economical aspects

- Access to forecast rail spur, 161Kv power and new roads

- Entire history of development from 1948

- Vanadium extractive metallurgy review

- Extensive beneficiation, smelting and salt-roasting testing by various groups

- Ground and airborne geophysical surveys

- Historical economic studies and feasibility studies

- Current claim expansion underway

- Comparable projects

- 2014 vanadium market study

- Nearby infrastructure and permitting

- Adjacent mine development and analysis

- Conversion process for high-purity vanadium electrolyte can be easily redone

- Commercialization of VRB and LVP batteries in North America depends on large-scale domestic primary production of high-purity vanadium

- Recommendations and specific budgets to complete resource calculations and a PEA by end of 2014

- Recommendations regarding the update or completion of a feasibility study

[box type=”note” align=”aligncenter” ]

According to the technical report, a confidential feasibility report was completed by the consulting firm SNC-Lavin on behalf of Mackenzie Bay Resources in 2002. If the company were to gain access to the existing confidential report they could save a great deal of time and money. A new study could take up to two years and would come at a significant cost. What’s interesting is that the author of this report has been studying this property for several years and was involved in much of this previous work. He is ethically and professionally bound to keep unpublished data confidential, regardless of his personal knowledge and current client’s needs. However, he recommends that VanadiumCorp attempt to acquire the information from it’s owners.

[/box]

Adriaan Bakker, CEO of VanadiumCorp, states: “The first NI 43-101 Report ever completed at Lac Dore far exceeds expectations by dramatically reducing budgets, timelines and work necessary for our goal of taking the Lac Dore deposit to production. Production at Lac Dore would represent the first large-scale primary source of vanadium in North America. Alleviating the North American dependence on disruptive foreign supply of vanadium would provide price stability, security and independence. The Lac Dore deposit has the supply and scale for North America to make vanadium-strengthened steel, and vanadium batteries, a reality for years to come.”

[box type=”note” align=”aligncenter” ]Over the last ten years the price of vanadium has been trading above $6.0 per pound (V2O5). There have been a few spikes in the price of the metal due to disruptions in supply but since 2009 the price has been relatively stable. It has been suggested that the current price of vanadium ($5.70 per pound) is sustainable for the long term.

VanadiumCorp is currently trading at $0.07 .[/box]

Regarded as a “super metal”, vanadium is the number-one steel strengthener in the world and is internationally acclaimed as the “ultimate energy storage solution”. The vision of VanadiumCorp is to become the lowest cost, primary producer of vanadium in the world.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]