Opening a new mine is a long, difficult, complicated process, and the bigger the mine, the bigger the challenge. This is certainly the case for Simandou. Despite containing in excess of 2 billion tons of exceptionally high grade iron ore, the project has been bogged down for decades. Recent progress, however, may finally turn the mine into a reality.

Overview

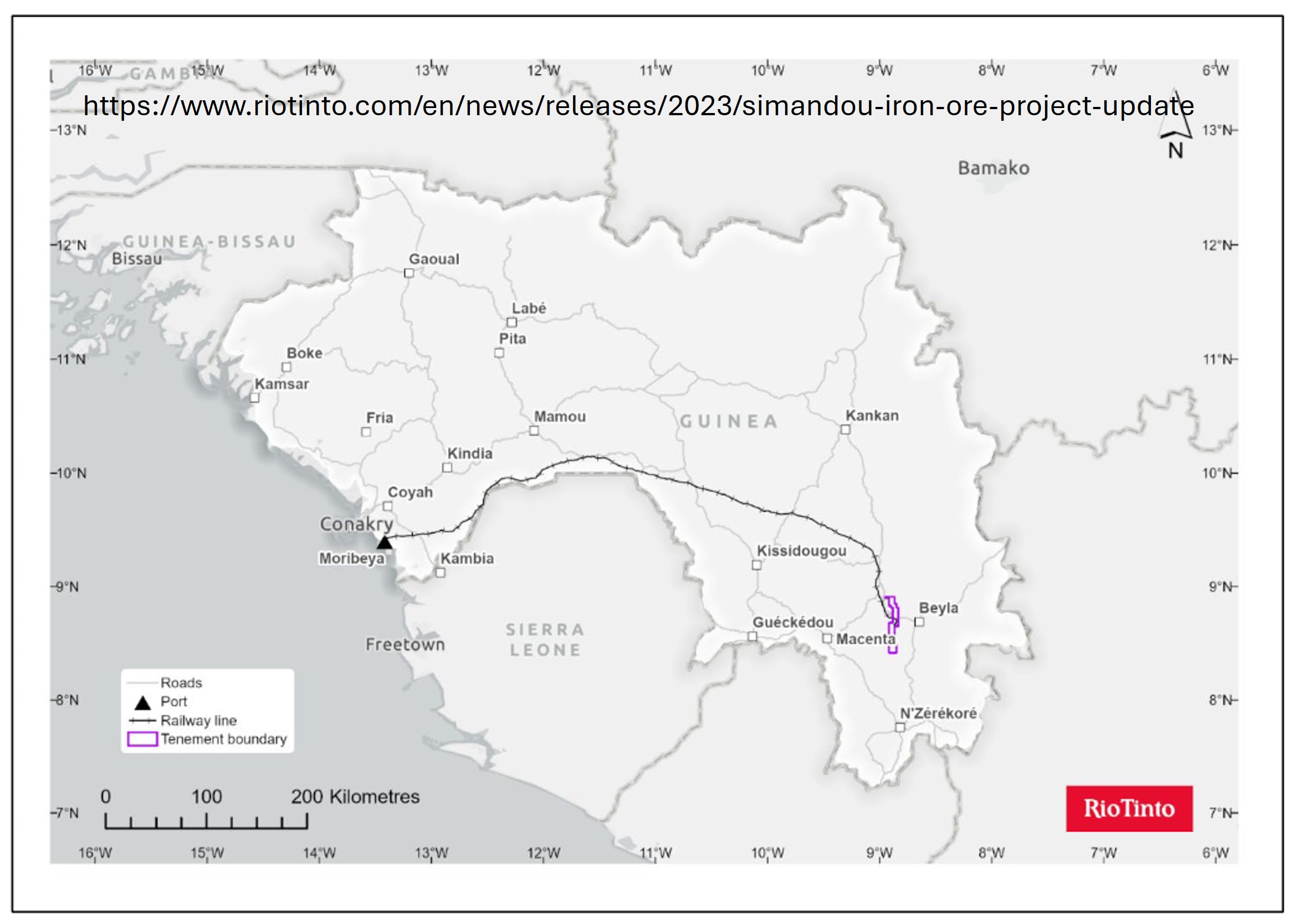

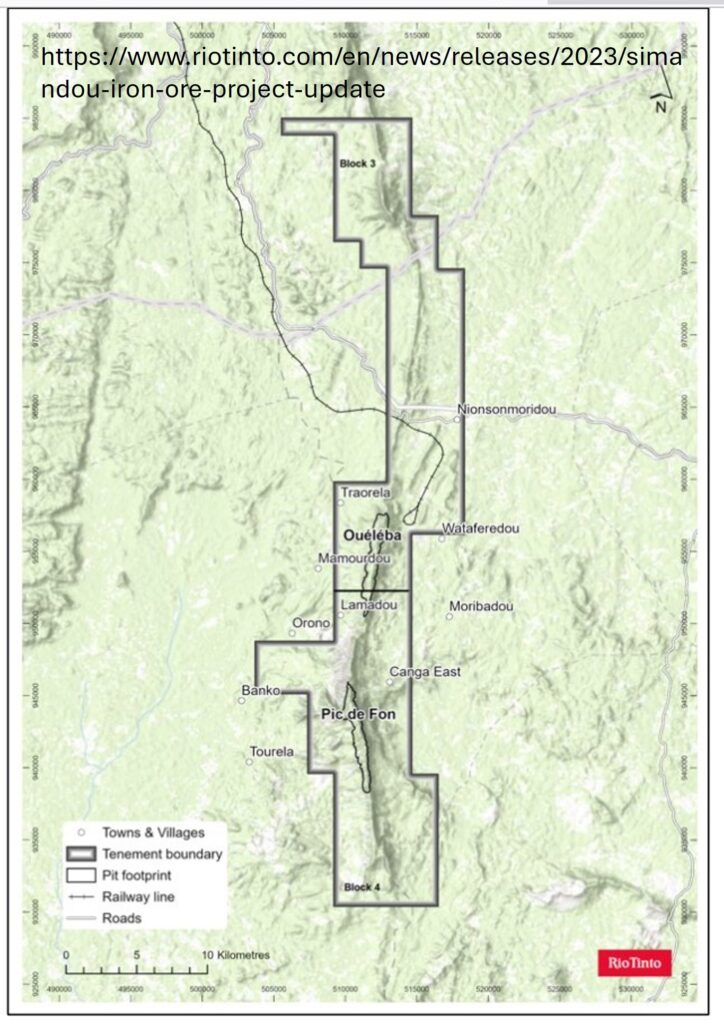

Simandou, in the west African nation of Guinea, has reserves of 2.4 Gt at 65% iron. Impurities are very low at ~1% SiO2, ~1.5% Al2O3 and ~0.1% P. The ore occurs at surface over an area of >100 km2. This vast deposit occurs in the remote Simandou mountain range, approximately 650 km southeast of Guinea’s capital, Conakry. The deposit is so large, and its’ history so complicated, that sources often vary on the details of the projects location, infrastructure, and even proposed production.

The ownership structure of Simandou is not straightforward. The deposit is divided into four blocks, with the southern blocks 3 and 4 being owned by the Simfer consortium (85%) and the Government of Guinea (15%). Simfer is composed of 53% Rio Tinto and 47% China’s Chalco Iron Ore Holdings (CIOH). CIOH is in turn owned by the Aluminium Corporation of China (Chinalco) (75%), Baowu Steel Group (20%), and China Railway Construction Corporation and China Harbour Engineering Company (2.5% each). Blocks 1 and 2 are controlled by the Winning Consortium Simandou (WCS) (90%) and the Government of Guinea (10%). WCS is composed of the Winning International Group of Singapore (50%), Weiqiao Aluminium (50%) with United Mining Suppliers also having an insignificant share.

Simandou is located in a remote region of Guinea’s Simandou Mountains, near the border with Liberia and Côte d’Ivoire. The easiest way to exploit it would be to ship the ore across the border and onto international markets via Liberia, but this has been all but ruled out by Guinea’s government, which is determined to keep as much of the economic benefit within the country as possible.

The current plan calls for two open pit mines supported by a ~650 Km long railway, including 235 bridges and more than 24 km of tunnels, to be built through the rugged Simandou Mountains so that ore can be shipped from the newly built port at Matakong. With a capacity of 120 Mt/year, it will be the highest capacity heavy-duty railway in Africa. Rio Tinto expects to spend $6.2 billion on infrastructure, with unclear but undoubtedly large investments also made by the Chinese companies. The entire investment in Simandou may exceed $25 billion, which would make it the largest single investment ever made in Africa. Construction is expected to begin in late 2024.

Rio Tinto anticipates production beginning in 2025, with capacity reaching 60 Mt/year within 2.5 years. Mine life is estimated at 26 years. The status of WCS’s blocks are less clear, but it appears to be targeting 30-60 Mt/year production, and is partnering with Simfer to develop the necessary infrastructure.

Geology

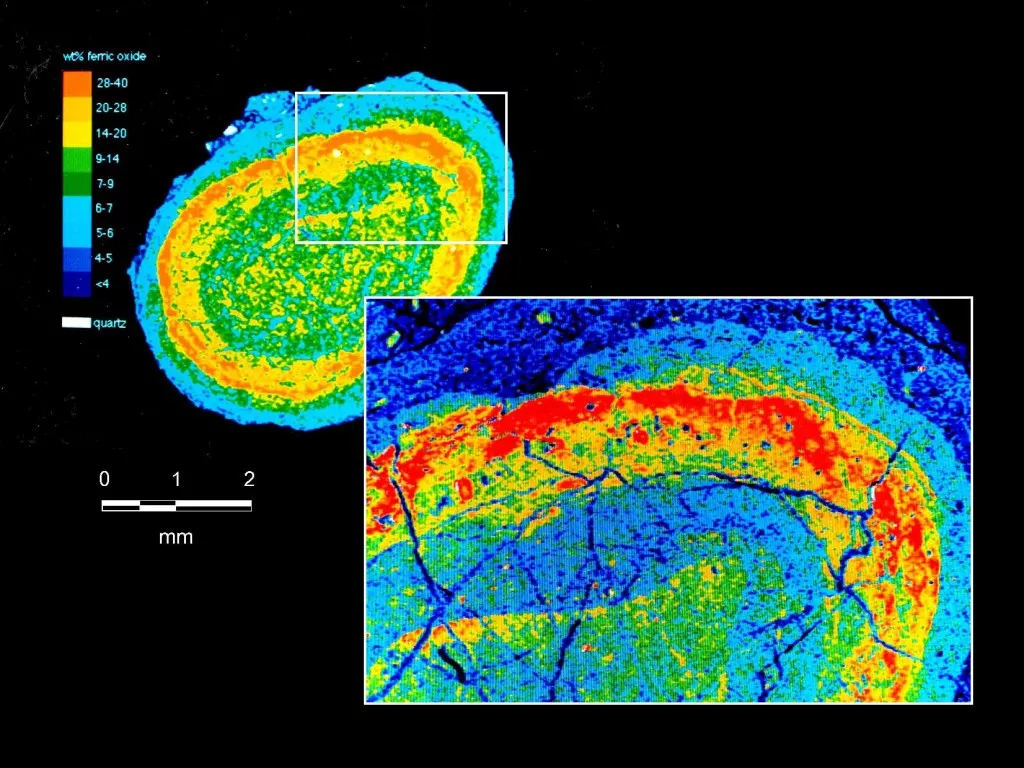

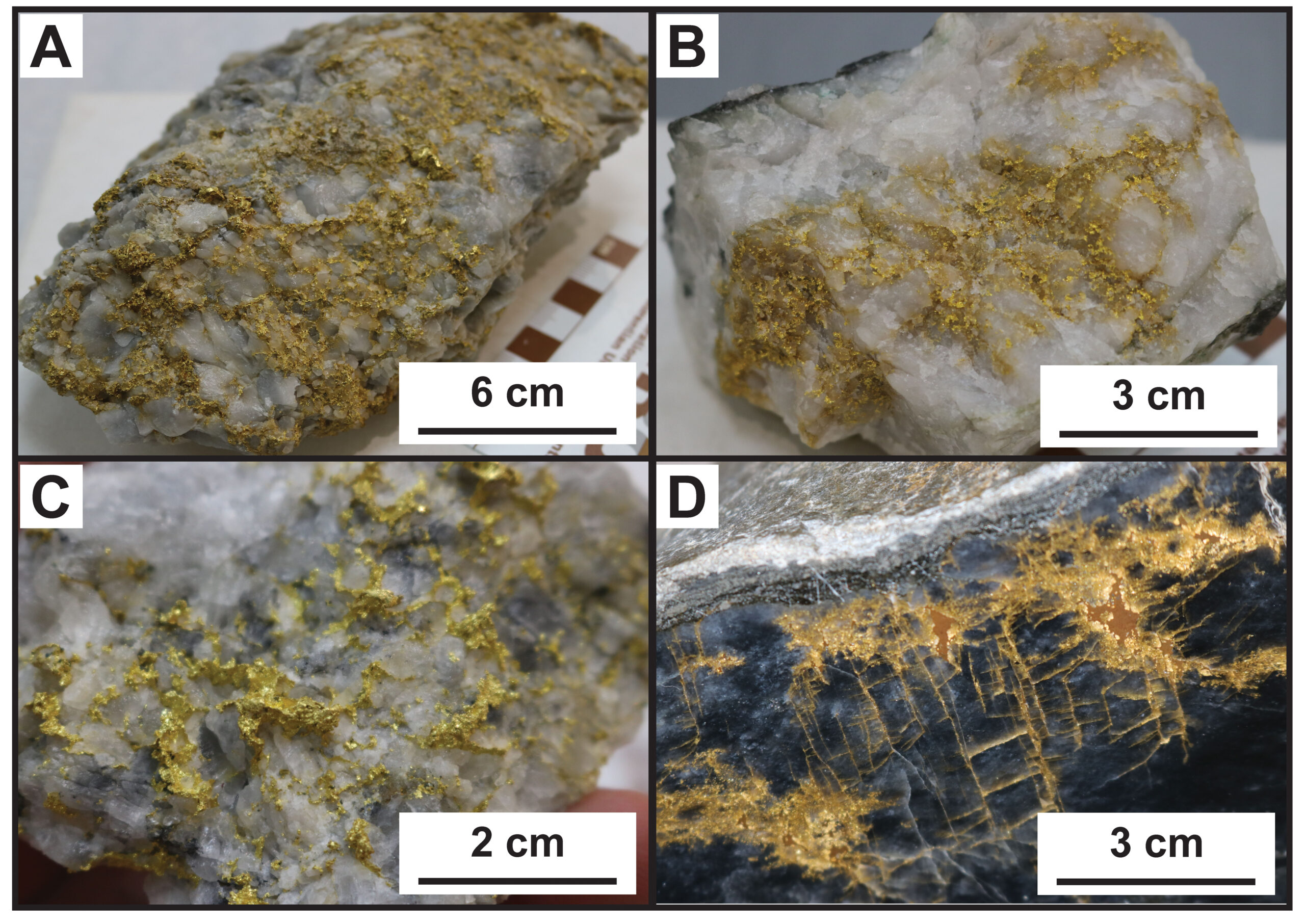

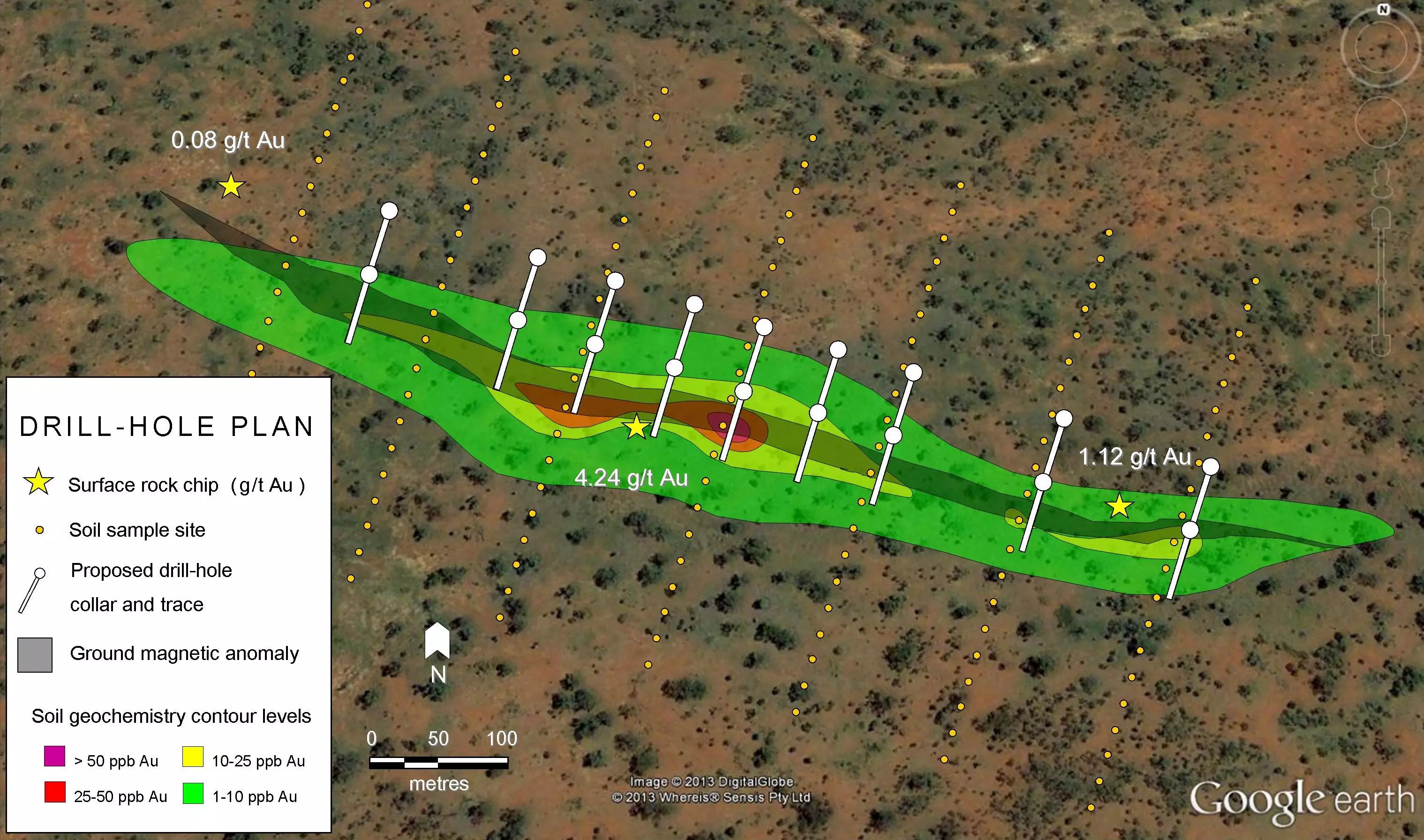

Like most iron deposits, Simandou is a Banded Iron Formation (BIF) type deposit. BIFs formed during the Archean and Proterozoic eons when Earth’s atmosphere contained little to no oxygen. Without oxygen, iron occurs in its’ reduced Fe2+ state, which dissolved readily in seawater. Once oxygen began to build up in the atmosphere due to the metabolism of photosynthesizing algae this dissolved iron became oxidized to the Fe3+ state, which is highly insoluble and precipitated out to form layers of iron-rich sediment on the seafloor. BIFs typically grade 50% iron or less.

Simandou’s exceptionally high grade is due to supergene weathering. The BIFs sit at the surface, exposed to intense tropical rain and heat, which breakdown and eventually wash away most of the gangue (non-economic) minerals. The iron minerals, mainly hematite, however, are highly insoluble, and become concentrated in the residual, leaving the ore strongly upgraded. The Simandou ore consists of hematite and geothite, a common weathering product of iron-bearing minerals. The ore is also friable and crumbly, making it easily mined.

A Fraught History

Rio Tinto was granted exploration licenses for all four Simandou blocks in 1997, and by 2002 the massive scale of the deposit had become evident. Rio Tinto received a mining concession for all four blocks in 2006 but was stripped of rights for blocks 1 and 2 in 2008. These blocks were turned over to BSG Resources the same year.

Vale entered into an agreement to purchase a 51% interest in blocks 1 and 2 for $2.5 billion in 2010. Not to be outdone, Rio Tinto entered into a $1.2 billion joint partnership with Chinalco to develop blocks 3 and 4 in the same year. These arrangements would not last long.

In 2010 Guinea transitioned from decades of authoritarian rule to democracy; within months the newly elected government scrutinized the deals the previous government had made and found them to be rife with corruption. Rio Tinto retained rights to blocks 3 and 4 after paying a $700 m settlement to the government in 2011. Rio Tinto has also faced investigations from UK, Australian, and American authorities over how mining rights were secured.

Vale shelved its’ part of the project in 2012, leaving BSG to fight several corruption and bribery investigations. In 2013 an agent for BSG was arrested by the FBI on bribery charges. BSG handed control of blocks 1 and 2 back to the government in 2019, keeping only the smaller Zogata Deposit. WCS successfully bid for blocks 1 and 2 just six months later.

Better Late than Never?

Simandou is expected to raise global seaborn iron supply ore by 5%. Essentially all of this is expected to be shipped to China, which produces the majority of the world’s steel. The high grade, high purity Simandou ore will require less energy-intensive processing, something which Rio Tinto and its’ partners are keen to advertise as climate-friendly.

The opening of such a large project could have an impact on global iron prices, which have been volatile but generally high over the last two decades. Iron is unusual in that its’ price is governed more by transport costs than by availability of ore.

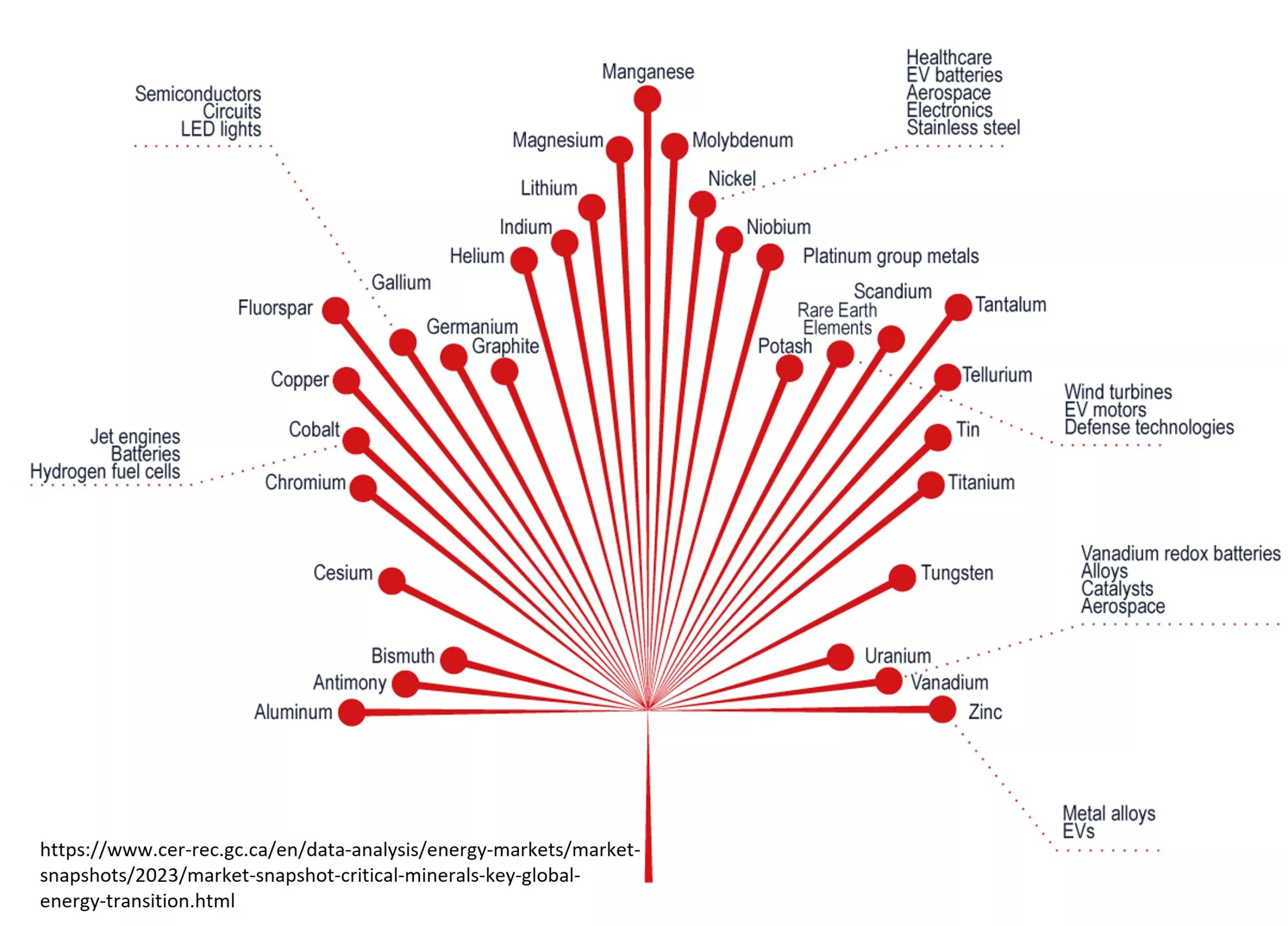

While this project will have a modest global impact, it may prove transformative for Guinea. $25 billion in an enormous investment in a country with a GDP of $21 billion in 2022. At $110/t Simandou’s iron ore would increase this by more than 50%. It’s easy to see why Guinea’s government has been so particular about how the mine is developed. Guinea has abundant natural resources, including as much as half of the world’s bauxite (aluminum ore) reserves, and Simandou’s supporting infrastructure might be just the thing to spur more development.

All this, of course, assumes the mine will go into production as planned. Given Simandou, and Guinea’s, tumultuous recent history it’s hard to be completely certain. Guinea’s government was overthrown by a military coup in 2021, but so far this doesn’t seem to have affected the Simandou project. In its’ 27 years, Simandou has seen four presidents, three elections, and two coups. Even barring political interference, the number of companies involved and amount of infrastructure to be built leaves plenty of potential snags along the road to production. Still, Rio Tinto’s massive investment speaks to a high level of confidence that the tide has finally turned.

Investor Takeaways

After decades of setbacks, Simandou appears to be on track to becoming one of the biggest mines in the world. With an enormous, uniquely high grade and high purity resource at surface you couldn’t ask for a better deposit. It may be too soon to start celebrating, Simandou’s high infrastructure costs, complex ownership structure, and Guinea’s history of political instability could still cause issues, but momentum is building, and for now Simandou’s future looks bright.

List of Companies Mentioned

- Rio Tinto www.riotinto.com (website)

- Aluminium Corporation of China (Chinalco) https://www.chalco.com.cn/en/ (website)

- Baowu Steel Group https://www.baowugroup.com/en/home (website)

- China Railway Construction Corporation https://english.crcc.cn/ (website)

- China Harbour Engineering Company https://www.cccme.cn/shop/cccme12721/introduction.aspx (website)

- Winning International Group of Singapore https://www.winninggroup.com.sg/en/ (website)

- Weiqiao Aluminium http://www.weiqiaocy.com/en/ (website)

- United Mining Suppliers https://ums-international.com/en/home-en/ (website)

- BSG Resources https://www.bsgresources.com/ (website)