Introduction

Although helium is quite abundant in the universe, it is rather scarce here on Earth. It is so light that it simply floats away. In the past years, recurrent concerns about helium shortages have become more and more common. The liquidation of the US federal helium reserve by 2021 adds to the threat of a steady helium crisis. This means now could be a good time to start thinking about investing in helium.

This article is the second in a series about helium mining. The first, an overview of the helium commodity, is available here.

Commercial uses of helium

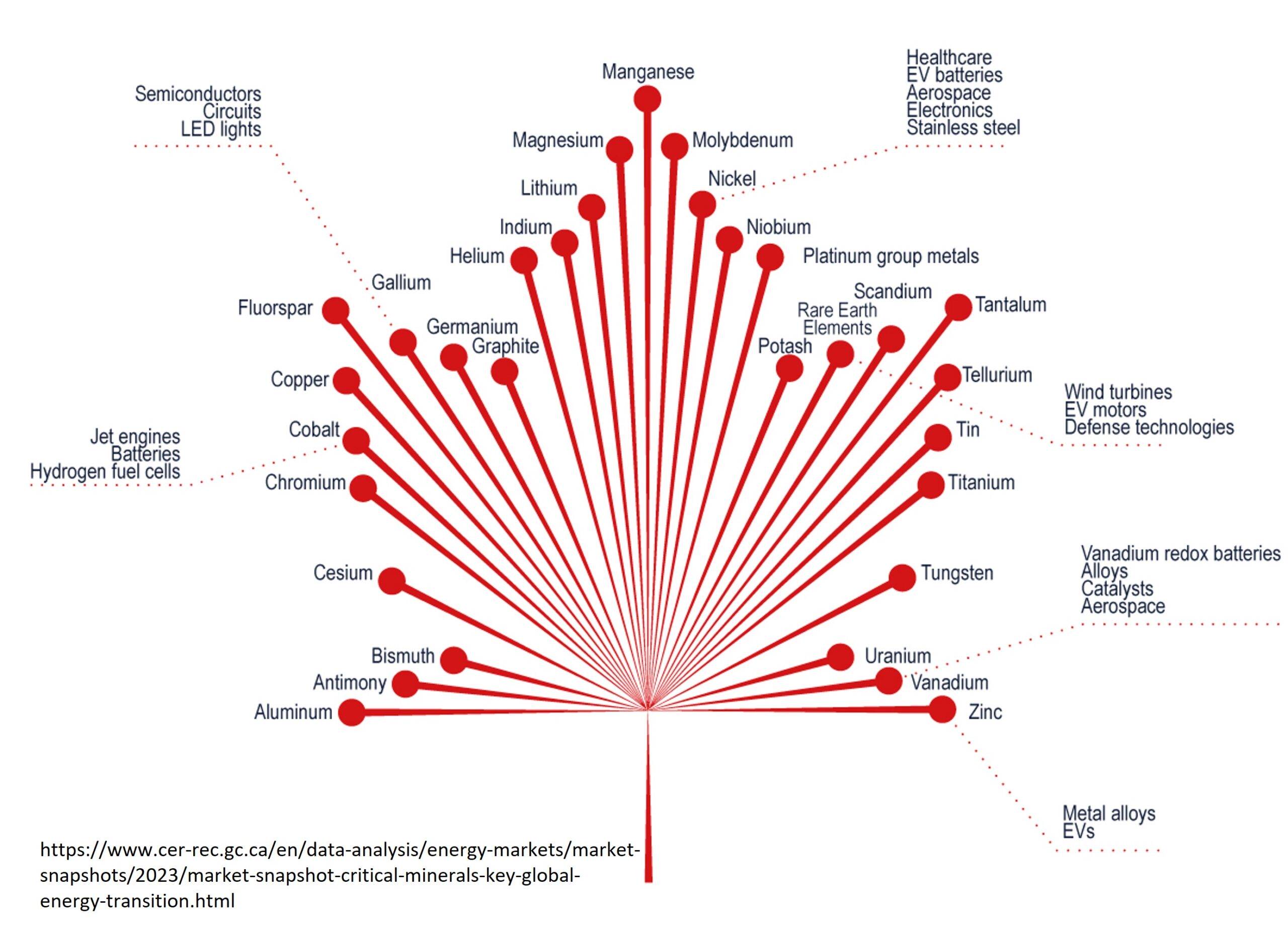

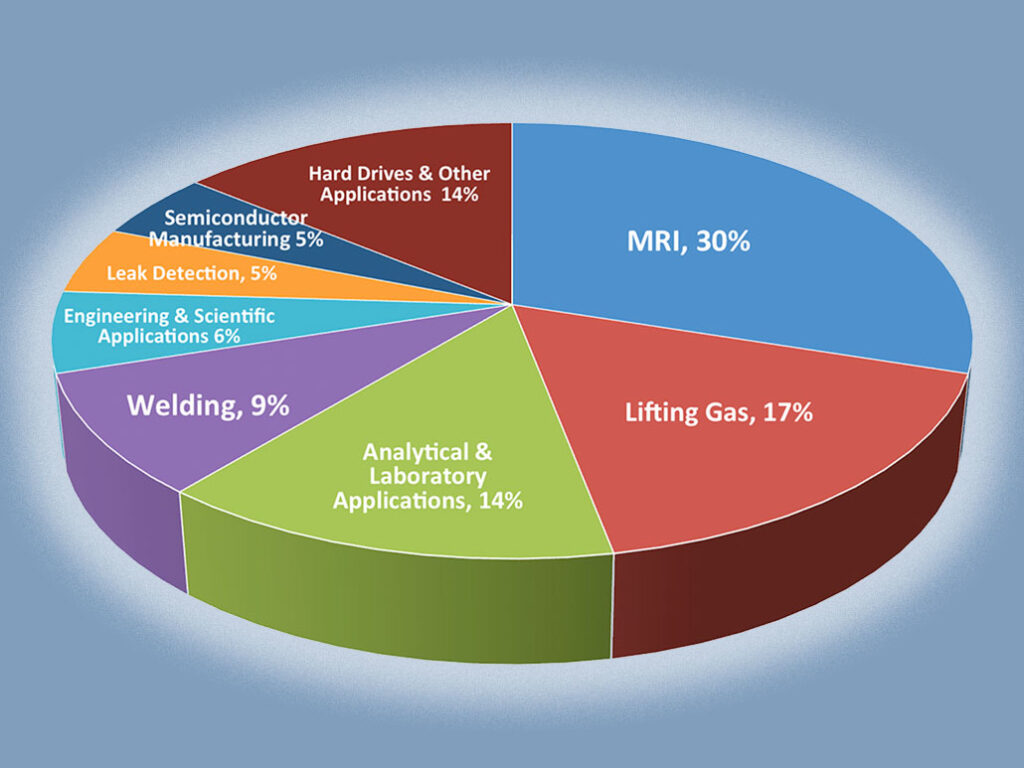

Helium has unique properties that make it a key commodity in several applications. For some of its functions, there is few or no suitable replacement for helium. Aside from its most famous uses as a balloon filling (Figure 2), helium plays a crucial role in many industries (Figure 1). It is dominantly used as a coolant in low-temperature systems, such as in superconductive devices like magnetic resonance imaging (MRI) machines. The gas is also applied to inflate aircraft as dirigibles (blimps), conduct analytical and laboratory analyses, welding, leak detection, and hard drive and semiconductor manufacturing.

Currently Producing Helium Reservoirs

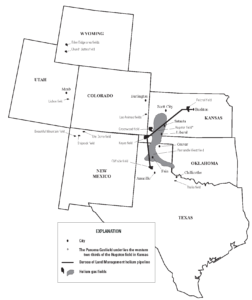

According to the USGS, the total estimate of global helium reserves in 2018 was 51.9 billion cubic meters. The US is the largest producer (~ 40 %), followed by Qatar (~ 30 %) and Algeria (15-20 %). The two most prominent US sources of helium are the Hugoton-Panhandle complex, in Texas, Oklahoma, and Kansas, which is connected to the Helium Pipeline and the Bush Dome Reservoir (the BLM system), and ExxonMobil’s Riley Ridge Field, in southwestern Wyoming (Figure 2).

processing plants in the US (source: USGS)

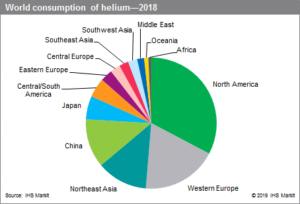

Helium projects in Qatar and Algeria, however, are afflicted by geopolitical uncertainty. Qatar’s supply is somewhat vulnerable due to conflicts with Saudi Arabia that caused several shutdowns in its industry. Similarly, Algeria is subject to political instability. Since helium extraction in both countries is secondary, i.e. a byproduct of natural gas, a significant reduction in their helium production is presumed by the recent collapse of oil and gas prices.

Extraction Methods

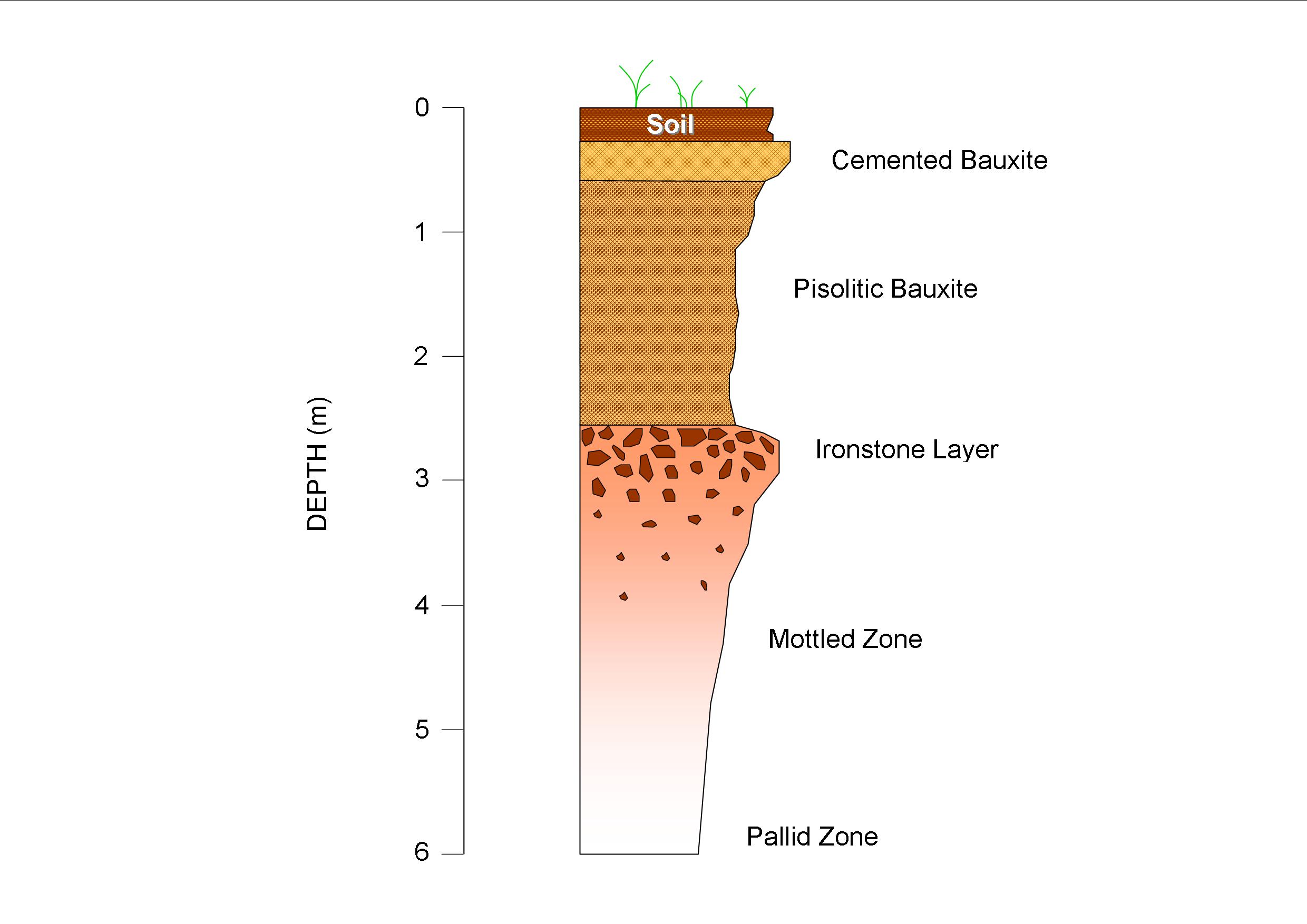

Helium is primarily extracted as a byproduct in natural gas wells. A natural gas deposit with just 0.3% He in is enough to make helium the most valuable component. As helium prices have doubled prices in the last 10 years, helium is now worth 40 times LNG (liquefied natural gas).

Helium extraction essentially consists of exposing natural gas to high pressures leading to a temperature drop and subsequent liquefaction of the gas. At -250°F, all the gas liquefies, except nitrogen and helium. Then, the liquid natural gas is separated and returned to its gaseous state to be sold as fuel. The leftover gaseous mixture, aka crude helium (75-80% He), is later put under lower temperatures to remove the nitrogen, leaving ‘Grade A’ helium (99.99% He).

It is difficult and extremely expensive to store helium. The current understanding is that one of the best ways to trap large amounts of helium in place is by storing it in reservoirs. After being compressed at the Earth’s surface, helium is injected into dolomite rock 3,000 feet (914 meters) deep that is covered by a halite (salt) layer.

However, the costliness of this operation prevents widespread usage of helium stockpiles.

Prospective Reservoirs

The looming end of the US government helium inventories and the geopolitical issues involving other major suppliers increases the uncertainty of the helium supply chain. Fortunately, fresh sources are on the way. New production plants in Russia are planned to start production by 2021.

Exploration for new reservoirs worldwide resulted in the recent discovery of a few deposits. London-listed Georgina Energy PLC (LSE:GENL) has made a helium discovery in the Georgina Basin, Northern Territory, Australia.

In the U.S., Canada-based Desert Mountain Energy Corp. (TSX-V:DME, OTCQX:DMEHF) has prospects in Arizona and Oklahoma. Desert Mountain’s flagship prospect in Arizona, Heliopolis, is a primary helium deposit. Local historic production ranged from 8-10% grade helium, significantly exceeding the commercial benchmark of 0.3-1%. German-based NASCO Energie and Rohstoff AG have been in the U.S. helium space since 2014. They are producing from the DBK field in northeast Arizona, where the helium has a grade of 5%.

There are several helium exploration and development projects in Canada, primarily in British Columbia, Alberta, and Saskatchewan. Canada-based North American Helium have discovered four fields in southeastern Saskatchewan and are looking to commercialize their Battle Creek field. They also have acreage in the U.S., purchased from the BLM in Utah. Canada-based Royal Helium Ltd. (TSX.V:RHC) is also exploring in southern Saskatchewan at the Climax and Bengough fields. Both companies have significant nitrogen assets associated with the helium.

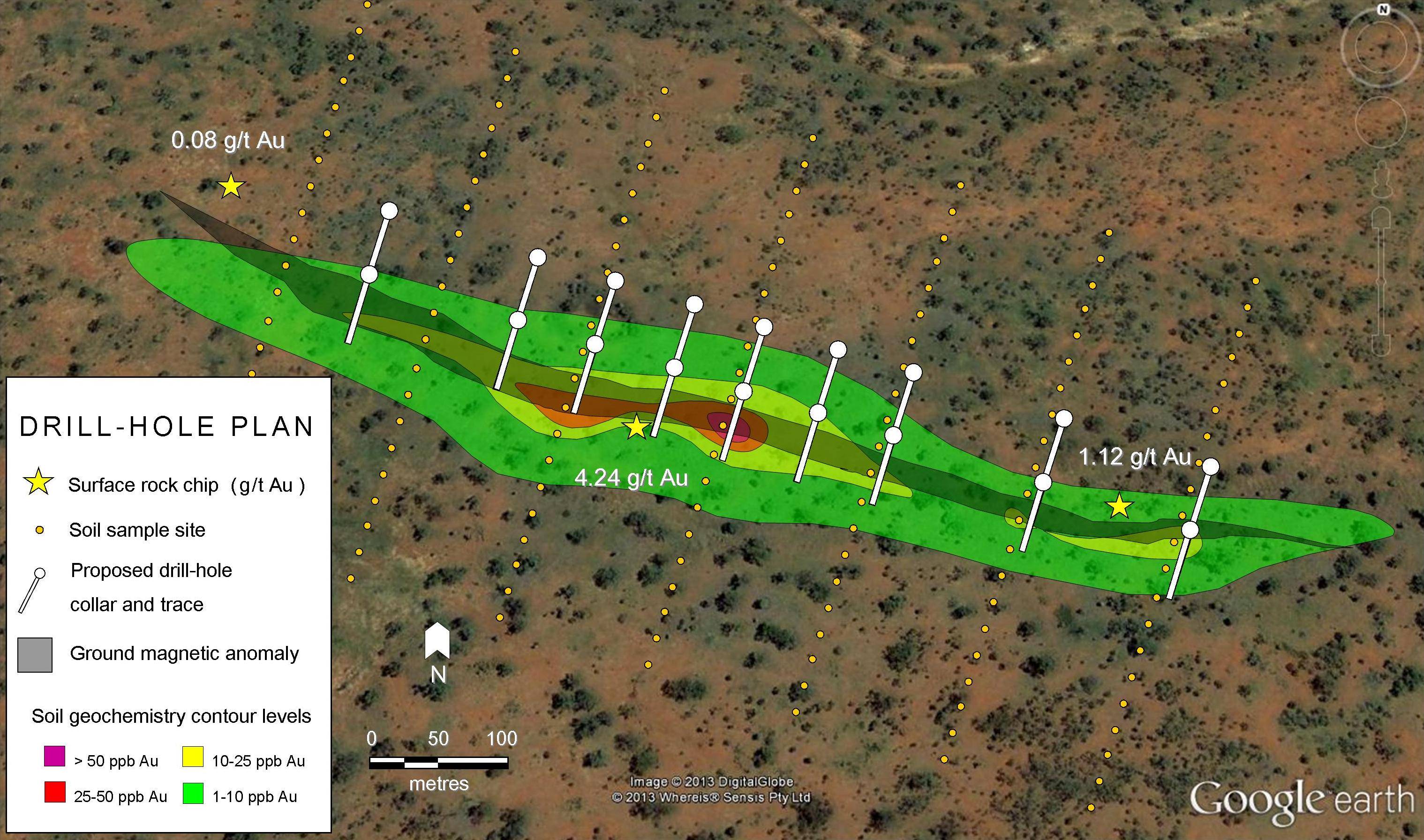

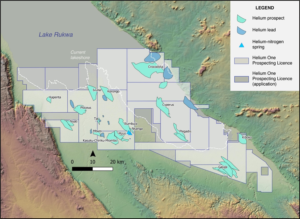

The recent discovery of a helium field in Tanzania’s Rift Valley, in East Africa, may also help alleviate the surging demand. The massive project has very high helium concentration (8-10 % He) and is estimated to hold a resource of just under 100 billion cubic feet of helium – enough to provide global demand for nearly seven years (Figures 3 and 4). The discovery was made by researchers from Oxford University and Durham University and exploration company Helium One and is the first of its kind. Heat from volcanic activity is thought to have caused the helium to rise and become trapped in natural gas reservoirs close to the surface.

Future outlook

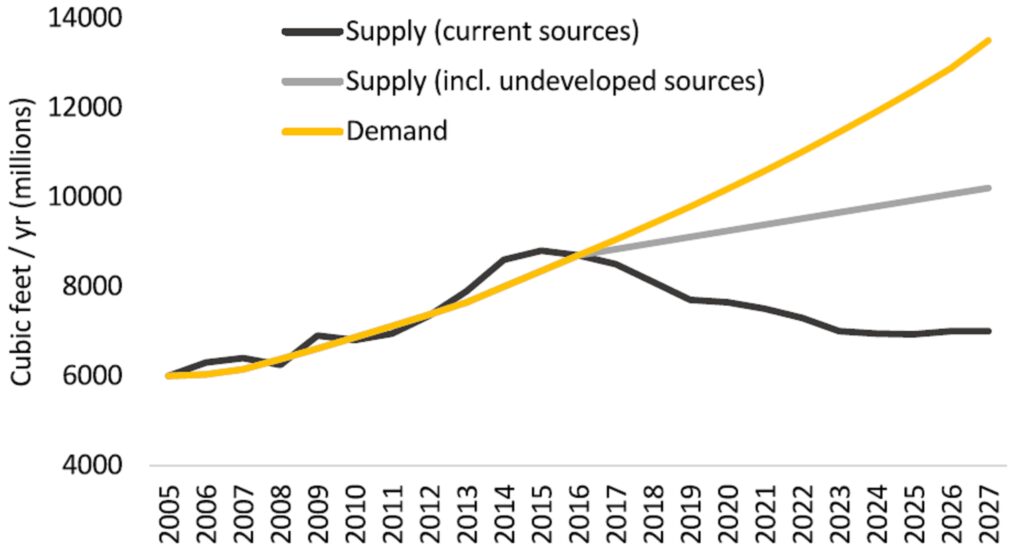

The Earth is not actually running out of helium. Shortages were in reality prompted by imbalances in the market, partially caused by the end of the U.S. helium reserve and geopolitical matters in other suppliers. With the exit of the U.S. government from the helium market, prices are expected to keep rising, at least until new players as Russia and Australia are set to gain from the surge in global demand for the commodity. This ‘democratization’ of helium has also prompted major helium finds in several places outside the U.S., as the massive reservoir in Tanzania.

Investor Takeaways

With the helium prices up more than 160% in the last three years, investors are beginning to feel enthusiastic about helium stocks worldwide. The recent depreciation of the oil and gas industry is probably going to have an impact on helium production, particularly where the gas is a byproduct of natural gas. That said, projects primarily mining helium are presumed to thrive.