Many companies are now getting stuck with small or moderate resource reports and no cash to continue exploration. Luckily for Sabina, they have the cash to sustain their work and have been continuously working to expand the size of a potential mine at Back River.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Oct. 7, 2014) – Sabina Gold & Silver Corp. (the “Company”) (TSX:SBB) is pleased to provide a progress report on optimization work currently being undertaken as part of the Feasibility Study (“FS”) being prepared on the Company’s 100% owned Back River Gold Project, (“Back River”) or (the “Project”) Nunavut, Canada.

[box type=”note” align=”aligncenter” ]

Sabina Gold and Silver (formerly Sabina Silver) has a number of projects in Canada’s far north, the most advanced of which is the Back River Gold Project. The Back River property was discovered in 1982 during a reconnaissance exploration program performed by a group known as the “Back River Joint Venture” after which it was explored and slowly advanced by several different firms. Sabina acquired the property in 2009 from Dundee Precious Metals (DPM).

The project itself consists of several different properties and deposits including the Goose, Llama, Umwelt and George deposits. The current mine plan calls for both open pit and underground operations.

[/box]

The FS, launched in June of this year, is being completed by a team of highly qualified engineering and environmental firms: JDS Energy and Mining Inc. (lead), Hatch, SRK Consulting, Knight Piesold Ltd., and AMC Consultants Pty Ltd. All of these firms have extensive recent Arctic experience.

“Our studies for the Back River FS are very much on track,” said Rob Pease, President & CEO “the Pre-feasibility Study (“PFS”) was a snapshot in time and enabled us to identify strategies to optimize the Project. While final results and economics for the FS are not expected to be completed until the first half of next year, we are very encouraged by our progress so far and believe with the volume of additional information we now have, that Back River is going to be a compelling project. We are also very fortunate to have what we believe is the best Arctic team in Canada working on the Project. Our consultants all have significant Northern experience in design, construction, operations and permitting which will bring relevant hands-on credibility to the FS.”

[box type=”note” align=”aligncenter” ]

As project’s advance from exploration and development, several types of studies are commissioned to determine the economic potential of a possible mining operation. Scoping Studies and Preliminary Economic Assessments are early stage studies that offer the lowest level of accuracy and detail, but are completed for a relatively low cost. Pre-feasibility (“PFS”) and Feasibility Studies (“FS”) are successively more accurate and more expensive, but offer a more accurate picture of what an operation might look like. Feasibility studies typically cost between 0.5% to 1.5% of the total project cost.

[/box]

After completion of the PFS announced in October 2013, a number of opportunities to enhance Project economics in the FS were identified and work has progressed in these areas (some of which were announced earlier this year):

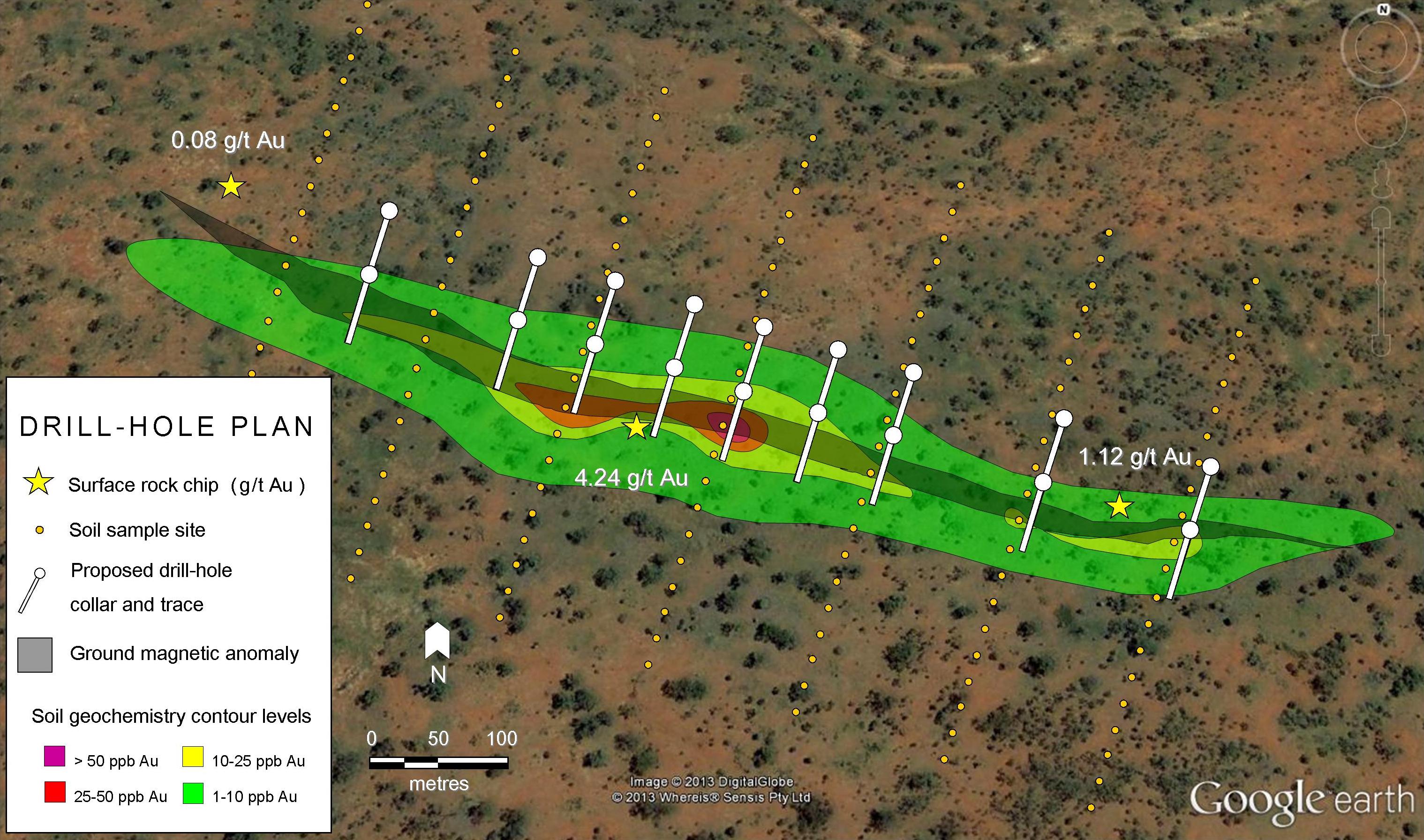

- As announced in March of this year, a new Mineral Resource estimate was completed compiling approximately 82,000 meters drilled in 2013 that were not included in the PFS. The current estimate includes a Measured Mineral Resource of 10.4 million tonnes grading 5.2 g/t for 1,761,000 million contained ounces Au, an Indicated Mineral Resource of 17.9 million tonnes grading 6.1 g/t for 3,536,000 contained ounces Au and an Inferred Mineral Resource of 8.2 million tonnes grading 7.3 g/t for a contained 1,927,000 ounces Au. (see press release dated March 4, 2014). Although the impact of the increased resource on the Project will not be fully known until completion of the FS, we believe that the increase in measured and indicated mineral resources and increase in confidence in the continuity and grade of the deposits offers the potential for a larger mineral reserve on the project and a potentially longer mine life;

[box type=”note” align=”aligncenter” ]

In their 2012 PEA, the company reported 23.2 million tonnes indicated 9.3 million tonnes inferred at 5.6 g/t gold. Earlier this year these resources were upgraded through further drilling to:

- A Measured Resource of 10.4 million tonnes grading at 5.2 g/t gold

- An Indicated Resource of 17.9 million tonnes grading at 6.1 g/t gold

- An Inferred Resource of 8.2 million tonnes grading at 7.3 g/t gold

This is a slight tonnage improvement over the previous report, but the primary gain is the upgrade of Indicated Resources to the more confident Measured category. The company is reporting today that it expects further increases. It’s not uncommon for a company to initially place it’s focus on a smaller more well-explored area of a deposit in order to clear those first resource and reporting hurdles. In a hot (or even warm) mining market a reasonably positive PEA or 43-10 compliant resource would be enough for a company to get cash to support further work and expansion of a potential deposit, but many companies are now getting stuck with small or moderate resource reports and no cash to continue exploration. Luckily for Sabina, they have the cash to sustain their work and have been continuously working to expand the size of a potential mine at Back River.

[/box]

- For the FS, a comprehensive review of all the mining areas is being undertaken. This review is focusing primarily on underground areas where conversion of inferred resources into the Measured and Indicated categories has demonstrated increased continuity leading to potentially more efficient development strategies and mining methods. The FS will consider whether this could offer a potential reduction in underground mining costs, increased mining recovery and decreased dilution;

- The life of mine (“LOM”) gold recoveries in the PFS were estimated to average 88.0%. As previously announced, metallurgical testing since the PFS has resulted in increased recoveries to an estimated 93.9% over the LOM. This indicates approximately 5% more metal over the LOM relative to the PFS, and more significantly, a potentially bigger impact in the early years from the first two pits at Llama and Umwelt which had the lowest recoveries in the PFS (see news release dated April 22, 2014);

- The PFS contemplated underground development occurring from the bottom of the open pits and a single tailings storage facility (“TSF”) to accommodate tailings waste for the LOM. Current studies for the FS are evaluating the effects of ramp access to the underground external to the open pits. This change allows for other tailings disposal options to be considered in the FS, including the use of open pits for tailings disposal. This may have a positive impact on sustaining capital as well as on the permitting process; and

- In the PFS the Project envisioned a 5,000 tonne per day operation, producing a LOM average of approximately 287,000 ounces Au per year. Analysis is underway for the FS on a scenario which would increase the throughput of the process plant by up to 20% for the majority of the LOM. This could alleviate some of the planned open pit stockpiling and increase the overall production profile.

Detailed engineering on these concepts is ongoing and Project economics are not yet available. Readers are cautioned that until the FS is completed, the implications of these concepts on the Project, including on Project economics, will not be fully understood. Results will be used to support the FS which is expected to be completed in the first half of 2015.

[box type=”note” align=”aligncenter” ]

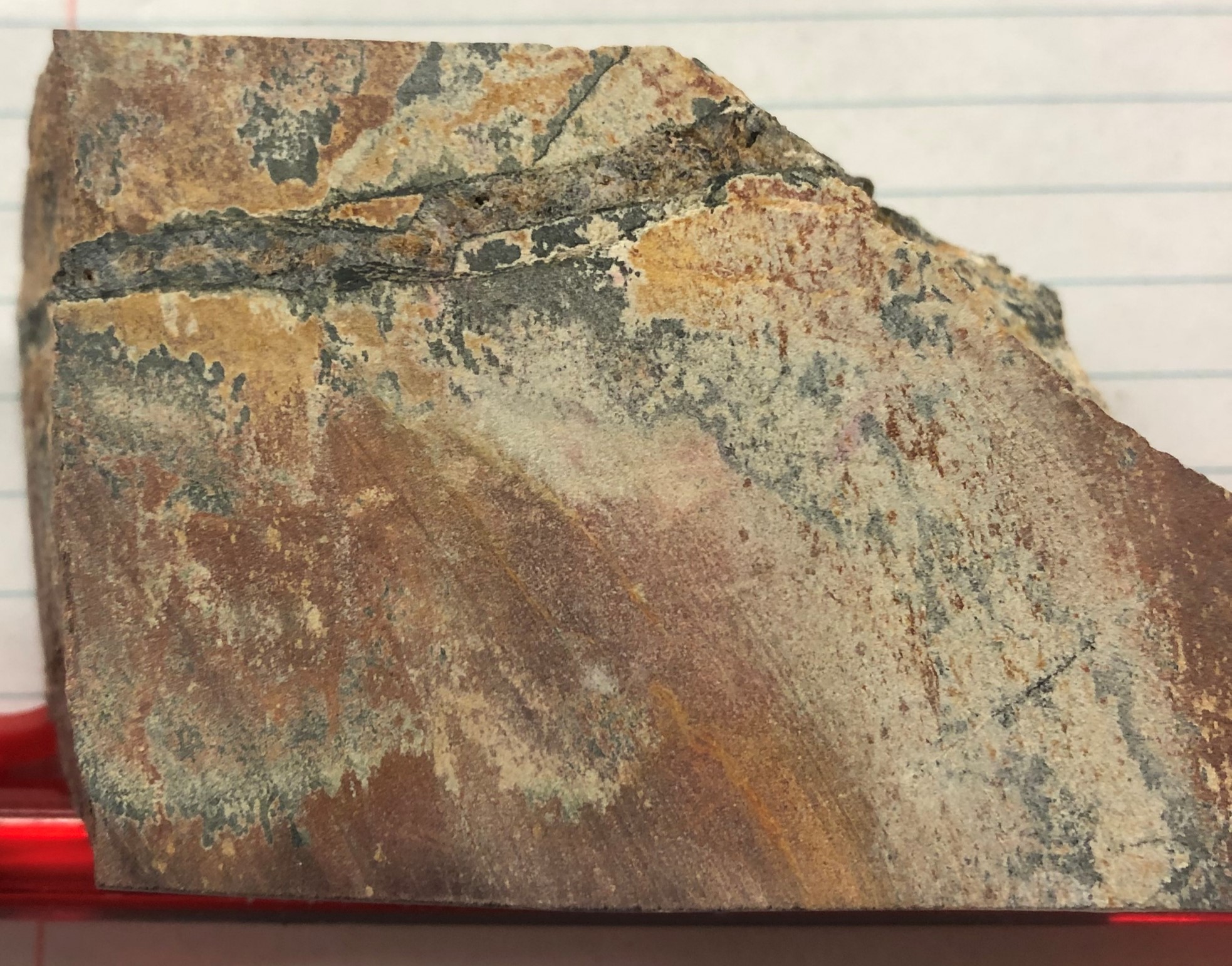

The Back River project consists of gold hosted in “banded iron formations”. Banded Iron Formations, or BIF’s are important iron deposits in many parts of the world. All the world’s known iron formations are virtually the same age and are thought to have occurred during the oxygenation of the the Earth’s atmosphere about 2.4 billion years ago.

[/box]

Permitting

On January 22, 2014, the Company submitted the Back River draft Environmental Impact Study (“DEIS”) and associated water license application for the Project to the Nunavut Impact Review Board (“NIRB”) and the Nunavut Water Board. The DEIS presents scientific and community based knowledge that determined key aspects of the natural and socio-economic environments in the region. Project interactions were identified; residual effects assessed and proposed mitigation and monitoring plans developed for the construction, operation and closure of the Project. In February 2014, the Company received notice from NIRB that the Back River DEIS conformed to the environmental assessment guidelines. In March, 2014 the Company received information requests from the technical review process. On July 23, 2014, the company submitted its information request responses to NIRB. On July 31, 2014, NIRB advised that the Company’s submission was conformant and that meetings for the technical review process had been set for November 13-15, 2014, and the pre-hearing conference was set for November 17-19, 2014 in Cambridge Bay.

The Back River Final Environmental Impact Statement (“FEIS”) will be informed by the FS early next year and is expected to be submitted to NIRB during the third quarter of 2015.

[box type=”note” align=”aligncenter” ]

Environmental impact studies and the building of good will and “social license” are crucial for successful mining operations. Our recent discussions of Polymet’s permitting process and the disaster at Mount Polley highlight the often cumbersome, but necessary processes of building consensus among stakeholders. (Note: Watch for our upcoming article on social license in mining projects.)

[/box]

Project Financing

It is anticipated that the Company will end 2014 with approximately $30 million in cash. Sabina remains well funded to take the Project through completion of the FS and the environmental assessment process. The Company forecasts that its cash balance after completion of the FS and the FEIS would be approximately $23 million (at the end of 2015 and not including any field work that may be required to complete the FEIS).

Management is currently informally exploring project financing alternatives and opportunities. While the Project is expected to be substantively de-risked by the end of 2015, (with the FS and environmental assessment completed), subject to the results of the FS and FEIS, the Company would start construction of the Back River Project at an appropriate time once financing is secured on satisfactory terms in a manner which is in the best interests of all shareholders.

Quality Assurance

The Mineral Resources for the Back River deposits were estimated by AMC Mining Consultants (Canada) Ltd. The Qualified Persons are Dinara Nussipakynova, P Geo. and Andrew Fowler MAusIMM CP (Geo) both of AMC Mining Consultants (Canada) Ltd., and both are independent of Sabina.

Wes Carson, P.Eng. and Vice-President, Project Development for Sabina Gold & Silver Corp. is a Qualified Person under the terms of NI 43-101 and has reviewed the technical content of this press and has approved its dissemination.

[box type=”note” align=”aligncenter” ]

Any time a project in the far north comes up for discussion the same three issues surface: Cost, cost and cost. It’s ridiculously expensive to operate up north. Long, cold winters and remote operations make for a logistical nightmare and because of this, mining projects must be exceptional in order to survive. Couple that with the current state of the market and you find yourself edging towards the “miracle” end of the spectrum. Mind you, Sabina itself is something of a miracle. They’ve managed to publish both a PEA and a PFS in two of the worst resource market years in recent history, and by all accounts have the cash to keep drilling and advancing the project. A full feasibility study on Back River is expected in the first half of 2015.

Sabina is currently trading at $0.51.

[/box]

SABINA GOLD & SILVER CORP

Sabina Gold & Silver Corp. is an emerging gold developer with district scale, world class assets in one of the world’s newest, most politically stable mining jurisdictions: Nunavut, Canada.

Sabina’s primary assets, all located in Nunavut, consist of: the Back River Gold Project, currently in the feasibility and permitting phase; the Wishbone Claims, a vastly prospective grass roots project; and the Hackett River Silver Royalty, a silver production royalty on Glencore’s Hackett River project comprising 22.5% of the first 190 million ounces produced and 12.5% of all the silver produced thereafter.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]

Subscribe for Email Updates

Hi, I am rather new in mining investing. Thanks for the great website. From my knowledge and my understanding the report does not look bad and I find your comments positive. Do you know why is the stock down then since the press release? Is there a rationale not captured in your analysis? Many thanks. Jean

Hi, The short answer is gold prices. If you pull up a chart of the one year gold price and overlay it with virtually any gold stock for the same period (including Sabina), you’ll have your answer. Gold has been tanking lately and so have virtually all the gold miners and explorers. Companies with more advanced projects or producing mines tend to track commodity prices more closely. Those that buck the trends tend to have really exciting or really terrible news – or trade is such low volumes that no one cares.

many thanks for the answer.