While many companies deal with the challenges of infrastructure and access in remote locations, the Hardrock Deposit presents the opposite problem: It’s located right under the main highway!

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

PREMIER GOLD MINES LIMITED (TSX:PG) is pleased to provide an update for the Company’s 100% owned Hardrock Project and to announce its plan to drill test the recently identified Bankfield West open pit target located just 10 km west of the Hardrock Project.

[box type=”note” align=”aligncenter” ]

If you’re a regular reader you may have noticed that last week was quiet over here. We were attending the Northwestern Ontario Mining Symposium in Thunder Bay, Canada and this week we’ll be writing a little about what we learned there. The theme of the conference was “Perseverance in Challenging Times”. That itself says a lot about the state of the mining industry. Earlier in March when we attended the much larger PDAC conference in Toronto the mood was much the same. While in past years these conferences were a place to close deals and promote projects, this year is was all about showing solidarity within the industry and maybe doing a little complaining. So how bad is it? One of the most common talking points offered by the junior mining companies these days is “low burn rate” – meaning that they are not doing anything, but they are not burning up their cash reserves on management costs as fast as a the next guy. Hardly something to brag about, but if you’ve got money tied up with a company like this then I guess there’s some comfort in knowing they might survive the downturn.

One of the biggest complaints heard from mining companies is that no matter what they do, no matter how good their results, the market doesn’t seem to take notice. This seems to be mostly true. Anything less than a world-class result is largely ignored by the markets. Yet some companies seem to be able to advance their projects without getting punished too badly by the markets. That brings us to Premier Gold Mines. Their approach has been to invest their resources in advanced high-end projects – those with the highest chance of success.

Although this news release from Premier is a few weeks old, it gives us a chance to talk about their projects and bring home a few key points about why some company stocks are doing well and others are not.

Premier is a cash-rich junior focused on 3 projects:

- Their “Rahill -Bonanza” project is an underground exploration project currently in joint venture with Gold Corp. and adjacent to the Red Lake, Ontario gold mines.

- Their Cove Gold Project is on the Battle Mountain Trend in Nevada and includes a past producer immediately south of Newmont’s Phoenix Mine. Newmont has the option to buy into the project.

- Their Trans-Canada Project comprises 4 gold deposits located just off the highway near Geraldton, Ontario

This release deals with the largest of the 4 deposits in the Trans-Canada project, the Hardrock Deposit. Let’s talk about Hardrock for a bit and then get back to the the big picture.

[/box]

The current drill program at Hardrock consists of some 60,000 metres of infill drilling designed to upgrade the Inferred portion of the open pit mineral resource estimate to Indicated (See Table 1 for current Hardrock mineral resource estimate). The program, which is near completion, has been very successful in intersecting mineralization within multiple horizons and has identified a potential higher grade core within the recently discovered North Wall Zone. Results from this program will be incorporated in an updated mineral resource estimate for Hardrock planned for release in Q2 2014. Highlights from this current program include:

- High grade intercepts within the primary resource area include 15.13 grams per tonne gold (g/t Au) across 6.0 metres (m) in hole MM534, 12.40 g/t Au across 7.0 m in hole MM544, and 18.54 g/t Au across 25.5 m in hole MM552.

- Broad intercepts within the primary resource area include 2.90 g/t Au across 27.3 m in hole MM538, 1.56 g/t Au across 35.8 m in hole MM545, and 1.67 g/t Au across 29.5 m in hole MM556.

- Results from the North Wall Zone situated to the north of the primary resource area include 1.30 g/t Au across 57.0 m and 29.20 g/t Au across 11.0 m in hole MM571, 80.57 g/t Au across 4.5 m in hole MM573, and 16.73 g/t Au across 3.0 m and 2.13 g/t across 15.0 m in hole HR180.

“Drilling at Hardrock continues to demonstrate strong continuity within the open pit resource and suggests the existence of potential higher-grade mineralization within several lenses including the recently identified North Wall Zone” stated Stephen McGibbon, Executive Vice-President of Premier.

Open Pit Drilling

The 2014 drill program is designed to demonstrate continuity and to upgrade mineral resources primarily within the open portion of the Hardrock deposit as reported on October 29, 2013 and presented in Table 1 below. This drilling has consistently intersected mineralization within the target horizons and has identified areas for potential resource expansion.

[box type=”note” align=”aligncenter” ]

While many companies deal with the challenges of infrastructure and access in remote locations, the Hardrock Deposit presents the opposite problem: It’s located right under the main highway! Access and infrastructure couldn’t be better, but the company will need to have the highway relocated.

As shown in the table below, the deposit has a 55 million tonne indicated resource with a cut-off grade of 0.5 g/t and an average grade of 1.87 g/t. By comparison, this is more than twice the grade of Osisko’s Hammond Reef Project, but about a quarter the size. Hardrock is the most advanced of the 4 Trans-Canada deposits

[/box]

Table 1: 2013 Hardrock Mineral Resource Estimate

| Cut-off Category | Resource Category | Tonnes (Mt) | Gold (Au) Grade (g/t) | Au Ounces (M ozs) |

|---|---|---|---|---|

| Open Pit (O/P) | Indicated (I) | 50.228 | 1.46 | 2.352 |

| Inferred | 17.793 | 1.5 | 0.859 | |

| Underground (U/G) | Indicated (I) | 5.522 | 5.01 | 0.889 |

| Inferred | 16.919 | 5.38 | 2.925 | |

| Combined | Total Indicated | 55.75 | 1.87 | 3.241 |

| Total Inferred | 34.712 | 3.5 | 3.784 |

(Cut-off grade 0.5 g.t Au – See Press Release dated October 29, 2013)

Table 2 provides a summary of highlight results from the 2014 portion of the open pit delineation drilling program and Appendix 1 provides a full table of results from the current program. No holes within the primary pit area returned no significant values (less than 0.5 g/t Au) and one hole was abandoned.

[box type=”note” align=”aligncenter” ]

The “infill drilling” program at Hardrock is designed to upgrade the inferred resources to indicated resources and increase the overall indicated resource for the deposit. Since all these holes are in or near the proposed pit, there shouldn’t be any surprises and it doesn’t look like there are.

[/box]

Table 2: Highlight New Assay Results from the Hardrock pit area – delineation drilling

| Hole-ID | UTM Coordinates (m) | Dip/Az (degrees) | From (m) | To (m) | Interval (m) | Grade (g/t) | Interval (ft) | Grade (oz/ton) | Zone | |

|---|---|---|---|---|---|---|---|---|---|---|

| MM526 | 5502688N 505049E | -46/360 | 80.0 | 119.0 | 39.0 | 0.85 | 127.92 | 0.02 | Near-Pit | |

| 352.0 | 358.0 | 6.0 | 2.09 | 19.68 | 0.06 | U/G | ||||

| MM531 | 5502860N 504500E | -65/360 | 109.4 | 113.0 | 3.6 | 26.67 | 11.81 | 0.78 | In-Pit | |

| 148.5 | 159.5 | 11.0 | 1.08 | 36.08 | 0.03 | In-Pit | ||||

| MM534 | 5502964N 504500E | -54/360 | 68.5 | 76.0 | 7.5 | 1.37 | 24.60 | 0.04 | In-Pit | |

| 172.0 | 178.0 | 6.0 | 15.13 | 19.68 | 0.44 | In-Pit | ||||

| 313.7 | 317.5 | 3.8 | 4.83 | 12.46 | 0.14 | Near-Pit | ||||

| MM538 | 5502826N 504300E | -54/360 | 233.0 | 237.4 | 4.4 | 1.58 | 14.43 | 0.05 | In-Pit | |

| 295.0 | 322.3 | 27.3 | 2.90 | 89.54 | 0.08 | In-Pit | ||||

| 383.5 | 386.5 | 3.0 | 7.86 | 9.84 | 0.23 | In-Pit | ||||

| 394.0 | 418.0 | 24.0 | 1.59 | 78.72 | 0.05 | In-Pit | ||||

| MM539 | 5502779N 504615E | -68/360 | 65.5 | 73.0 | 7.5 | 1.61 | 24.60 | 0.05 | In-Pit | |

| 174.0 | 192.0 | 18.0 | 3.27 | 59.04 | 0.10 | In-Pit | ||||

| MM543 | 5502743N 504749E | -62/360 | 72.5 | 83.0 | 10.5 | 4.17 | 34.44 | 0.12 | In-Pit | |

| 92.5 | 111.0 | 18.5 | 2.81 | 60.68 | 0.08 | In-Pit | ||||

| 199.5 | 211.0 | 11.5 | 1.32 | 37.72 | 0.04 | In-Pit | ||||

| MM544 | 5502726N 504450E | -58/360 | 294.4 | 295.4 | 1.0 | 427.00 | 3.28 | 12.47 | In-Pit | |

| 376.0 | 383.0 | 7.0 | 12.40 | 22.96 | 0.36 | In-Pit | ||||

| 390.0 | 403.0 | 13.0 | 1.39 | 42.64 | 0.04 | In-Pit | ||||

| MM545 | 5502659N 504701E | -55/360 | 181.0 | 216.8 | 35.8 | 1.56 | 117.42 | 0.05 | In-Pit | |

| 270.0 | 275.5 | 5.5 | 1.76 | 18.04 | 0.05 | In-Pit | ||||

| MM546 | 5502722N 504626E | -60/360 | 108.0 | 113.0 | 5.0 | 4.04 | 16.40 | 0.12 | In-Pit | |

| 122.0 | 142.5 | 20.5 | 0.70 | 67.24 | 0.02 | In-Pit | ||||

| 160.5 | 175.5 | 15.0 | 0.87 | 49.20 | 0.03 | In-Pit | ||||

| 185.0 | 192.0 | 7.0 | 4.71 | 22.96 | 0.14 | In-Pit | ||||

| 329.5 | 340.0 | 10.5 | 2.32 | 34.44 | 0.07 | In-Pit | ||||

| 427.0 | 442.0 | 15.0 | 3.55 | 49.20 | 0.10 | In-Pit | ||||

| MM551 | 5502755N 504576E | -69/360 | 398.0 | 402.5 | 4.5 | 1.85 | 14.76 | 0.05 | In-Pit | |

| 414.5 | 419.0 | 4.5 | 5.05 | 14.76 | 0.15 | In-Pit | ||||

| 431.0 | 438.5 | 7.5 | 11.24 | 24.60 | 0.33 | In-Pit | ||||

| MM552 | 5502906N 504426E | -68/360 | 122.0 | 132.5 | 10.5 | 0.52 | 34.44 | 0.02 | In-Pit | |

| 238.5 | 264.0 | 25.5 | 18.54 | 83.64 | 0.54 | In-Pit | ||||

| MM553 | 5502775N 504450E | -56/360 | 67.0 | 73.0 | 6.0 | 8.21 | 19.68 | 0.24 | In-Pit | |

| 348.5 | 356.0 | 7.5 | 2.08 | 24.60 | 0.06 | In-Pit | ||||

| MM556 | 5502676N 504501E | -71/360 | 258.0 | 287.5 | 29.5 | 1.67 | 96.76 | 0.05 | Near-Pit | |

| MM558 | 5502612N 504546E | -59/360 | 247.0 | 256.0 | 9.0 | 4.21 | 29.52 | 0.12 | In-Pit | |

| 275.5 | 289.0 | 13.5 | 1.05 | 44.28 | 0.03 | In-Pit | ||||

| 297.6 | 303.1 | 5.5 | 4.90 | 18.04 | 0.14 | In-Pit | ||||

| MM560 | 5502804N 504149E | -68/360 | 275.0 | 293.0 | 18.0 | 2.99 | 59.04 | 0.09 | In-Pit | |

| 367.0 | 371.0 | 4.0 | 3.17 | 13.12 | 0.09 | In-Pit | ||||

* True widths estimated at 60-70% of intercept * Assays as presented are un-cut

North Wall Zone Drilling

The North Wall Zone was discovered when condemnation drilling intersected mineralization in an area to the north of the primary zones that had previously received little to no drilling. Previous results from the North Wall Zone include intercepts of 132.32 g/t Au across 3.9 m (3.86 oz/t gold across 12.8 feet) in hole HR155; 13.96 g/t Au across 6.0 m and 1.52 g/t across 17.0 m in hole HR157, 3.70 g/t Au across 22.0 m in hole HR161, and 2.30 g/t Au across 21.0 m in hole HR180. The North Wall Zone remains open for expansion and is currently being tested by additional drilling.

[box type=”note” align=”aligncenter” ]

The results below are from a new zone which is not included in current resource calculations. Companies will often focus their economic assessments or feasibility studies on the core area of a deposit for which they have the most drill data. However, exploration is often ongoing in other areas which are not included in the base resource calculation until they have significantly advanced. If a company manages to start a mine, these new areas may never be included in the economic assessment and instead are simply added to the mine resources further down the road.

[/box]

Table 3 provides a summary of highlight drill results from new drilling in the North Wall Zone.

Table 3: New Assay Results from the Hardrock pit area – North Wall Zone

| Hole-ID | UTM Coordinates (m) | Dip/Azimuth (degrees) | From (m) | To (m) | Interval (m) | Grade (g/tonne) | Interval (ft) | Grade (oz/ton) | Zone |

|---|---|---|---|---|---|---|---|---|---|

| MM563 | 5503385N 504247E | -57/180 | 140.5 | 145.0 | 4.5 | 7.27 | 14.76 | 0.21 | In-Pit |

| 187.4 | 206.0 | 18.6 | 0.61 | 61.01 | 0.02 | In-Pit | |||

| 226.0 | 229.0 | 3.0 | 2.22 | 9.84 | 0.06 | In-Pit | |||

| 261.5 | 271.5 | 10.0 | 2.91 | 32.80 | 0.08 | In-Pit | |||

| 388.5 | 397.0 | 8.5 | 1.18 | 27.88 | 0.03 | In-Pit | |||

| 449.1 | 452.1 | 3.0 | 2.63 | 9.84 | 0.08 | Near-Pit | |||

| 519.7 | 521.5 | 1.8 | 6.93 | 5.90 | 0.20 | U/G | |||

| MM569 | 5503259N 504300E | -53/180 | 20.0 | 27.1 | 7.1 | 1.42 | 23.29 | 0.04 | In-Pit |

| 259.0 | 269.0 | 10.0 | 1.06 | 32.80 | 0.03 | In-Pit | |||

| 279.5 | 280.5 | 1.0 | 8.56 | 3.28 | 0.25 | In-Pit | |||

| MM570 | 5503168N 504350E | -79/360 | 176.0 | 182.5 | 6.5 | 1.38 | 21.32 | 0.04 | In-Pit |

| 188.5 | 208.0 | 19.5 | 0.89 | 63.96 | 0.03 | In-Pit | |||

| 297.4 | 301.4 | 4.0 | 3.18 | 13.12 | 0.09 | U/G | |||

| 344.6 | 351.1 | 6.5 | 1.22 | 21.32 | 0.04 | U/G | |||

| MM571 | 5503200N 504350E | -74/360 | 111.0 | 122.0 | 11.0 | 29.20 | 36.00 | 0.85 | In-Pit |

| MM572 | 5503185N 504398E | -50/360 | 74.5 | 76.5 | 2.0 | 15.05 | 6.56 | 0.44 | In-Pit |

| MM573 | 5503259N 504300E | -78/360 | 16.0 | 38.0 | 22.0 | 1.56 | 72.16 | 0.05 | In-Pit |

| 16.0 | 73.0 | 57.0 | 1.30 | 186.96 | 0.04 | In-Pit | |||

| 110.0 | 175.5 | 65.5 | 0.65 | 214.84 | 0.02 | In-Pit | |||

| 189.0 | 193.5 | 4.5 | 80.57 | 14.76 | 2.35 | Near-Pit | |||

| 255.0 | 258.9 | 3.9 | 2.23 | 12.79 | 0.07 | Near-Pit | |||

| MM574 | 5503185N 504398E | -64/180 | 212.0 | 217.0 | 5.0 | 7.71 | 16.40 | 0.23 | In-Pit |

| 264.4 | 267.4 | 3.0 | 16.73 | 9.84 | 0.49 | In-Pit | |||

| 279.0 | 292.0 | 13.0 | 1.03 | 42.64 | 0.03 | In-Pit | |||

| 300.0 | 305.5 | 5.5 | 3.14 | 18.04 | 0.09 | In-Pit | |||

| MM575 | 5503259N 504300E | -61/360 | ABANDONED | ||||||

| MM576 | 5503207N 504475E | -67/360 | 24.0 | 59.5 | 35.5 | 0.57 | 116.44 | 0.02 | In-Pit |

* True widths estimated at 60-70% of intercept * Assays as presented are un-cut

[box type=”note” align=”aligncenter” ]

As usual take note of the true width estimate shown above. Read more about true widths and apparent widths. You can also read about QA/QC procedures for geochemcial assays. The “cutting” of assays is usually done in order to prevent statistical outliers from skewing the result data. The cut-off is the maximum assay value that can be reported. For example, the result of 80.57 g/t shown above might be considered a statistical outlier and capped at 30 g/t. The cap depends on the nature of the deposit and the whole exercise of cutting assays is designed for the purposes of maintaining data integrity and confidence in the reported results.

[/box]

Hardrock, which is one of four gold deposits that make up the Trans-Canada Property, is the subject of a recently completed Preliminary Economic Assessment (PEA) Study released by the Company on January 28. The Hardrock Project has potential development advantages given the Trans-Canada Highway, the Trans-Canada Pipeline, and major power lines run through or in close proximity to the main deposit area. Significant services and a skilled labour pool also exist within several communities located in close proximity.

The Hardrock PEA Study was prepared as an open-pit only mining project related solely to the mineral resources estimate reported by the Company on October 29, 2013 (press release “Premier Gold Releases Updated Mineral Resource Estimate on Hardrock Deposit”). The PEA Study demonstrates the potential for an open pit operation with a 15 year mine life and producing more than 200,000 ounces of gold per year (see press release dated January 28, 2014).

[box type=”note” align=”aligncenter” ]

At their presentation in Thunder Bay the company commented that they had been good to the community and they hoped the community would be good to them. Moving the highway and opening up a mine will require buy-in from local and regional governments. While Ontario has traditionally been a mining-friendly jurisdiction, the support of governments have been something of a moving target as of late. The withdrawal of Cliffs Natural Resources from the Ring of Fire and the current $100+ million lawsuit by Northern Superior Resources against the Ontario Government are just a few examples of how projects can go sideways.

That said, Premier has some great projects in friendly mining communities. That takes us back to our initial question: Why are some junior mining companies doing well while many others are not? There seem to be three critical factors:

- Advanced Projects

- High Grades

- Access to existing infrastructure

You might also add “mining friendly jurisdiction” to the list, but as we mentioned above, that can be a moving target. In good times these types of “high-end” projects would be out of reach for a junior miner, but in this market there are bargains to be had and the smart companies are going shopping.

[/box]

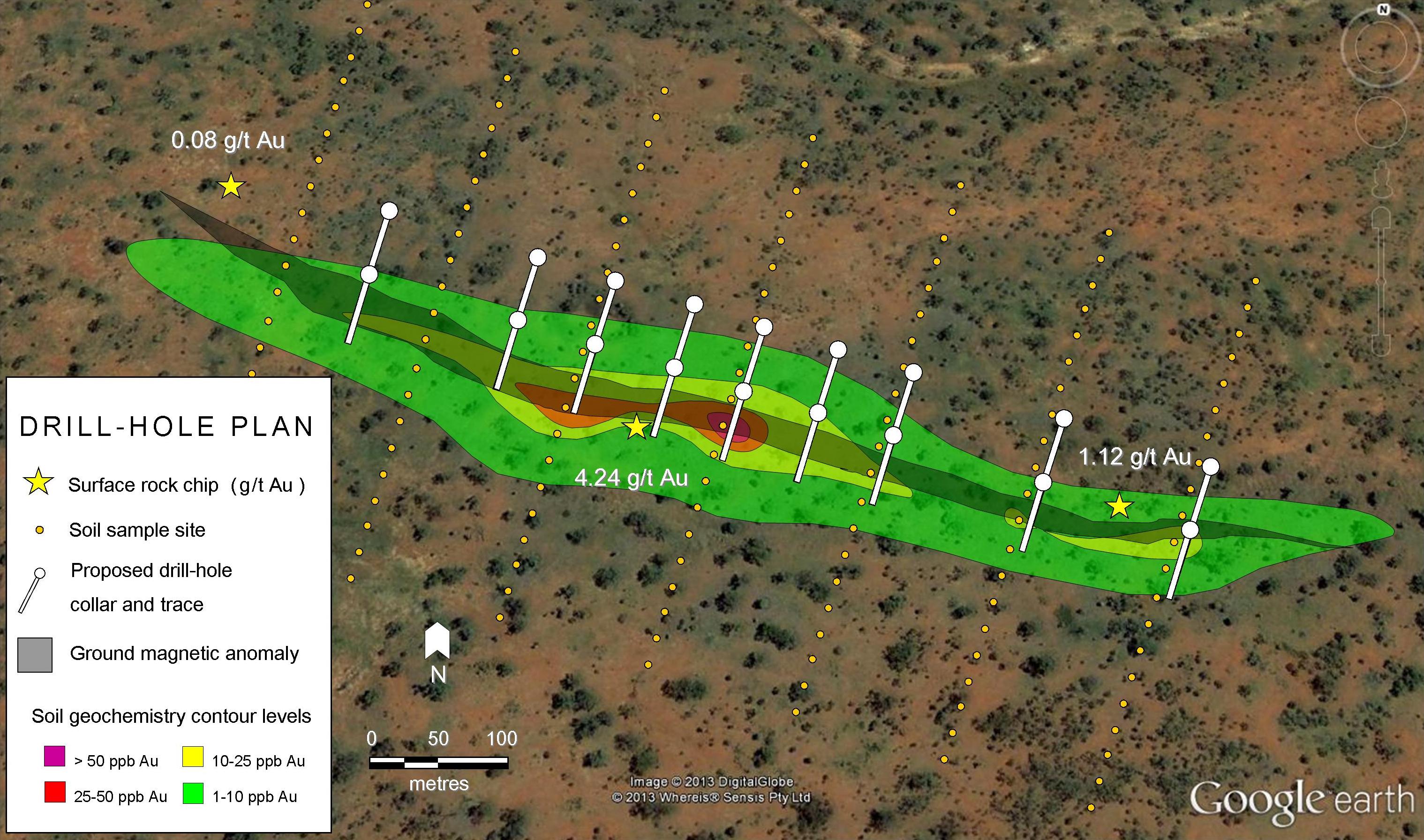

Bankfield West

The Bankfield West target, which lies within the boundary of the Company’s Trans Canada Property’s, is of significant interest given its close proximity the Hardrock Project. The target was identified through a review of historic drill data where several holes drilled by Placer Dome in the 1990’s suggested the potential for widespread gold mineralization within a porphyry host rock unit. The program, which will consist of several holes designed to confirm the existence of mineralization with the potential to host significant gold resources, will commence at the conclusion of the current confirmation program at Hardrock.

Stephen McGibbon, P. Geo., is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101. Assay results are from core samples sent to Activation Laboratories, an accredited mineral analysis laboratory in Ancaster, Ontario, for preparation and analysis utilizing both fire assay and screen metallic methods.

Premier Gold Mines Limited is one of North America’s leading exploration and development companies with a high-quality pipeline of gold projects focused in proven, safe and accessible mining jurisdictions in Canada and the United States. The Company is well financed with a portfolio of advanced-stage assets in world class gold mining districts such as Red Lake and Geraldton in Ontario and the most prolific gold trends in Nevada.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]

Pingback: Transition Metals Going Deep for Sunday Lake Platinum | Geology for Investors