With prices soaring to new all-time highs, high-grade gold has never been more attractive. Over the last few years New Found Gold has turned heads with a steady drip of almost unbelievably impressive drill intercepts (i.e. 106 g/t Au over 35.40m) from their Queensway Project. This has sparked both excitement and skepticism. Is it the next big discovery, or is it too good to be true?

Queensway Overview

New Found Gold’s (NFG) sprawling Queensway Project covers 1756 km2 in Newfoundland, Canada. It’s large enough to be clearly visible in a provincial map. Queensway enjoys excellent access to infrastructure, being only 15 km west of Gander. The TransCanada highway crosses the northern end of the property.

The property was prospected for base metals as early as the 1950s, but gold exploration didn’t begin until the 1980’s. Numerous companies and individuals worked the claims, leading to the discovery of several high-grade gold prospects. NFG, then known as Palisade Resources Corp, began working on the property in 2016 and quickly consolidated claims in the area. Most of the individual claims are subject to NSRs that range from 1-3%.

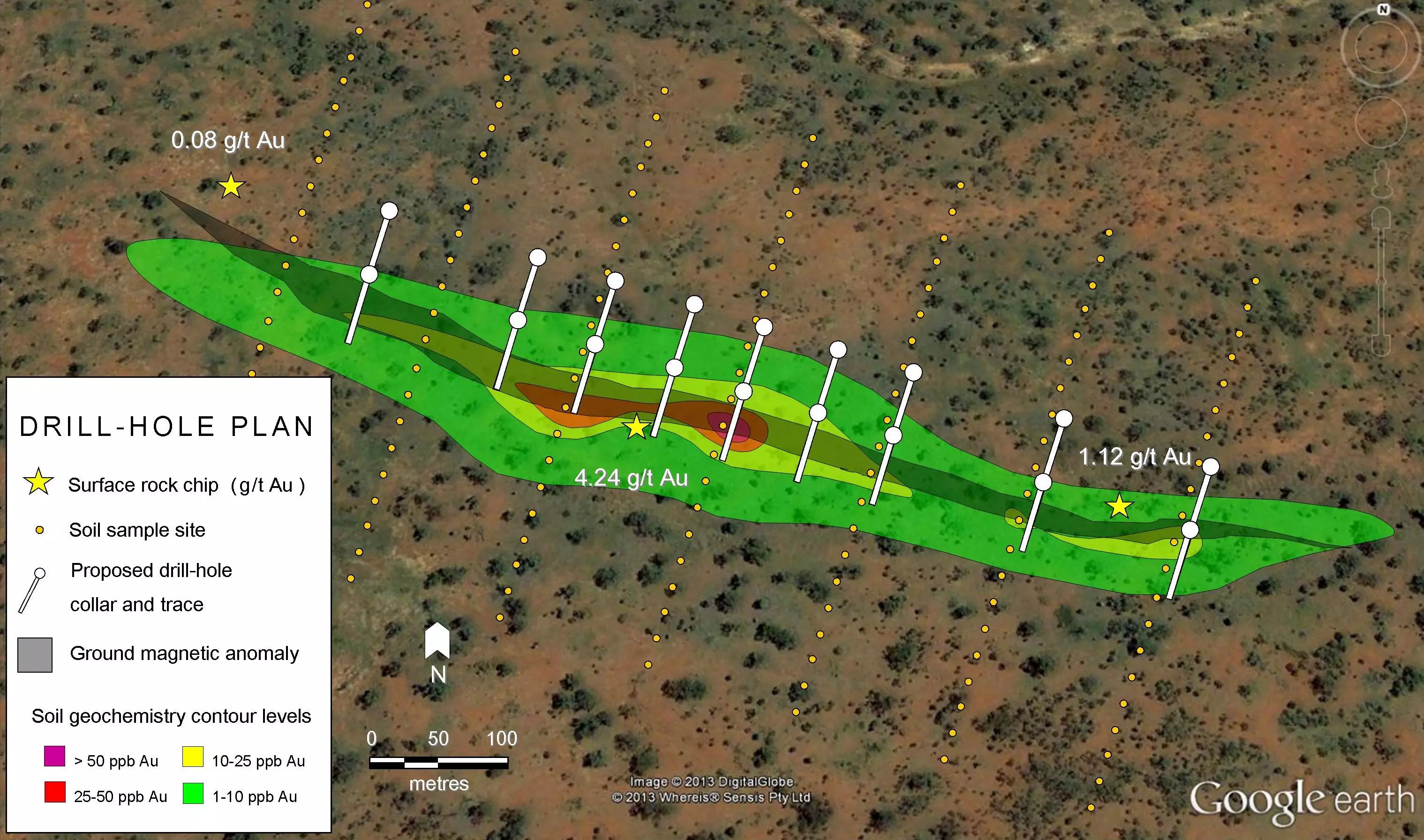

NFG has completed a staggering 650 000 m of drilling across 20 mineralized zones, producing spectacular intercepts such as 105 g/t Au over 27.05m, 430 g/t Au over 5.25m, and 106 g/t Au over 35.40m among others. They are some of the best gold intercepts reported worldwide in the last five years. A preliminary economic assessment and maiden resource estimate is expected to be released in Q2 2025.

Too good to be true?

In September 2024 a shortseller, Iceberg Research, released a report criticizing NFG for misleading investors by, among other things, ‘smearing’ short high-grade intercepts into longer, lower grade intercepts. This supposedly creates the impression of mineralization being more continuous, and more minable, than it really is. Iceberg claims that NFG has published confusing geologic cross sections and deliberately delayed preparing a resource estimate to conceal a lack of continuity.

The British Columbia Securities Commission has twice criticized NFG for making misleading statements and forced them to release more information on how intercepts are reported.

Geology

Gold mineralization at Queensway is concentrated along two major fault zones: the Appleton Fault Zone and the Joe Batt’s Pond Fault Zone, with some mineralization within smaller faults. These subparallel faults run northeast-southwest through the property. The host rocks are marine sedimentary and igneous rocks of Ordovician age. They have been deformed multiple times.

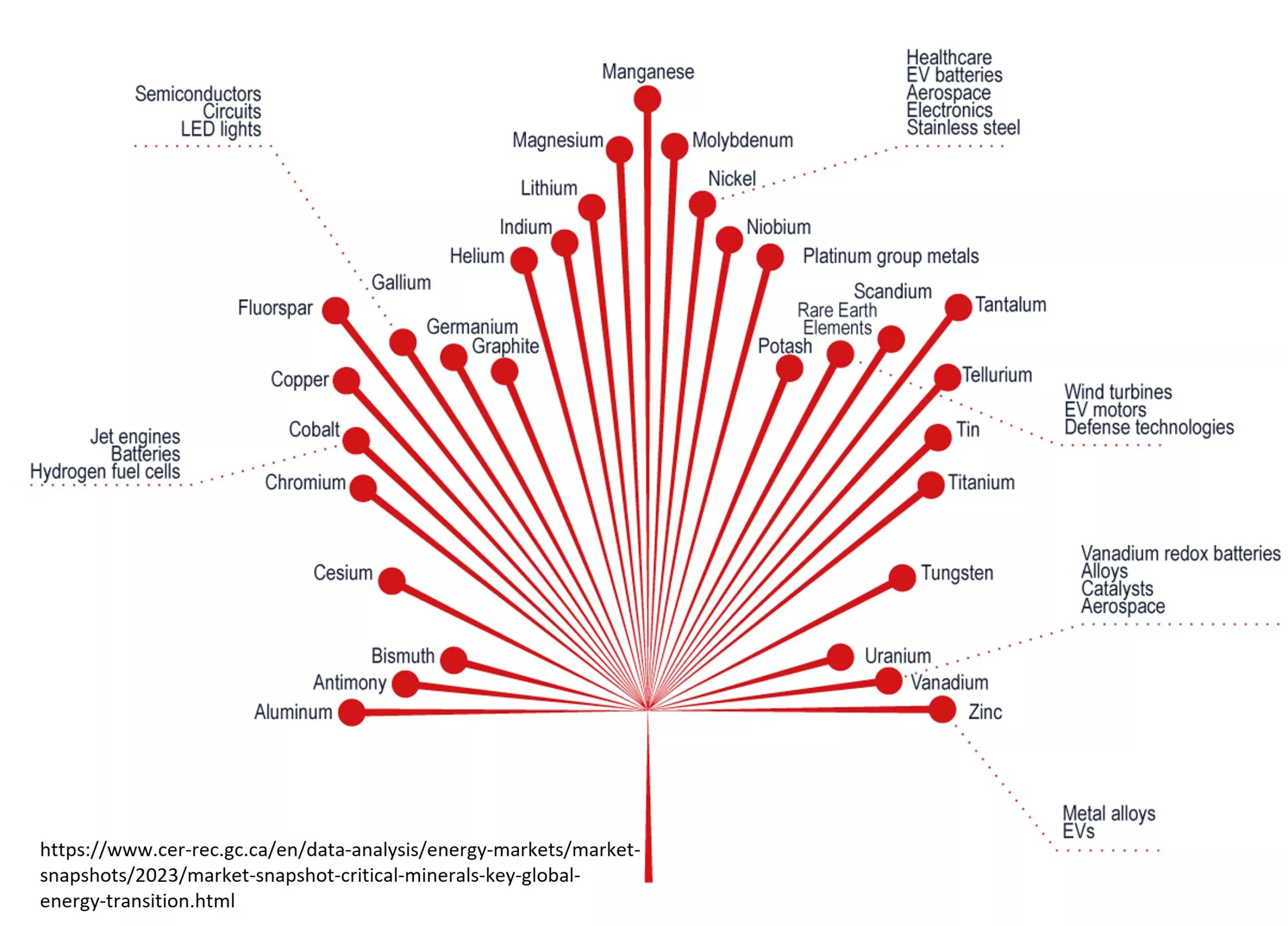

The gold itself occurs as large nuggets within quartz-carbonate veins with a variety of textures. The gold is strongly concentrated within major vein sets which occur within complex fault zones. Gold is associated with arsenic, antimony, and tungsten minerals.

Mineralization is consistent with an epizonal (relatively near-surface) orogenic gold deposit. These form when rocks are cooked by the heat and pressure created by mountain-building during collisions between tectonic plates. This breaks down certain minerals which release fluids that transport and concentrate gold. These fluids flow along fault zones formed during mountain-building before solidifying to form gold-bearing quartz-carbonate veins.

Reading between the lines

Three things stand out when studying Queensway: structural complexity, the nugget effect, and how data drill data is reported.

Queensway is clearly a structurally complex deposit. Information released by NFG contains many references to uncertainty in true width and orientation of gold-bearing veins due to crosscutting infill veins. It seems that there’s an early, very gold-rich vein system that has been crosscut, chopped up, and perhaps partially consumed by generation(s) of later veins that contain little to no gold. Finding the remnants of these high-grade veins won’t be easy.

The bedrock stripping projects are particularly telling. From August-November 2023 NFG excavated a 200 x 70 m area of the high-grade segment of the Keats-Baseline Fault Zone. A year later the detailed mapping and sampling project was still ongoing. For stripping such a large area to be necessary, and for mapping and sampling it to take so long, the ore zone must be very complex indeed.

The dreaded nugget effect also comes into play. Gold is generally incompatible with most minerals, the only thing it really likes to bond with is itself. In high-grade gold systems a few small nuggets can grow like snowballs, leaving the gold strongly concentrated into a few large nuggets with relatively little in between them. A drillhole that hits a nugget will produce a high-grade intercept, while one even a meter away may hit little if anything. Accurately measuring the overall grade requires a lot of closely spaced holes and careful treatment of data, or better yet a bulk sample.

Reading the fine print is essential when accessing NFG’s impressive intercepts. NFG’s website highlights 11 intercepts, all of which are reported as raw drill data. The lengths are drill thicknesses exaggerated by the angle of drill vs the angle of the vein. Intercept 1 (105 g/t Au over 27.05m) has an estimated true thickness of 70-95% of this raw length, meaning the actual ore zone is only 18.94-25.70m wide. Intercept 4 (69.2 g/t Au over 14.15m) could be as short as 10% of this drill thickness, or just 1.4 m. Furthermore, these are composite intercepts, averages of multiple closely spaced intercepts as well as the low-grade or waste rock in between them.

While there are many high-grade intercepts, a much larger number of modest (i.e. 1-5m at 1-3 g/t) intercepts have been reported. Where very high-grade intercepts are present, they almost always occur as a very short interval within a longer, much lower-grade intercept. Take the big intercept from hole NFGC-23-1210 (27.05 m at 105 g/t) for example. This includes six smaller high-grade intervals within 13.25 m of drillcore: 99.4% of the gold is contained in 49% of the interval. The other 51% averages just 1.25 g/t. Many of NFG’s truly high-grade intercepts are shorter than 1 m.

The reported intercepts are strongly skewed by nuggets because they’re reported without capping. Many companies deal with the nugget effect by capping results (treating all >50g/t intercepts as 50 g/t for instance), ensuring that resource estimates are conservative and preventing nasty surprises down the road. How NFG treats capping will be very important in accurately assessing the true potential.

NFG’s website contains many comparisons to other high-grade gold districts, but one seems particularly apt: Red Lake. Red Lake is famous for large, high-grade orogenic deposits, and for being a challenging place to mine. Gold zones have been chopped up and relocated by faults, partially consumed by crosscutting dykes and barren veins, and remobilized by hydrothermal fluids. There’s plenty of nuggety, high-grade gold but keeping track of where it is and where it’s going takes a careful, methodical approach to defining a resource. This requires a lot of time and a lot of drilling; not everyone has what it takes to succeed. Recent years have seen one junior, Great Bear Resources, acquired by Kinross for billions and fast-tracked for production, whereas Pure Gold and Rubicon both proved unable to find the gold they expected and filed for bankruptcy protection shortly after entering production.

Where’s the resource?

Getting to grips with what NFG has, or doesn’t have, requires a resource estimate. So why has it taken 9 years and 650 000 m of drilling (and counting) for NFG to come out with an estimate?

The optimistic explanation boils down to size and patience. Queensway is a huge land package without a lot of prior work and structural complexity makes interpreting results complicated. Spectacular drill results have created sky-high expectations; defining a modest resource would disappoint investors, even if it’s likely to expand as drilling continues. The experience of companies like Pure Gold is a reminder that rushing into production with incomplete information can be fatal. Taking the time and money to drill the hell out of the deposit before making definitive claims may be the smart play.

The way drill results have been reported creates a favorable impression, but it’s a stretch to call it dishonest. All the information is readily available on their website (although provincial regulators had to order them to report it in more detail). Reporting drill widths instead of true widths is industry standard for early-stage projects where true widths often aren’t yet known with certainty. The composite intervals smear small high-grade intervals over larger areas, but reporting many consecutive intercepts would get confusing very quickly, and small intervals tend to get diluted during mining anyway.

Most of the gold is near the surface, well in the depth range of an open pit. A low-cost pit operation can accept a large amount of dilution, potentially allowing NFG to sidestep the issue of tracking unpredictable gold in fine detail.

A skeptical take sees a house of cards. The extremely large amount of drilling allows NFG to cherry-pick usually good results to highlight. They may grab headlines, but if they’re not continuous and consistent they do little to contribute to the economics. Extremely nuggety ore will also create issues with extraction: mills are optimized to run on consistent feed and efficiency can drop if there’s too much or too little gold.

NFG’s website and technical reports contain many large-scale maps suggesting large-scale mineralization, but taking a look at the more geologically-relevant cross sections reveals that many of the best intercepts and even some of the mineralized zones themselves are extremely close together. The way these cross sections are presented, in particular the tiny, blurry scale bars, makes this far from obvious. It’s hard to say what the overall tonnage will be.

High-grade ores are often mined with small underground stopes to reduce dilution, but finding it will be hard if the geology is complex, and dilution by lower-grade material will be a major issue. The resource will likely be much lower-grade than investors might expect from reading the headlines. Disappointment could see a drop in investment, meaning less drilling, fewer spectacular results, and less investment.

Takeaways

New Found Gold has produced many spectacular gold intercepts at its Queensway project. A closer look at the results reveals a complex, nuggety deposit which will present challenges to mine. Don’t be surprised is the upcoming resource estimate is much lower-grade than you might expect from the headlines. Tonnage and depth may be decisive factors: trying to chase a small, high-grade resource underground will require meticulous planning and flawless execution, while a large open pit could cope with structural complexity more easily. The resource estimate upcoming in Q2 2025 will be decisive; be sure to read it carefully, the details of how dilution and grade capping are handled will be significant factors.

List of Companies Mentioned

- New Found Gold: https://newfoundgold.ca

- Kinross: https://www.kinross.com/home/default.aspx

Further Reading

- Iceberg Research report: https://iceberg-research.com/2024/09/19/new-found-gold-corp-nyse-nfgc-tsx-nfg-lies-misrepresentations-and-a-professional-stock-promoter/

- New Found Gold technical report https://d3fdao4v11ybep.cloudfront.net/wp-content/uploads/2025/02/NFG-Queensway-43-101-2024-Technical-Report-15-Nov-2024.pdf

Subscribe for Email Updates