A soft commodity market trumps all but the highest grade deposits. Nevada Iron is holding onto a unique property situated in a mining friendly jurisdiction, but they know that they’ll need to improve grades and expand the deposit if they are to advance their project.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

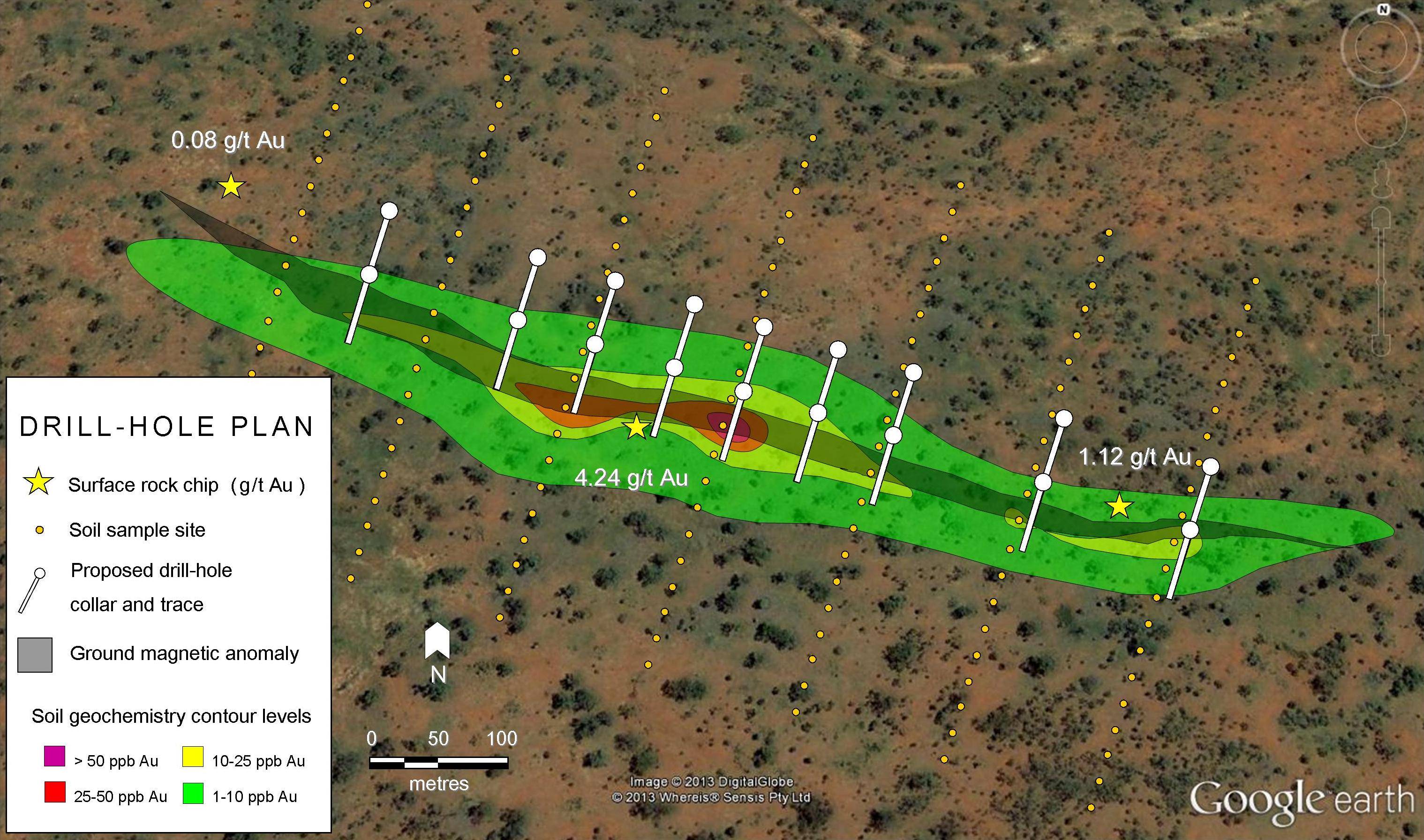

Nevada Iron Ltd (the Company) (ASX: NVI and TSX: NVR) is pleased to announce drill results from its first pass drill program over the Section 27 prospect at the Buena Vista Iron Project in Nevada, USA. Section 27 is located approximately 5.1 km to the northeast of the proposed processing plant, and 3.5 km to the northeast of the proposed primary crusher location at the Section 5 pit (Refer Figure 1). Ground mapping over the Section 27 prospect has identified an area 800m long by an average width of 180m wide with an extensive magnetite surface float. The first phase of drilling has covered approximately 60% of the strike length and indicates that the mineralisation is open to both the north and south, and at depth.

[box type=”note” align=”aligncenter” ]Whenever we come across a company operating in Nevada,USA we are quick to assume they are working on the next big Carlin-type gold deposit. This release is interesting for we usually don’t hear to often about iron ore deposits within the area.

Nevada Iron is a junior exploration company based out of Perth, Australia and operating in the United States. The company has been listed on the TSX since November 2013.The Buena-Vista Magnetite deposit is the Nevada Iron’s flagship project and located in north western Nevada. We have included a location map below.

The deposit is interpreted as having formed through the interaction of hot hydrothermal fluids and the Humboldt Gabbro. A gabbro is a mafic volcanic rock that forms in high temperatures and is rich iron, magnesium and calcium . Previous faults and fractures provided conduits for fluids to flow through the volcanic rock and the surrounding limestone rock and produce a style of alteration known as scapolitization. Scapolite is a mineral that contains calcium, aluminum and sodium and silica. The magnetite ore is usually associated with this type of alteration and occurs as lenses, veins and dispersed grains throughout the rock.

The company has compared the Buena-Vista deposit to the Kiurana Magnetite Ore Deposit, one of the world’s largest producers of magnetite ore. The Kiurana deposit is estimated to have a current proven reserve of 602Mt grading 48.5% iron, with probable reserves of 82Mt at 46.7% iron. A 43-101 compliant pre-feasibility study filed by Nevada Iron in October, 2013 has the area pegged at 111.2 Million tonnes of ore, 18.6% Fe. Although the style of mineralization has been described as similar to the Kiuranan deposit, these current estimates appear far from the world’s largest.

With today’s iron ore prices this project may have a tough time moving into production. The company’s latest pre-feasibility study suggested that the project could have a 13 year mine life and produce ~8 million tons of ore annually. Their financials are based on a long term iron ore price of USD $110/tonne, however iron ore prices have been plummeting over the last 6 months and as of June it was trading at $92.75/tonne. Many big players in iron ore such as Rio Tinto in Australia and Cliff Natural Resources’s Wabush mine in Newfoundland, Canada have ceased operations due to falling prices. Other large players such as BHP are set to boost production in an effort to squeeze higher-cost producers. This likely won’t help prices recover, at least in the short term.[/box]

Results include:

- 33.5 metres grading 20.1% Total Fe in hole 2714-002

- 76 metres grading 22 % Total Fe in hole 2714 –003, including 9.7m grading 52.1% Total Fe

- 30.4 metres grading 21.9% Total Fe in hole 2714-004

- 80.8 metres grading 23.4% Total Fe in hole 2714-006, including 6.5m grading 51.8% Total Fe and

- 3.2m grading 60% Total Fe

- 73.1 metres grading 20.0% Total Fe in hole 2714-009

[box type=”note” align=”aligncenter” ]According to the companies drilling methodology, these holes were drilled by Reverse Circulation (RC) drilling. This type of drilling is common among exploration programs throughout Nevada. Although the highlights appear promising, we must be cautious for they only represent the apparent thickness and not the true width of the mineralization.

Here is a link to the original press release including the full drill results.[/box]

The Section 27 prospect is part of the land package acquired by the Company on 31 October 2013 and this drill program confirms the prospectivity of the area. The at surface nature of the mineralisation makes it amenable to bulk tonnage open pit mining at very low waste to ore ratios and low cost extraction. This prospect is located on private land controlled by the Company and is within a short haul of the planned crushing facilities.

[box type=”note” align=”aligncenter” ]The mineralization occurs fairly close to the surface and therefore open-pit mining methods are the most economic. This is not surprising since the only types of iron deposits that are economic to mine are those with near-surface iron oxides. Iron is very common and occurs in high concentrations in many deposits, but it is easiest and cheapest to extract from iron oxide minerals like magnetite (Fe3O4) and hematite (Fe2O3). While iron often occurs within sulfide minerals like pyrite (FeS2), extraction from sulfides is not economic. In sulfide-rich mines like VMS base-metal deposits, the iron sulfides are considered waste. [/box]

Commentary Mick McMullen, Executive Chairman commented on the results: “ The drill results confirm our belief that the Section 27 prospect contains a broad, at surface zone of magnetite mineralisation with higher grade cores. Additional drilling is planned along the open strike length to the north and south, and at depth to better define the higher grade shoots as seen in the 9.7m grading 52.1% Total Fe in hole 2714-003 and the 6.5m grading 51.8% Total Fe and 3.2m grading 60% Total Fe in hole 2714-006 We strongly believe that what the Company now controls in the area constitutes not just one iron deposit, but a field of iron deposits that have the potential to host much larger mineral resources and to support a large, centralised processing facility sourcing mineralisation from multiple mines in the field. This has the potential to transform Nevada Iron into a large, long life US iron ore supplier producing high quality (+67% Fe) concentrates at a competitive cost.”

[box type=”note” align=”aligncenter” ]Nevada Iron’s stock is currently trading at $0.59 CAD or $0.53 AUD. As of the end of March, the company had about USD $4 million in cash and had planned to spend USD $1.6 million in the second quarter.

A soft commodity market trumps all but the highest grade deposits. Nevada Iron is holding onto a unique property situated in a mining friendly jurisdiction, but they know that they’ll need to improve grades and expand the deposit if they are to advance their project. The alternative is to do nothing and hope for the best.

[/box]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]