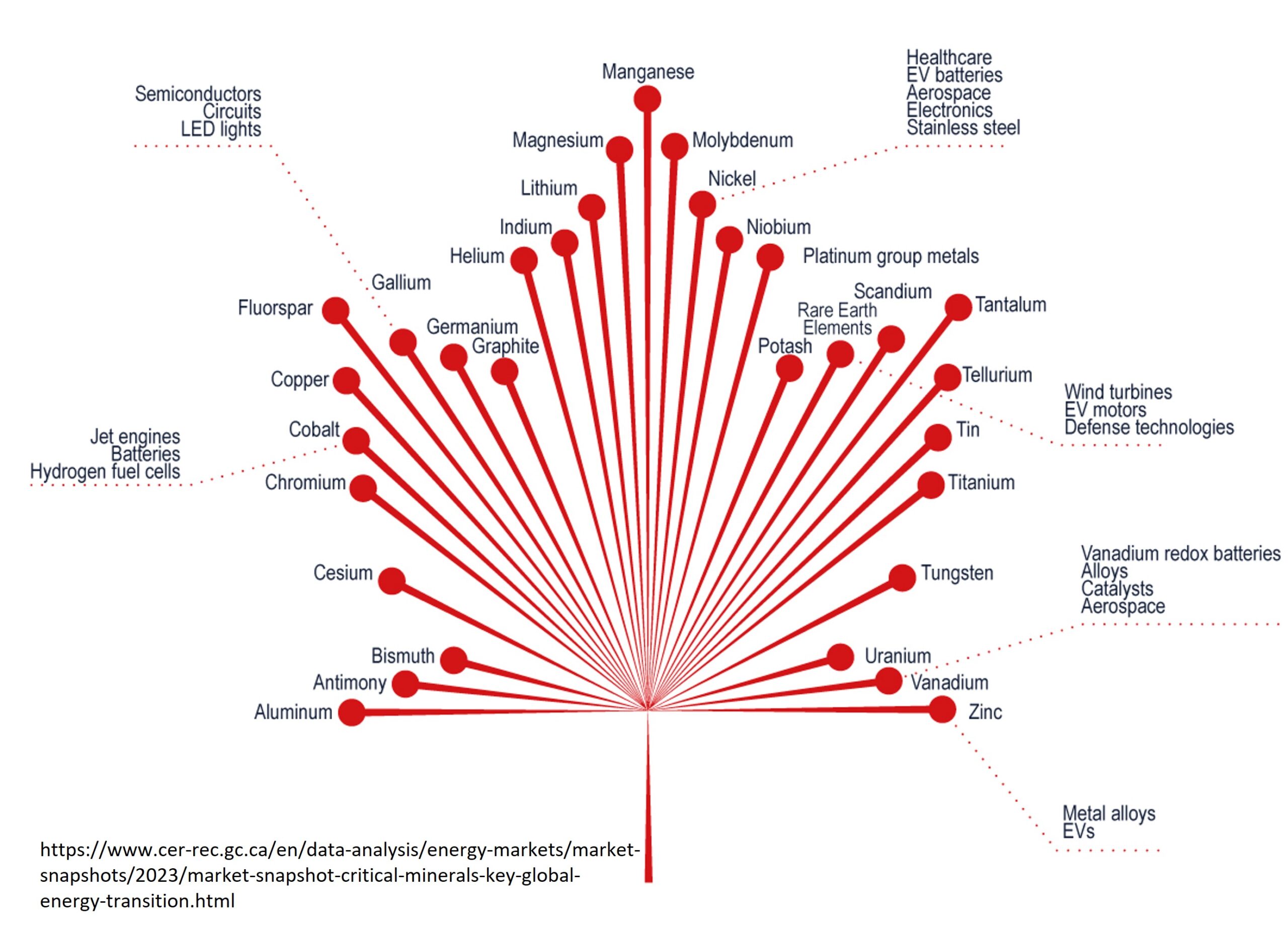

Having a number of sought after metals in one project could be a real asset for Santacruz Silver. The mix could provide a buffer for the rise and fall of any one particular metal.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and may include opinions or points of view that may not be shared by the owners of geologyforinvestors.com or the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text. Please view the full release here.[/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Oct. 2, 2013) – Santacruz Silver Mining Ltd. (TSX VENTURE:SCZ) reports additional results from its ongoing 2013 diamond drill program at its San Felipe project in Sonora State, Mexico.

[box type=”note” align=”aligncenter” ]We have provided a map showing the location of the San Felipe project in Sonora State, Mexico.[/box]

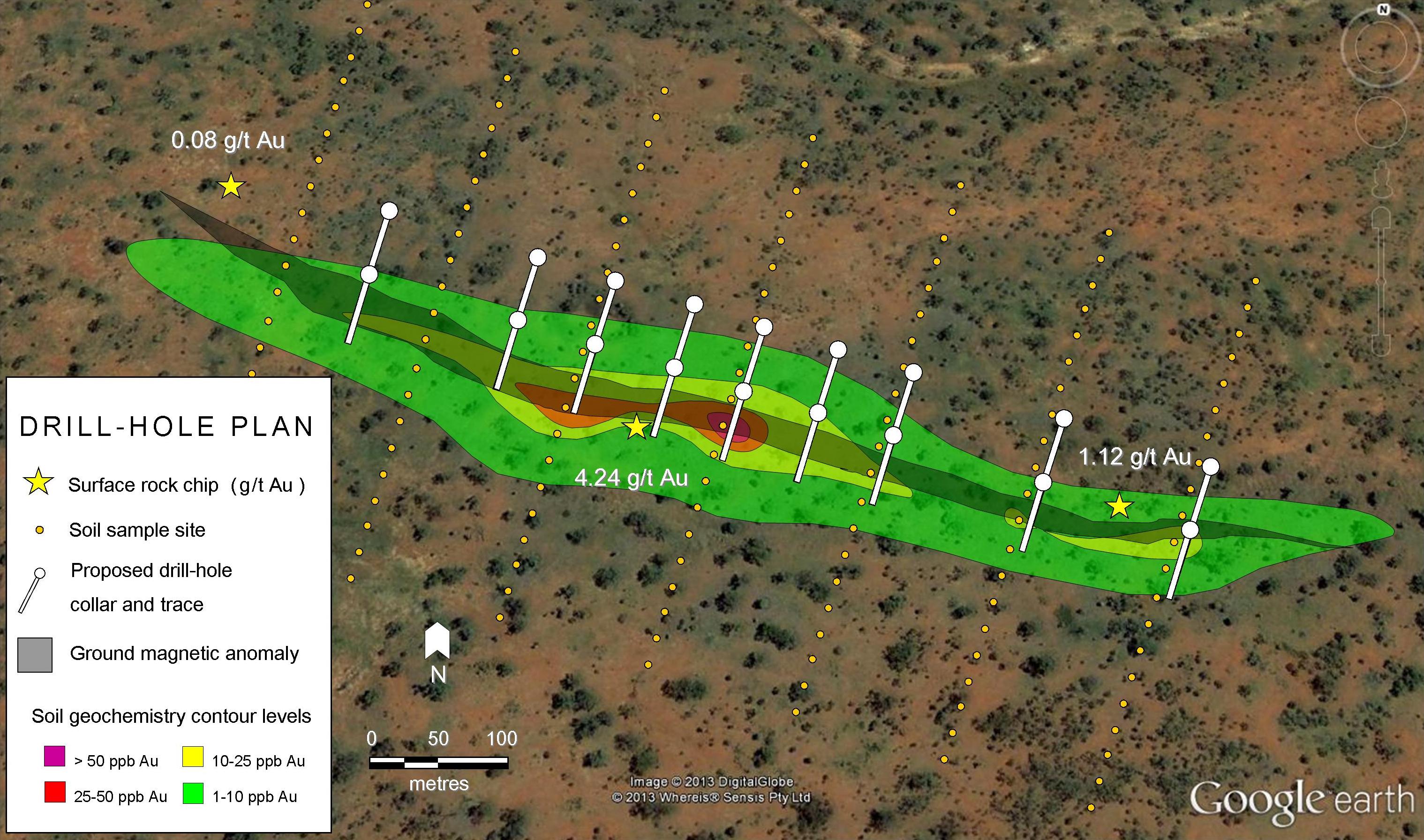

Drilling continues to focus on the La Ventana, Las Lamas and Transversales veins (see attached maps).

[box type=”note” align=”aligncenter” ]For your convenience, we provide below diamond drill-hole (DDH) program maps for the La Ventana and Las Lamas veins. There is no map of the Transversales vein in the press release nor is there any other reference to it in the text, so this may be an error in the press release.[/box]

[box type=”note” align=”aligncenter” ]It is worth noting that the mapping of the “vein” is a geological interpretation based on exploration results so far. This might include surface outcrops, geophysics and drilling. The dashed line indicates a less-confident interpretation and drill-hole SCLL-32 (not yet published) is intended to test that interpretation. Andesite and rhyodacite are volcanic rocks, while alluvium is loose sediment. The dashed lines on the maps may refer to faults or other structural features, but there is no way to know since their map is incomplete. All features on a map should be labelled or included in the legend.[/box]

Highlights include:

- Extension of the strike length at the Las Lamas vein by an additional 450 meters plus an additional 100 meters at depth. The vein has now been systematically tested by drilling over 630 meters on strike length and to depths of 250 meters.

- Higher drill core recoveries (95%-99%) resulting in increased grades when compared to historical resources at the La Ventana and Las Lamas veins.

[box type=”note” align=”aligncenter” ]You might be wondering what is meant by drill-core recoveries. When are drill-core is extracted from a drill-hole, bits of the drill-core can break off and fall back down the hole. When drilling very competent rock, high drill-core recoveries are to be expected. However, when drilling through rock that has undergone shearing and faulting it is much more difficult to extract the whole core from the hole without bits breaking off and falling down the hole. Mineralized zones can have this problem because often they are hosted within shear zones and faults. It is important that high drill-core recoveries are achieved when drilling mineralized zones otherwise the resource may be underestimated.[/box]

Highlights of drilling results (reported as true widths and assays uncut) include:

La Ventana vein

- SCLV-04: 2.80 m @ 810 g/t Ag eq. (215 g/t Ag, 0.02 g/t Au, 11.05% Zn, 1.13% Cu, and 4.93% Pb);

Las Lamas vein

- SCLL-15: 6.95 m @ 355 g/t Ag eq. (93 g/t Ag, 0.01 g/t Au, 8.06% Zn, 0.22% Cu and 0.24% Pb); and

- SCLL-23: 1.40 m @ 542 g/t Ag eq. (383 g/t Ag, 0.05 g/t Au, 3.78% Zn, 0.13% Cu and 1.12% Pb).

The current drill program has confirmed the continuation of the Las Lamas vein and the strength of the La Ventana vein.

Arturo Préstamo Elizondo, President and CEO states, “The ongoing drill results from the 2013 campaign at the San Felipe project have continued to exceed our expectations. The Las Lamas vein has proven to be a robust silver-polymetallic vein with high zinc grades in addition to lead and copper credits. The new data will be incorporated into our mine plans, and the impact of these drilling results will increase the strength of this asset.”

[box type=”note” align=”aligncenter” ]Lead and zinc prices have held ground over the last few years, hovering above US$0.80 per pound since a peak of US$1.20 per pound at the height of the commodity price boom in 2009. Likewise, copper has been quite resilient staying above a spot price of US$3.00 per pound since mid-2010. And of course silver is still above US$22 per ounce. Having a number of sought after metals in one project could be a real asset for Santacruz Silver. The mix could provide a buffer for the rise and fall of any one particular metal.[/box]

The Company will continue to explore the extension of the Las Lamas vein on strike and at depth during the balance of 2013. The results of this work will be incorporated in to the upcoming technical study on the San Felipe project, with a focus of advancing the project to production.

[box type=”note” align=”aligncenter” ]Below is quite a long list of results. What is really important are the totals in bolded text. In summary, the vein thicknesses are reasonable and grades are quite good for zinc, lead and silver.

It is good to see that Santacruz Silver has calculated the true widths (thicknesses) of the mineralized intervals. This shows that they are confident of the orientation of the mineralized vein.[/box]

| DESCRIPTION OF THE LAS LAMAS AND LA VENTANA DIAMOND DRILL HOLES ASSAYS: | |||||||||||

| VEIN | DDH | From | To | Length mts. |

True Width mts. |

Au ppm |

Ag | Cu | Pb % |

Zn | AgEq g/t |

| LAS LAMAS | SCLL-12 | 25.75 | 27.00 | 1.25 | 0.81 | 0.17 | 78 | 0.03 | 0.29 | 0.47 | 114.21 |

| SCLL-12 | 27.00 | 27.60 | 0.60 | 0.39 | 0.02 | 14 | 0.02 | 0.10 | 0.36 | 30.10 | |

| SCLL-12 | 27.60 | 28.35 | 0.75 | 0.49 | 0.23 | 40 | 0.06 | 0.29 | 0.74 | 91.36 | |

| SCLL-12 | 28.35 | 29.40 | 1.05 | 0.68 | 0.28 | 131 | 0.14 | 2.32 | 0.89 | 260.12 | |

| SCLL-12 | 29.40 | 30.45 | 1.05 | 0.68 | 0.03 | 28 | 0.06 | 0.40 | 1.15 | 81.90 | |

| Total | 4.70 | 3.05 | 0.15 | 64 | 0.07 | 0.74 | 0.74 | 125.21 | |||

| LAS LAMAS | SCLL-13 | 70.45 | 71.40 | 0.95 | 0.74 | 0.02 | 247 | 0.34 | 0.66 | 3.70 | 411.79 |

| SCLL-13 | 71.40 | 72.45 | 1.05 | 0.81 | 0.02 | 27 | 0.01 | 0.07 | 0.12 | 35.65 | |

| Total | 2.00 | 1.55 | 0.02 | 132 | 0.17 | 0.35 | 1.82 | 214.32 | |||

| LAS LAMAS | SCLL-15 | 188.80 | 189.50 | 0.70 | 0.53 | 0.01 | 173 | 0.51 | 0.44 | 13.10 | 616.44 |

| SCLL-15 | 189.50 | 190.05 | 0.55 | 0.42 | 0.00 | 50 | 0.21 | 0.10 | 4.09 | 193.80 | |

| SCLL-15 | 190.05 | 190.45 | 0.40 | 0.30 | 0.02 | 340 | 0.30 | 1.08 | 25.20 | 1124.65 | |

| SCLL-15 | 190.45 | 191.10 | 0.65 | 0.49 | 0.00 | 32 | 0.13 | 0.05 | 5.28 | 198.53 | |

| SCLL-15 | 191.10 | 191.70 | 0.60 | 0.46 | 0.00 | 13 | 0.03 | 0.03 | 1.75 | 67.46 | |

| SCLL-15 | 191.70 | 192.50 | 0.80 | 0.61 | 0.01 | 212 | 0.40 | 0.40 | 18.80 | 804.24 | |

| SCLL-15 | 192.50 | 192.95 | 0.45 | 0.34 | 0.00 | 97 | 0.19 | 0.22 | 11.60 | 454.84 | |

| SCLL-15 | 192.95 | 193.85 | 0.90 | 0.68 | 0.00 | 20 | 0.05 | 0.07 | 2.14 | 87.98 | |

| SCLL-15 | 193.85 | 195.10 | 1.25 | 0.95 | 0.01 | 72 | 0.17 | 0.22 | 6.29 | 276.99 | |

| SCLL-15 | 195.10 | 196.60 | 1.50 | 1.14 | 0.01 | 55 | 0.16 | 0.10 | 6.82 | 269.41 | |

| SCLL-15 | 196.60 | 197.50 | 0.90 | 0.68 | 0.01 | 100 | 0.43 | 0.27 | 5.69 | 319.15 | |

| SCLL-15 | 197.50 | 197.95 | 0.45 | 0.34 | 0.01 | 98 | 0.17 | 0.41 | 5.28 | 280.55 | |

| Total | 9.15 | 6.95 | 0.01 | 93 | 0.22 | 0.24 | 8.06 | 355.03 | |||

| LAS LAMAS | SCLL-20 | 282.05 | 283.05 | 1.00 | 0.69 | 0.01 | 21 | 0.04 | 0.14 | 0.68 | 50.23 |

| SCLL-20 | 283.05 | 283.35 | 0.30 | 0.21 | 0.01 | 177 | 0.13 | 1.29 | 15.15 | 662.62 | |

| Total | 1.30 | 0.90 | 0.01 | 57 | 0.06 | 0.41 | 4.02 | 191.55 | |||

| LAS LAMAS | SCLL-23 | 115.70 | 116.45 | 0.75 | 0.58 | 0.05 | 180 | 0.12 | 0.87 | 4.78 | 359.09 |

| SCLL-23 | 116.45 | 117.05 | 0.60 | 0.47 | 0.02 | 133 | 0.13 | 0.60 | 3.42 | 264.29 | |

| SCLL-23 | 117.05 | 117.50 | 0.45 | 0.35 | 0.07 | 1055 | 0.14 | 2.22 | 2.58 | 1217.21 | |

| Total | 1.80 | 1.40 | 0.05 | 383 | 0.13 | 1.12 | 3.78 | 542.02 | |||

| LAS LAMAS UPPER | SCLL-24 | 160.25 | 161.45 | 1.20 | 0.80 | 0.03 | 208 | 0.36 | 0.37 | 12.05 | 604.08 |

| Total | 1.20 | 0.80 | 0.03 | 208 | 0.36 | 0.37 | 12.05 | 604.08 | |||

| LAS LAMAS | SCLL-24 | 166.75 | 167.00 | 0.25 | 0.21 | 0.05 | 354 | 0.28 | 0.61 | 19.50 | 961.65 |

| SCLL-24 | 167.00 | 167.50 | 0.50 | 0.41 | 0.03 | 60 | 0.03 | 0.11 | 1.65 | 115.04 | |

| SCLL-24 | 167.50 | 168.30 | 0.80 | 0.66 | 0.11 | 2 | 0.00 | 0.00 | 0.02 | 9.65 | |

| SCLL-24 | 168.30 | 169.25 | 0.95 | 0.78 | 0.11 | 6 | 0.00 | 0.02 | 0.18 | 18.91 | |

| SCLL-24 | 169.25 | 170.35 | 1.10 | 0.91 | 0.02 | 16 | 0.02 | 0.02 | 0.60 | 37.87 | |

| SCLL-24 | 170.35 | 171.05 | 0.70 | 0.58 | 0.26 | 230 | 0.17 | 0.27 | 16.20 | 733.08 | |

| Total | 4.30 | 3.55 | 0.10 | 71 | 0.05 | 0.10 | 4.16 | 204.29 | |||

| LA VENTANA | SCLV-02 | 215.20 | 217.10 | 1.90 | 1.15 | 0.02 | 382 | 1.07 | 9.08 | 9.66 | 1058.51 |

| SCLV-02 | 217.10 | 218.60 | 1.50 | 0.91 | 0.01 | 17 | 0.52 | 2.27 | 2.27 | 211.22 | |

| SCLV-02 | 218.60 | 220.00 | 1.40 | 0.85 | 0.01 | 68 | 0.45 | 8.95 | 12.35 | 746.55 | |

| Total | 4.80 | 2.90 | 0.01 | 176 | 0.72 | 6.91 | 8.14 | 702.74 | |||

| LA VENTANA | SCLV-04 | 105.80 | 106.60 | 0.80 | 0.50 | 0.04 | 311 | 1.84 | 9.77 | 18.65 | 1352.23 |

| SCLV-04 | 106.60 | 107.25 | 0.65 | 0.40 | 0.07 | 598 | 2.29 | 4.55 | 19.65 | 1558.93 | |

| SCLV-04 | 107.25 | 108.00 | 0.75 | 0.47 | 0.02 | 171 | 1.07 | 4.40 | 11.50 | 755.39 | |

| SCLV-04 | 108.00 | 108.55 | 0.55 | 0.34 | 0.01 | 191 | 1.83 | 8.78 | 14.10 | 1069.85 | |

| SCLV-04 | 108.55 | 109.65 | 1.10 | 0.68 | 0.01 | 31 | 0.20 | 0.93 | 1.50 | 124.60 | |

| SCLV-04 | 109.65 | 110.30 | 0.65 | 0.40 | 0.01 | 100 | 0.13 | 3.44 | 6.14 | 395.65 | |

| Total | 4.50 | 2.80 | 0.02 | 215 | 1.13 | 4.93 | 11.05 | 809.84 | |||

| LA VENTANA | SCLV-05 | 150.00 | 151.25 | 1.25 | 0.62 | 0.01 | 130 | 0.00 | 3.82 | 8.64 | 494.60 |

| SCLV-05 | 151.25 | 152.35 | 1.10 | 0.55 | 0.00 | 14 | 0.00 | 0.90 | 2.28 | 106.68 | |

| SCLV-05 | 152.35 | 152.85 | 0.50 | 0.25 | 0.01 | 59 | 0.01 | 3.66 | 4.01 | 287.61 | |

| SCLV-05 | 152.85 | 154.00 | 1.15 | 0.57 | 0.00 | 2 | 0.00 | 0.13 | 0.17 | 10.74 | |

| SCLV-05 | 154.00 | 154.80 | 0.80 | 0.40 | 0.00 | 24 | 0.30 | 2.06 | 2.48 | 191.80 | |

| SCLV-05 | 154.80 | 155.30 | 0.50 | 0.25 | 0.03 | 294 | 0.96 | 7.68 | 30.00 | 1493.52 | |

| SCLV-05 | 155.30 | 156.15 | 0.85 | 0.42 | 0.02 | 162 | 0.19 | 1.14 | 24.40 | 912.80 | |

| SCLV-05 | 156.15 | 156.65 | 0.50 | 0.25 | 0.00 | 47 | 0.13 | 0.41 | 8.23 | 307.82 | |

| SCLV-05 | 156.65 | 157.25 | 0.60 | 0.30 | 0.01 | 186 | 0.22 | 1.29 | 21.60 | 865.15 | |

| SCLV-05 | 157.25 | 157.85 | 0.60 | 0.30 | 0.00 | 105 | 0.47 | 0.85 | 20.80 | 774.79 | |

| SCLV-05 | 157.85 | 158.50 | 0.65 | 0.32 | 0.00 | 66 | 0.06 | 0.98 | 20.20 | 676.85 | |

| SCLV-05 | 158.50 | 159.65 | 1.15 | 0.57 | 0.01 | 30 | 0.05 | 0.33 | 9.58 | 318.45 | |

| SCLV-05 | 159.65 | 160.65 | 1.00 | 0.50 | 0.00 | 44 | 0.14 | 0.82 | 13.10 | 456.86 | |

| SCLV-05 | 160.65 | 161.95 | 1.30 | 0.65 | 0.00 | 34 | 0.09 | 0.97 | 8.93 | 327.59 | |

| Total | 11.95 | 5.95 | 0.00 | 73 | 0.14 | 1.57 | 11.02 | 451.43 | |||

| LA VENTANA | SCLV-06 | 179.20 | 179.60 | 0.40 | 0.15 | 0.02 | 35 | 0.80 | 9.21 | 7.71 | 629.19 |

| SCLV-06 | 179.60 | 180.05 | 0.45 | 0.17 | 0.00 | 1 | 0.01 | 0.06 | 0.03 | 5.42 | |

| SCLV-06 | 180.05 | 180.65 | 0.60 | 0.22 | 0.01 | 52 | 0.65 | 3.37 | 4.07 | 345.33 | |

| SCLV-06 | 180.65 | 181.45 | 0.80 | 0.30 | 0.02 | 97 | 2.48 | 12.80 | 14.35 | 1180.61 | |

| SCLV-06 | 181.45 | 182.20 | 0.75 | 0.28 | 0.03 | 182 | 0.76 | 20.00 | 22.40 | 1523.51 | |

| SCLV-06 | 182.20 | 182.80 | 0.60 | 0.23 | 0.01 | 62 | 0.89 | 8.01 | 8.67 | 656.47 | |

| Total | 3.60 | 1.35 | 0.02 | 82 | 1.06 | 9.94 | 10.84 | 817.31 | |||

EqAgOz=((Au*Pau/31.1035)+(Ag*Pag/31.1035)+(Cu*Pcu*22.05)+(Pb*Ppb*22.05)+(Zn*Pzn*22.05))/Pag

[box type=”note” align=”aligncenter” ]Care always needs to be taken when assessing the economics of a project using an equivalent (Eq) grade. Metal prices are continually changing in absolute and relative terms to each other, so the Eq value is constantly changing too. It’s always best if you do your own calculations.[/box]

| Metal | Symbol | Grade Units |

Price | Price Units |

Price Symbol |

| Gold | Au | g/t | 1,348.80 | $/t oz | Pau |

| Silver | Ag | g/t | 22.5638 | $/t oz | Pag |

| Copper | Cu | % | 3.7062 | $/lb | Pcu |

| Lead | Pb | % | 1.0164 | $/lb | Ppb |

| Zinc | Zn | % | 0.9349 | $/lb | Pzn |

| Diamond Drill Holes Location | ||||||

| UTM Collar Coordinates | ||||||

| DDH ID | North | East | Elevation | Strike | Dip | Total Length (mts) |

| SCLL-12 | 3,305,308.67 | 567,325.89 | 747.40 | S 29.40° E | -45.70° | 54.30 |

| SCLL-13 | 3,305,203.43 | 567,038.68 | 738.70 | S 17.70° E | -48.30° | 108.85 |

| SCLL-15 | 3,305,292.25 | 567,009.39 | 711.67 | S 08.92° E | -50.28° | 297.20 |

| SCLL-20 | 3,305,303.51 | 567,008.48 | 711.50 | S 13.72° E | -59.63° | 305.20 |

| SCLL-23 | 3,305,205.24 | 566,986.93 | 762.04 | S 15.78° E | -49.46° | 221.05 |

| SCLL-24 | 3,305,206.01 | 566,986.61 | 762.13 | S 12.24° E | -62.98° | 234.80 |

| SCLV-02 | 3,305,841.90 | 567,576.44 | 823.78 | S 35.35° E | -62.00° | 88.45 |

| SCLV-04 | 3,305,867.50 | 567,561.13 | 807.37 | S 32.75° E | -63.20° | 124.50 |

| SCLL-05 | 3,305,821.97 | 567,482.11 | 824.43 | S 33.73° E | -66.97° | 187.70 |

| SCLL-06 | 3,305,822.42 | 567,481.65 | 824.66 | S 29.48° E | -78.18° | 233.50 |

Drilling is ongoing and results will be reported as assays are received from the laboratory.

San Felipe Project

San Felipe is a late stage exploration project, located in the State of Sonora, approximately 130 kilometers north-east of Hermosillo City, the state capital of Sonora. Previously, Minera Hochschild Mexico SA de CV (“MHM”) explored and developed the property from 2001 to 2008, with more than 18,500 meters of diamond drilling and significant development work completed on the project at the La Ventana, San Felipe and Las Lamas veins. The Company released a NI 43-101 compliant resource in 2012, containing combined measured and indicated resources of 4,069,000 tonnes grading 70.24 gpt silver, 5.00% zinc, 2.77% lead and 0.28% copper. In addition there is an inferred resource of 1,495,000 tonnes grading 44.70 gpt silver, 3.92% zinc, 2.68% lead and 0.20% copper.

Sampling and Laboratory

HQ-sized drill core was sawn in half at site and sent to ALS Chemex, a fully accredited and certified laboratory service. Samples were prepared at the ALS Chemex facility in Zacatecas, Mexico, and were assayed at ALS Chemex in Vancouver, Canada. All samples were analysed using a one assay ton fire assay with an AA finish Au and Ag (Au-AA23) and a 48 element ICP method for Pb, Zn and other elements (ME-MS61). A comprehensive QA/QC procedure is followed using standards, blanks and duplicates, all samples are randomly placed.

[box type=”note” align=”aligncenter” ]Halved HQ core is the standard sample size for the geochemical analysis of drill-core. The full core is not usually assayed because a representative sample of the core needs to be kept in a core tray in a core shed (library) for later reference.

A QA/QC program is a must for all drilling programs. It keeps everyone honest.[/box]

Qualified Person

Marc Prefontaine, M.Sc. P.Geo, Director of Santacruz Silver is the qualified person that has reviewed the press release and results.

Data Verification

Mr. Prefontaine verified the data disclosed in this release, including the sampling, analytical and test data underlying the information contained in this release. Verification included a review and validation of the applicable assay databases and reviews of assay certificates.

About Santacruz Silver Mining Ltd.

Santacruz is a Mexican focused silver company with a producing project (Rosario); two advanced-stage projects (San Felipe and Gavilanes) and an early-stage exploration project (El Gachi). The Company is managed by a technical team of professionals with proven track records in developing, operating and discovering silver mines in Mexico. Our corporate objective is to become a mid-tier silver producer.

Arturo Préstamo Elizondo, President, Chief Executive Officer and Director

[toggle title=”We’ve skipped some of the boilerplate. You can read it in here.” state=”close” ]

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements contained in this news release, such as potential mineralization on the Company’s properties, the Company’s exploration and development plans and anticipated production dates on the Company’s mineral properties, constitute “forward-looking information” as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company’s financial condition and development plans do not change as a result of unforeseen events, that the Company obtains regulatory approval, future metal prices and the demand and market outlook for metals. Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Factors that could cause the forward-looking information in this news release to change or to be inaccurate include, but are not limited to, the risk that any of the assumptions referred to prove not to be valid or reliable, that occurrences such as those referred to above are realized and result in delays, or cessation in planned work, that the Company’s financial condition and development plans change, delays in regulatory approval, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company’s expectations, as well as the other risks and uncertainties applicable to mineral exploration and development activities and to the Company as set forth in the Company’s Annual Information Form filed under the Company’s profile at www.sedar.com The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

To view Figures 1 and 2, please visit the following link: http://media3.marketwire.com/docs/scz1002_F1-2.pdf.

[/toggle]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]