Although only the “significant results” are presented to us, they do demonstrate the presence of low grade gold and silver on the property. As they move forward the question will be whether this work supports their previous resource estimate for the property.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – May 30, 2014) –

El Tigre Silver Corp. (“El Tigre” or the “Company”) (TSX VENTURE:ELS)(FRANKFURT:5RT)(OTCQX:EGRTF) is pleased to announce the assay results of a recently completed extensive underground and surface sampling exploration program at its El Tigre Silver and Gold Project (“the Project”) in northern Sonora, Mexico. A total of 173 underground and 393 surface samples were collected as channel samples from outcrops, as well as 25 stream samples and 27 regional samples from the main El Tigre Vein district.

[box type=”note” align=”aligncenter” ]

El Tigre Silver Corp. acquired the former Lucky Tiger mine in the northern Mexico in 2010 and in 2013 filed a 43-101 complaint pre-feasibilility study establishing reserves within the old mine tailings and additional resources not yet mined. From the mine tailings they estimate proven and probable reserves of roughly 1.3 million tonnes grading 83 g/t silver and 0.28 g/t gold. Within the mine they are estimating a resource of approximately 17 millions tonnes grading at 38 g/t silver and 0.6 g/t gold.

This process of “mining” tailings is nothing new. In fact we’ve talked before about companies trying to do exactly that. El Tigre hopes to build value in the project not only from the mine tailings, but through further evaluation of the unmined, low grade resource.

The Lucky Tiger mine was operated from 1903 to 1938 with production grades estimated at 40 oz/ton silver (1,371 g/t silver) and 0.25 oz/ton gold (8.57 g/t gold) with minor copper, lead and zinc. During the 1980’s the Anaconda Minerals Company explored the property with the intention on of finding the next “high grade vein deposit” and after several attempts chose to give up on the property. Although they recognized the possibility of a low grade near surface deposit, they likely had their sights set much higher.

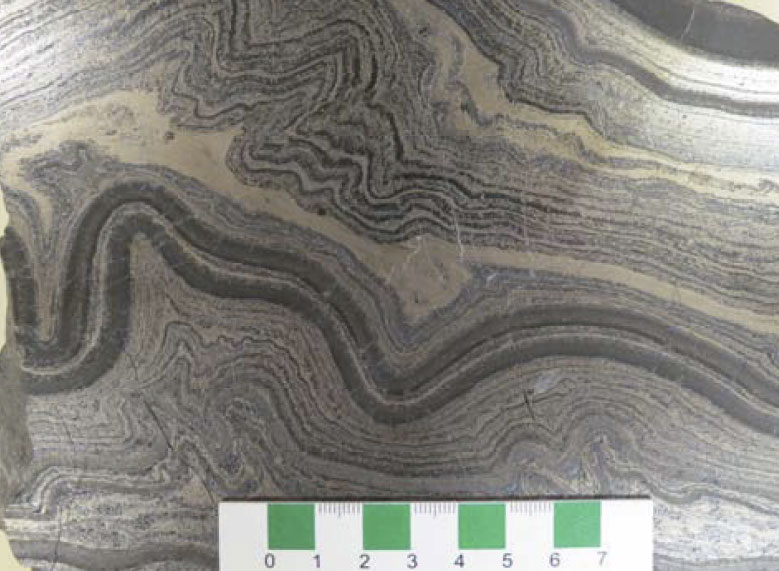

The El Tigre resource is considered a silver–gold structurally hosted vein deposit and is part of a major north trending fault system in the area known as the Teras Fault Zone. Currently the property is optioned to El Tigre Silver, who has two years to evaluate the economic potential of the tailings and the remaining resource.

[/box]

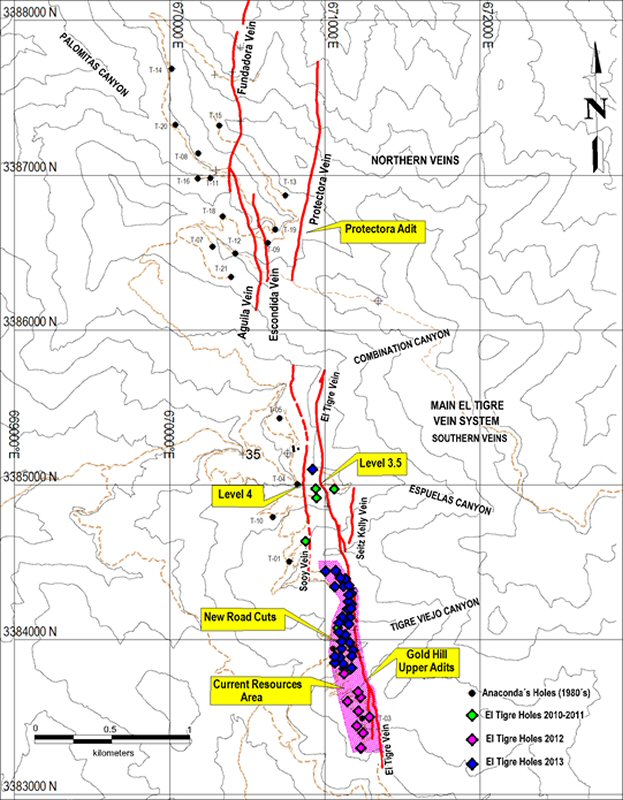

The sampling program was undertaken in the 3rd quarter of 2013 and focused on obtaining horizontal channel samples by cutting a two inch (5 cm) wide channel in the rock, and then chiseling out the rock with a hammer to collect samples. This method of sampling is done to collect a series of continuous samples similar to a horizontal drill hole and will assist in defining any surface mineralization that could correlate with the underlying drill intercepts. This program concentrated on the main El Tigre vein district consisting of the El Tigre Viejo canyon, Gold Hill area and the Espuelas Canyon area at the Southern vein area, and the Protectora vein at the Northern vein area. El Tigre is reporting assay results from the El Tigre Viejo canyon and Gold Hill area below. Assay results from the Espuelas Canyon area and the Protectora vein will be released as they become available for publication.

The following map shows the areas in relation to the current resource (shown in purple) as defined by the National Instrument 43-101 (“NI 43-101”).

[box type=”note” align=”aligncenter” ]National Instrument 43-101 is a technical reporting standard for publicly traded mining companies within Canada. Since about 80% of the world’s mining companies are Canadian listed, the standard is widely recognized. Even companies not listed on Canadian exchanges will often refer to the 43-101 standard in their company reports. 43-101 technical reports along with other documents associated with public mining companies may be accessed on SEDAR.com (System for Electronic Document Analysis and Retrieval). [/box]

The intention of the sampling program at the El Tigre Viejo canyon and Gold Hill area of the Southern vein area was to support the results from the Company’s Preliminary Feasibility Study for the El Tigre Silver & Gold Project, Municipio De Nacozari De Garcia, Sonora, Mexico (“PFS”) filed on SEDAR August 15, 2013. The Mineral Resources for the Project, are estimated by HRC to be 9.875 million tonnes grading an average of 0.630 g/t Au and 39.7 g/t Ag totaling 24.713 million ounces of EqAg classified as Indicated Mineral Resources with an additional 7.042 million tonnes grading an average of 0.589 g/t Au and 31.1 g/t Ag totaling 16.075 million ounces of EqAg classified as Inferred Mineral Resources. The base case estimated mineral resource is based on a 50 g/t silver equivalent (“AgEq“) cut-off grade.

[box type=”note” align=”aligncenter” ]It’s worth noting that while a pre-feasibility study has allowed the company to establish a low grade reserve from the mine tailings, the real potential here is still in the ground and a fair bit of exploration work will be required to prove up the in-ground resources. The company’s pre-feasibility study recommended a phased exploration programme including drilling, channel sampling and mapping in order to advance the resource and this news release reports on channel sample results.

[/box]

The Mineral Resources are reported in accordance with NI 43-101 and have been estimated in conformity with generally accepted Canadian Institute of Mining, Metallurgy and Petroleum “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resource will be converted into Mineral Reserves.

[box type=”note” align=”aligncenter” ]Keep in mind that Eq, or “equivalent” assay values are dependent on market prices for the included commodities and can therefore change. In this case the company is showing the gold and silver assays, but also including an AgEq (silver equivalent) and using a 60:1 value ratio for gold:silver.[/box]

The following tables summarize the significant assay results in the Gold Hill and El Tigre Viejo canyon area in the Southern vein system at El Tigre (widths reported are not true widths):

| GOLD HILL UPPER ADITS CHANNEL SAMPLE SIGNIFICANT RESULTS (greater than 50 g/t for AgEq) |

||||||

| Sample Num. | Width (m) | Au (g/t) | Ag (g/t) | Ag Eq (g/t) | ROCK | |

| 165191 | 1.30 | 0.03 | 299.0 | 300.8 | El Tigre Vein | |

| 165192 | 0.90 | 0.89 | 45.4 | 98.8 | El Tigre Vein | |

| 165196 | 2.00 | 12.00 | 256.0 | 976.0 | El Tigre Vein | |

| 165197 | 0.70 | 30.60 | 110.4 | 1946.4 | El Tigre Vein | |

| 165198 | 2.10 | 1.06 | 136.4 | 200.0 | El Tigre Vein | |

| 165202 | 1.40 | 1.21 | 152.0 | 224.6 | El Tigre Vein | |

| 165203 | 0.45 | 0.17 | 73.0 | 83.2 | White Tuff, weak Hem & Qtz veinlets | |

| 165204 | 1.20 | 1.15 | 71.0 | 140.0 | White Tuff, weak Hem & Qtz veinlets | |

| 165206 | 1.50 | 0.34 | 53.2 | 73.6 | White Tuff, weak Hem & Qtz veinlets | |

| 165207 | 1.00 | 2.78 | 236.0 | 402.8 | White Tuff, weak Hem & Qtz veinlets | |

| 165208 | 2.00 | 0.82 | 110.6 | 159.8 | White Tuff, weak Hem & Qtz veinlets | |

| 165215 | 1.15 | 2.66 | 126.0 | 285.6 | Qtz Vein hosted in white Tuff | |

| 165230 | 1.90 | 6.1 | 1.6 | 367.6 | White Tuff, weak Hem & Qtz veinlets | |

| 165234 | 0.64 | 4.12 | 878 | 1125.2 | Qtz Vein | |

| 165238 | 0.80 | 6.71 | 874 | 1276.6 | Qtz Vein | |

| 165243 | 0.40 | 3.54 | 141.2 | 353.6 | Qtz Vein | |

| 165247 | 0.25 | 10.3 | 232 | 850 | Qtz Vein | |

| 165248 | 0.65 | 0.89 | 13.4 | 66.8 | Lithic Tuff | |

| 165250 | 0.25 | 17.8 | 63.4 | 1131.4 | Qtz Vein | |

| 165252 | 0.25 | 15.4 | 133.4 | 1057.4 | Qtz Vein | |

| 165253 | 0.75 | 0.51 | 63.4 | 94 | El Tigre Formation | |

| 165255 | 0.20 | 4.59 | 144.2 | 419.6 | Qtz Vein with abundant clay filling | |

| 165256 | 0.75 | 1.34 | 12 | 92.4 | El Tigre Formation | |

| 165258 | 0.25 | 2.09 | 30.2 | 155.6 | Qtz Vein | |

| 165303 | 0.75 | 1.37 | 39.2 | 121.4 | Qtz Vein | |

| 165305 | 0.45 | 0.65 | 21.4 | 60.4 | Qtz Vein | |

| 165318 | 1.00 | 0.24 | 36.2 | 50.6 | Dark Gray Tuff, weak-mod Hem Veinlets | |

| 165319 | 1.10 | 1.13 | 99 | 166.8 | Dark Gray Tuff, weak-mod Hem Veinlets | |

| 165323 | 0.30 | 0.96 | 144.6 | 202.2 | Qtz Vein | |

| 165325 | 0.30 | 1.54 | 221 | 313.4 | Qtz Vein | |

| 165327 | 0.70 | 0.55 | 63.2 | 96.2 | Qtz Vein | |

| 165330 | 1.45 | 1.95 | 228 | 345 | Qtz Vein/Bx | |

| 165331 | 1.10 | 0.79 | 36.8 | 84.2 | Silicified Tuff with strong Hem in veinlets | |

| 165333 | 0.60 | 0.83 | 93.8 | 143.6 | Qtz Vein | |

| 165335 | 0.50 | 2.08 | 280 | 404.8 | Qtz Vein | |

| ROAD CUT CHANNEL SAMPLE SIGNIFICANT RESULTS | ||||||||

| Location | ID | From | To | Interval (m) | Au (g/T) | Ag (g/T) | Ag Eq (g/T) | |

| Road to Hole ET13-82 | ET-CHN1 | 0.00 | 6.10 | 6.10 | — | 22.1 | 22.1 | |

| ET-CHN2 | 0.00 | 9.00 | 9.00 | 0.304 | — | 18.24 | ||

| Road to Holes ET13-67 & 68 | ET-CHN3 | 0.00 | 6.64 | 6.64 | 0.237 | — | 14.22 | |

| ET-CHN4 | 0.00 | 72.00 | 72.00 | 1.296 | — | 77.76 | ||

| Includes | 16.00 | 20.00 | 4.00 | 3.77 | — | 226.2 | ||

| Includes | 26.00 | 28.00 | 2.00 | 7.95 | — | 477 | ||

| Includes | 38.00 | 40.00 | 2.00 | 4.25 | — | 255 | ||

| Road to Hole ET13-70 | ET-CHN5 | 0.00 | 44.00 | 44.00 | 1.275 | — | 76.5 | |

| Includes | 26.00 | 28.00 | 2.00 | 3.27 | — | 196.2 | ||

| ET-CHN6 | 0.00 | 8.00 | 8.00 | 1.713 | — | 102.78 | ||

| Includes | 0.00 | 4.00 | 4.00 | 3.235 | — | 194.1 | ||

| ET-CHN7 | 0.00 | 12.00 | 12.00 | 0.440 | — | 26.4 | ||

| ET-CHN8 | 0.00 | 8.00 | 8.00 | 0.223 | — | 13.38 | ||

| ET-CHN9 | 0.00 | 37.40 | 37.40 | 0.611 | — | 36.66 | ||

| ET-CHN10 | 0.00 | 20.00 | 20.00 | 0.798 | 20.9 | 68.78 | ||

| Includes | 10.00 | 14.00 | 4.00 | 3.345 | 71.1 | 271.8 | ||

| Road to Holes ET13-69 & 74 | ET-CHN11 | 0.00 | 14.00 | 14.00 | 0.324 | — | 19.44 | |

| ET-CHN12 | 0.00 | 20.00 | 20.00 | 0.652 | — | 39.12 | ||

| Road to Hole ET13-48 | ET-CHN13 | 0.00 | 8.00 | 8.00 | 0.293 | — | 17.58 | |

| ET-CHN14 | 0.00 | 9.40 | 9.40 | 1.185 | — | 71.1 | ||

| Note 1: All intervals reported as core length in metres. | ||||||||

| Note 2: Channel samples on road cuts stated in composite intervals. | ||||||||

| Note 3: Silver Equivalent (Ag Eq) is calculated using a 60 to 1 ratio of the dollar value of Ag and Au (Ag + Au x 60). | ||||||||

The sampling program by El Tigre was designed to support the work reported in the PFS as well as providing guidance for geological work necessary to identify drill targets. The sample results are not representative of the true thickness at the locations sampled. The results confirm the presence of a wider zone of alteration/stockwork containing anomalous gold surrounding the veins with higher silver grades within the prospect area and support further work in exploring and developing the southern El Tigre Vein system.

[box type=”note” align=”aligncenter” ]

Although these results are presented like typical diamond drill hole results, we have to keep in mind that these are channel samples taken in the adits and road cuts in and around the old mine. An adit is a horizontal passageway or an entrance into the side of a mountain. This style of drift mining is common in near surface vein deposits. When the mine was active, typically the high grade veins were mined out leaving a vast network of tunnels. With the lower grade material left behind, it allows easy access for sampling. The results confirm that the alteration that occurs outside of the vein still contains silver and gold.

Although only the “significant results” are presented to us, they do demonstrate the presence of low grade gold and silver on the property. As they move forward the question will be whether this work supports their previous resource estimate for the property.

[/box]

“We are pleased with the progress that our team has made, as led by Country Manager Jose Velazquez,” said Stuart Ross, El Tigre Silver’s President and CEO. “The initial resource calculation was published in a NI 43-101 Report in August 2013 and was based on a 1.2 kilometre section of the Southern vein system at the EL Tigre property. We anticipate that after analysis of all of the assays from this program we will be in a position to plan our next drill program which will identify targets for further exploration activity.”

[box type=”note” align=”aligncenter” ]

As of writing, El Tigre Silver Corps’s stock is sitting at $0.15 and the price of silver is at $18.74/oz. It’s been a fairly rocky ride for silver miners as prices over the last year have fluctuated between $19 and $25/oz. El Tigre’s stock has roughly tracked the ups and downs of the silver market.

[/box]

The technical content of this news release has been approved by Zachary J. Black, SME-RM (No. 4156858RM), Director – Geology and Resources for Hard Rock Consulting, a Qualified Person as defined in NI 43-101.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]