The company is reporting that an economic mining operation MAY be possible if the resource is there. Now their task will be to make sure the gold is there and upgrade their resources through the boring but necessary process of infill drilling.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. [/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Oct. 17, 2014) – Atlantic Gold Corporation (TSX VENTURE:AGB)(ASX:AGB) (“Atlantic” or the “Company”) is pleased to announce that it has filed a National Instrument 43-101 (“NI 43-101”) Technical Report in respect of a Preliminary Economic Analysis (“PEA”) in respect of the Company’s Nova Scotia projects. The PEA is available for review on SEDAR and on the Company’s website.

[box type=”note” align=”aligncenter” ]

Atlantic Gold is a Canadian-based junior listed on both the TSX Venture and Australian Stock Exchange. They have four gold projects in Nova Scotia, Canada and this news discusses highlights from a recent NI 43-101 compliant Preliminary Economic Assessment (PEA) which presents an economic case for open pit operations combining the Nova Scotia projects. PEA’s are essentially designed to determine whether a future mining operation might be profitable. They are a pre-cursor to more in-depth feasibility studies.

[/box]

The PEA analyzes two potential open-pit production scenarios over a minimum 8 year mine life:

- Base Case – assumes initial production from the Company’s fully-permitted Touquoy project, and the recently acquired Beaver Dam project, located approximately 37 km by road from Touquoy, for total life of mine production of 702,000 ounces of gold at an average grade of 1.55 g/t

- Base Plus Cochrane Case – includes the addition of gravity and float concentrate production from the Company’s Cochrane Hill Project in year 3 of production, processed into doré at the Touquoy facility for a total life of mine production of 1,129,000 ounces of gold at an average grade of 1.62 g/t

[box type=”note” align=”aligncenter” ]

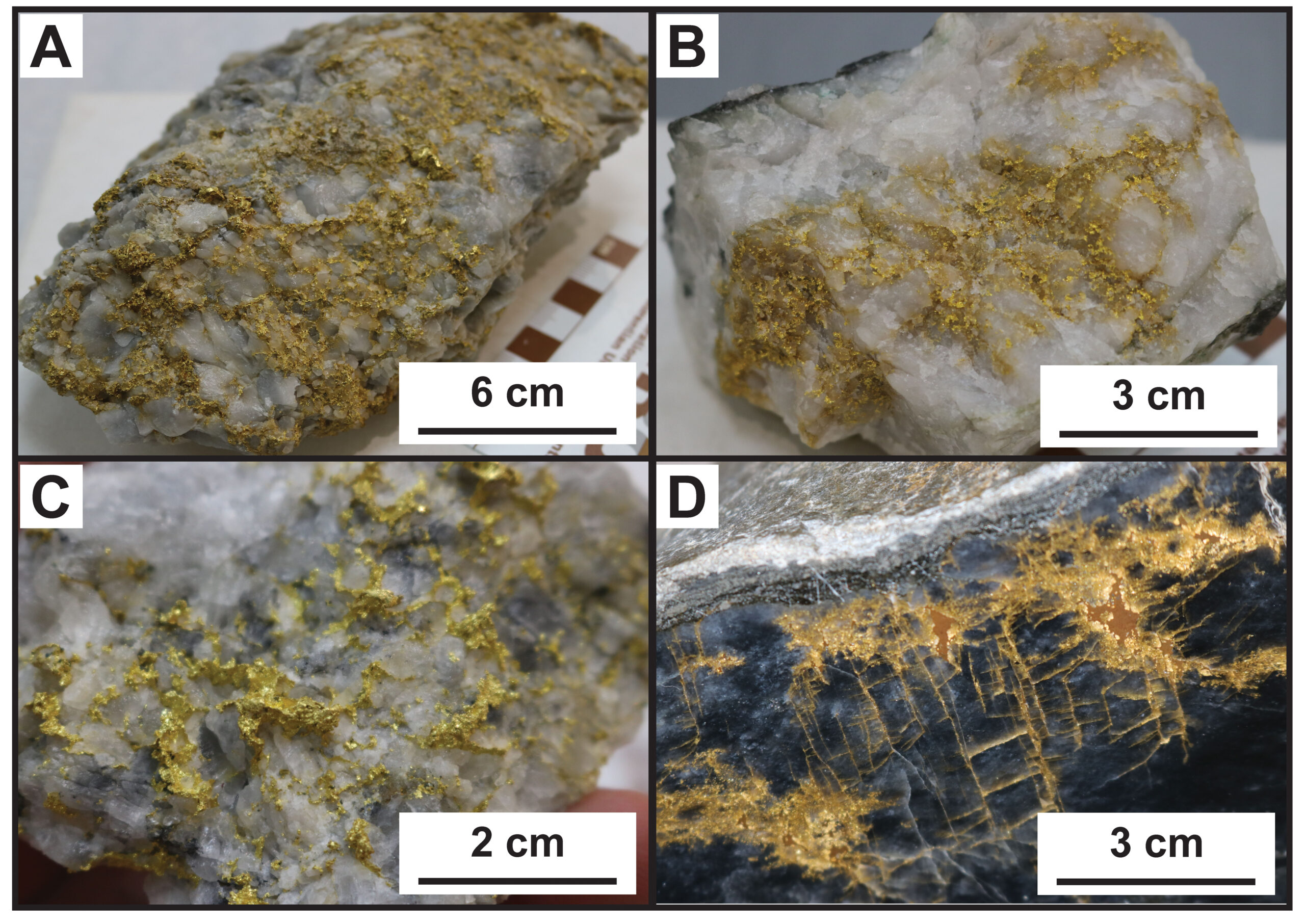

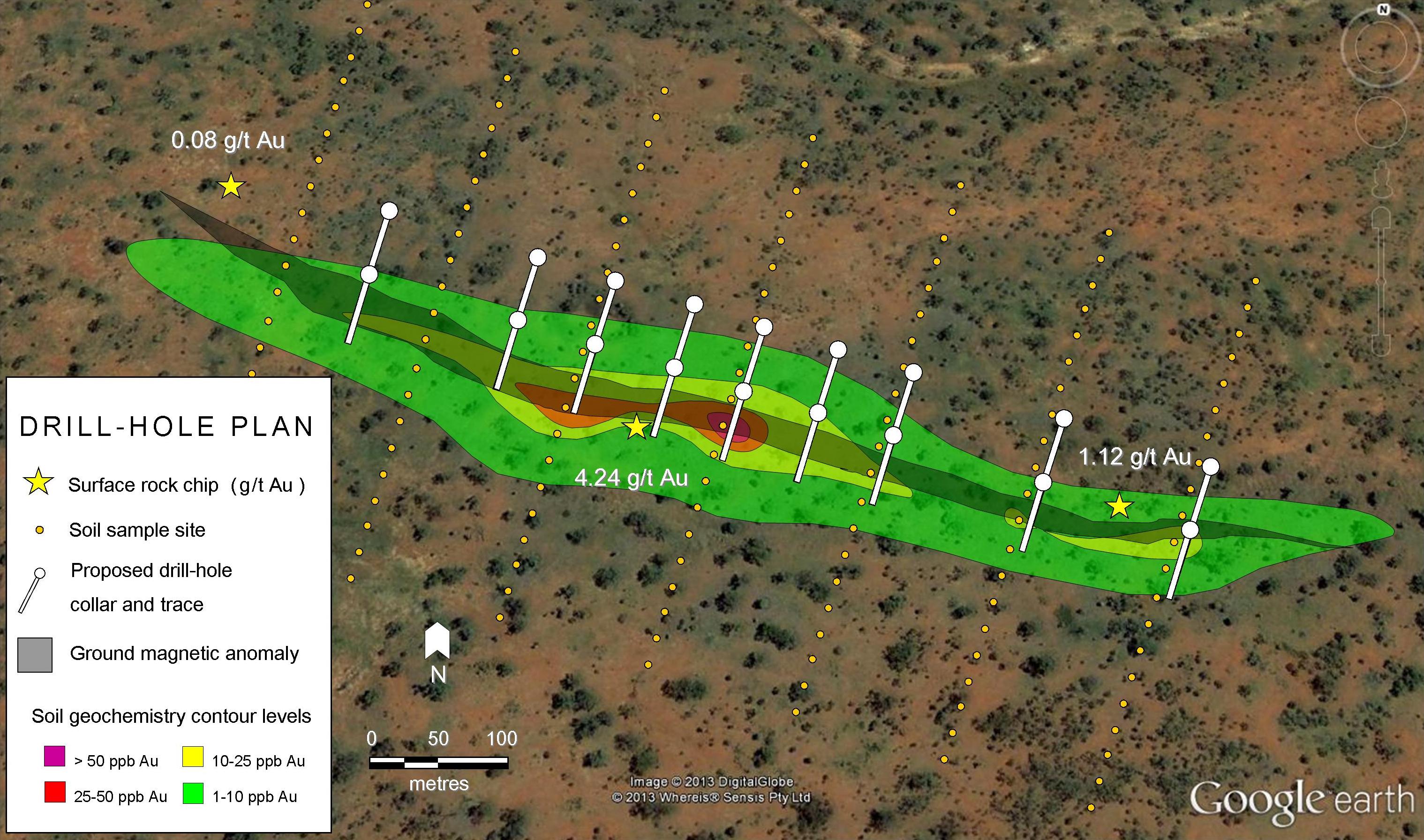

Gold in this area is hosted along the limbs and axes of large scale folds in an ancient sedimentary bedrock belt known as the Meguma Group. Folding creates structural weaknesses in the rocks that act as conduits for metal bearing fluids. Narrow gold-bearing quartz veins along these folds provide evidence of this ancient fluid movement.

Disseminated (dispersed) gold also occurs within the bedded sandstones and mudstones of the folded rock units. While the narrow gold-bearing quartz veins had been mined using underground methods for more than a century, it wasn’t until the 1980’s that the potential for a larger scale bulk tonnage mining of the disseminated gold was recognized.

[/box]

PEA HIGHLIGHTS

Canadian dollars unless otherwise indicated (assuming 1CND $ = $0.90 US$):

| Gold price: US $1,300/oz | Base Case | Base Plus Cochrane Case | ||||

| Pre-tax NPV (5%) | $ | 233 million | $ | 354 million | ||

| Post-tax NPV (5%) | $ | 163 million | $ | 242 million | ||

| Pre-tax IRR | 39.6% | 38.0% | ||||

| Post-tax IRR | 33.5% | 31.5% | ||||

| Post-tax Payback | 1.7 years | 3.3 years | ||||

| Initial capital cost | $ | 131 million | $ | 131 million | ||

| Capital Cost Cochrane Hill (Yr 2) | N/A | $ | 108 million | |||

| LOM cash operating cost | $ | 576/oz | $ | 612/oz | ||

| LOM all-in sustaining cost | $ | 653/oz | $ | 684/oz | ||

| Total LOM Au production | 702,000 oz’s | 1,129,000 oz’s | ||||

| Average annual production | 87,700 oz’s | 141,000 oz’s | ||||

| LOM strip ratio | 3.44 | 4.45 | ||||

| Average grade | 1.55 g/t | 1.62 g/t | ||||

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the conclusions in the PEA will be realized or that any of the resources will ever be upgraded to reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

[box type=”note” align=”aligncenter” ]

The company notes that the PEA includes inferred mineral resources which are too speculative to be considered economic mineral reserves. Inferred mineral resources represent the lowest level of confidence in resource reporting. Future infill drilling may upgrade these to indicated or even measured resources, but only a feasibility study will upgrade them from resources to reserves.

For now, the company has a PEA which shows that an economic mining operation MAY be possible if the resource is there. Now their task will be to make sure the gold is there and upgrade their resources through the boring but necessary process of infill drilling.

[/box]

A sensitivity table for each case, based on various gold prices is set out below:

Base Case Sensitivities

| US $1,100 | US $1,200 | US $1,300 | US $1,400 | US $1,500 | ||||||

| Pre-tax NPV (5%) | $ | 140 m | $ | 189 m | $ | 233 m | $ | 276 m | $ | 320 m |

| Post-tax NPV (5%) | $ | 98 m | $ | 132 m | $ | 163 m | $ | 193 m | $ | 223 m |

| Pre-tax IRR | 28.3% | 34.7% | 39.6% | 44.1% | 48.4% | |||||

| Post-tax IRR | 24.0% | 29.4% | 33.5% | 37.4% | 41.0% | |||||

| Post-tax Payback | 2.1 years | 1.8 years | 1.7 years | 1.5 years | 1.4 years | |||||

Base Plus Cochrane Case Sensitivities

| US $1,100 | US $1,200 | US $1,300 | US $1,400 | US $1,500 | ||||||

| Pre-tax NPV (5%) | $ | 194 m | $ | 276 m | $ | 354 m | $ | 431 m | $ | 508 m |

| Post-tax NPV (5%) | $ | 131 m | $ | 188 m | $ | 242 m | $ | 296 m | $ | 349 m |

| Pre-tax IRR | 25.3% | 32.3% | 38.0% | 43.3% | 48.2% | |||||

| Post-tax IRR | 20.6% | 26.5% | 31.5% | 36.0% | 40.2% | |||||

| Post-tax Payback | 4.3 years | 3.8 years | 3.3 years | 3.0 years | 2.7 years | |||||

The data in the Base Plus Cochrane Case Sensitivities table above has been updated since originally disclosed in the September 29, 2014 news release. There has been no change to the Base Case Sensitivities table.

[box type=”note” align=”aligncenter” ]

Atlantic Gold is trading at $0.26 TSX-V, $0.295 ASX.

[/box]

The independent qualified persons responsible for preparing the PEA are; Neil Schofield MS – Applied Earth Sciences, MAusIMM, MAIG, and Marc Schulte, P.Eng. of MMTS,and John Thomas, P.Eng. of JAT Metconsult Ltd., all of whom act as independent consultants to the Company, are Qualified Persons as defined by National Instrument 43-101 (“NI 43-101″) and have reviewed and approved the contents of this news release.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]