What’s interesting is that, unlike many junior mining companies, only a very small fraction of the company’s shares are in public hands. Perhaps we should be thankful that they’ve saved a little bit for the rest of us.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. [/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – March 10, 2014) – Kaizen Discovery (TSX VENTURE:KZD) announced today that it has filed an independent technical report for the Fairholme copper-gold porphyry exploration project in central New South Wales, Australia. The report was prepared by SRK Consulting (Australasia) Pty. Ltd., in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, and is available on the company’s profile on SEDAR and on the Kaizen website.

[box type=”note” align=”aligncenter” ]

Here’s an early stage project with a recently filed 43-101 technical report. We haven’t talked about this company before, but there are a few interesting items worth discussing.

“Kaizen” is a Japanese business philosophy involving continuous improvement and efficiency. Not surprisingly, the company’s focus is to develop mineral resources for supply to its Japanese partners. Kaizen is 85% owned by HPX TechCo Inc., and was founded through a combination of Concordia Resource Corp. and HPX TechCo. The Japanese ITOCHU Corporation is also a major shareholder with 6.35%. ITOCHU paid just over $5 million for it’s share in the company. HPX TechCo is 50% owned by mining industry financier, Robert Friedland and falls under the umbrella of Ivanhoe Capital Corporation. What’s interesting is that unlike many junior mining companies, only a very small fraction of the company’s shares are in public hands. The management and directors are mostly Ivanhoe veterans.

Kaizen’s Fairholme Project is located in New South Wales, Australia in a Ordovician-aged (~450 Million years) geologic terrane known as the Macquarie Arc. The Macquarie Arc consists primarily of volcanic rocks and is part of a larger fold and fault belt known as the Lachlan Fold Belt. The area is home to a number of copper and gold mines and is Australia’s only economic copper-gold porphry region. Porphyry deposits generally consist of low-grade, high tonnage disseminated (dispersed) copper sulfides in igneous intrusions – typically associated with volcanic belts around the Pacific “Ring of Fire”. Many porphyries also contain gold, silver, and molybdenum.

[/box]

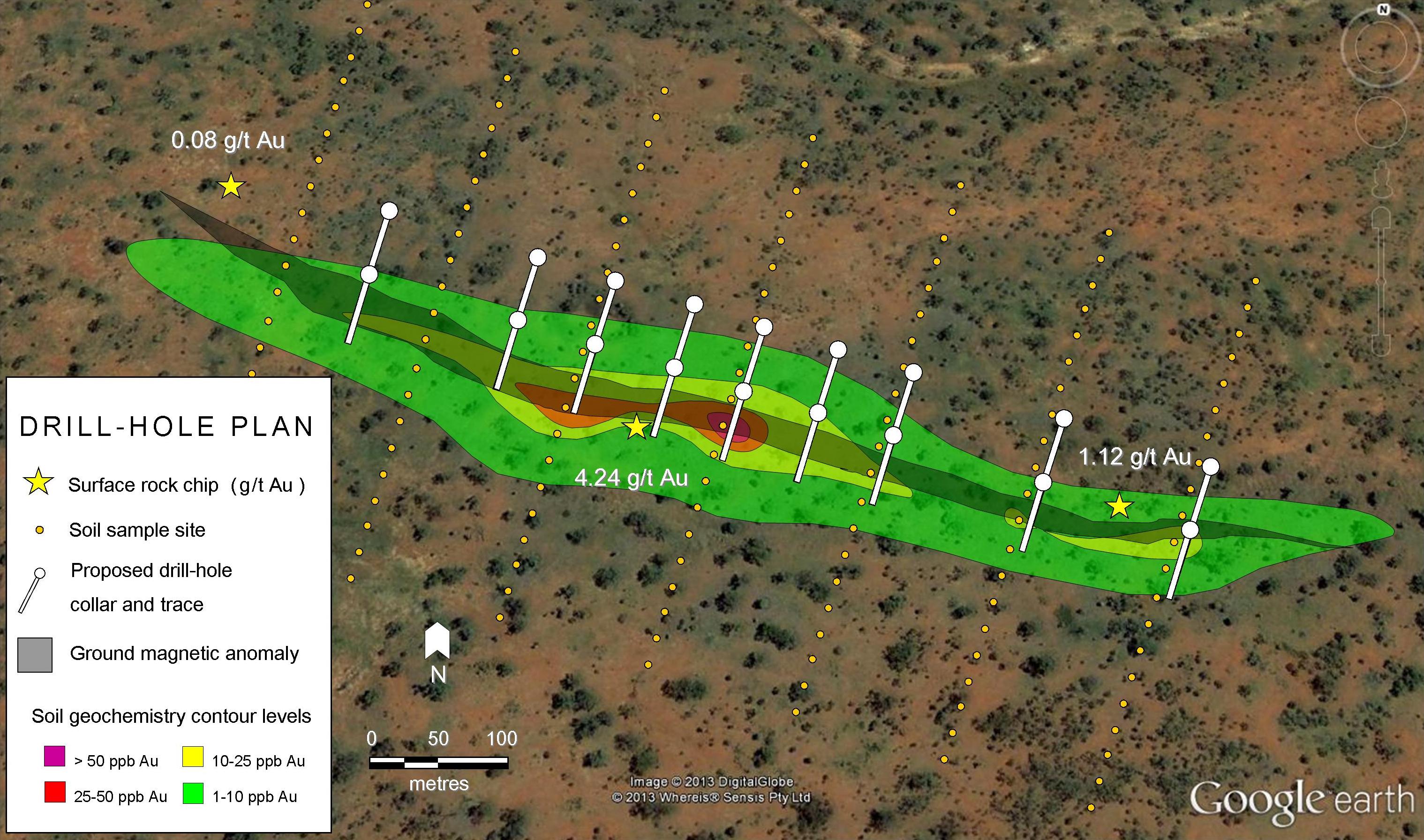

The report provides information on the project’s history, previous exploration results and exploration potential; it also recommends that Kaizen undertake a further 3-D induced-polarization survey on the property, followed by diamond drilling of targets that are generated. A second-phase drill program is recommended to delineate the extent of any promising mineralization that is encountered.

[box type=”note” align=”aligncenter” ]

Induced Polarization is a good geophysical method for detecting disseminated mineralization of the type found in Porphyry deposits. Apparently HPX TechCo. (Kaizen’s majority shareholder) uses proprietary geophysical techniques to collect and evaluate geophysical data. The problem with proprietary methods is that they can’t necessarily be fully and independently scrutinized by the scientific community. Though if it works I’m sure no one will care.

[/box]

The technical report has been prepared and filed in satisfaction of an undertaking made to the TSX Venture Exchange in connection with the December 2013 reverse take-over involving Concordia Resource Corp., which created Kaizen.

[box type=”note” align=”aligncenter” ]

We’ve mentioned this before, but it’s worth repeating. NI 43-101 is a technical reporting standard and filing 43-101 complaint reports is a requirement of public Canadian listed companies. Since almost all mining companies are listed on Canada’s TSX, the standard is widely known and used. Filing a 43-101 does not mean the company has a resource or a reserve or an economic deposit. It simply means the report that what they have filed complies with the standard. The 50 page report simply outlines and discusses the project using currently available data. It can be found on SEDAR.

[/box]

Fairholme is an early-stage exploration project targeting porphyry-related gold and copper mineralization within the Fairholme Igneous Complex, which forms part of the Macquarie Arc that hosts porphyry copper-gold deposits at Cadia and Northparkes. The project consists of two tenements that cover approximately 172 square kilometres.

[box type=”note” align=”aligncenter” ]

Again, this is an early stage project. No resource is defined at this point and the company is still exploring. Its also worth noting that the company has a very large land position in a mining-friendly and stable jurisdiction. One issue that was readily apparent at the most recent PDAC mining convention is that many companies employ a great deal of resources dealing with political instability, security and stakeholder issues. While landowner liaison is not always necessarily easy, its certainly better than getting shot at.

[/box]

The Fairholme Project is being explored by Kaizen under the terms of an earn-in agreement between ASX-listed Clancy Exploration Limited and Kaizen. Kaizen already has earned a 49% interest in the project. The agreement gives Kaizen the right to increase its interest in the project to 65% by funding an additional A$4 million in exploration over the next two years. Kaizen can further increase its stake up to 95% by funding additional, staged programs leading to a feasibility study.

About Kaizen Discovery

Kaizen is a Canadian, technology-focused, mineral exploration company that was formed in late 2013 through a combination of Concordia Resource Corp. and assets acquired from HPX TechCo Inc., a 100%-owned subsidiary of High Power Exploration Inc. Kaizen’s existing portfolio of exploration projects consists of Ebende and Kabongo in the Democratic Republic of Congo, Fairholme in Australia and Kerboulé in Burkina Faso. With its collaboration agreement with ITOCHU, the company’s long-term growth strategy is to produce and deliver minerals to Japanese industries. A strong management team and an experienced board, combined with the improved project portfolio and access to HPX TechCo’s leading-edge, proprietary technology, will help enable Kaizen to more effectively identify and advance world-class mineral projects.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]