The company appears to be reasonably well financed with money to continue exploring their property and define their existing resource estimate. Though it’s too early to say where this project will go, that puts them light years ahead of many other juniors in this market.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Sept. 10, 2014) – East Africa Metals Inc. (TSX VENTURE:EAM) (“East Africa” or the “Company”) is pleased to announce diamond drill results from follow-up drilling at the Mato Bula Prospect (“Mato Bula”), and on-going exploration results and plans for both the Adyabo and Harvest Projects. Nine additional holes (WMD013 to 021) have been completed at Mato Bula totalling 2,126 metres. Drilling on 80 metre sections targeted extensions and infill to mineralization previously defined (WMD002 to 012). Recent drilling has extended mineralization to a depth of over 220 vertical metres below surface, and defined a series of steeply plunging, high-grade gold mineralized shoots. A new campaign of over 6,000 metres of diamond drilling is expected to commence in late September 2014, to target extensions to known mineralization at Mato Bula, Mato Bula North, Da Tambuk and VTEM09, and to conduct first pass drilling on other emerging prospects such as Hanbassa.

[box type=”note” align=”aligncenter” ]East Africa Metals is a junior exploration company working out of Ethiopia. The mining industry in Ethiopia provides 1% of the country’s GDP; gold, gemstones and industrial minerals are the country’s primary exports.

The company made some news a few months back relating to a civil lawsuit where an individual is claiming to be owed a $16 million finder’s fee from the company for aiding in a $1.6 million private placement. Orca gold was also named in the suit. According to East Africa Metals, the pursuant had no involvement with the private placement and his claim is invalid.

Finder’s fees are sometimes paid to individual’s or companies who facilitate deals or investments in a company. These must be can be a mutually agreed upon upfront in order to be valid. For background, you may wish to read this article on the lawsuit and the company’s response. There’s also an interesting article here relating to another case where a finder’s fee dispute made it’s way through the courts. Finder’s fees can vary based on the size of a deal, but a 5-10% fee is not uncommon.

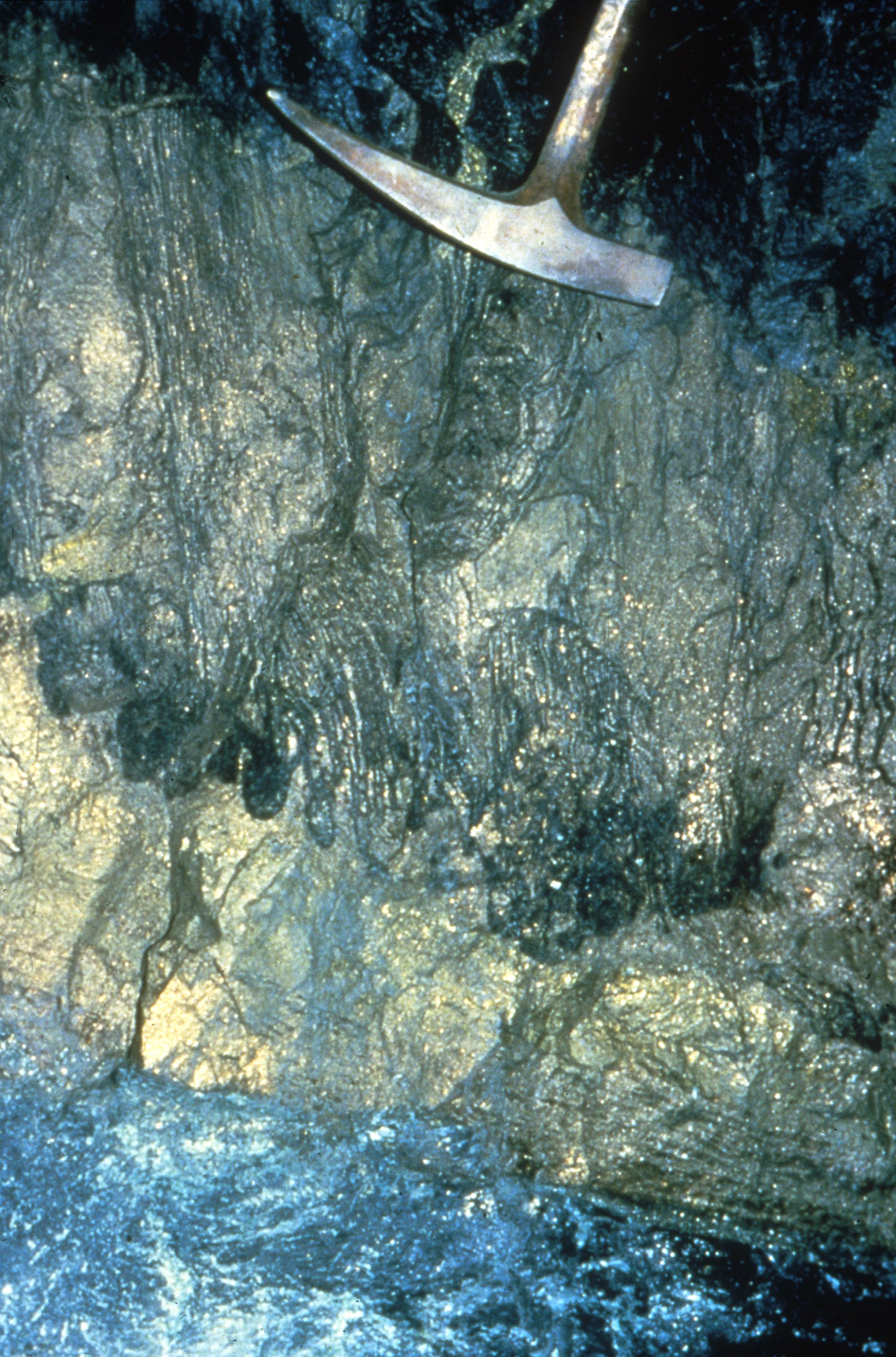

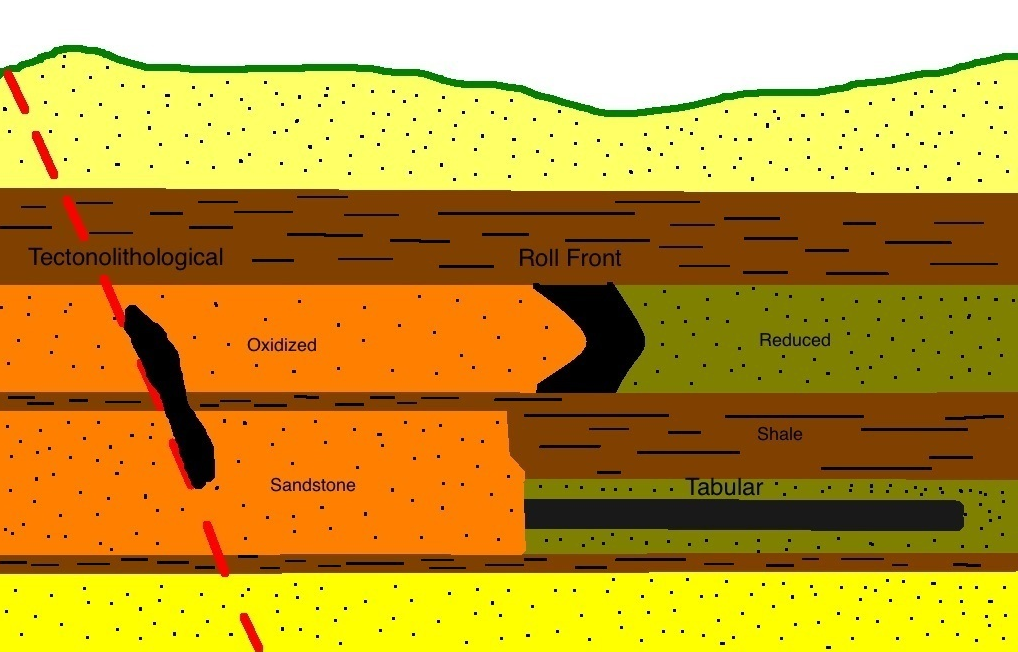

The company is currently working on it’s Mato Bula, Adyabo and Harvest projects, all Volcanic Massive Sulfide or (VMS) prospects. Earlier this year, the company published an initial resource calculation for a portion of the Harvest project known as the Terakimti. This release includes drill and trench results for other prospects on the Harvest property.[/box]

Highlights from recent drilling include;

- 34.04 metres at 5.65 grams per tonne gold and 0.29 percent copper (WMD019 – Section 19880N) including 17.48 metres at 9.50 grams per tonne gold and 0.43 percent copper, from 171.13 metres drill depth at Silica Hill. WMD019 was drilled 80 vertical metres down dip of mineralization intersected in WMD007 (28.20 metres at 8.50 grams per tonne gold and 0.24 percent copper – refer to Tigray’s news release dated April 7, 2014 ), highlighting a high-grade gold shoot persistent from surface to over 220 metres depth.

- 4.29 metres at 8.06 grams per tonne gold and 0.61 percent copper, from 165.85 metres (WMD016 – Section 19640N) at Mato Bula, approximately 80 metres vertically below WMD005 (6.61 metres at 5.3 grams per tonne gold and 0.26 percent copper – refer to Tigray’s news release dated July 16, 2013).

Additional drill assay results are expected for Da Tambuk in the coming weeks. Four previous diamond drill holes at Da Tambuk, located approximately 4 kilometres northeast of Mato Bula yielded best results of 12.00 metres at 17.34 grams per tonne gold and 0.32 percent copper from 52.75 metres drill depth (refer to Tigray’s news release dated March 11, 2014).

Mato Bula Diamond Drill Intercepts

| Hole ID | From (m) |

To (m) |

Interval (m)1 |

Gold grams/ tonne 2, 3 |

Copper % |

Zone | Local Azimuth |

Dip | |

| WMD013 | 153.79 | 160.10 | 6.31 | 1.71 | 0.48 | Upper | |||

| including | 158.32 | 160.10 | 1.78 | 4.17 | 0.62 | 87.5 | -45 | ||

| 203.70 | 207.65 | 3.95 | 3.54 | 0.37 | Main | ||||

| WMD014 | 220.18 | 221.08 | 0.90 | 0.88 | 0.73 | Upper | |||

| 231.70 | 233.20 | 1.50 | 0.61 | 0.35 | Upper | 90 | -60 | ||

| 261.15 | 263.50 | 2.35 | 4.23 | 0.61 | Main | ||||

| WMD015 | 126.75 | 129.50 | 2.75 | 0.83 | 0.82 | Main | 269 | -48 | |

| 189.10 | 196.95 | 7.85 | 0.44 | 0.41 | Upper | ||||

| WMD016 | 165.85 | 170.14 | 4.29 | 8.06 | 0.61 | Main | 270 | -50 | |

| 182.85 | 183.85 | 1.00 | 0.48 | 0.92 | Upper | ||||

| WMD017 | 55.00 | 57.70 | 2.70 | 0.49 | 0.26 | Main | 270 | -46 | |

| WMD018 | 186.90 | 193.30 | 6.40 | 1.33 | 1.70 | Upper | 90 | -47 | |

| including | 189.40 | 192.60 | 3.20 | 1.66 | 2.85 | ||||

| WMD019 | 171.13 | 205.17 | 34.04 | 5.65 | 0.29 | Upper | 89 | -62 | |

| including | 171.98 | 189.46 | 17.48 | 9.50 | 0.43 | ||||

| WMD020 | No Significant Results | 90 | -50 | ||||||

| WMD021 | 114.73 | 115.53 | 0.80 | 4.25 | 0.02 | 90 | -48 | ||

| 156.39 | 159.57 | 3.18 | 1.11 | 0.12 | |||||

| 1 | True thicknesses are interpreted as 65-90% of stated intervals. |

| 2 | Intervals use 0.3 grams per tonne gold cutoff value. |

| 3 | No top cut has been used on assay values. |

[box type=”note” align=”aligncenter” ]Some of the drill results show “nested highlights” – a high grade interval included within a larger interval. The problem with drill highlights is that they skew the average grade of the entire interval and it can be a useful exercise to calculate the grade of the remaining interval with the high grade zone removed. For example, hole WMD019 intersected 34.04 m of 5.95 g/t gold, including 17.48 m of 9.5 g/t gold. With some relatively simple math, we can remove the higher grade interval to determine that the remaining 16.48 m contains an average grade of 1.59 g/t gold.

These copper and gold grades appear comparable to many VMS deposits and prospects we have reported before. What’s curious is that they haven’t reported any zinc and silver grades since these metals are typically significant in VMS-type deposits. Previous results from this project have included zinc and silver assays so either the grades from these holes weren’t all that spectacular or the company chose not to have those elements analyzed.

Note that the results reported are only the apparent thicknesses and may be within 65-90% of the true thickness.[/box]

Igub Concession Trench Results

Three trenches were completed at the Igub prospect, in the north east section of the Harvest Project, to test gold soil anomalies and areas with minor artisanal bedrock workings and limited outcrop. Peak results from Widak include 48 metres at 3.06 grams per tonne gold (IGT002).

Igub Trench Results

| Trench | From (m) |

To (m) |

Interval (m)2 |

Gold grams/ tonne1 |

Prospect | |

| IGT001 | 23.30 | 31.30 | 8.00 | 1.29 | Widak | |

| 2.00 | 50.00 | 48.00 | 3.06 | |||

| IGT002 | including | 2.00 | 36.00 | 34.00 | 4.03 | Widak |

| including | 12.00 | 20.00 | 8.00 | 11.11 | ||

| IGT0033 | 0.00 | 12.00 | 12.00 | 2.72 | Igub |

| 1 | Intervals use 0.3 grams per tonne Au cutoff value |

| 2 | True thickness intervals cannot be determined |

| 3 | Extension from previous trench |

The results are preliminary in nature, as the orientation of mineralization with respect to trench coverage is unknown due to lack of outcrop surface definition. Follow-up mapping, soil sampling and trenching will be conducted.

[box type=”note” align=”aligncenter” ]Three trenches were cut through the surface testing various soil anomalies and “artisanal workings”. Trenching is a fairly early-stage prospecting tool so we can’t say much about these results other than that there is gold present. The company plans to follow-up with further trenching, mapping and soil sampling. [/box]

Exploration Work Program

A follow-up diamond drill program of over 6,000 metres is expected to commence in late September 2014, testing extensions to high grade drill intercepts at the Mato Bula, Mato Bula North, Da Tambuk, and VTEM09 prospects. Additionally, this program will provide preliminary drill testing to assess the most prospective emerging targets on both the Adyabo and Harvest Projects, including Hanbassa, Mugnae Andi and Lihamat prospects. Additional ground work will be required to further define the new target identified by recent trench results at Igub. A 4,500 metre infill Reverse Circulation drilling is planned at the Terakimti oxide resource for later in Q4 2014.

[box type=”note” align=”aligncenter” ]The company is using diamond drilling for it’s 6,000m exploration program. Diamond drilling is more expensive, but will give the company more geologic information which makes it more useful in exploration. Reverse Circulation drilling will be used for it’s 4,500m infill drilling program to help define and upgrade it’s resource at Terakimti. [/box]

Quality Control

The planning, execution and monitoring of East Africa’s quality control programs at the Harvest and Adyabo Projects are under the supervision of Jeff Heidema, P.Geo., East Africa’s Vice President Exploration. Mr. Heidema is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosures of Mineral Projects (“NI 43-101”). Diamond drill core samples and trench samples have undergone preliminary preparation at the Acme Laboratories facility in Ankara, Turkey, and are crushed to 80% passing 10 mesh, and pulverized to 85% passing 200 mesh (PRP70-1KG package). Analyses are conducted at Acme Laboratories in Vancouver, Canada, utilizing Aqua Regia digestion and ICP-ES for base metal and silver analyses. Gold analyses are conducted via Fire Assay Fusion with AA finish, and gravimetric analyses are completed for over-limit samples. Blanks and certified reference standards are inserted into the sample stream to monitor laboratory performance. For core, duplicate samples are inserted into the sample stream to both monitor laboratory performance and also characterize potential mineralization.

Qualified Person

Technical information included in this news release was verified, reviewed and approved by Jeff Heidema, P.Geo., the Company’s Vice President Exploration. Mr. Heidema is a Qualified Person as defined by NI 43-101.

About East Africa Metals

[box type=”note” align=”aligncenter” ]East Africa Metals is currently trading at $0.115, within striking distance of it’s 52-week low of $0.11.

The company appears to be reasonably well financed with money to continue exploring their property and define their existing resource estimate. Though it’s too early to say where this project will go, that puts them light years ahead of many other juniors in this market.[/box]

The Company’s principal assets and interests include both the 70%-owned Harvest polymetallic VMS exploration Project, which covers approximately 116 square kilometres in the Tigray region of Ethiopia, 600 kilometres north‐northwest of the capital city of Addis Ababa, and the Adyabo Project, covering 312 square kilometres immediately west of the Harvest Project. The Company has entered into an agreement to acquire up to 80% of the Adyabo Project. Additionally, the Company owns the 97 square kilometre Handeni Property located in north-eastern Tanzania. Handeni includes the Magambazi Project, a gold deposit discovered in 2009.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know through our contact page, through Google+, Twitter or Facebook.[/box]