At best, the shallow zone is a low grade zone loss-leader with minor metal credits to keep the mill busy on a slow day. At worst, it is waste rock. Regardless, the higher grade zones may be economic and if we separate out the shallow cap there is still a decent resource.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Please view original release here.[/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Nov. 21, 2013) – Prophecy Platinum Corp. (TSX VENTURE:NKL)(OTCQX:PNIKF)”Prophecy Platinum” or the “Company” is pleased to announce further results from the ongoing 2013 exploration drilling program at its 100%-owned Wellgreen PGM-Ni-Cu project, located in Canada’s Yukon Territory, and to provide an update on additional development initiatives currently underway. Drill hole 215 in the Far East Zone has intercepted 756 metres of continuous mineralization grading 1.92g/t Platinum Equivalent (“Pt Eq.”) or 0.46% Nickel Equivalent (“Ni Eq.”), including 461 metres of continuous mineralization grading 2.31g/t Pt Eq. (0.55% Ni Eq.), which contains a 65.6 metre interval grading 4.19g/t Pt Eq. (1.00% Ni Eq.), comprised of 1.33g/t platinum+palladium+gold (“3E”) with 0.56% nickel and 0.45% copper.

[box type=”note” align=”aligncenter” ]

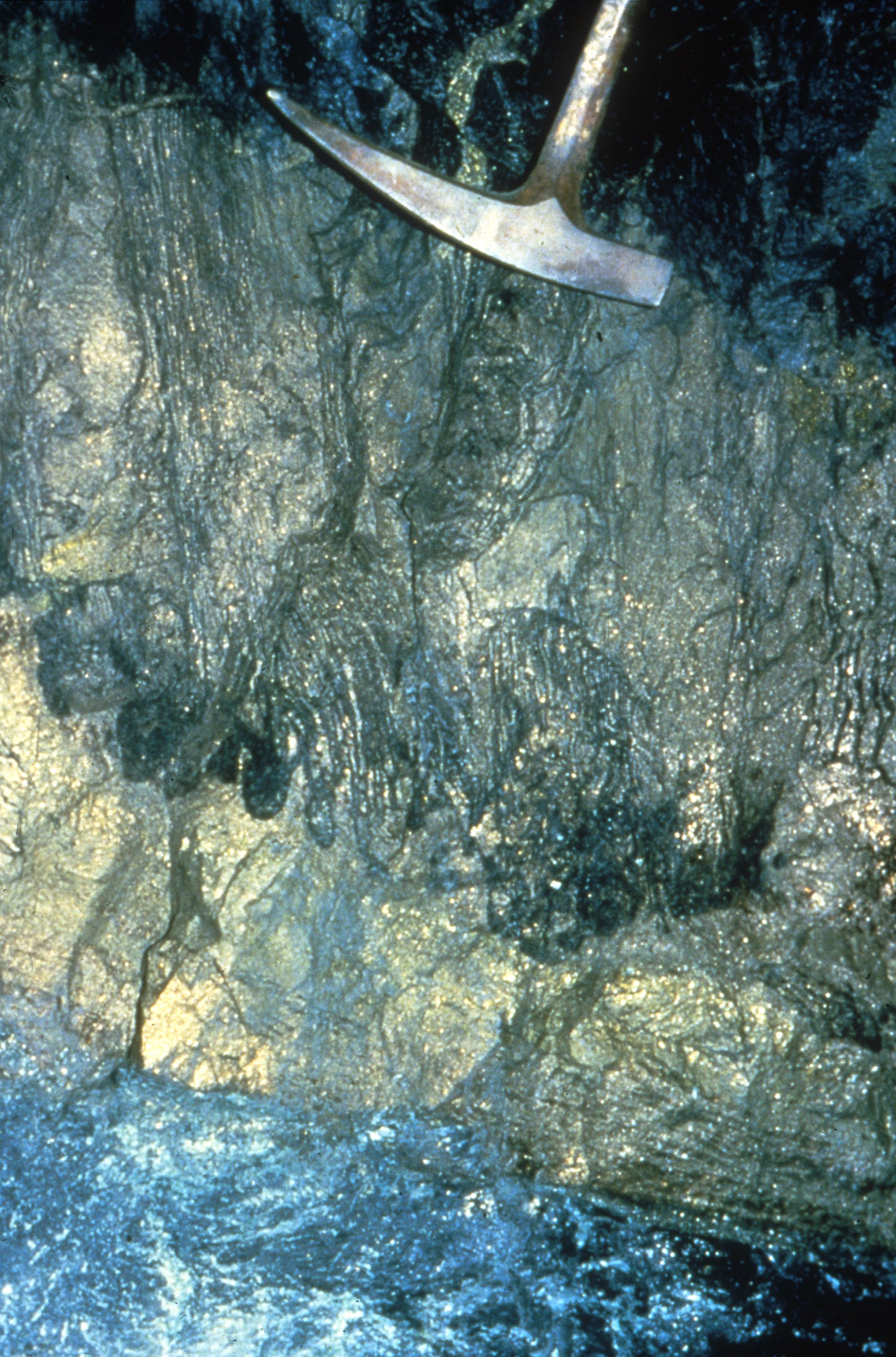

This release seemed like a good opportunity to test out the metal equivalents calculator that we launched earlier this week. Prophecy’s Wellgreen Project is a Nickel, Copper, Cobalt, PGE deposit located in the Yukon Territory of Canada. The deposit is hosted in an ultramafic intrusion.

[/box]

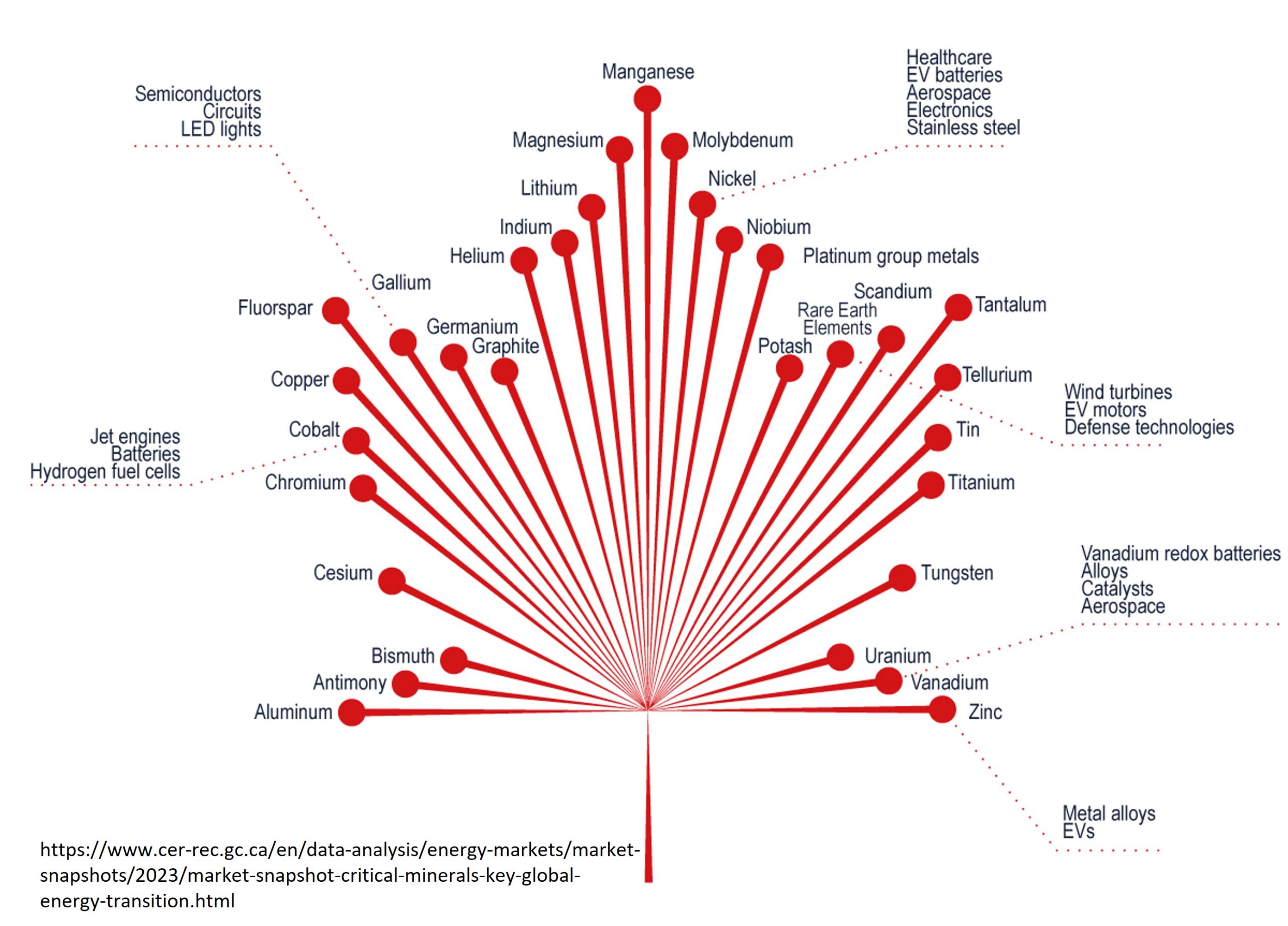

Investors should note that Wellgreen is a polymetallic deposit with mineralization that includes Platinum Group Metals (PGMs), gold, nickel, copper and cobalt. Although the 2012 Wellgreen PEA indicated that nickel was the single largest contributor of value, at current metal prices using anticipated metallurgical recoveries for separate Ni and Cu concentrates, the net economic contribution is anticipated to be largest for the 3E elements (Pt+Pd+Au), followed by nickel and then by copper and cobalt. A platinum equivalent value is intended to reflect total metal equivalent content in platinum for all of the metals using relative prices for each of the metals. Please refer to Table 1 for assay results by individual metal and the metal prices used to calculate Pt Eq. and Ni Eq.

[box type=”note” align=”aligncenter” ]

It’s interesting that the company has downgraded the contribution of value that nickel provides to the project and is essentially now marketing it as a PGE deposit. The reason for this is simple: Nickel prices are low (~$6.00 per lb) and worldwide nickel inventories are at an all time high. What this means is that nickel prices are likely to be depressed for some time. Even the largest and highest grade nickel mines are losing money or just breaking even at these prices, but the fact that they are still mining and contributing to already-high inventories is probably not helping market prices.

On the other hand, PGE (including Platinum and Palladium) prices are not particularly bad right now and the price outlook is fairly good.

[/box]

Greg Johnson, Prophecy Platinum’s President and Chief Executive Officer, stated, “At three quarters of a kilometre (or half a mile) of continuous mineralization, or roughly the equivalent of seven football fields in a row, the width of PGM mineralization intercepted by hole 215 is the longest yet at Wellgreen. The Company is not aware of any other ultramafic PGM-containing deposits anywhere in the world with continuous mineralization over comparable widths. This is a massive intercept with a grade thickness value of 1,451 gram per tonne metres Pt Eq. (“g-m”), which demonstrates the significant scale and potential of the Wellgreen system. While South African platinum mines are struggling because they typically mine mineralized seams just a few metres at great depths underground, the mineralization at our Wellgreen property is typically several hundred metres wide and begins at surface, making it amenable to open pit mining and the project is located in one of the Fraser Institutes’ top-ranked mining jurisdictions in the world. Within the broad continuous zone of mineralization in hole 215 is a higher grade portion that includes a 65.6 metre wide zone grading 4.19g/t Pt Eq. (1.00% Ni Eq.) and a second higher grade zone which correlates with the recently announced higher grade zones intercepted in holes 160 and 165 to the west. We believe this material may be suitable for bulk underground extraction early in the anticipated mine plan in conjunction with the higher grade starter pits on the western end of the deposit to potentially increase the overall project economics and accelerate payback. We are very pleased with these results and the potential that is being shown at the eastern end of the known Wellgreen deposit.”

[box type=”note” align=”aligncenter” ]

While the grades are not very high, they have *very* long (756 m) and continuous mineralized intersection that starts at the surface. This should help expand the size of the company’s resource.

[/box]

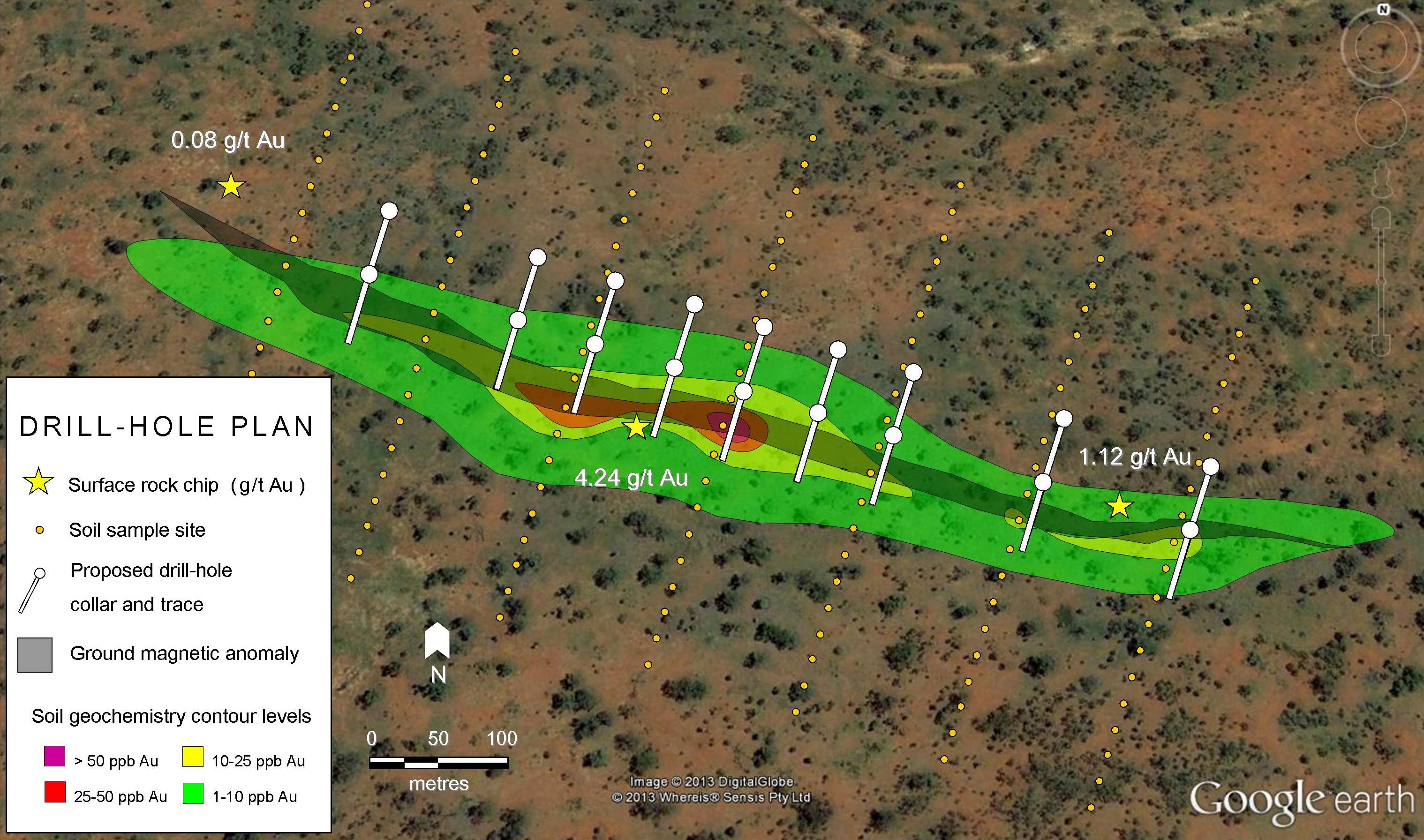

Far East Zone Exploration

The Far East Zone of the Wellgreen deposit is continuing to show significantly wider zones of mineralization than have been tested to date in other parts of the deposit. In addition, higher grade portions within these broad zones are demonstrating bulk mineable underground potential. This has made the Far East Zone a top priority for drilling, re-logging and sampling in 2013. Hole 215 was drilled from surface and targeted mineralization where previous drilling had identified a broad mineralized zone extending beyond the previously recognized main tabular Wellgreen deposit. Drill hole 215 was collared approximately 300 metres south and on the next section east of holes 160 and 165 in the Far East Zone. The cross section in Figure 1 below shows the 756 metre intercept in hole 215 and its relationship with the mineralization intercepted in holes 154, 205 and 195. As can be seen in the cross section, the broad zone of mineralization these holes intercepted remains open to the south, north, east and at depth. Additional results are anticipated to follow from the re-logging and re-sampling of historic holes to the east and west of hole 215.

[box type=”note” align=”aligncenter” ]

We’ve included the cross section diagram below. Note that other holes in the area have encountered similar low grade continuity, with the higher grades found at depth.

[/box]

Hole 154 intercepted five mineralized intervals totalling 457 metres grading 1.95 g/t Pt Eq. (0.47% Ni Eq.), with a grade thickness of 891 g-m. Above hole 154, hole 205 intercepted 5 intervals totalling 305 metres grading 2.23 g/t Pt Eq. (0.53% Ni Eq.), with a grade thickness of 682 g-m but which ended in higher grade material and did not make it to its full target depth. Hole 195 was a shorter hole only drilled in the upper tabular zone, yet it intercepted three intervals totalling 94 metres grading 2.80 g/t Pt Eq. (0.67% Ni Eq.). Each of these drill holes contained higher grade mineralized zones of 28 to 44 metres grading between 3.8 g/t to 4.8 g/t Pt Eq. (0.92% to 1.16% Ni Eq.) which may be amenable to bulk underground mining methods. Future drilling from surface and underground will focus on extending the mineralization in the Far East Zone as well as delineating the extent and continuity of the higher grade zones with potential for targeting this material early in the anticipated mine plan.

Table 1 – Far East Drill Hole Intercept Highlights

| Drill Hole | Downhole | Base Metals | Precious Metals | Total Metals | |||||||||

| From | To | Width | Ni | Cu | Co | Ni Eq. | Pt | Pd | Au | 3E | Pt Eq. | Ni Eq. | |

| m | m | m | % | % | % | % | g/t | g/t | g/t | g/t | g/t | % | |

| WS-215* | 0 | 295 | 295 | 0.25 | 0.03 | 0.014 | 0.28 | 0.08 | 0.13 | 0.01 | 0.22 | 1.30 | 0.32 |

| 295 | 756 | 461 | 0.32 | 0.23 | 0.018 | 0.44 | 0.35 | 0.30 | 0.08 | 0.73 | 2.31 | 0.55 | |

| including | 561 | 626.6 | 65.6 | 0.56 | 0.45 | 0.026 | 0.78 | 0.70 | 0.46 | 0.17 | 1.33 | 4.19 | 1.00 |

| 2 intervals | 756.0 | 0.29 | 0.15 | 0.016 | 0.38 | 0.24 | 0.23 | 0.05 | 0.53 | 1.92 | 0.46 | ||

| WS-154 * | 53.2 | 218.2 | 165.0 | 0.25 | 0.15 | 0.015 | 0.33 | 0.25 | 0.23 | 0.04 | 0.52 | 1.88 | 0.45 |

| 293.8 | 306.6 | 12.8 | 0.16 | 0.29 | 0.015 | 0.29 | 0.52 | 0.31 | 0.15 | 0.98 | 2.16 | 0.51 | |

| 353.1 | 625.8 | 272.6 | 0.27 | 0.23 | 0.016 | 0.38 | 0.34 | 0.27 | 0.06 | 0.67 | 2.23 | 0.53 | |

| 3 intervals | 450.5 | 0.26 | 0.20 | 0.016 | 0.36 | 0.31 | 0.26 | 0.06 | 0.63 | 2.10 | 0.50 | ||

| WS-195 * | 65.0 | 118.7 | 53.7 | 0.28 | 0.11 | 0.015 | 0.35 | 0.18 | 0.26 | 0.03 | 0.46 | 1.90 | 0.45 |

| 132.9 | 144.5 | 11.6 | 0.36 | 0.32 | 0.021 | 0.51 | 0.43 | 0.34 | 0.08 | 0.85 | 2.94 | 0.70 | |

| 161.2 | 190.0 | 28.8 | 0.72 | 0.55 | 0.036 | 0.99 | 0.55 | 0.44 | 0.09 | 1.07 | 5.11 | 1.22 | |

| including | 184.0 | 190.0 | 6.0 | 2.26 | 1.55 | 0.103 | 3.02 | 1.39 | 1.13 | 0.20 | 2.71 | 15.03 | 3.61 |

| 3 intervals | 94.1 | 0.43 | 0.27 | 0.022 | 0.57 | 0.32 | 0.32 | 0.05 | 0.70 | 3.01 | 0.72 | ||

| WS-196 | 67.8 | 135.7 | 67.9 | 0.29 | 0.14 | 0.016 | 0.37 | 0.20 | 0.26 | 0.04 | 0.50 | 2.01 | 0.48 |

| 147.8 | 162.3 | 14.5 | 0.25 | 0.24 | 0.018 | 0.37 | 0.37 | 0.26 | 0.11 | 0.74 | 2.25 | 0.53 | |

| 178.0 | 194.0 | 16.0 | 0.44 | 0.73 | 0.030 | 0.76 | 0.85 | 0.44 | 0.19 | 1.48 | 4.58 | 1.09 | |

| 3 intervals | 98.5 | 0.31 | 0.25 | 0.018 | 0.43 | 0.33 | 0.29 | 0.07 | 0.69 | 2.46 | 0.59 | ||

| WS-202 | 43.0 | 65.5 | 22.5 | 0.30 | 0.10 | 0.017 | 0.37 | 0.16 | 0.25 | 0.02 | 0.44 | 1.96 | 0.47 |

| 71.5 | 106.5 | 35.0 | 0.31 | 0.13 | 0.017 | 0.39 | 0.23 | 0.29 | 0.03 | 0.55 | 2.15 | 0.51 | |

| 141.4 | 186.2 | 44.8 | 0.30 | 0.12 | 0.016 | 0.37 | 0.22 | 0.24 | 0.03 | 0.49 | 1.99 | 0.48 | |

| 193.0 | 260.0 | 67.0 | 0.26 | 0.07 | 0.016 | 0.32 | 0.11 | 0.19 | 0.02 | 0.32 | 1.61 | 0.39 | |

| 4 intervals | 169.3 | 0.29 | 0.10 | 0.016 | 0.35 | 0.17 | 0.23 | 0.02 | 0.43 | 1.87 | 0.45 | ||

| WS-203 | 43.0 | 325.0 | 282.0 | 0.28 | 0.13 | 0.016 | 0.35 | 0.21 | 0.24 | 0.05 | 0.50 | 1.94 | 0.46 |

| WS-204 | 42.0 | 122.4 | 80.4 | 0.28 | 0.10 | 0.016 | 0.34 | 0.17 | 0.23 | 0.02 | 0.43 | 1.83 | 0.44 |

| 129.4 | 147.0 | 17.6 | 0.27 | 0.11 | 0.015 | 0.34 | 0.19 | 0.25 | 0.02 | 0.46 | 1.86 | 0.44 | |

| 152.4 | 207.0 | 54.6 | 0.28 | 0.33 | 0.017 | 0.43 | 0.42 | 0.30 | 0.08 | 0.80 | 2.55 | 0.61 | |

| 258.0 | 312.0 | 54.0 | 0.10 | 0.13 | 0.011 | 0.17 | 0.18 | 0.10 | 0.07 | 0.35 | 1.03 | 0.25 | |

| 393.4 | 489.0 | 95.6 | 0.27 | 0.11 | 0.017 | 0.34 | 0.33 | 0.26 | 0.02 | 0.61 | 1.98 | 0.47 | |

| 5 intervals | 302.2 | 0.24 | 0.15 | 0.016 | 0.33 | 0.27 | 0.23 | 0.04 | 0.54 | 1.87 | 0.44 | ||

| WS-205 * | 44.0 | 145.7 | 101.7 | 0.30 | 0.10 | 0.017 | 0.37 | 0.19 | 0.24 | 0.02 | 0.45 | 1.94 | 0.46 |

| 155.0 | 185.0 | 30.0 | 0.27 | 0.35 | 0.018 | 0.43 | 0.54 | 0.35 | 0.14 | 1.03 | 2.78 | 0.66 | |

| 197.0 | 241.1 | 44.1 | 0.35 | 0.88 | 0.026 | 0.73 | 0.56 | 0.31 | 0.20 | 1.07 | 4.02 | 0.96 | |

| 261.3 | 299.0 | 37.7 | 0.12 | 0.22 | 0.012 | 0.23 | 0.20 | 0.10 | 0.05 | 0.35 | 1.27 | 0.30 | |

| 363.1 | 455.0 | 91.9 | 0.34 | 0.16 | 0.016 | 0.43 | 0.33 | 0.38 | 0.03 | 0.74 | 2.50 | 0.60 | |

| 5 intervals | 305.4 | 0.30 | 0.27 | 0.018 | 0.43 | 0.32 | 0.28 | 0.07 | 0.67 | 2.41 | 0.57 | ||

| WS-215 * | 0 | 756 | 756 | 0.29 | 0.15 | 0.016 | 0.38 | 0.24 | 0.23 | 0.05 | 0.53 | 2.07 | 0.49 |

| including | 295.0 | 756.0 | 461.0 | 0.32 | 0.23 | 0.018 | 0.44 | 0.35 | 0.30 | 0.08 | 0.73 | 2.50 | 0.60 |

| including | 561 | 626.6 | 65.6 | 0.56 | 0.45 | 0.026 | 0.78 | 0.70 | 0.46 | 0.17 | 1.33 | 4.49 | 1.07 |

| * Drill holes highlighted on section | |||||||||||||

Footnotes to Drill Interval Tables and Figures: (1) Nickel equivalent (Ni Eq. %) and platinum equivalent (Pt Eq. g/t) calculations reflect total gross metal content using US$ of $7.58/lb nickel (Ni), $2.85/lb copper (Cu), $12.98/lb cobalt (Co), $1270.38/oz platinum (Pt), $465.02/oz palladium (Pd) and $1102.30/oz gold (Au) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are a 20% reduction of the LME 3-year trailing average metal prices as presented in the Company’s technical report entitled “Wellgreen Project, Preliminary Economic Assessment, Yukon Canada” dated August 1, 2012 (the “2012 Wellgreen PEA”) and prepared by Andrew Carter, C.Eng., Pacifico Corpuz, P. Eng., Philip Bridson, P.Eng., and Todd McCracken, P.Geo., of Tetra Tech Wardrop Inc. The 2012 Wellgreen PEA is available under the Company’s profile on SEDAR at www.sedar.com. (2) Ni Eq. % and Pt Eq. g/t in “Base Metals” and “Precious Metals” columns only refers to equivalents of base and precious metals respectively, not total metals. In the “Total Metals” column the Pt Eq. includes both base and precious metals, as does the NiEq. (3) 3E represents the sum of platinum, palladium and gold, measured in g/t. (4) Significant interval defined as a minimum 15 g-m Pt Eq. interval. (5) Cutoff grade of 0.2% Ni Eq. (6) Internal dilution up to six continuous metres of <0.2% Ni Eq. (7) Some rounding errors may occur. (8) True thicknesses have not been measured.

[box type=”note” align=”aligncenter” ]

Let’s take a closer look at the drill results. While 756 m of 1.92 g/t PtEq (platinum equivalent) sounds pretty decent, the actual assay results don’t sound nearly as impressive on their own.

According to the company, the first 300 m of the hole grade at 1.3 g/tPtEq or 0.32% NiEq and contain

- 0.08 g/t pllatinum

- 0.13 g/t palladium

- 0.01 g/t gold and

- 0.28% total of nickel, copper and cobalt.

The company’s Eq calculations use three year market average as of the time of their July 2012 economic report. They are using an optimistic market price of $7.58 for nickel, but they are also using a price of $465 for palladium which is well below the current price of $700. Other commodities are more or less in line with current market rates.

If we use current rates for calculating the metal equivalents at $6.00 nickel, $3.00 copper, $1200 gold and platinum and $700 at 100% recovery we get:

- NiEq 0.34%

- PtEq 1.18g/t

- PdEq 2.01g/t

The lower nickel prices bring down the PtEq to 1.18 g/t, not far off from what was reported. However, if we also factor in the recovery rates that they have used in their [tooltip text=”economic report” gravity=”nw”]Based on “Wellgreen Project Preliminary Economic Assessment, Yukon, Canada” dated August 1, 2012 by Wardrop; resource estimated at 0.2% NiEq cut-off, and the following metal recoveries: 67.6% for Ni, 87.8% for Cu, 64.4% for Co, 46% for Pt, 72.9% for Pd, and 58.9% for Au.[/tooltip], we get the following:

- NiEq 0.23%

- PtEq 0.79g/t

- PdEq 1.35g/t

It is likely that the company set a cut-off grade of 0.2% nickel in order to be able to include this shallow zone in the resource calculation, but it really shouldn’t be. A grade of 0.2% will likely never be economic, especially in the Yukon where costs are much higher. Even 0.5% is pushing it except maybe at $10+ nickel prices.

If we look at the 65 m higher grade, but deeper interval at today’s market rates and the same published recovery rates we get:

- NiEq 0.86%

- PtEq 2.93g/t

- PdEq 5.03g/t

This interval definitely has a better chance of being economic. What does this mean? At best, the shallow zone is a low grade zone loss-leader with minor metal credits to keep the mill busy on a slow day. At worst, it is waste rock. Regardless, the higher grade zones may be economic and if we separate out the shallow cap there is still a decent resource.

Prophecy’s task will be to further define the extent of the higher grade zone and hope that nickel prices eventually recover.

[/box]

2013 Field Program Update

The 2013 field program at Prophecy Platinum’s Wellgreen project is nearly complete for the season with drilling anticipated to conclude by month end. Additional updates will be issued by the Company over coming months as results are received and interpreted. The 2013 program consisted of a combination of approximately 4,735 metres of new drilling in 29 drill holes for exploration and environmental monitoring, along with assaying another 8,136 metres of core from approximately 21,784 metres of historical drill core that had previously only been selectively sampled (Table 2). Wellgreen was historically evaluated as a narrow high grade underground mine only targeting semi-massive and massive sulphide mineralization. The current approach to potential mining will employ both open pit and bulk underground mining methods that target both the disseminated sulphide mineralization and the high grade mineralized zones it surrounds that were the focus of historic work.

Advancement of Metallurgical Optimization Test Work

Metallurgical optimization test work continues on representative samples from disseminated mineralization at Wellgreen. Testing has focused on optimizing the process flow sheet and grind size of the mineralized samples. Current work has been advanced using a staged copper flotation process followed by nickel flotation, which could be used to produce separate copper and nickel concentrates as well as a bulk concentrate. Magnetic separation is being assessed as part of the flowsheet to confirm possible increases in metal recoveries to concentrates and improvements in concentrate quality. The magnetic separation process occurs in the flowsheet after the copper flotation circuit and before the nickel flotation circuit. It is believed this additional process step will increase overall PGM and copper recovery, decrease copper that reports to the nickel concentrate, and allow a much more aggressive flotation in the nickel circuit due to the removal of most of the non-nickel sulphide material before it enters the nickel circuit. Testing is ongoing at this time with Locked Cycle Tests pending. Magnetic separation may also create an option to produce a separate PGM concentrate, which Prophecy Platinum will investigate in future testing. Based on the preliminary test work that has been completed this year, results are confirming improvement over the recovery levels used in the Wellgreen PEA.

Prophecy Platinum also continues to review the potential addition of value from the significant rare PGM enrichment (i.e. rhodium, iridium, osmium and ruthenium) that is present within the Wellgreen deposit. These rare PGMs were not considered in the 2012 Wellgreen PEA but were recognized by Sumitomo in the smelting of concentrates produced during underground mining and milling operations at Wellgreen in the 1970s by Hudbay Minerals.

Environmental and Engineering Update

During 2013, the Company completed drilling and instrumentation of 18 groundwater wells at nine separate sites at Wellgreen that will be monitored in parallel with the environmental baseline monitoring program initiated in Q4 2012. In addition, the Company continues with its baseline environmental data collection to allow for the initiation of the Yukon environmental assessment process beginning in 2014.

Studies have also been initiated to select optimal locations for mine infrastructure, which includes the camp, mill, water treatment plant and the tailings storage facility. In addition, engineering studies are under way to look at optimizing the project using a staged production approach that will reduce pre-production capital requirements and allow the Company to consider additional project financing options. In parallel, Prophecy Platinum will continue to evaluate various larger-scale production scenarios that will highlight the full potential of the Wellgreen project.

About Prophecy Platinum

Based in Vancouver, Canada, Prophecy Platinum Corp. is a platinum group metals exploration and development company with advanced projects in the Yukon Territory, Ontario, and Manitoba, Canada. Our 100% owned Wellgreen PGM-Ni-Cu project, located in the Yukon, is one of the world’s largest undeveloped PGM deposits and one of the few significant PGM deposits outside of southern Africa or Russia. Our Shakespeare PGM-Ni-Cu project is a fully-permitted, production-ready brownfield mine located in the well-established Sudbury mining district of Ontario, and our Lynn Lake project is a former operating mine located in Manitoba, Canada.

Our experienced management team has an extensive track record of successful, large-scale project discovery, development, permitting, operations and financing combined with an entrepreneurial approach to sustainability and collaboration with First Nations and communities. Our shares are listed on the TSX Venture Exchange under the symbol “NKL” and on the US OTC-QX market under the symbol “PNIKF”.

[box type=”note” align=”aligncenter” ]

I like that the company has provided a fairly detailed statement on its quality control procedures (below). Read more about QA/QC procedures.

[/box]

Quality Assurance, Quality Control: The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). The Wellgreen project geological technical information was prepared under the supervision of Neil Froc, P. Eng., Prophecy Platinum’s Wellgreen Project Manager, who is a “Qualified Person” as defined in NI 43-101 and the person who oversees exploration activities on the project. All other technical information was prepared under the supervision of John Sagman, P.Eng., Prophecy Platinum’s Senior Vice President and Chief Operating Officer and a “Qualified Person” as defined in NI 43-101. In addition, Mr. Sagman has reviewed and approved the technical information contained in this news release.

Prophecy Platinum executes a quality control program to ensure data verification using best practices in sampling and analysis. Samples are cut for assay with the remaining sample retained for reference. Blanks, Standard Reference Material (“SRM”), and duplicates were inserted into the sample stream every 25th sample. A duplicate sample is sawn in half and then sawn in half again. The quartered core is then placed into two different sample bags with different sample numbers and sealed. The SRM material comes from Natural Resources Canada and Analytical Solutions Limited. These were inserted into the sample stream immediately after the second duplicate. The SRMs used are OREAS 13P, WMS-1a, WPR-1, WGB-1, and WMG-1. Sample Blanks are obtained from garden marble from hardware stores in Whitehorse, Yukon. Assayed samples are transported in sealed and secured bags for preparation at Acme Analytical Laboratories (Vanc) Ltd. or ALS Global Prep Lab located in Whitehorse, Yukon. Pulverized (pulp) samples are shipped for analysis to Acme Analytical Laboratories (Vanc) Ltd. or ALS Global l in Vancouver, B.C. Platinum, palladium and gold were determined by lead fusion fire assay with an ICP atomic emission spectrometry finish. Copper, nickel and cobalt were determined by four-acid digestion followed by an ICP atomic emission spectrometry finish. Acme Analytical Laboratories (Vanc) Ltd. and ALS Global are ISO/IEC 17025:2005 accredited laboratories and registered under ISO 9001: 2000. Acme Analytical Laboratories (Vanc) Ltd. and ALS Global independent from the Company.

Quality assurance and quality control are monitored using scatterplots, Thompson-Howarth plots and statistical analysis to ensure duplicates, blanks and standard data are reliable, and indicate robustness of overall results. ALS Global quality-assurance procedures are also included in this process.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]