While not technically inaccurate, its not completely straightforward. A more accurate statement might be, “Drilling results extend zone along 710 vein.” A perfectly acceptable statement that I wish they would have used.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Please view original release here.[/box]

WINNIPEG, MANITOBA–(Marketwired – Nov. 20, 2013) – San Gold Corporation (TSX:SGR)(OTCQX:SGRCF) today provided updated drilling results from its underground program on 26 Level of the Rice Lake mine.

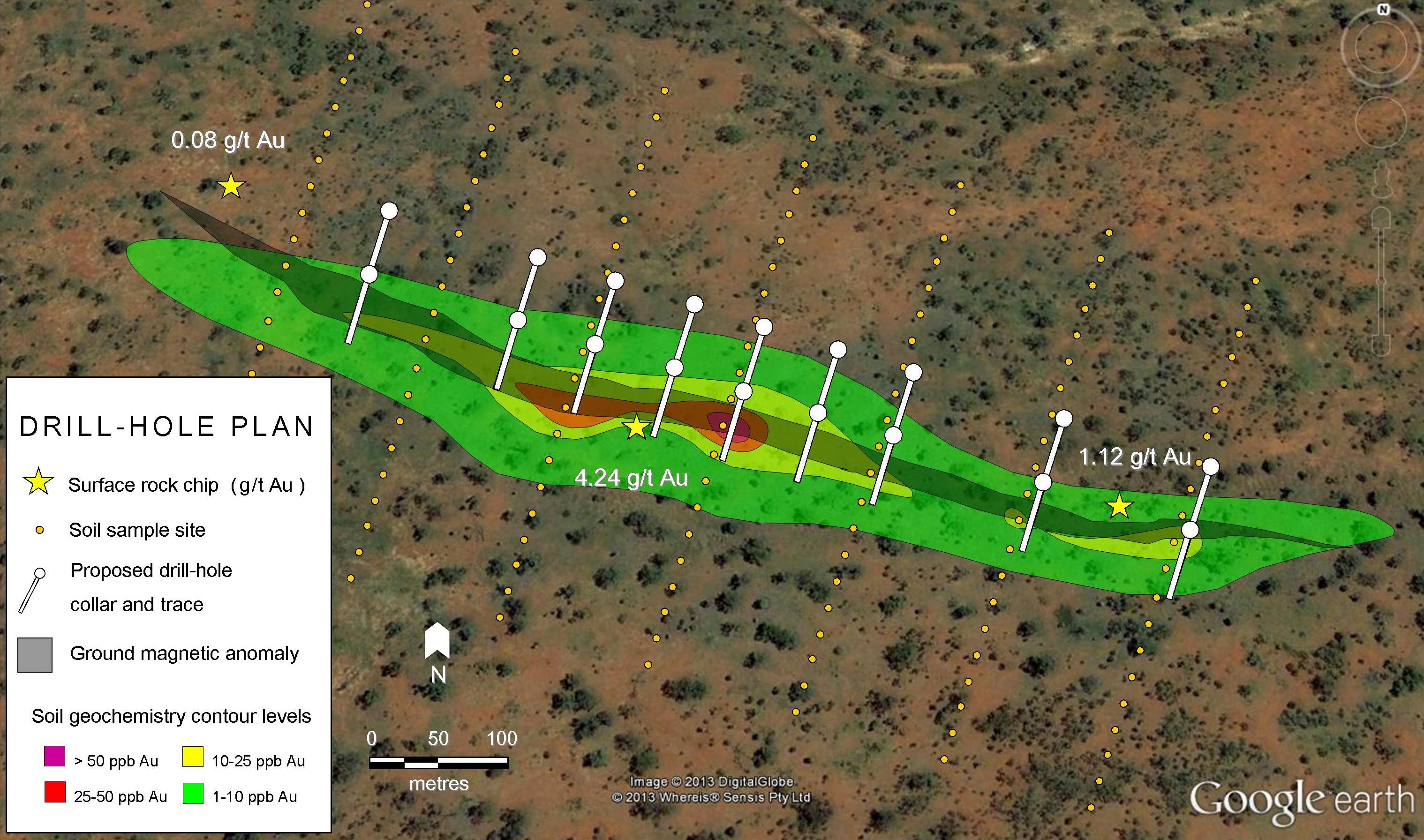

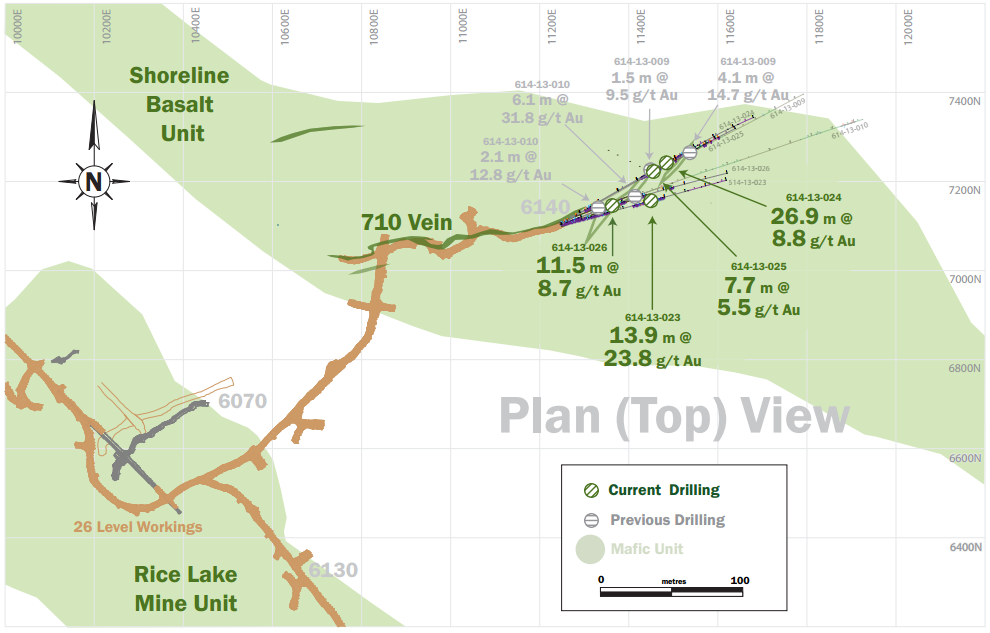

Drilling results at the eastern extent of the 710 zone continue to return high grade gold values over significant widths. This newly discovered 710 HW zone is located in the hanging wall of the 710 zone and is interpreted to be the down dip extension of the 007 zone. The 710 HW zone is within 100 metres of the new 26 level development and is therefore easily accessible. Recent highlights include drill hole 614-13-023 which returned 23.8 g/t Au over 13.9 metres and drill hole 614-13-024 which returned 8.8 g/t Au over 26.9 metres.

[box type=”note” align=”aligncenter” ]

The last time we talked about small Canadian gold miner, San Gold, we wondered aloud if the company would be meeting it’s goals of trimming costs, increasing grades and ultimately turning a profit. Following the release of their third quarter financials a few weeks ago the answer has become apparent. While the company was able to reduce expenses by a slim margin, their average grade dropped by 19% from last quarter down to 4.24 g/t and the company posted a another loss. So far they have lost $0.06/share for the year compared to $0.03 last year.

So does today’s news matter? Let’s find out.

[/box]

“We are extremely pleased with the success of the 710 HW drilling program which continues to expand this zone of gold mineralization. This zone represents an excellent opportunity to provide high grade incremental mill feed and to increase overall grade going forward. Capital expenditure to develop this region is expected to be minimal as mining has already commenced,” said Ian Berzins, San Gold’s President, CEO and Chief Operating Officer.

Initial interpretation of the 710 HW zone indicates true thickness to be between 30% and 70% of core length. This will be confirmed as mining operations proceed in this region. The following table provides recent highlights of this drilling.

[box type=”note” align=”aligncenter” ]

Before we examine the intersections reported in the drilling, note that the reported thickness is estimated by the company to be between 30 and 70% of the true width. If one examines the plan view diagram of the reported drill holes, you can see why: They are drilling subparallel to the 710 vein. In an underground mine it can be hard to do anything else except drill in the direction you are headed, but it does seriously skew the drill intervals.

[/box]

| Hole Number | Zone | From (m) |

To (m) |

Core Length (m) |

Grade* (g/t Au) |

Depth (m) |

| 614-13-023 | 710 HW | 54.1 | 68.0 | 13.9 | 23.8 | 1156 |

| Including | 57.7 | 63.2 | 5.5 | 53.3 | ||

| 614-13-024 | 710 HW | 71.2 | 98.1 | 26.9 | 8.8 | 1159 |

| Incl. | 71.2 | 77.5 | 6.3 | 13.9 | ||

| Incl. | 82.8 | 89.6 | 6.9 | 14.7 | ||

| Incl. | 95.8 | 98.1 | 2.3 | 22.9 | ||

| 614-13-025 | 710 HW | 69.6 | 77.3 | 7.7 | 5.5 | 1184 |

| Incl. | 69.6 | 71.7 | 2.1 | 13.5 | ||

| 614-13-026 | 710 HW | 32.7 | 44.2 | 11.5 | 8.7 | 1182 |

| Incl. | 35.2 | 39.9 | 4.7 | 18.6 | ||

| 614-13-009** | 710 HW | 72.2 | 73.6 | 1.5 | 9.5 | 1173 |

| 710 HW | 98.6 | 102.7 | 4.1 | 14.7 | 1173 | |

| 614-13-010** | 710 HW | 19.2 | 21.3 | 2.1 | 12.8 | 1172 |

| Incl. | 19.5 | 20.1 | 0.6 | 37.0 | ||

| 710 HW | 51.1 | 57.3 | 6.1 | 31.8 | 1172 | |

| Incl. | 52.1 | 53.6 | 1.5 | 61.4 |

* Assay values are capped at 102.8 g/t Au (3 oz per ton Au). ** Updated from November 4, 2013.

[box type=”note” align=”aligncenter” ]

Even though they are drilling along the vein and not across, it does show us that there are some good grades in this zone. Let’s take a closer look.

First, we’ll remove the drill highlights to see what the average grades were for the intervals outside the “including” intervals. We end up with residual grade that ranges from 0 g/t (614-13-024) to 4.49 g/t (614-13-023). What this essentially means is that outside of the “including” intervals the grades are below average to zero. My biggest problem with these results is that according to the data provided, hole 614-13-024 includes 11 meters of barren rock which should not have been reported as part of a gold bearing interval. While it could be argued that the for an operating mine that takes out larger blocks of ore the average grades are most important, the results don’t give us a lot of confidence in the company’s reporting. This is especially true when we consider that the company miscalculated their projected grade for the previous quarter by almost 20%.

So is there good news here? There appears to be a narrow moderate to high grade vein at this level and the company has managed to find continuity for some length. This extends the current zone and gives them something to mine that should be at or possibly above their current mill grade. Not great news, but better than nothing for current shareholders.

At the top of this release San Gold sates that, “Drilling results at the eastern extent of the 710 zone continue to return high grade gold values over significant widths.”

While not technically inaccurate, its not completely straightforward. A more accurate statement might be, “Drilling results extend zone along 710 vein.” A perfectly acceptable statement that I wish they would have used.

[/box]

The 710 HW zone is located at the eastern extent of known mineralization at 26 Level of the Rice Lake mine and remains open to the east and northeast. It was identified as part of the Company’s ongoing structural analysis to refine the its exploration model.

This program was carried out by San Gold mine geologists under the supervision of Michael Michaud, P.Geo., the Qualified Person for San Gold under National Instrument 43-101 who has reviewed and approved this news release. Underground drill core samples are assayed on site in the Company’s assay lab using the fire assay method with an AA and gravimetric finish. San Gold’s quality control and assurance program includes the insertion of standards, the retention of pulps and rejects, and spot checks utilizing independent labs including Accurassay Laboratories of Thunder Bay, ON and Acme Analytical Laboratories Ltd in Winnipeg, MB.

[box type=”note” align=”aligncenter” ]

More about QA/QC procedures.

[/box]

About San Gold

San Gold is an established Canadian gold producer, explorer, and developer that owns and operates the Rice Lake Mining Complex near Bissett, Manitoba. The Company employs more than 420 people and is committed to the highest standards of safety and environmental stewardship. San Gold is on the Toronto Stock Exchange under the symbol “SGR” and on the OTCQX under the symbol “SGRCF”.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]