The McArthur River mine is the world’s largest high grade uranium mine located in northern Saskatchewan, Canada. The mine was discovered in 1988 and has been in production since 1999. It is currently operated by Cameco (TSX:CCO, NYSE:CCJ) who owns 70% of the operation. The other 30% is owned by French multinational, Orano (formerly Areva). Proven and probable mine reserves are 2.568 Mt at 6.72% U3O8, for 380.5 Mlb U3O8. Recover is an impressive 99%. Measured and indicated resources are relatively small at 139.3 kt conatining 7 Mt U3O8.

In Q2 2024 McArthur River produced 6.2 Mlb U3O8. Cameco’s Key Lake Mill, which processes the McArthur River ore, has produced nearly 550 Mlb U3O8 since 1983: enough to power New York City for about 175 years. The mining operation is underground and is carried out via remote controlled mining methods in order to ensure the safety of the the workers.

Regional Geology

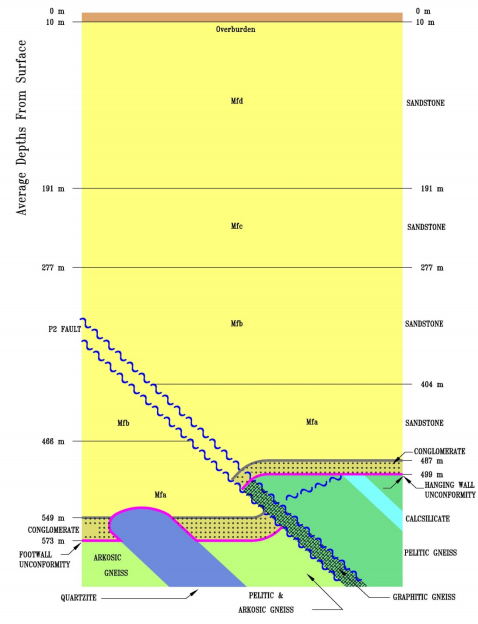

The McArthur deposit is located in the southeastern part of the Athabasca Basin. This portion of the basin consists of a sandstone and conglomerate package known as the Helikian Athabasca Group. The Helikian Athabsaca group unconformably overlies the Wollaston Domain, archean age (2.2 Billion year old) metamorphic rocks.

Deposit Geology

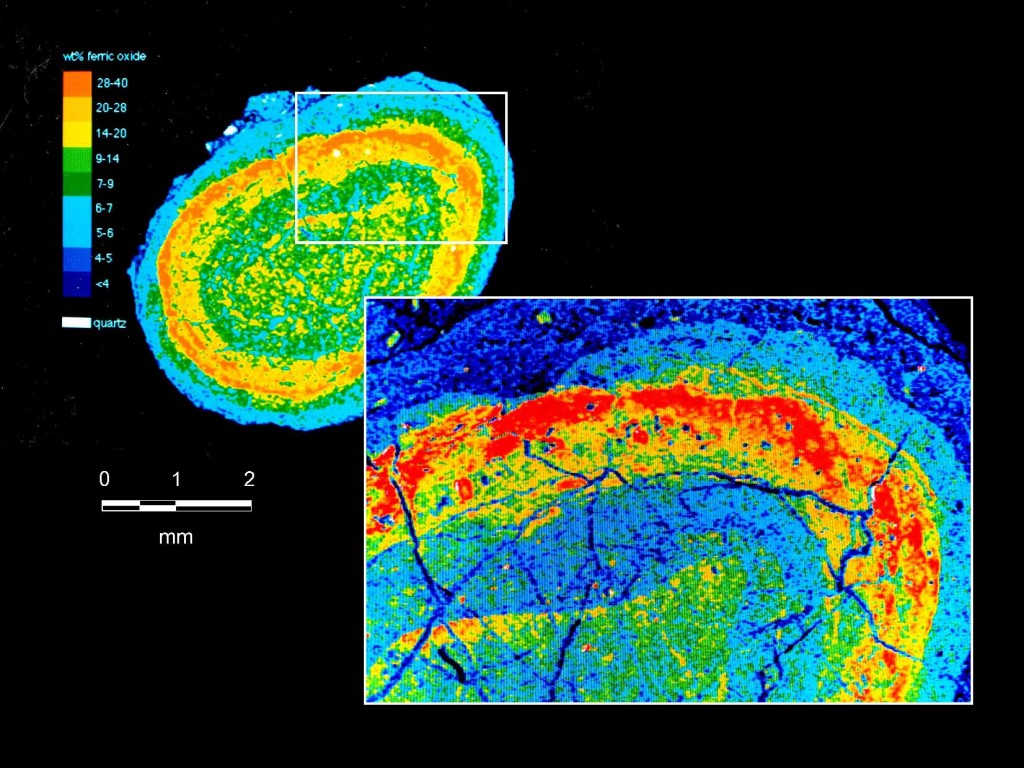

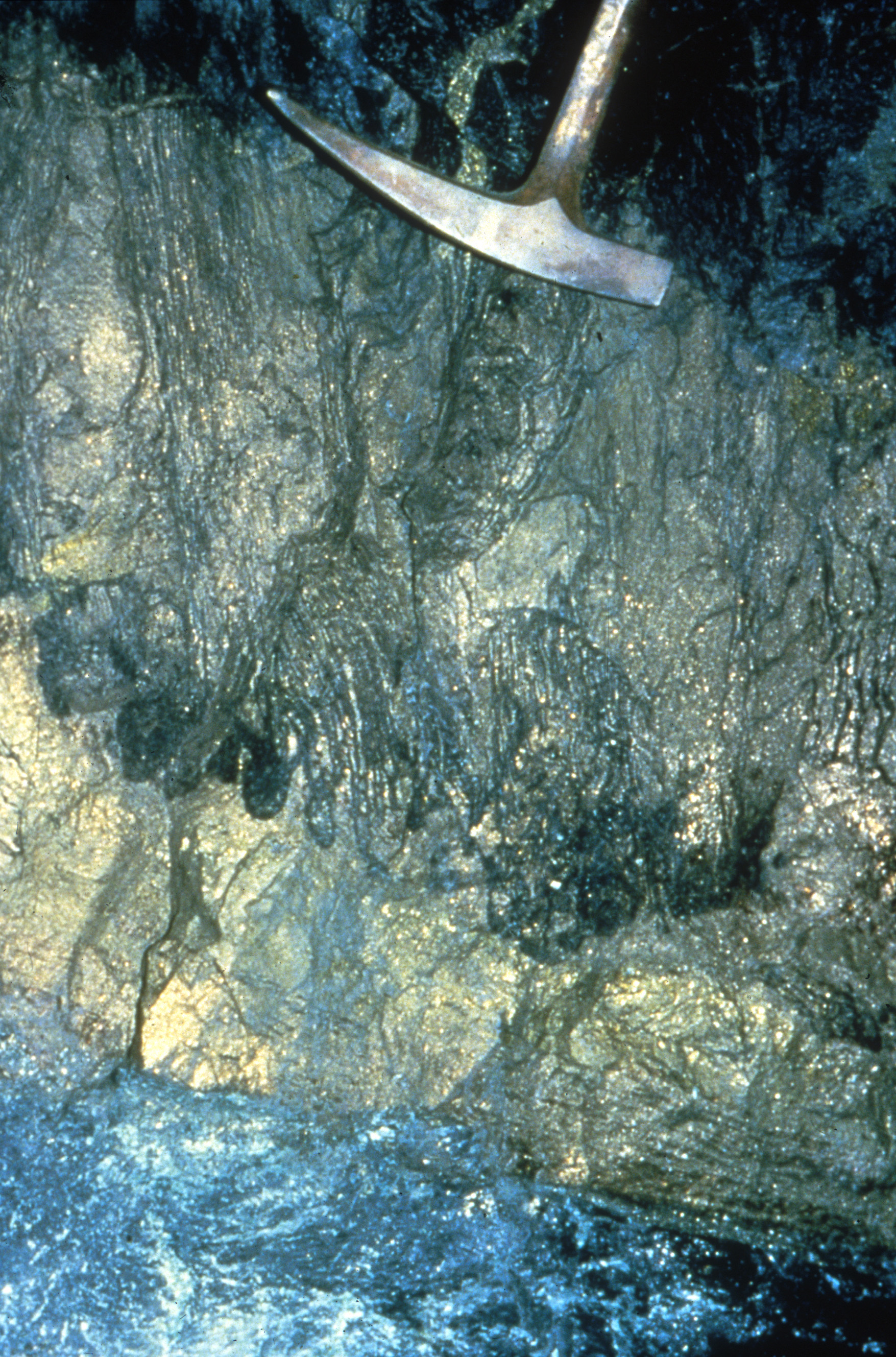

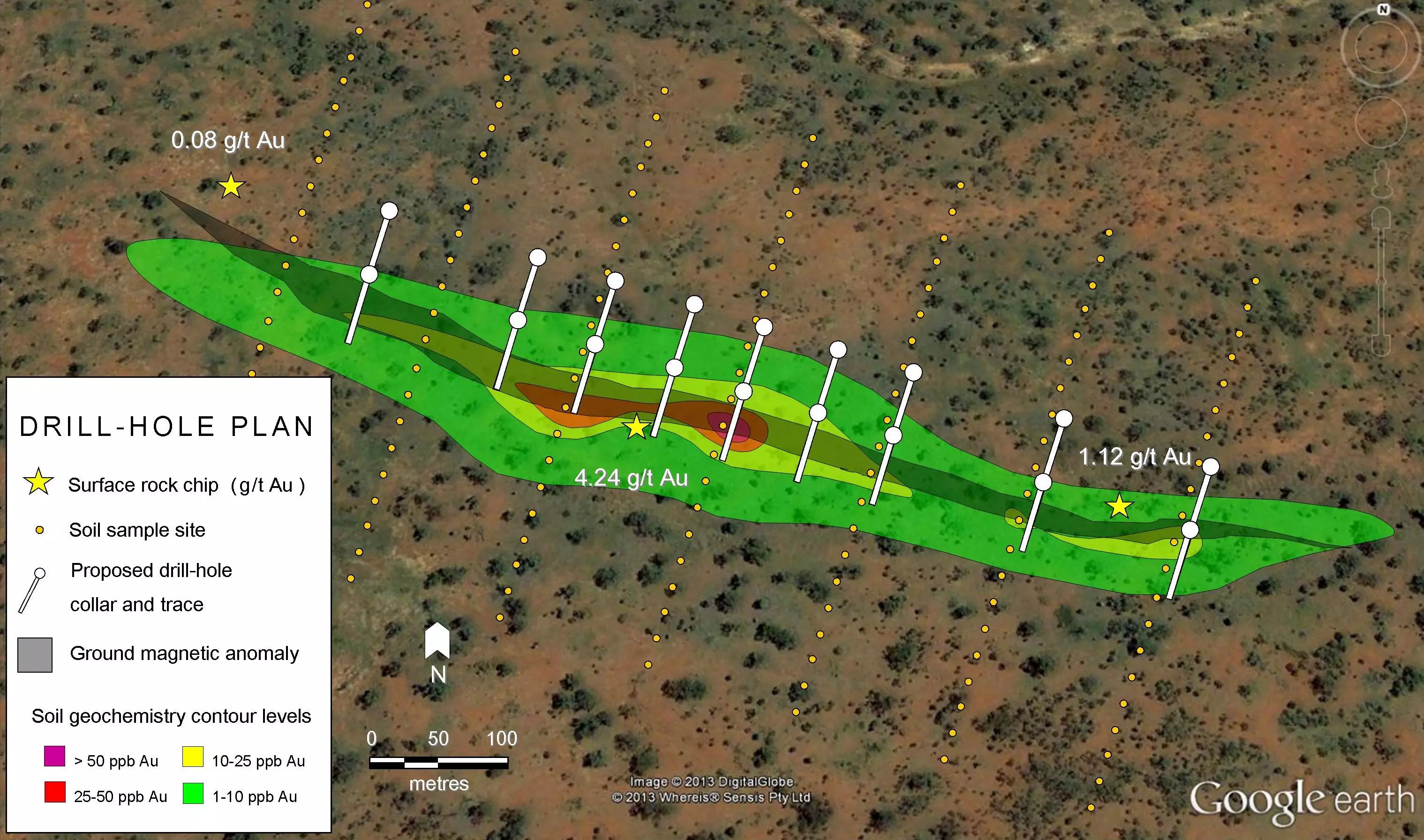

Uranium in the McArthur deposit is structurally hosted within the P2 fault and is classified as an unconformity-related uranium deposit. Mineralization occurs between 500 and 640m depth. Most of the mineralization occurs within metamorphic rocks below the Athabasca sedimentary basin, but the orebody extends somewhat into the overlying basin sandstones as well. These rocks are so porous and waterlogged that Cameco freezes them with -32 degree brine to prevent the mine from flooding.

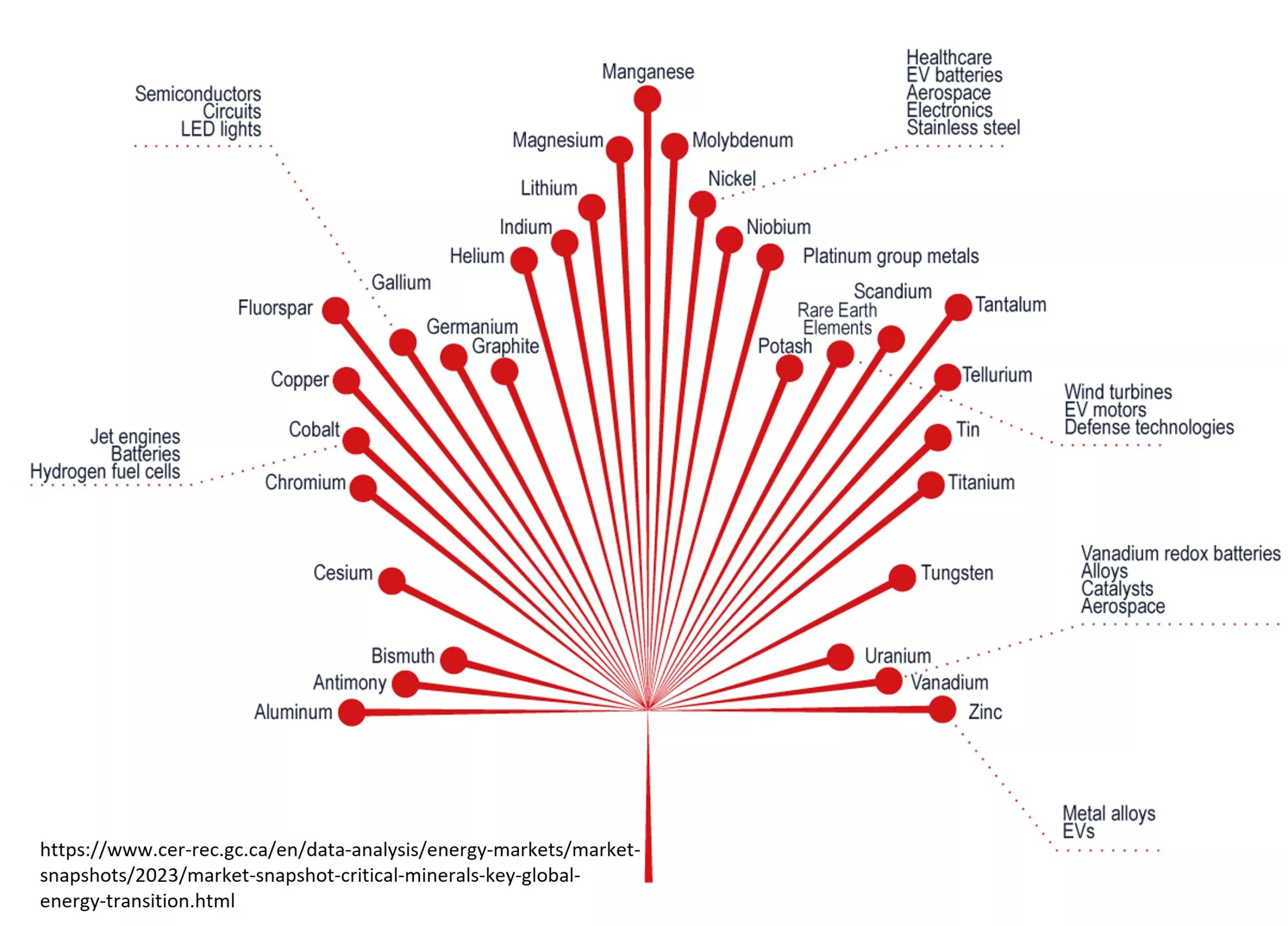

McArthur River is considered a ‘monometallic’ unconformity-related deposit because it doesn’t contain substantial amounts of other metals such as nickel, cobalt, and gold, which are often found in ‘polymetallic’ unconformity-related deposits. Uranium occurs mainly in the mineral uraninite (UO2). Metallic sulfides are also found within the primary uraninite mineralization including pyrite (iron sulfide), chalcopyrite (copper-iron sulfide) and galena (lead sulfide). Galena is formed mainly through the slow radioactive decay of uranium to lead.

Discussion

McArthur River is something of a unique deposit. A deposit with only a few million tonnes of ore would normally be of little significance, but McArthur River so high grade (over 100x higher than many operations) that its production accounts for ~10% of global uranium supply. Operating costs are relatively high, so in 2018, with uranium prices hovering around $20/lb, Cameco suspended operations. By 2022 prices returned to ~$40/lb, prompting Cameco to restart production. This move was well timed, years of uranium oversupply have come to an end, and prices jumped to over $80/lb by early 2024.

Cameco is an elephant in the industry, producing nearly 15% of global uranium production from it’s mines. The company also provides nuclear fuel processing and manufacturing services. And they consistently pay dividends to investors. So while the junior uranium explorers may struggle in an uncertain market, big players like Cameco and the world-class McArthur mine are likely to weather the downturn without too many scars.