In general, the reported grades appear consistent with previous drilling elsewhere on the property, though these results appear to be shallower than many of the previous intercepts.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

NV Gold Corporation (TSX VENTURE:NVX) (“the Company”) announced today that the 14-hole drill program recently completed on its newly-acquired Rattlesnake Hills Project in Natrona County, Wyoming has intercepted significant gold mineralization at Blackjack, a previously undrilled target on the property.

[box type=”note” align=”aligncenter” ]The last time we talked about NV Gold was when they announced the beginning of this year’s RC drilling program. Though the advantages of RC drilling are speed and cost-effectiveness, the 3 week turnaround from drilling to the release of assay results is still incredibly quick. This is no doubt related to the slow pace of activity in the junior mining sector. Assay labs can offer a quick turn-around since they’re just not that busy.

This release reports the first gold assays from the Blackjack target on NV Gold’s Rattlesnake property in Wyoming, USA.[/box]

Hole NVJ 001 intercepted 33.5 m grading 1.33 grams per tonne (or 1.33 ppm or 110 feet @ 0.039 ounces per ton (opt)). Hole NVJ 001 was mineralized throughout its entire length of 152 meters (500 feet), with an average grade for the entire hole of 0.556 g/t. The hole is the western-most hole in the program and therefore this new zone is open in that direction. The Company has not received the silver assays for Hole NVJ 001 and will report them separately when received. Hole NVJ 001 was transected by Hole NVJ 008 (-45 degrees), which passed Hole NVJ 001 at approximately 85 meters from its collar (60m south of Hole NVJ 001). Several intercepts were present in Hole NVJ 008, confirming the results in Hole NVJ 001. (See table below)

Two additional holes were completed to the east of Hole NVJ 001 to test lateral continuity. Holes NVJ 005 and NVJ 007 were drilled 50 meters and 90 meters east of Hole NVJ 001, respectively. Both holes were angle holes drilled to test the structure at 60-80 meters depth. Both holes encountered multiple intercepts of gold and silver mineralization. Importantly, mineralization is increasing in intensity and grade from east to west. Significant results from the Blackjack program are as follows:

| Hole | TD (m) | Intercept (m) | Length (m) | Au Grade (g/t) | Ag Grade (g/t) | Au Eq Grade (g/t) | Area or Zone | ||||||

| NVJ 001 | 152 | 0-152 | 152 | 0.556 | * | * | Blackjack | ||||||

| inc | 0-33.5 | 33.5 | 1.332 | * | * | ||||||||

| 43-60 | 17 | 0.518 | * | * | |||||||||

| 65.5-152 | 87 | 0.342 | * | * | |||||||||

| NVJ 002 | 76 | 0-12.2 | 12.2 | 0.384 | 1.33 | 0.40 | Blackjack | ||||||

| NVJ 003 | 116 | 0-12.2 | 12.2 | 0.423 | 1.33 | 0.44 | Blackjack | ||||||

| NVJ 004 | 76 | 0-20 | 20 | 0.201 | 1.39 | 0.22 | Blackjack | ||||||

| NVJ 005 | 152 | 0-12 | 12 | 0.446 | 1.10 | 0.46 | Blackjack | ||||||

| 46-58 | 12 | 0.545 | 3.63 | 0.60 | |||||||||

| 64-98 | 34 | 0.315 | 6.75 | 0.42 | |||||||||

| NVJ 007 | 152 | 111-122 | 11 | 0.860 | 11.44 | 1.04 | Blackjack | ||||||

| NVJ 008 | 136 | 0-14 | 14 | 0.352 | 1.09 | 0.37 | Blackjack | ||||||

| 38-46 | 8 | 0.286 | 6.86 | 0.39 | |||||||||

| 67.1-80.8 | 13.7 | 0.721 | 33.26 | 1.23 | |||||||||

| 81-96 | 15 | 0.235 | 7.18 | 0.35 | |||||||||

| 105-119 | 14 | 0.316 | 14.08 | 0.53 | |||||||||

| * Sample results not yet received | |

| Notes: | True widths of these intercepts cannot be determined with the information currently available. Au Equivalent is calculated using gold:silver of 1:65. |

[box type=”note” align=”aligncenter” ]In general, the reported grades appear consistent with previous drilling elsewhere on the property, though these result appear to be shallower than many of the previous intercepts. Perhaps most significant from these new results is the 152 meters (~500 feet) of 0.556 g/t gold from surface with the top 100 feet assaying at 1.332 g/t.

The company has also included a gold equivalent calculation for those intervals with silver assays in order to give us a better picture of the overall value. Gold equivalent calculations can be useful when comparing multi-metallic assay results, but since these types of calculations make use of current market values they are subject to fluctuating market conditions and price ratios. In this particular case the company has simply used a 1:65 ratio for the gold:silver value and has presented the AuEq as an “equivalent gold grade” based on this ratio.[/box]

Key observations are as follows:

- Seven of eight holes at Blackjack returned gold values of significance. Six of eight holes, so far, report silver values of interest, with Hole 1 remaining to report.

- Hole NVJ 001 was collared in strong mineralization and was mineralized throughout its entire length.

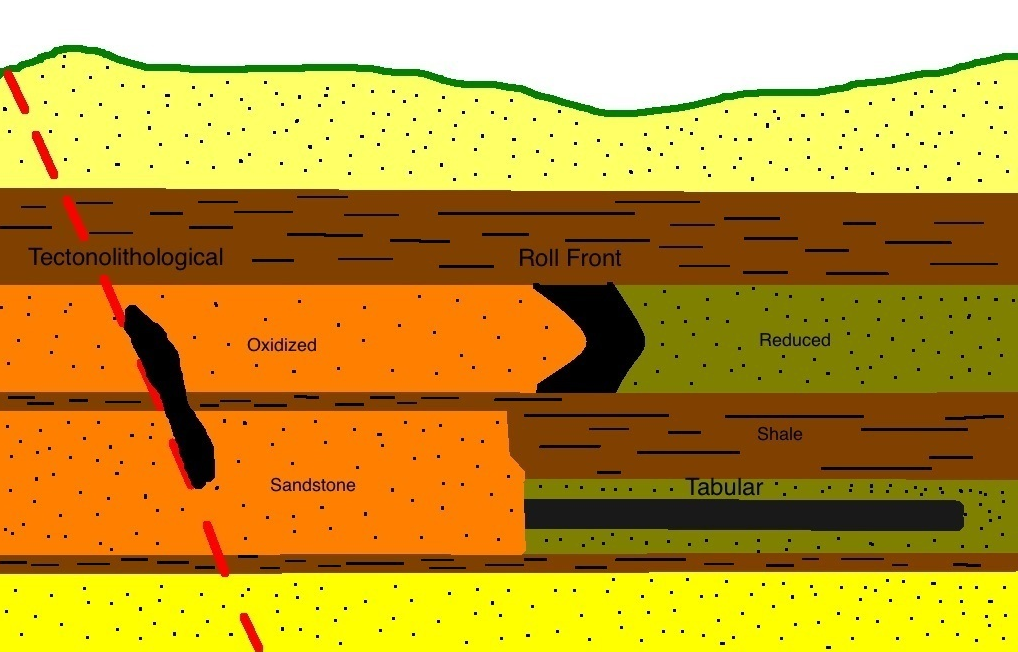

- Gold mineralization encountered in this drill program represents the first discovery of gold outside the two previously drilled deposits at North Stock and Antelope basin, located nearly 8 kilometers to the east, supporting the concept that Rattlesnake Hills could be a district-scale gold play.

- Results indicate that the Blackjack Zone is increasing in grade and intensity in an east to west direction. The strongest hole was on the western edge of the drilling and is open to the west and north and at depth.

Additionally, 6 holes were drilled at the Baldy Prospect, located on the northwestern portion of the property. Although there was no significant mineralization encountered in these holes, the alteration and structure was of interest and additional follow-up work will be undertaken.

[box type=”note” align=”aligncenter” ]The Baldy target was characterized by alteration and mineralization observed in float material (loose rock). Although float material may indicate the presence of local bedrock mineralization, it may not mean anything. Float can be the remains of long-eroded bedrock or represent material transported great distances by natural processes. In this case, drilling of the Baldy target didn’t produce any significant assay results, but the geologic data may help guide them to other targets.[/box]

John E. Watson, the Company’s President, said “This was the Company’s first exploration drilling program at Rattlesnake Hills and it has succeeded in its primary objective of discovering a new gold zone outside the two known, previously drilled deposits. The mineralization remains open to the west along strike and to the north. Both directions have geochemical sampling supportive of a successful follow-up program. We are very excited by these results and will be planning additional drilling at Blackjack and other targets in 2015.”

Exploration activities at the Rattlesnake Hills Gold project were conducted under the supervision of Michael B. Ward, P.Geo., a contract geologist of NV Gold who is not independent but is a Qualified Person under NI 43-101. Mr. Ward has approved this news release. Assays reported were conducted by ALS Chemex (Reno, Nevada and Vancouver, BC, Canada) using fire assay with an AA finish and ICP. The data verification procedures and QA/QC procedures followed for the recent drilling program involved inserting certified standards and blanks into the sample stream. Rig duplicates have been collected.

[box type=”note” align=”aligncenter” ]It’s important to have a good QA/QC program in order to ensure that assay results are accurate. The company describes their quality assurance program above.

NV Gold’s stock reached a 52-week high of $0.34 a couple of days ago which was double it’s price from just a few weeks before. It is currently sitting at $0.30.[/box]

NVX is a Vancouver-based company, whose objective is to create shareholder value by the acquisition, exploration, and development of gold projects located within the major gold producing areas of the western United States and in Switzerland.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know through our contact page, through Google+, Twitter or Facebook.[/box]