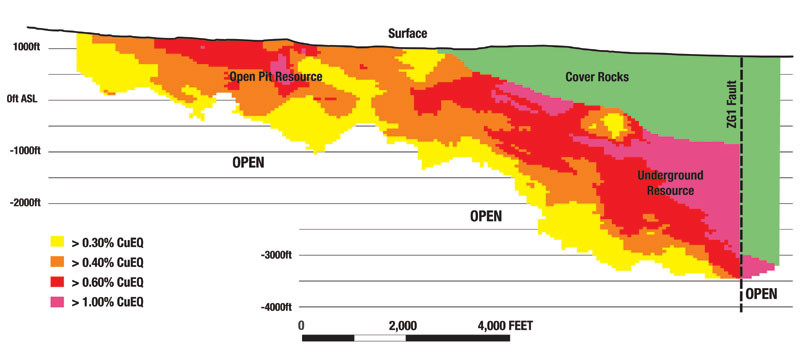

There are big deposits and then there are supermassive deposits. A big deposit will have a good 20-40 year resource life at with mining current techniques. A supermassive one, they have the resources that last for centuries. The Pebble Cu-Au-Mo-Ag Porphyry deposit in southwest Alaska is one such deposit, with a global resource of just under 11 billion tonnes ( measured, indicated and inferred) with a contained metal resource of 70,000,000,000 pounds copper, 107,000,000 ounces gold , 5,580,000,000 pounds molybdenum and 510,000,000 ounces silver. However, there is such a thing as too big, where the impact to the surrounding environment is so big and so profound that resistance is fierce enough to overcome even the most bullish economic case. A famous geologist once quipped. “I’d rather have 19 one billion tonne deposits, than one 19 billion tonne deposit.”

Ownership & Location

The Pebble deposit is owned by the Pebble Limited Partnership which is 100% owned by Northern Dynasty Minerals (TSX:NDM, NYSE:NAK). It is located in 160 miles Northeast of Bristol Bay and 60 miles northwest of Cook Inlet. The terrain around the deposit is rolling hills, and valleys with thick glacial gravels in the valleys. The deposit was discovered by Cominco ( now Teck Corp) in 1989, and was sold to Northern Dynasty in 2001. Teck maintains 2 small net profit royalties. For many years Rio Tinto maintained a 19.1% interest in Northern Dynasty and Anglo was a 50/50 joint venture partner in the Pebble Limited Partnership.

Geology

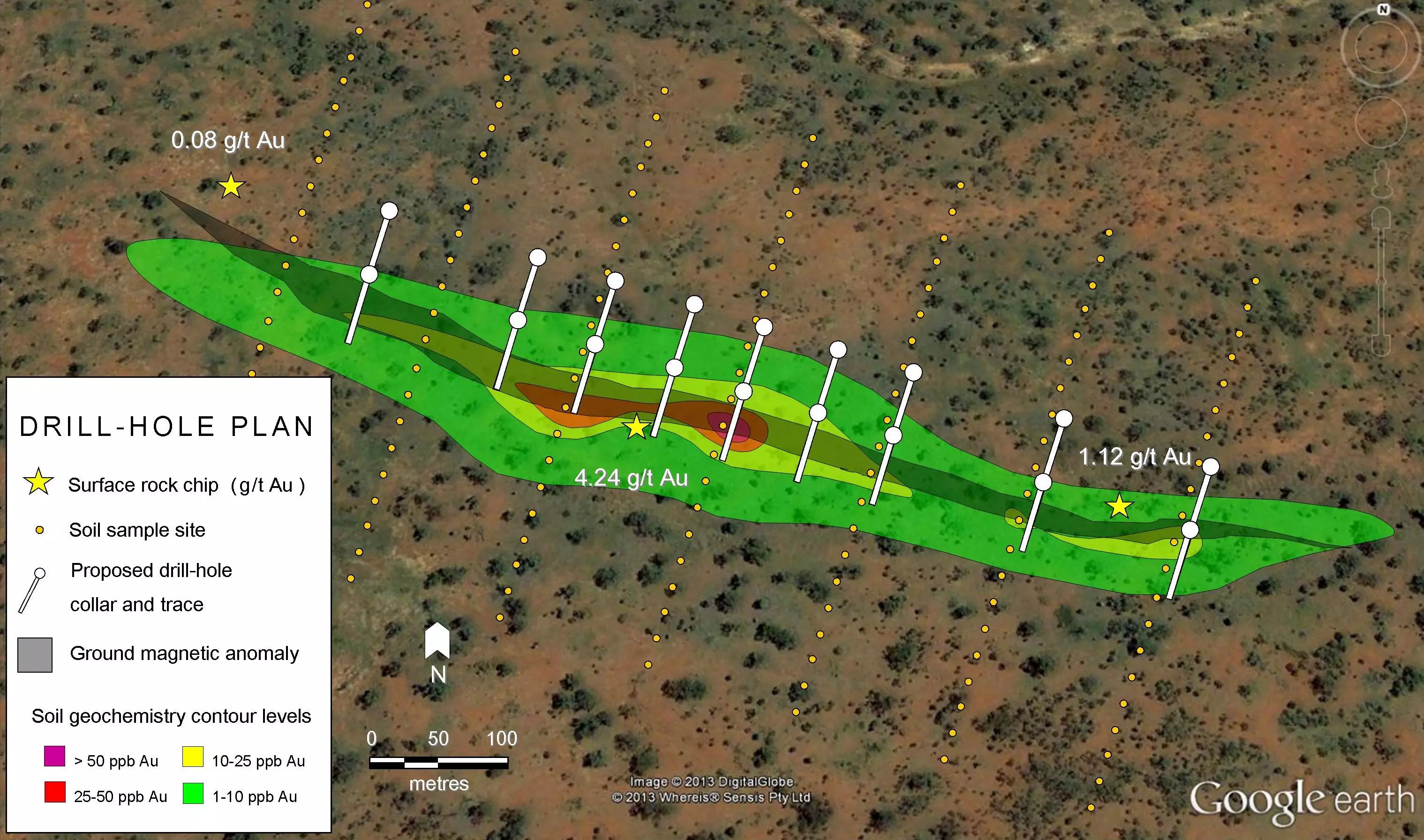

Like many deposits in this series, there is no one element that separates this deposit from other ones, except that the strength and intensities of the mineralizing processes were an order of magnitude greater. Like Grasberg, Pebble is hosted in a series of oceanic sediments that have been folded and upthrust and intruded. The main mineralization event is 90 million year old granitic (hornblende granodiorite porphyry) intrusion with numerous smaller intrusions and veins extending upward and outward. Five of these smaller intrusions form the core of the deposit. After and during formation the deposit was cut by numerous faults, including an important one known as the “brittle-ductile deformation zone”. Apparently active during the emplacement of the deposit, copper and gold grades and quartz vein density are all substantially increased adjacent to the fault. Post-mineralization the deposit was cut by an graben and partially buried under a series of volcanic and sedimentary flows. This undoubtedly preserved the deposit in such a tectonically active region.

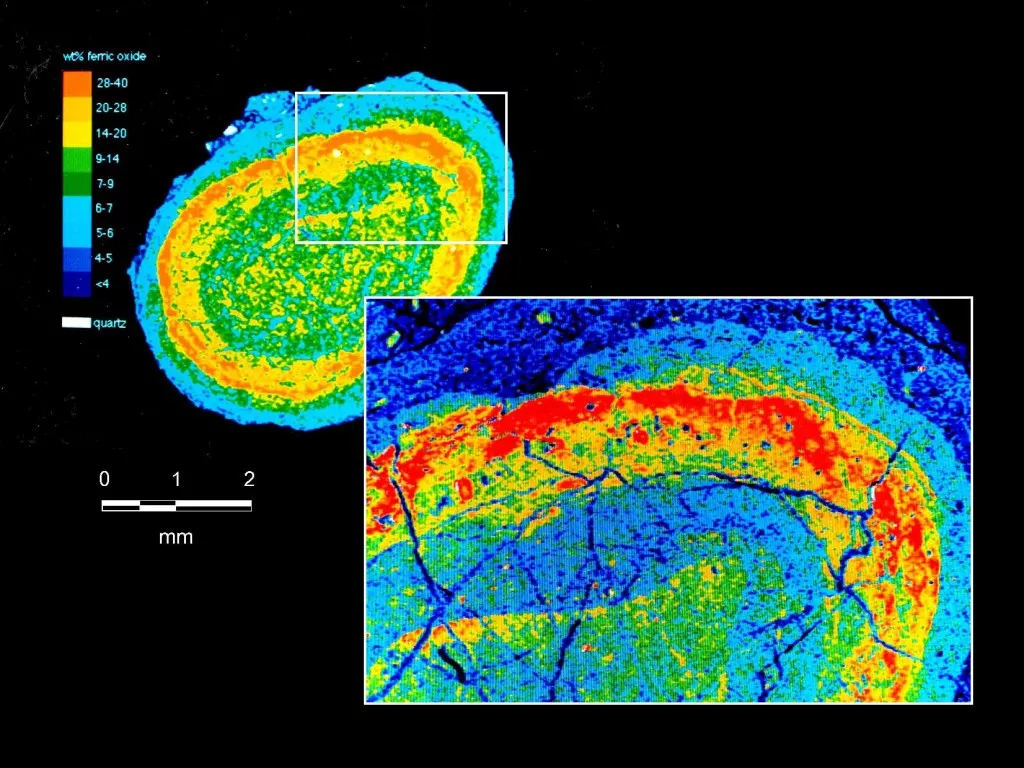

Alteration and mineralization is classically porphyry, with elements suggesting that it might be more on the alkalic end of the spectrum. The core is is a large zone of potassic mineralization which grades into a sodic-potassic surounded by a quartz-sericite-pyrite zone and finally an outer propylitic zone. Bornite and Chalcopyrite (Copper-bearing sulfide minerals) are the dominant ore minerals and occur in veins. Each of these vein types is divided into sub-types depending on the exact composition and timing. The deposit is open in several directions and based on the patterns alteration and mineralization, and how they are cut by a major fault. The awe inspiring possibility is that we are only seeing half the deposit and another monster lurks at depth across the fault.

Issues & Social Licence

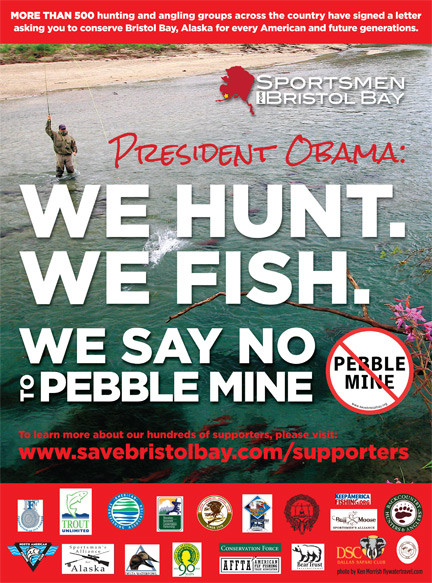

So in period of sky high metal prices how did this deposit slip through cracks and remain a large if tantalizing dream? It comes back to the size. Bristol bay is one great salmon fishing areas in the world and concerns about the impact of a having a large mine in the head waters of the bay mobilized opposition. Three main interrelated issues are the impact during development and operation of the project, what happens afterward and finally the impact of both on the fisheries. With a project of this size, the transformation of the local economy and environment will be profound and includes but is not limited to the massive infrastructure(roads, power), influx of people, potential greenhouse gases, and disruption to traditional subsistence many locals are resolutely opposed to the project.

Secondly, is the concerns over tailings and waste rock. Since the metals are hosted in sulfide minerals, there are concerns over the potential harm from acid mine drainage, and with such a large amount of rock being removed over the mine life, the potential impact of any leakage in the future could be substantial.

Finally driving both of these concerns, and providing the unifying rallying point is the spectacular richness of the Bristol Bay fishery. It is the largest sockeye fishery in the world and Alaska’s largest herring fishery, in addition to an abundance of other salmon species. This abundance has created a thriving guiding-fishing industry with numerous fishing lodges and provides a steady if seasonal income for the locals.

Finally driving both of these concerns, and providing the unifying rallying point is the spectacular richness of the Bristol Bay fishery. It is the largest sockeye fishery in the world and Alaska’s largest herring fishery, in addition to an abundance of other salmon species. This abundance has created a thriving guiding-fishing industry with numerous fishing lodges and provides a steady if seasonal income for the locals.

So to many groups, having one of the worlds largest mines in the upper reaches of this deposit was anthema and opposition was fierce and disciplined. Lawsuits, ordinances, ballot initiatives, and wrangling with EPA stretched out the timeline and low metal prices did the rest. Northern Dynasty’s partners Anglo-American and Rio-Tinto abandoned their investments as they retrenched. This points to fundamental issue with these extra-large deposits, in that the difference between a viable deposit and large geochemical anomaly is matter of time and context. When dealing with a supermassive mine in hostile cultural environment, there is always the danger that commitments needed to get a social license will render the deposit uneconomic in a period of low metal prices.

In addition, Pebble’s 0.3% Copper Equivalent cut-off was always the lower end of the grade spectrum and many of the stakeholders knew that such a low grade mine would have presented an economic risk with a potential bankruptcy and subsequent legal wrangling leaving site at risk for environmental degradation. Hence the project was never able to get a critical mass of support behind it locally, at the state level or federally.

So Pebble stands as a symbol and a challenge to the mining industry. To access these deposits we as an industry need to raise our game and not be so focused on pure economics. The ground has shifted under our feet, and we need to be ready to move to the next level to secure the resources of tomorrow, today.

Subscribe for Email Updates