The project is highly speculative and doesn’t stand much of a chance unless uranium prices recover. On the other side, it has cost the company almost nothing. If a joint-venture partner can be found to foot the bills then the risk to shareholders, where this project is concerned, should be minimal.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. [/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Feb. 3, 2014) – Millrock Resources Inc. (TSX VENTURE:MRO) (“Millrock” or the “Company”) announces today that it has generated a new uranium project named Red Basin. The claims are thought to be underlain by at least three uranium deposits that may be conducive for In-situ Recovery (ISR) mining. Millrock has unconfirmed reports that the deposits were discovered and drilled by Gulf Minerals in the 1970s. The project is located in Catron County, New Mexico, west of the town of Sorroco and 18 km north of the village of Datil, which is situated on Highway 60.

[box type=”note” align=”aligncenter” ]

We haven’t talked about Millrock before, but this news release brings up a few interesting topics worth discussing. The company’s new Red Basin project is located western New Mexico, southwest of Albuquerque. We’ve included a location map above.

New Mexico was a significant past producer of uranium and contains significant known reserves of uranium, but no mines have been operating since 2002

As a company Millrock is not interested in developing mines, but is instead focused on building project value through joint venture agreements and ultimately profiting from the sale of more advanced properties. This is a strategy adopted by many juniors who have no desire to open mines, but instead focus on the getting their big pay-off from more established mine developers.

[/box]

Gregory Beischer, Millrock President & CEO commented: “This is not a typical target for Millrock. However, ISR mining is known to be the lowest cost method by which to produce uranium and we decided to act on this target of opportunity. We were able to acquire the asset for very low cost – essentially the cost of claim staking. Uranium prices are presently low, but we anticipate this will change, potentially making the Red Basin project a valuable and profitable acquisition.”

[box type=”note” align=”aligncenter” ]

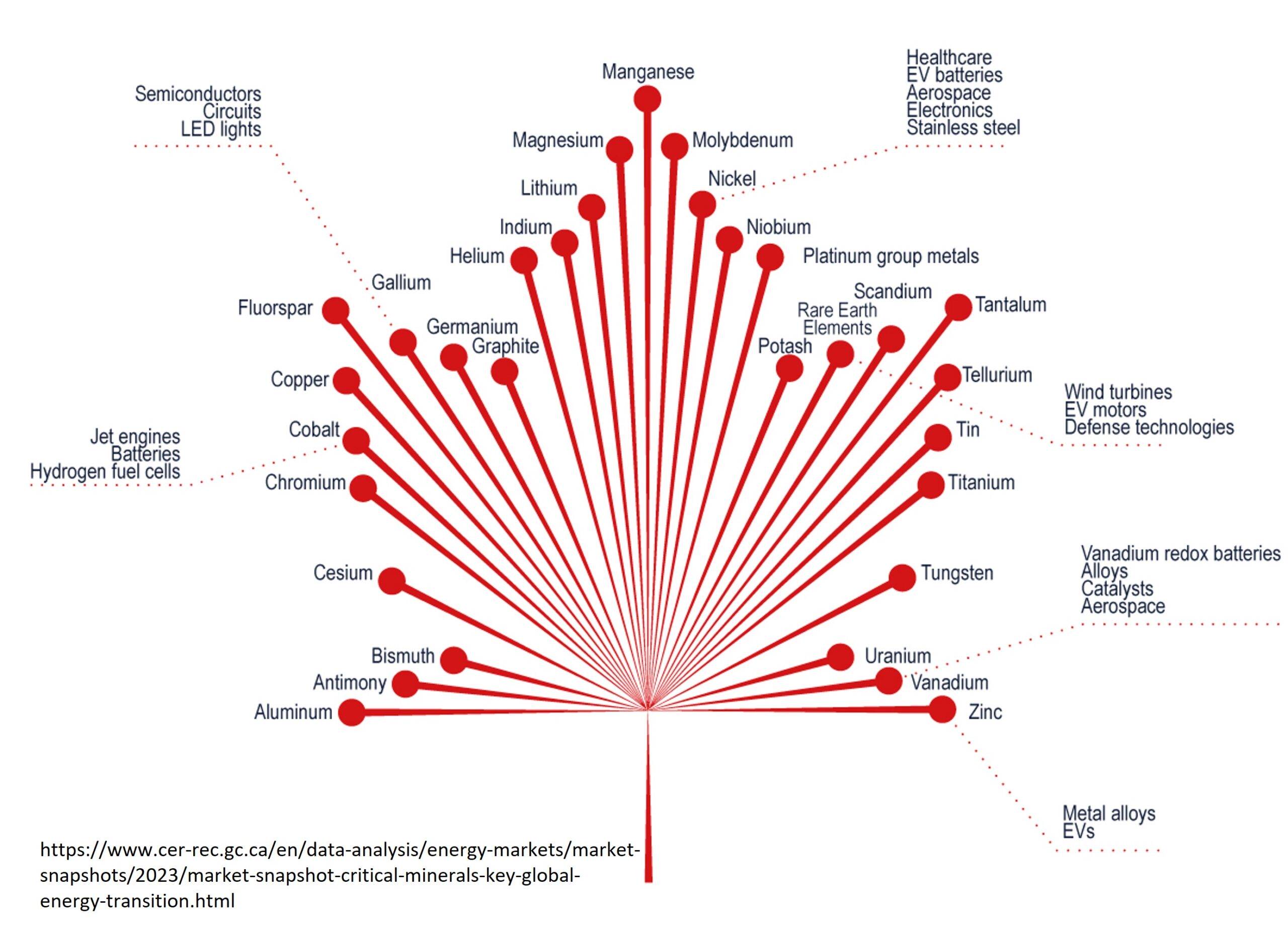

In-situ recovery (ISR), also known as in-situ leaching or solution mining is perhaps the most economical of all mining techniques, but is only appropriate under certain conditions. The commodity must be soluble (can be dissolved in solution) and the host rock must be permeable (fluid can flow through it). In some cases the host rock can be hydraulically fractured (“fracked”) in order to increase permeability. Additionally, care must be taken to avoid the contamination of groundwater sources and permitting may be difficult in populated areas. Read more about in-situ recovery in our mining techniques article.

[/box]

Roll-front type uranium mineralization is known in the Red Basin – Pietown District within which the property is situated. Minor historic past production has been reported from small mines off the claim block dating back to the 1950s. The uranium mineralization in the basin occurs primarily at the lower contact of the Baca Formation sandstone in association with redox boundaries and organic material. The favourable lower Baca Formation traverses the new Millrock property.

[box type=”note” align=”aligncenter” ]

Sandstone and unconformity-related sandstone deposits are discussed in more detail in our article on uranium deposits. Unconformity-related uranium deposits typically occur in sedimentary basins concentrated along the border between sedimentary rock units such as sandstone and the underlying igneous “basement” rock. Sandstone uranium deposits occur in permeable sandstone beds sealed between impermeable rocks beds like shale.

[/box]

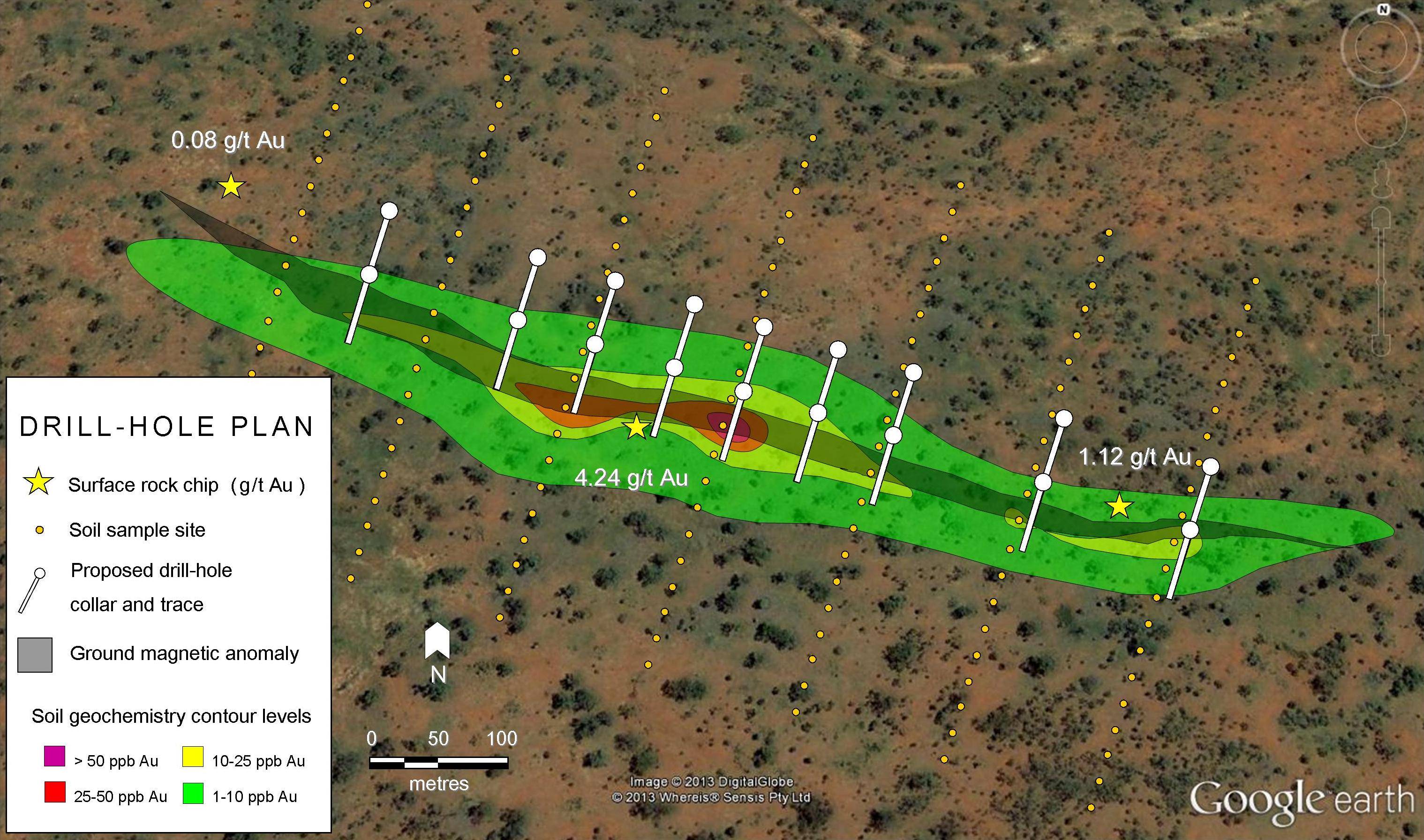

Millrock has documented the location of approximately 239 drill hole monuments that are situated on the present Red Basin claim group. Most of the holes were drilled by Gulf Minerals in the 1970s. Based on the approximate 30 m drilling pattern in three particular areas and from discussion with geologists familiar with the area, it is thought that uranium deposits underlie these densely drilled areas. Millrock Chief Exploration Officer Philip St. George has observed drill logs from the historic drill holes but Millrock does not presently have access to them.

[box type=”note” align=”aligncenter” ]

In many jurisdictions holders of mining claims are assessed annual fees or must prove equivalent work expenditures in order to maintain a claim in good standing. Work reports associated with claim expenditures including all the data and exploration details are required from the claim-holder. This ensures that project or claims are not held indefinitely by speculators and that property knowledge continues to advance. Filed work reports including drill logs, geophysical reports and other data acquired by the claim-holder become public after a time allowing prospectors to find properties of interest through historical work.

While the age of the internet has significantly advanced the availability of this type of data, older reports or those from jurisdictions where reports were not required may be hard to come by or contain incomplete or inaccurate data. In addition, geographic data that pre-dates the availability of accurate GPS equipment cannot be relied upon to any great degree. Millrock is telling us that a good deal of historical work has been done on the property and they may be able to acquire that data. That’s great from a prospecting point of view, but in order to advance the project with any level of confidence, much -if not all- of that work will need to be done again.

[/box]

The property consists of 103 claims, 71 of which are wholly-owned by Millrock and 32 of which are the subject of an option to purchase agreement whereby Millrock can earn a 100% interest, free of any royalties, by making payments totaling US$1.3 million and expending US$1.0 million on exploration over a ten-year period. The federal mining claims on the lands are administered by the US Forest Service. Millrock has secured exploration drilling permits.

Following its project generator business model, Millrock will prepare the project for exploration and is concurrently seeking a partner. The Company has laid forth the following exploration plan to ready the project:

- Acquire past data -make an agreement to purchase Gulf Minerals data from the 1970s.

- Digitize drill logs – develop 3D models of the deposits.

- Confirmation drilling – drill a series of holes and re-enter some historic holes.

- Resource estimation – calculate the tonnage, grade and write 43-101 resource estimate report.

- Drill for deposit extensions – Focus on down-dip areas from known mineralization.

- Begin hydrology and beneficiation studies – Understand aquifer and groundwater flow.

Millrock sees potential to quickly define a uranium resource and expand upon it. If uranium deposits are present, they potentially could be mined by low-cost ISR methods. However, Millrock cautions readers that there is no certainty the proposed exploration will lead to the discovery of a uranium deposit or that if discovered, a deposit could be profitably extracted.

[box type=”note” align=”aligncenter” ]

Millrock is telling the reader outright that this is highly speculative and that the project doesn’t stand much of a chance unless uranium prices recover. On the other side, the project has cost the company almost nothing. If a joint-venture partner can be found to foot the bills and advance the project then the risk to shareholders, at least where this particular project is concerned, should be minimal.

[/box]

Millrock, which has 100% ownership of the project, is currently seeking a joint venture partner.

The technical information within this document has been reviewed and approved by Gregory A. Beischer, President & CEO of Millrock Resources Inc. Mr. Beischer is a qualified person (QP) as defined in NI 43-101. The QP has inspected the property and observed drill hole monuments but has not verified drill hole logs.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. In the search for world-class metallic mineral deposits in mineral-rich Alaska and southwest USA, Millrock identifies, packages and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. Millrock currently has nine active exploration projects, seven gold-copper properties in Alaska, two porphyry copper prospects in Arizona and a uranium project in New Mexico. Funding for Millrock’s exploration projects primarily comes from its joint venture partners. Business partners of Millrock include some of the leading names in the mining industry: First Quantum, Teck and Altius.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]