All too often, in exploration geology we only hear about the big scores. The Chuck Fipkes, the David Lowells, the Robert Friedlands. It has been my pleasure to work with many, many talented geologists who don’t have the same name brand recognition, but were out there out there doing the hard work of whacking rocks, plotting drill hole sections, and using that sixth sense as to where to plot the next hole, or do the next line of IP. They have practiced and polished their craft over the decades and in this series I hope to interview a few of these veterans and sit at their feet as they share their wisdom.

My first interview is with Arthur Leger, Vice President of Exploration for Atoka Gold. Atoka is currently exploring for Carlin style gold in Nevada, but Arthur, has had a long a varied career exploring for porphyry copper, tungsten, volcanogenic massive sulfide copper, volcanogenic gold, and Carlin-type gold systems for global companies including Continental Oil Minerals Group, Callahan Mining, Gold Fields Mining Corp., Hecla Mining, Cyprus Exploration and Cameco Gold Corporation. He was kind enough to respond to a series of emailed questions. This interview has been lightly edited and condensed for clarity.

When and how did you decide geology would be a career?

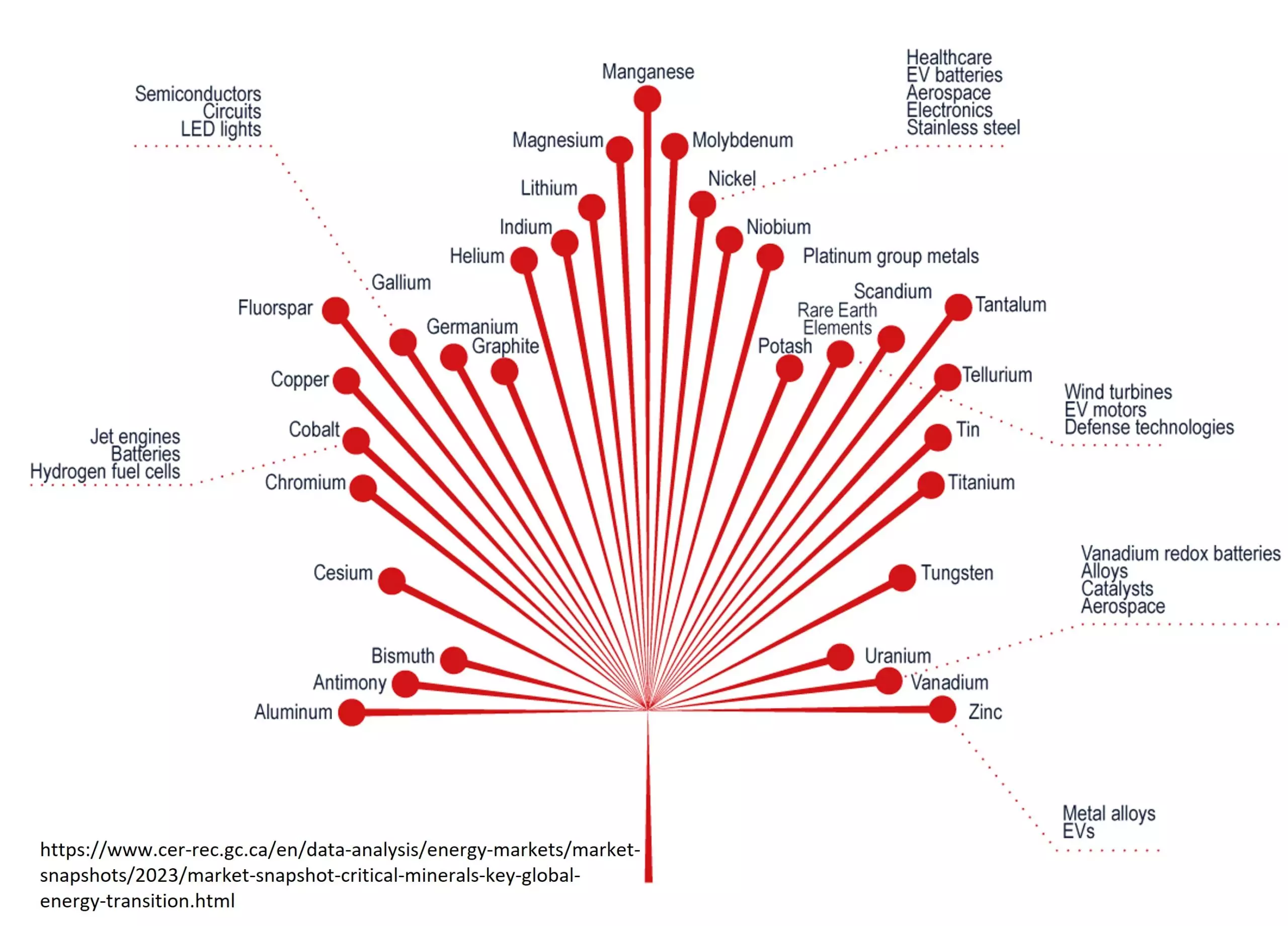

During my sophomore year at Southern Illinois University, I took an introductory geology course and was hooked. The subject was, and continues to be, so fascinating because the earth continuously reveals mineral secrets and new metal discoveries. After completing my B.A., I continued my education at the University of Arizona and earned a M.Sc. in Geology and Groundwater Hydrology. Since then, I have pursued opportunities within the mineral industry (gold, silver, copper, nickel, uranium, lead and zinc) and groundwater hydrology for the state of Nevada.

What are some of the highlights of your exploration career?

In my 45+ years as a geologist, my most infamous career highlights were during my years with Gold Fields Mining, and they include:

- Our team discovered two world-class gold deposits in Nevada – Chimney Creek and Mule Canyon – which so far have produced over 10+ million ounces of gold.

- Also, I was directly involved with the discovery of the 10+ million-ounce Pipeline Gold Deposit, which is now owned and operated by Barrick Gold Corp.

- Finally, my field partner and I discovered and actively promoted the Big Canyon Gold Deposit, located near the Mother Lode Gold Belt of California.

Now, as VP of Exploration with Atoka Gold, I have the opportunity to oversee the discovery of another world-class gold deposit, like the ones listed above.

Tell us a little about Atoka Gold and what is Atoka Gold doing?

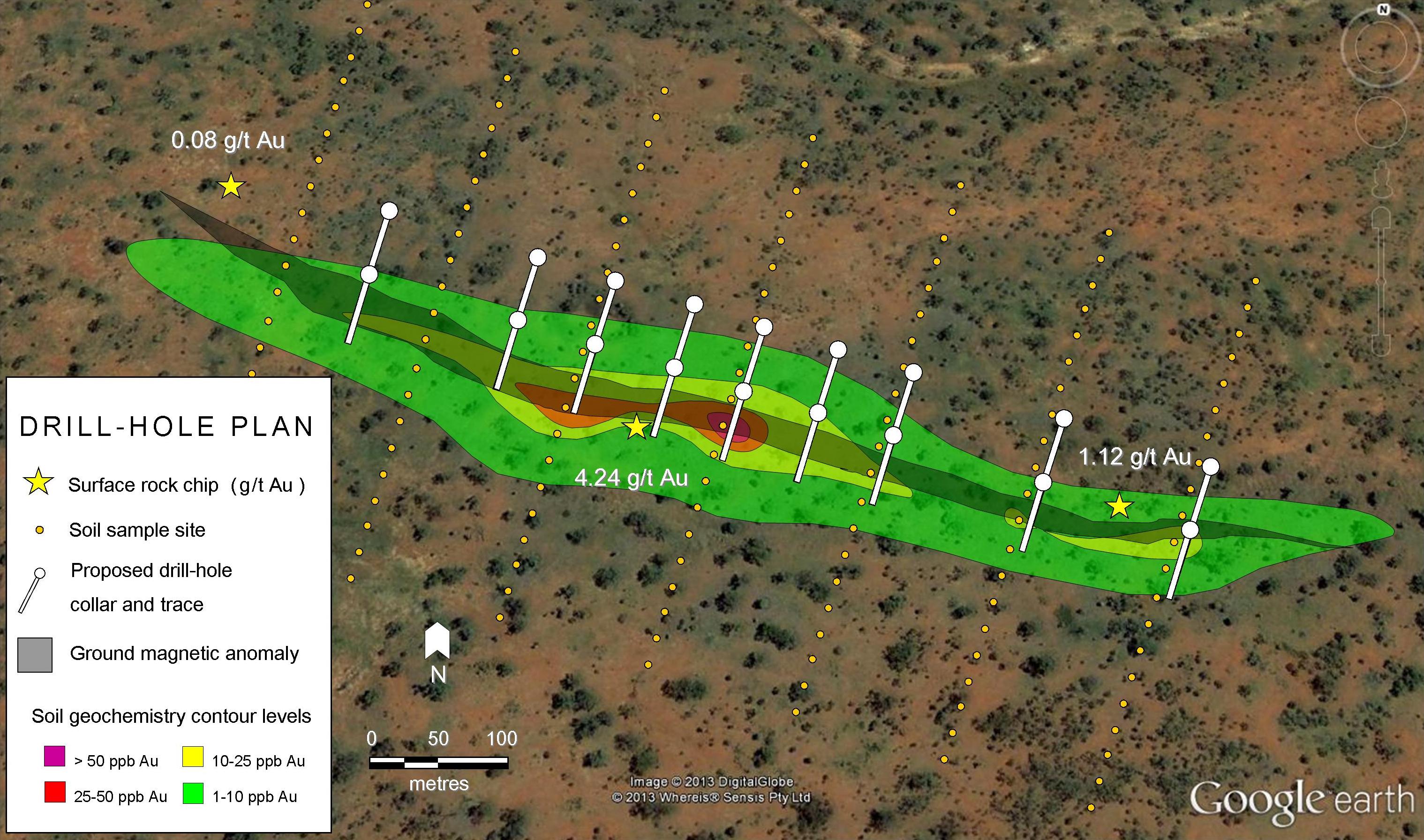

Atoka Gold is a privately-held, U.S. based, gold/silver exploration company dedicated to the discovery of world-class gold/silver deposits in Nevada, USA. Our leadership team includes an international business executive, a mining veteran, an internationally known geochemist, and an online communications expert. As the VP of Exploration, I assert that major gold discoveries are more likely found by concentrating our exploration efforts in one of the world’s leading gold regions, North-Central Nevada. Therefore, our premier property is the Red Rock Gold Property, which hosts a gold-rich belt that extends over 6+ kilometers (4 miles) in length. Most importantly, previous exploration activities have defined four major gold project areas. Each has the potential of hosting a world-class gold deposit. At this time, we are seeking continued investor funding and a lease partnership and/or joint venture.

Tell us about your exploration philosophy?

After 45+ years of exploration activities throughout the U.S. and parts of Canada, I concluded that there are specific areas that contain major gold deposits. As most of my gold exploration career has been in the U.S., I noted that many areas have recorded mineral occurrences but only a few regions yield world-class gold deposits.

The foremost region for major gold discoveries is in Nevada, a mining and tax friendly state. So far, areas known to contain big and profitable mines are located in North-Central Nevada, the home of the world-class Battle Mountain-Eureka, Rabbit Creek and Carlin Gold Belts.

As stated above, I have concentrated my exploration efforts in North-Central Nevada, an area that produces over 79% of the gold in the U.S. Because of geo-political global instability, I am not a strong supporter of overseas gold exploration.

How do I decide if a project is worth your time?

- Location – I only spend my time, energy and resources on projects that show favorable geologic settings including rock types, earth faults and cracks, and are accessible for future operations. Additionally, I like properties that are in close proximity to existing and operating mines.

- Structure – I look for a major structural break, which is a crack in the earth’s crust that could allow for metal-bearing fluids to rise and create a deposit.

- Experience – I rely on my past experiences, including both fruitless exploration and successful discoveries, to direct Atoka Gold’s exploration and funding efforts.

- Future Buyers – I also take into consideration who the potential buyers of our project will be. As referred to in the points above, I prefer properties near existing mines overseen by a major mining company.

In your opinion, what are some of the key drivers of value for exploration companies?

I have worked for major mining companies, I have consulted for junior and major mining companies, and I am now a majority share holder in my own private exploration company. I believe the following are the most important principles for successful exploration and mining companies:

- The management team includes a person, or persons, who have been involved in a major gold discovery.

- The location of the properties must be:

- located along or near a major gold belt,

- accessible to large equipment for operations,

- near existing and operating mines, and

- within a region and country that is favorable for mining.

What are a few of the trends that you see in the future of Mineral Exploration?

Due to the retirement or passing on of senior exploration geologists, I see fewer metal discoveries. Additionally, the upcoming generations seem to lack field experience and have not developed a sense of imagination for “what could be.”

Another reason I see for a decrease in metal discoveries is that there seems to be a reluctance to fund high risk ventures. The fact is gold deposits require extensive drilling and drilling for gold is very expensive. However, if and when a gold deposit is discovered, the return on this investment could be in the billions of dollars.

As the gold price heads above $US 1,400/ounce, junior mining companies will gain in popularity again. They will return to their roots as actual mining groups and begin to mine smaller gold deposits, such as 50,000+/- ounce gold occurrences. These groups should be focused on one or two projects and be “lean and mean.”

Investor participation will increase towards the junior mining groups as return on investment will be realized in the short term.

What are a few of the things that make you really excited about doing exploration geology after all these years?

As a senior geologist, who is now much slower climbing hills than in earlier years, I still delight in meaningful research and field activities that lead to new gold targets. When my rock samples and assay results reveal high gold values, I get really excited to drill for a mineral discovery hole. While I have been part of numerous discovery teams, I would like to prove that the Red Rock Gold Property truly contains a major world-class gold deposit.

In closing,what are a few pieces of advice for investors in mineral exploration?

- Exploration is high risk. But, if you are successful, you will be highly rewarded.

- Be patient. It may take 5+ years to get a return on investment.

- Be willing to continue to fund your exploration group so you can see the project to completion.

- Geologists are not equally educated, credentialed, experienced, or gifted. There are very few imaginative and visionary geologists.

- In my opinion, make sure the management team includes a geologist, over 50 years of age, who has worked for a major mining company such as Newmont, Gold Fields, Agnico Eagle, Kinross, and Barrick Gold.

- Enjoy the investment. If possible, visit your property with your geologist.

- Be skeptical of overly high corporate expenditures and bloated staff costs.

- Beware of new exploration techniques that claim to be the “best” developed to find gold.

- Also, beware of too many properties with too little activity or forward movement.

- Do not pay money to individuals claiming to represent mining groups. Scams are prominent.

Sage Advice- Ed.