This is what most gold exploration companies could ever hope for; consistently wide intersections of respectable grade. I’m not sure whether the word “high” is justified though. This is a relative term.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and may include opinions or points of view that may not be shared by the owners of geologyforinvestors.com or the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text. Please view the full release here.[/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Sept. 12, 2013) – Orca Gold Inc. (TSX VENTURE:ORG) (“Orca” or the “Company”) is pleased to report the successful completion of the second drilling campaign of an initial exploration program at the Galat Sufar South (“GSS”) prospect on its Block 14 mineral license in Sudan.

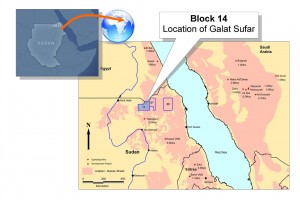

[box type=”note” align=”aligncenter” ] We have compiled a location map using maps obtained from Orca Gold’s corporate website. Note that Orca’s project is located in northern Sudan near the Egyptian border and the Red Sea. Sudan is divided into 2 countries: Sudan and Southern Sudan. The border regions of the two are considered to be unsafe and armed conflicts continue especially in the Darfur region. Orca’s project appears to be well away from this, but long term political stability is a risk for any company operating in the region.[/box]

Based on the results of a comprehensive analysis of the initial exploration programs at GSS the Board of Directors has approved:

- an exploration budget aimed at delineating an NI 43-101 compliant initial resource at GSS by the end of the first quarter of 2014; and

- the second required option payment to increase Orca’s interest in the Block 14 license to 52.5%.

On September 9, 2013, Orca made a second option payment of US$3 million to its joint venture partner. This payment increases Orca’s interest in the joint venture company, Meyas Sand Minerals Co. Ltd (“MSMCL”) from 35.0% to 52.5%. Orca must make a final option payment of US$3 million by September 20, 2014 to retain and increase its interest in MSMCL to 70%.

Results from the second drilling campaign at GSS continue to exhibit wide intercepts and excellent grades (eg: holes GSDD004: 59m @ 2.43 g/t, GSRC161: 26m @ 3.78 g/t, GSDD008: 48m @ 2.26 g/t, GSRC174: 32m @ 6.63 g/t). The entire results are set out in Schedule A to this release and in full represent 5,897 metres of drilling completed since the last exploration update (News Release: May 16, 2013). A total of 15,940 metres of drilling (13,790m of RC and 2,150m diamond) has been completed to date at GSS. For ease of reference, the results reported previously are attached as Schedule B. The Orca exploration team is extremely encouraged by the consistent widths of high grade material being intersected.

[box type=”note” align=”aligncenter” ]This is what most gold exploration companies could ever hope for; consistently wide intersections of respectable grade. I’m not sure whether the word “high” is justified though. This is a relative term. Some exploration companies may believe it is “high” grade while others may say just “moderate”. It just depends on your point of view and the current price of gold. By the way, if you look carefully in the above paragraph you may see that Orca Gold has left off the commodity that the intervals are referring to. We have to assume here that they are referring to gold (Au).[/box]

Mineralization at GSS is hosted in and is typical of structurally controlled, mesothermal, shear zone hosted gold systems. The geology is dominated by calc-alkaline volcaniclastics which are in places interbedded with marls and dolomites and intruded by small, syenite and granite stocks. The dominant alteration associated with gold mineralisation is sericite + silica +/- carbonate. Pyrite is the main sulphide present.

[box type=”note” align=”aligncenter” ]Structurally controlled, mesothermal shear-hosted gold mineralization can make for long-term profitable mines especially if the shear maintains consistently wide intervals and reasonable grades along its length and down dip. Unfortunately, I can’t see anywhere in the press release what the dip of the shear is. This important piece of information appears to be missing. A low-angle shear, say 15 degrees would be great because the favourable strip ratio would allow for lower cost open cut mining of the near surface mineralization. For the deeper ore, an underground development would be more profitable. A success story of mining shear-hosted mesothermal gold mineralization is at Macraes in New Zealand by Oceana Gold Corporation. The shear they mine has an overall length of 30km and a dip of only 15 degrees.

Below is a geology and drill-hole trace map of the Galat Sufar South prospect. I suspect that Orca Gold will find more mineralization along the length of the shear/s as exploration continues, as these structures are normally kilometres long.[/box]

Mineralisation is divided into two domains. The Main Zone is a N-S and NW trending series of mineralized bodies associated with intense shearing and quartz sericite alteration. The East Zone is 500m east of Main Zone where broad zones of ENE trending mineralisation have been intersected in an area of similar alteration with small, brecciated granitic stocks. The gap area between the Main and East Zones remains substantially untested. This gap, like much of the area around GSS is under sand cover. To date exploration at GSS has focused on outcroppings and extensions thereof. There remains a wider area of alteration (as mapped by geophysics) and prospective geology around GSS, much of it under sand cover that is highly prospective and still to be explored. Part of the next seven month work program will be aimed at testing the gap and other covered areas.

The excellent results of the just completed exploration program, including an assessment of the future potential of GSS, was the basis for a positive recommendation by Orca’s management to its Board to carry out a second, aggressive, exploration program. This $7 million program will include:

- ~18,000 metres of infill drilling aimed at delineating an NI 43-101 compliant initial resource at GSS by the end of Q1 2014

- An additional 10,000 metres of drilling targeted at areas outside the contemplated initial resource area

- Metallurgical testwork on composite samples from GSS

- Baseline environmental work

- Initial hydrological studies

- Scoping level engineering for indicative operating and capital costs

Simon Jackson, President & CEO, said, “We are very excited by the discovery of GSS and its potential. Exploration to date indicates solid widths to the mineralization accompanied by significant grade. Our internal review of results from our first program provides a compelling basis for increasing our interest in Block 14 and advancing our pace of exploration. Our initial entry into Block 14 was always with the objective of finding a deposit that is capable of becoming a commercial mining operation, and we believe that GSS is showing early signs that it has real potential to fulfill that objective.”

About Orca

Orca Gold Inc. is a Canadian resource company focussed on exploration opportunities in Africa. The Company has an experienced board of directors and management team and a strong balance sheet that includes over $50 million in cash.

The technical contents of this release have been approved by Stuart Mills, BSc., MSc, a Qualified Person pursuant to NI-43101. Mr. Mills is the Sudan Manager of the Company and a Member of the Institute of Materials, Mining and Metallurgy. Samples used for the results described herein are prepared and analyzed by fire assay using a 50 gram charge at the ALS Chemex facility at Rosia Montana in Romania in compliance with industry standards. Field duplicate samples are taken and blanks and standards are added to every batch submitted.

On behalf of the Board of Directors:

Simon Jackson, President, CEO and Director

[toggle title=”We’ve skipped some of the boilerplate. You can read it in here.” state=”close” ]

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “plan”, “expect”, “intend”, “estimate”, “forecast”, “project”, “budget”, “schedule”, “may”, “will”, “could”, “might”, “should” or variations of such words or similar words or expressions or statements that certain events “may” or “will” occur. Forward-looking statements in this press release include, but are not limited to, statements relating to the plans of the Company to delineate an NI 43-101 compliant resource and increase its ownership in Block 14 and the future potential of GSS to become a commercial mining operation, including exploration activities. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; the speculative nature of strategic metal exploration and development including the risks of diminishing quantities of grades of reserves; contests over title to properties; and changes in project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of gold; the demand for gold; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner;

the ability to operate in a safe, efficient and effective manner; the expected timing, costs, and results of a PEA; the expected burn rate; the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. The Company does not undertake any obligation to update forward-looking information if circumstances or management’s estimates, assumptions or opinions should change, except as required by applicable law. Accordingly, readers should not place undue reliance on forward-looking information contained herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[/toggle]

[box type=”note” align=”aligncenter” ]Orca has included their drill results as rather lengthy appendices which you can expand in the toggle box below. When looking at these results keep in mind that these intervals are apparent thicknesses not true thicknesses (or widths) and that the true thicknesses are supposedly 50-70% of the apparent thicknesses (or widths). Therefore, these seemingly wide zones could be much narrower.[/box]

[toggle title=”View the published drill results in here.” state=”close” ]

Appendices

1. Map showing the interpreted zones

To view accompanying map, visit the following link: http://file.marketwire.com/release/orca0912.jpg

| Schedule A – results from second drilling campaign | ||||||

| New Main Zone Drill Intercepts | ||||||

| Hole | Type | From | To | Metres | Au g/t Uncut | Au g/t Cut to 10g/t |

| GSDD004 | DD | 111 | 118 | 7 | 1.06 | |

| 128 | 187 | 59 | 2.43 | 1.99 | ||

| 194 | 226 | 32 | 1.53 | |||

| 235 | 241 | 6 | 1.84 | |||

| 267 | 273 | 6 | 1.44 | |||

| GSDD005 | DD | 144 | 167 | 23 | 2.44 | |

| 173 | 196 | 23 | 4.60 | 4.55 | ||

| 202 | 209 | 7 | 4.60 | 4.54 | ||

| 271 | 277 | 6 | 2.58 | |||

| 280 | 290 | 10 | 1.52 | |||

| GSDD006 | DD | 22 | 26 | 4 | 0.6 | |

| 36 | 54 | 18 | 1.29 | |||

| 57 | 62 | 5 | 1.22 | |||

| 73 | 78 | 5 | 0.65 | |||

| 119 | 125 | 6 | 2.52 | |||

| 154 | 158 | 4 | 1.03 | |||

| GSRC099 | RC | NSI | ||||

| GSRC100 | RC | 24 | 27 | 3 | 1.25 | |

| 29 | 32 | 3 | 1.03 | |||

| GSRC101 | RC | 98 | 115 | 17 | 3.18 | |

| GSRC102 | RC | 1 | 8 | 7 | 1.42 | |

| 14 | 22 | 8 | 1.28 | |||

| 197 | 201 | 4 | 3.91 | |||

| 212 | 218 | 6 | 2.60 | |||

| GSRC103 | RC | 9 | 25 | 16 | 8.47 | 5.57 |

| GSRC104 | RC | 11 | 26 | 15 | 2.14 | |

| GSRC105 | RC | 120 | 125 | 5 | 1.88 | |

| GSRC106 | RC | 12 | 38 | 26 | 2.81 | |

| 74 | 83 | 9 | 1.72 | |||

| GSRC107 | RC | 88 | 91 | 3 | 0.79 | |

| 93 | 100 | 7 | 1.01 | |||

| 113 | 116 | 3 | 1.16 | |||

| 127 | 130 | 3 | 0.70 | |||

| 139 | 149 | 10 | 1.11 | |||

| 160 | 164 | 4 | 0.66 | |||

| 277 | 294 | 17 | 3.11 | |||

| GSRC138 | RC | 19 | 31 | 12 | 1.65 | |

| 35 | 49 | 14 | 11.20 | 8.32 | ||

| 64 | 70 | 6 | 1.93 | |||

| GSRC139 | RC | 53 | 56 | 3 | 4.13 | |

| 61 | 64 | 3 | 2.84 | |||

| 69 | 72 | 3 | 12.57 | 7.59 | ||

| 116 | 120 | 4 | 2.29 | |||

| GSRC140 | RC | NSI | ||||

| GSRC141 | RC | NSI | ||||

| GSRC142 | RC | NSI | ||||

| GSRC143 | RC | 107 | 114 | 7 | 1.01 | |

| GSRC144 | RC | 1 | 4 | 3 | 1.90 | |

| GSRC145 | RC | NSI | ||||

| GSRC146 | RC | NSI | ||||

| GSRC161 | RC | 40 | 48 | 8 | 0.58 | |

| 78 | 104 | 26 | 3.78 | 3.19 | ||

| 106 | 115 | 9 | 2.66 | |||

| GSRC183 | RC | 33 | 36 | 3 | 1.51 | |

| 51 | 54 | 3 | 2.31 | |||

| 63 | 70 | 7 | 9.67 | 7.65 | ||

| 120 | 128 | 8 | 1.39 | |||

| GSRC184 | RC | 60 | 88 | 28 | 2.44 | 2.26 |

| GSRC185 | RC | NSI | ||||

| GSRC186 | RC | 4 | 18 | 14 | 1.10 | |

| GSRC187 | RC | 44 | 48 | 4 | 1.25 | |

| GSRC188 | RC | 55 | 58 | 3 | 0.76 | |

| Note: True widths are in general 50-70% of intercept width. The reported intercepts were determined using a cut-off grade of 0.50g/t with a maximum of 3m internal dilution being incorporated into the intercept where appropriate. |

| New East Zone Drill Intercepts | ||||||

| Hole | Type | From | To | Metres | Au g/t Uncut | Au g/t Cut to 10g/t |

| GSDD007A | DD | 39 | 44 | 5 | 0.91 | |

| 62 | 84 | 22 | 1.77 | |||

| 124 | 135 | 11 | 0.85 | |||

| 138 | 143 | 5 | 0.78 | |||

| 149 | 164 | 15 | 0.73 | |||

| 198 | 210 | 12 | 0.85 | |||

| 324 | 327 | 3 | 1.13 | |||

| 349 | 353 | 4 | 1.14 | |||

| 365 | 369 | 4 | 4.55 | 4.28 | ||

| GSDD008 | DD | 0 | 10 | 10 | 1.70 | |

| 16 | 27 | 11 | 1.61 | |||

| 29 | 33 | 4 | 0.91 | |||

| 36 | 48 | 12 | 1.24 | |||

| 60 | 65 | 5 | 1.67 | |||

| 69 | 117 | 48 | 2.26 | |||

| 125 | 131 | 6 | 1.18 | |||

| 179 | 183 | 4 | 0.56 | |||

| 188 | 192 | 4 | 1.20 | |||

| 203 | 210 | 7 | 1.53 | |||

| 216 | 232 | 16 | 1.50 | |||

| 242 | 256 | 14 | 1.20 | |||

| 259 | 278 | 19 | 2.83 | |||

| 286 | 293 | 7 | 1.87 | |||

| 296 | 329 | 33 | 0.57 | |||

| 331 | 351 | 20 | 1.57 | |||

| GSRC085 | RC | 39 | 44 | 5 | 1.28 | |

| 49 | 53 | 4 | 1.63 | |||

| GSRC086 | RC | 85 | 94 | 9 | 1.46 | |

| GSRC087 | RC | 102 | 105 | 3 | 1.07 | |

| GSRC088 | RC | 0 | 35 | 35 | 1.78 | |

| 38 | 44 | 6 | 1.05 | |||

| 47 | 92 | 45 | 1.01 | |||

| 95 | 120 | 25 | 2.14 | |||

| GSRC089 | RC | NSI | ||||

| GSRC090 | RC | NSI | ||||

| GSRC091 | RC | 66 | 69 | 3 | 1.29 | |

| GSRC092 | RC | NSI | ||||

| GSRC093 | RC | NSI | ||||

| GSRC094 | RC | 101 | 106 | 5 | 1.47 | |

| GSRC095 | RC | 94 | 97 | 3 | 3.07 | |

| 117 | 120 | 3 | 1.67 | |||

| GSRC096 | RC | 76 | 92 | 16 | 1.02 | |

| GSRC097 | RC | 35 | 40 | 5 | 0.75 | |

| GSRC098 | RC | 0 | 4 | 4 | 0.84 | |

| 42 | 60 | 18 | 1.66 | |||

| 70 | 77 | 7 | 1.20 | |||

| 81 | 85 | 4 | 1.74 | |||

| 123 | 132 | 9 | 1.00 | |||

| GSRC108 | RC | 3 | 15 | 12 | 1.14 | |

| 33 | 39 | 6 | 2.18 | |||

| 46 | 63 | 17 | 7.44 | 5.12 | ||

| 83 | 112 | 29 | 4.03 | 3.98 | ||

| GSRC109 | RC | 113 | 119 | 6 | 10.52 | 4.46 |

| 122 | 156 | 34 | 2.75 | 2.62 | ||

| GSRC110 | RC | NSI | ||||

| GSRC111 | RC | 7 | 10 | 3 | 2.20 | |

| 88 | 93 | 5 | 2.78 | |||

| 105 | 108 | 3 | 1.08 | |||

| 110 | 113 | 3 | 1.25 | |||

| GSRC112 | RC | 1 | 11 | 10 | 1.07 | |

| 48 | 52 | 4 | 0.71 | |||

| 58 | 62 | 4 | 1.14 | |||

| 110 | 115 | 5 | 0.52 | |||

| GSRC113 | RC | 75 | 79 | 4 | 1.11 | |

| 94 | 108 | 14 | 0.84 | |||

| GSRC114 | RC | 118 | 124 | 6 | 0.78 | |

| GSRC115 | RC | 51 | 61 | 10 | 0.74 | |

| 82 | 86 | 4 | 0.73 | |||

| GSRC116 | RC | 0 | 3 | 3 | 1.57 | |

| 30 | 33 | 3 | 0.58 | |||

| 35 | 43 | 8 | 1.90 | |||

| 64 | 72 | 8 | 0.66 | |||

| GSRC117 | RC | 1 | 26 | 25 | 1.56 | |

| 38 | 45 | 7 | 1.18 | |||

| 54 | 58 | 4 | 0.97 | |||

| 60 | 65 | 5 | 2.06 | |||

| GSRC118 | RC | 115 | 125 | 10 | 0.97 | |

| GSRC119 | RC | 8 | 84 | 76 | 1.02 | |

| 89 | 108 | 19 | 1.14 | |||

| 111 | 118 | 7 | 4.51 | 4.11 | ||

| 120 | 128 | 8 | 2.87 | |||

| 130 | 135 | 5 | 1.00 | |||

| GSRC147 | RC | NSI | ||||

| GSRC148 | RC | NSI | ||||

| GSRC149 | RC | NSI | ||||

| GSRC150 | RC | 15 | 19 | 4 | 2.17 | |

| GSRC151 | RC | 49 | 52 | 3 | 0.95 | |

| 78 | 92 | 14 | 1.55 | |||

| GSRC152 | RC | 2 | 8 | 6 | 1.30 | |

| 54 | 60 | 6 | 0.88 | |||

| 73 | 77 | 4 | 1.63 | |||

| 118 | 121 | 3 | 1.30 | |||

| 145 | 149 | 4 | 0.74 | |||

| GSRC153 | RC | NSI | ||||

| GSRC154 | RC | 89 | 93 | 4 | 4.93 | |

| 116 | 120 | 4 | 1.79 | |||

| GSRC155 | RC | 1 | 8 | 7 | 2.03 | |

| GSRC156 | RC | NSI | ||||

| GSRC157 | RC | NSI | ||||

| GSRC158 | RC | NSI | ||||

| GSRC159 | RC | 10 | 15 | 5 | 3.12 | |

| GSRC160 | RC | 13 | 23 | 10 | 1.89 | |

| 28 | 31 | 3 | 1.03 | |||

| 32 | 35 | 3 | 1.69 | |||

| 108 | 111 | 3 | 0.90 | |||

| GSRC171 | RC | 46 | 51 | 5 | 0.98 | |

| 72 | 79 | 7 | 0.76 | |||

| GSRC172 | RC | 3 | 6 | 3 | 2.66 | |

| 37 | 60 | 23 | 1.50 | |||

| 64 | 67 | 3 | 1.00 | |||

| 70 | 74 | 4 | 0.66 | |||

| 77 | 83 | 6 | 1.70 | |||

| 86 | 90 | 4 | 0.53 | |||

| 93 | 104 | 11 | 0.72 | |||

| GSRC173 | RC | 9 | 46 | 37 | 2.42 | |

| GSRC174 | RC | 1 | 4 | 3 | 1.47 | |

| 14 | 17 | 3 | 2.54 | |||

| 26 | 37 | 11 | 2.06 | |||

| 108 | 140 | 32 | 6.63 | 3.07 | ||

| GSRC175 | RC | 52 | 57 | 5 | 0.93 | |

| 61 | 73 | 12 | 2.83 | |||

| 114 | 137 | 23 | 3.80 | 2.95 | ||

| GSRC176 | RC | 1 | 8 | 7 | 0.60 | |

| 35 | 58 | 23 | 1.46 | |||

| 62 | 66 | 4 | 1.18 | |||

| 74 | 77 | 3 | 1.03 | |||

| 80 | 92 | 12 | 0.89 | |||

| 95 | 109 | 14 | 1.05 | |||

| GSRC177 | RC | 0 | 13 | 13 | 1.59 | |

| 17 | 47 | 30 | 2.16 | |||

| 49 | 122 | 73 | 1.59 | |||

| GSRC178 | RC | 18 | 42 | 24 | 0.88 | |

| 45 | 54 | 9 | 0.76 | |||

| GSRC179 | RC | 60 | 63 | 3 | 2.41 | |

| 110 | 114 | 4 | 0.68 | |||

| 126 | 131 | 5 | 0.91 | |||

| 134 | 137 | 3 | 2.16 | |||

| 152 | 155 | 3 | 5.47 | |||

| GSRC180 | RC | 71 | 81 | 10 | 1.45 | |

| 88 | 99 | 11 | 1.11 | |||

| GSRC181 | RC | NSI | ||||

| GSRC182 | RC | 76 | 94 | 18 | 1.32 | |

| 100 | 103 | 3 | 1.34 | |||

| 133 | 137 | 4 | 1.35 | |||

| Note: True widths are in general 50-70% of intercept width. The reported intercepts were determined using a cut-off grade of 0.50g/t with a maximum of 3m internal dilution being incorporated into the intercept where appropriate. |

| Schedule B – results from previous drilling campaigns | ||||||

| MAIN ZONE | ||||||

| Hole | Type | From | To | Metres | Au g/t Uncut | Au g/t Cut to 10g/t |

| GSDD001 | DD | 80 | 161 | 81 | 1.22 | 1.22 |

| GSDD002 | DD | 11 | 31 | 20 | 1.88 | 1.88 |

| 35 | 74 | 39 | 3.19 | 2.74 | ||

| 77 | 98 | 21 | 1.36 | |||

| 136 | 148 | 12 | 0.80 | |||

| 161 | 174 | 13 | 1.74 | |||

| 210 | 222 | 12 | 1.64 | |||

| GSDD003A | DD | 241 | 251 | 10 | 1.97 | |

| 298 | 311 | 13 | 2.07 | |||

| 322 | 352 | 30 | 1.38 | |||

| GSRC001 | RC | 26 | 85 | 59 | 2.67 | |

| 94 | 120 | 26 | 2.48 | |||

| GSRC002 | RC | 5 | 21 | 16 | 5.02 | 3.59 |

| 42 | 49 | 7 | 1.17 | |||

| 54 | 95 | 41 | 2.30 | |||

| GSRC003 | RC | 0 | 10 | 10 | 4.61 | 4.24 |

| 27 | 36 | 9 | 5.42 | 4.13 | ||

| 101 | 120 | 19 | 13.60 | 6.39 | ||

| GSRC004 | RC | 68 | 77 | 9 | 1.21 | |

| 86 | 121 | 35 | 1.42 | |||

| GSRC005 | RC | 21 | 25 | 4 | 1.02 | |

| 29 | 38 | 9 | 0.68 | |||

| GSRC006 | RC | 18 | 25 | 7 | 13.18 | 6.99 |

| 110 | 120 | 10 | 2.77 | 2.61 | ||

| GSRC007 | RC | 8 | 15 | 7 | 2.64 | |

| 68 | 78 | 10 | 1.13 | |||

| GSRC008 | RC | 12 | 18 | 6 | 1.92 | |

| 81 | 99 | 18 | 0.86 | |||

| GSRC009 | RC | 4 | 8 | 4 | 0.49 | |

| 11 | 16 | 5 | 2.01 | |||

| 19 | 24 | 5 | 6.63 | |||

| 77 | 84 | 7 | 1.92 | |||

| GSRC010 | RC | 23 | 34 | 11 | 0.65 | |

| GSRC032 | RC | 3 | 12 | 9 | 2.79 | |

| GSRC033 | RC | 6 | 11 | 5 | 1.36 | |

| 132 | 138 | 6 | 1.66 | |||

| GSRC034 | RC | 33 | 38 | 5 | 0.98 | |

| GSRC035 | RC | NSI | ||||

| GSRC081 | RC | 32 | 35 | 3 | 1.41 | |

| 52 | 71 | 19 | 15.29 | 6.24 | ||

| 77 | 80 | 3 | 3.62 | |||

| 98 | 101 | 3 | 12.36 | 7.70 | ||

| 136 | 144 | 8 | 6.12 | 5.35 | ||

| 149 | 159 | 10 | 1.79 | |||

| 162 | 187 | 25 | 7.60 | 6.30 | ||

| GSRC082 | RC | 1 | 5 | 4 | 3.47 | |

| 9 | 57 | 48 | 1.79 | |||

| 62 | 68 | 6 | 0.94 | |||

| 71 | 85 | 14 | 15.78 | 6.01 | ||

| 87 | 95 | 8 | 1.10 | |||

| 97 | 101 | 4 | 2.26 | |||

| 109 | 116 | 7 | 1.33 | |||

| 152 | 165 | 13 | 1.76 | |||

| GSRC083 | RC | 69 | 81 | 12 | 1.97 | |

| 157 | 168 | 11 | 1.31 | |||

| Note: True widths are in general 50-70% of intercept width. The reported intercepts were determined using a cut-off grade of 0.50g/t with a maximum of 3m internal dilution being incorporated into the intercept where appropriate. |

| East Zone | ||||||

| Hole | Type | From | To | Metres | Au g/t Uncut | Au g/t Cut to 10g/t |

| GSRC011 | RC | 0 | 35 | 35 | 3.65 | 3.6 |

| 47 | 51 | 4 | 0.56 | |||

| 57 | 72 | 15 | 3.27 | 3.03 | ||

| 76 | 79 | 3 | 1.4 | |||

| GSRC012 | RC | 0 | 63 | 63 | 2.39 | 2.03 |

| 66 | 84 | 18 | 0.76 | |||

| 89 | 94 | 5 | 2.61 | |||

| 99 | 106 | 7 | 0.84 | |||

| GSRC013 | RC | 0 | 16 | 16 | 1.85 | |

| 97 | 101 | 4 | 0.93 | |||

| GSRC014 | RC | 31 | 39 | 8 | 5.15 | 4.55 |

| 45 | 56 | 11 | 1.57 | |||

| 120 | 133 | 13 | 0.8 | |||

| GSRC015 | RC | 11 | 15 | 4 | 1.09 | |

| 19 | 30 | 11 | 2.49 | 2.09 | ||

| 35 | 47 | 12 | 1.23 | |||

| 54 | 59 | 5 | 0.9 | |||

| 99 | 107 | 8 | 0.75 | |||

| GSRC016 | RC | 53 | 60 | 7 | 2.18 | |

| GSRC017 | RC | 36 | 47 | 11 | 0.92 | |

| 123 | 140 | 17 | 2.58 | |||

| GSRC018 | RC | 23 | 27 | 4 | 1.07 | |

| 43 | 49 | 6 | 1.76 | |||

| 51 | 57 | 6 | 1.06 | |||

| 66 | 79 | 13 | 0.98 | |||

| GSRC019 | RC | 7 | 11 | 4 | 3.02 | |

| 43 | 48 | 5 | 1.36 | |||

| 55 | 59 | 4 | 0.69 | |||

| 86 | 90 | 4 | 0.74 | |||

| GSRC020 | RC | 5 | 9 | 4 | 0.8 | |

| 17 | 21 | 4 | 1.54 | |||

| 26 | 39 | 13 | 1.46 | |||

| 100 | 103 | 3 | 3 | |||

| GSRC021 | RC | 1 | 4 | 3 | 0.96 | |

| 7 | 39 | 32 | 1.45 | |||

| 44 | 48 | 4 | 1.57 | |||

| 57 | 65 | 8 | 1.71 | |||

| 80 | 87 | 7 | 2.33 | |||

| 93 | 98 | 5 | 2.8 | |||

| GSRC022 | RC | 1 | 15 | 14 | 2.15 | |

| GSRC023 | RC | 0 | 52 | 52 | 1.9 | |

| 62 | 67 | 5 | 0.97 | |||

| 70 | 81 | 11 | 1.01 | |||

| 83 | 109 | 26 | 1.07 | |||

| 112 | 120 | 8 | 2.06 | |||

| GSRC024 | RC | 13 | 16 | 3 | 0.97 | |

| 19 | 36 | 17 | 7.46 | 6.9 | ||

| 40 | 58 | 18 | 1.33 | |||

| GSRC025 | RC | NSI | ||||

| GSRC026 | RC | NSI | ||||

| GSRC027 | RC | 8 | 28 | 20 | 2.08 | |

| 45 | 56 | 11 | 2.02 | |||

| 98 | 104 | 6 | 2.03 | |||

| 127 | 134 | 7 | 0.71 | |||

| GSRC028 | RC | 22 | 27 | 5 | 0.58 | |

| 45 | 48 | 3 | 0.64 | |||

| 50 | 63 | 13 | 2.25 | 1.75 | ||

| 70 | 75 | 5 | 0.83 | |||

| GSRC029 | RC | NSI | ||||

| GSRC030 | RC | 92 | 95 | 3 | 11.43 | 7.08 |

| GSRC031 | RC | 8 | 15 | 7 | 0.72 | |

| GSRC084 | RC | 16 | 28 | 12 | 0.68 | |

| 108 | 111 | 3 | 1.08 | |||

| 114 | 118 | 4 | 4.67 | |||

| 121 | 126 | 5 | 2.82 | |||

| 129 | 132 | 3 | 0.81 | |||

| 137 | 140 | 3 | 1.45 | |||

| 152 | 157 | 5 | 0.61 | |||

| 169 | 187 | 18 | 3.36 | 3.15 | ||

| 197 | 202 | 5 | 0.87 | |||

| 219 | 224 | 5 | 0.76 | |||

| 228 | 243 | 15 | 1.09 | |||

| Note: True widths are in general 50-70% of intercept width. The reported intercepts were determined using a cut-off grade of 0.50g/t with a maximum of 3m internal dilution being incorporated into the intercept where appropriate. |

[/toggle]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]