This year, 2015, has started with a little more positivity in the Junior Exploration markets, although we are nowhere near to the levels of confidence we saw in 2011 or 2007. Many professionals have been forced from the industry by massive layoffs, but those remaining are now asking some difficult questions – has the fire burned off enough deadwood?

One day, supplies of the basic commodities will be depleted, allowing exploration to be ‘in vogue’ again as the economic cycles of ‘bear and bull’ markets continue their dance. This is the moment where investors get on board to make money off of shares of listed exploration companies known as “Juniors”, and they confidently assume that the funds they place in good faith with a Junior company will go towards exploration expenditures, but in fact, much of it could go to settling debt, or ‘negative equity’.

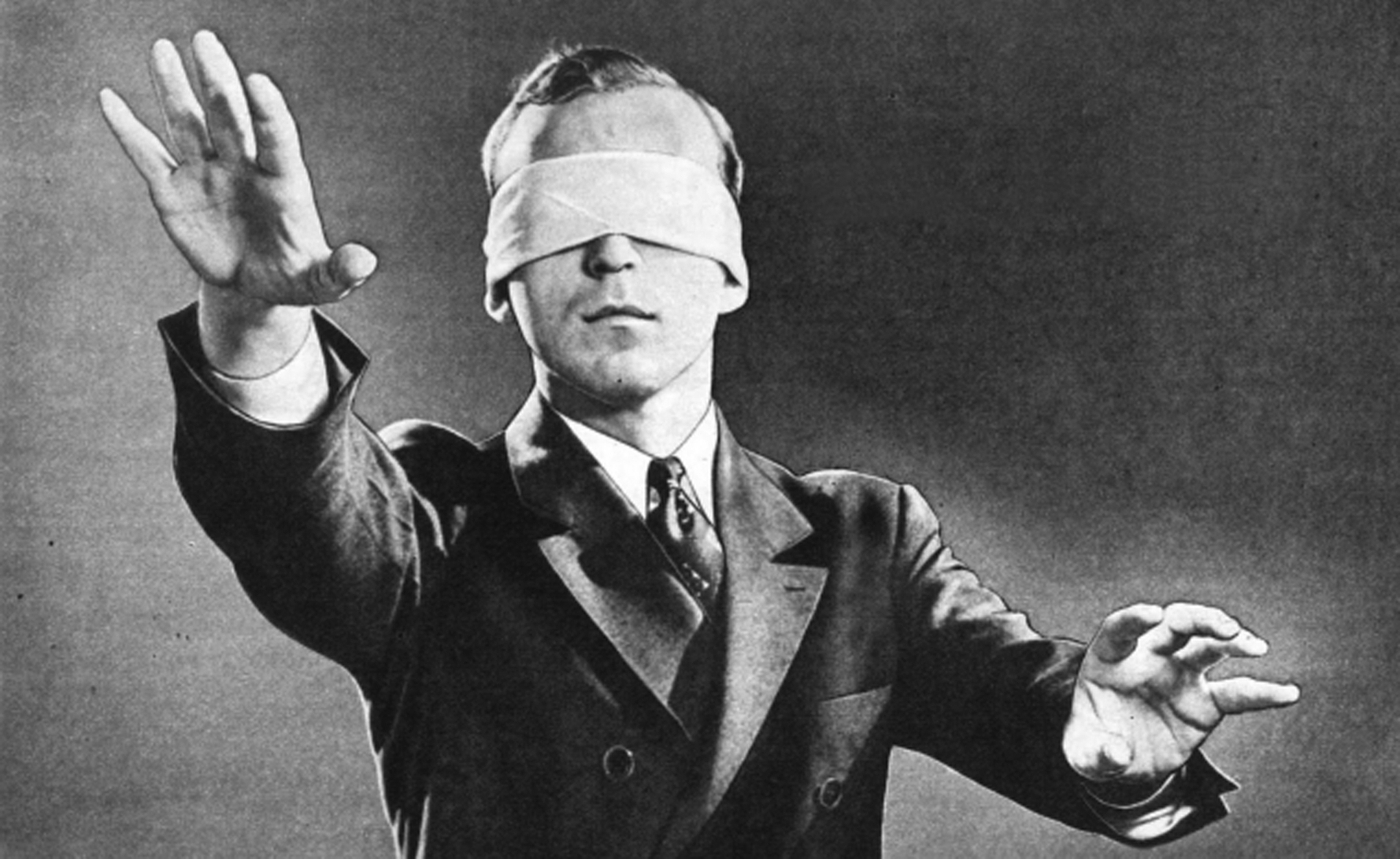

This is an issue that will deeply affect any future rebound, and it leads directly to the policies of the Toronto Stock Exchange and the implication that they are ‘turning a blind eye’ to investor protection in order to retain profits.

Diving Deeper Into the Issues

Recent independent studies by respected analysts have revealed that approximately 600 Juniors are non-compliant with the Toronto Stock Exchanges’ (TSX) basic listing requirements, and in total they carry over $2 billion in negative equity.

To be listed on the TSX, companies have to fulfill a set of well laid out rules and regulations. One of them, the ‘Continuous Listing Requirement’ (CLR), is described under Policy 2.5, Heading 2.1 of the TSX Listing Rules, and clearly states that a company must have at least $50,000 in working capital to stay listed on the markets. This is for good reason – exploration costs are not all about drilling, with basic funds being applied to licences, lands, permits and of course basic wages for administrative staff. If a company cannot maintain their land package, then they do not have any projects to work upon.

The rules for dealing with companies that are not complying with these basic regulations are also clearly laid out (Policy 2.5, Heading 3). Essentially, notices are handed out by the TMX Group allowing the company to reach compliance within a certain number of days, and if not, they are either demoted through the Tier system, or delisted altogether.

But this is where we hit a snag. If over 600 companies are non-compliant on that one point of the CLR alone, why are so few companies having notices issued to them? It seems to come down to one thing – the TMX Group is a ‘for profit’ entity, and the sudden loss of fees from delisting so many Juniors would have a huge impact. We have to start asking why this is not happening.

Can We Afford To Turn A Blind Eye?

Why is there an issue with these companies remaining on the public listings? As we mentioned before, the 600 Juniors targeted have a collective negative working capital of over $2 billion. When investor confidence rises, we will start to see money flow again, but the pool of funds will be limited. If all of these companies are resurrected, then at least $2 billion of investors money will go to settling these debts before any is spent in the ground.

There are perhaps an equal number of companies who are listed whose finances are in good standing, are well run, and they are compliant with the TSX regulations, but their credentials are severely diluted within a list of Junior companies, making it harder for potential investors to pick a company to invest in. When everyone starts campaigning for money, how will the investor know which horse to back? Sure, these same companies who carry the debt boast of over $5 billion in exploration assets, but how is this being quantified? Mainly through exploration and development expenses that have been capitalized. Once an asset is capitalized, then it can be subsequently amortized, or depreciated overtime like any tangible asset.

So we have a decision to make – do we want the next round of investment to go into paying the debts of these companies, or do we want funds to go into exploration, research and development and of course, employment? Delisting removes some of the risk, but also frees up properties that are ripe for exploration, further stimulating growth.

Critical Omissions

Most companies state that they are listed on the TSX or TSX-V in their SEDAR filings, websites and news releases, but they conveniently omit if these are not in compliance with the Continuous Listing Requirements. This would be classed as material information, but what is ‘material information’? Under National Instrument 52-101, it is described as;

Would a reasonable investor’s decision whether or not to buy, sell, or hold securities in your company likely be influenced or changed if the information in question was omitted or misstated? If so, the information is likely material.

The issues get right down to the Director level of a company. The directors have a fiduciary duty to the shareholders to be transparent about concerns. It would be incumbent on them to be open if they cannot continue their listing, instead of vaguely hoping to continue on the basis of future rebound or of being benignly ‘ignored’ by the TMX Group. This goes also for the capitalization of exploration assets, whose value is flimsy at best, and not well represented in the regulations laid out by the International Financial Reporting Standards (IFRS 6 Exploration for and Evaluation of Mineral Resources). It seems that the auditors of the 600 companies are relying on the vague language of IFRS 6 rather than considering if an exploration asset should be capitalized under any circumstances. With that said, we are starting to see early signs of a shift in this trend, as this article at Mining Global outlines.

There have been several conversations with auditors, companies and the TMX Group to fact check and garner their opinions, but none seem to show any immediate level of concern over the debt to asset ratio of companies listed on the TSX, let alone blatant non-compliance issues.

The Ontario Securities Commission, the BC Securities Commission, and the Alberta Securities Commission all have mandates that emphasize investor protection and market integrity, as do ten other commissions across Canada. All are ‘lawyer-heavy’ but have accounting staff that check SEDAR-filed financial statements in detail. They have never questioned the materiality of non-compliance with CLR by any of the companies on the negative working capital list.

The Right Move May Not Be The Easy Option

So what conclusions should be drawn, and what actions should be made? Given the demonstrated lack of awareness, it is a legitimate question to wonder if shareholders and other stakeholders are protected per the Securities Commissions’ mandates as expressed on their websites. Although many of these companies that are facing negative equity have ended up there due to prevailing financial conditions over bad management, the policies that are made to protect investors cannot be applied inconsistently across the board.

If we want a rapid and productive recovery from the current mining and exploration downturn, then we have to assume that putting money in the ground rather than paying several years of debt is going to be most beneficial. There needs to be an industrywide ‘soul searching’ and willingness to look at the merits of each company and decide upon those who may benefit from a legitimate ‘bail-out’ strategy over those who got into the red due to reckless spending. If institutions are not protecting the investor, then we need to rise up to the challenge. It is the only way to restore a modicum of investor faith in the industry.

It all comes down to the ethics and professionalism of the industry, and that previously quoted from NI 52-101, is this material information that would otherwise affect an investors decision to buy shares in a company. Omitting information is a dangerous precedent and it is hoped that 2015 will draw continued change, and see investor cash flow into a depressed industry, but is invested not into debt but real research and development.

[divider]

Links:

Toronto Stock Exchange Policy 2.5: http://apps.tmx.com/en/pdf/Policy2-5.pdf

International Financial Reporting Standards: http://www.iasplus.com/en/standards/ifrs/ifrs6

Mining Global Article: http://www.miningglobal.com/operations/1326/Is-it-Time-for-Junior-Miners-to-Cease-Capitalization-of-Exploration-Costs

Information Sourcing: Tony Simon at Seguro Consulting Inc.

Subscribe for Email Updates

Thanks James. You are correct that CEO.ca did run a similar story, although it was published on the same day (25th Feb) as ours. The information was provided to myself and Tommy by Tony Simon directly, following conversations we had had on this topic during the preceding months. The CEO.ca article is more or less a direct copy of Tony Simons ’44 Comments’ notes, but I wanted to write something that put it more into context for our readership. I also took some time to fact check the information as I felt with the delicacy of the topic, it is essential to understand the information and make sure the claims are valid. With this extra research, we ended up publishing several hours after CEO.ca. From the distribution of Mr. Simon’s notes though, we are likely to see this story crop up more and more.

Very interesting article. For a while Rick Rule was looking for a capitulation, but it never really manifested itself. Now I have a better idea why that is. Because the TSE has been letting these companies carry on doing business when clearly they should’ve been delisted. Essentially there would have been a capitulation if the TSE hadn’t backstopped the garbage companies. A chart tracking the number of issuers in the mining sector on the TSX Venture exchange really bares that out. A mere 10% reduction in issuers when the total cumulative value of the sector is just one third of what it was at the highs… something doesn’t add up. These corpse companies should’ve been thrown overboard a long time ago but instead they’re being kept alive by TMX, Weekend at Bernie’s-style.

https://i.imgur.com/O6GP3XO.png