Companies lucky enough to inherit old core left over from a previous operator can benefit from this previous work but must exercise caution when relying on the data: The core assays are only valuable if they can be confidently traced back to their original drill locations and depths.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. [/box]

TORONTO, ONTARIO–(Marketwired – March 26, 2014) – Nighthawk Gold Corp. (“Nighthawk”) (TSX VENTURE:NHK) reports assay results from 18 historic holes from 1986 drilled on its recently acquired Cass gold deposit (see December 18, 2013 news release) located on Nighthawk’s Indin Lake Gold Property in the Northwest Territories (“NWT”).

[box type=”note” align=”aligncenter” ]

Starting with a small chunk of ground 2010, Nighthawk Gold (formerly Merc International Minerals) has been aggressively expanding its land package around the “Indin Lake Gold Camp” in the Northwest Territories of Canada about 220 km north of Yellowknife. Currently they are sitting on almost 230,000 acres, or about 930 square km of mineral properties.

As we’ve discussed before, project branding can go a long way in attracting investment. In the mining world, the word “camp” is typically applied to an area hosting multiple deposits of similar type which have been mined in the past or are currently being mined. Several mining camps or deposits within a larger geologically similar region might be referred to a “mining district”. There are no legal ramifications (that I know of) associated with the use of these terms and junior miners looking to get some attention for their projects may reach a little high when branding their projects. For example, a prospect may be branded to as a mining project or an exploration project as a deposit. Companies may also refer their properties in the future tense: “The next great mining camp!” Or they may frame it as a question: “Is this the next great high grade gold mine?”

In Nighthawk’s case their property includes the former Colomac Gold Mine, an open pit gold mine which operated in the 1990’s. Although only one deposit was mined, Nighthawk’s property includes large number of gold prospects and a former mine with at least five separate deposits.

Incidentally, the Colomac mine went out of business in 1997 due to low gold prices and it took more than a decade to clean-up the site. When Nighthawk took it over, they agreed to spend up to $5 million on further site restoration. The scars left behind by lazy or unethical mining companies can make life very difficult for new operators to come into an area regardless of their good intentions or updated world views. But that’s another article.

The release also dealt with a 5 for 1 “share consolidation” designed to increase the company share price, but we’re not talking about that and have deleted those references.

[/box]

HIGHLIGHTS:

- Hole 86-34 intersected 36.85 metres of 5.67 grams per tonne (“g/t“) gold including 16.30 metres of 10.08 g/t gold, and 9.80 metres of 14.05 g/t gold;

- Hole 86-18 intersected 26.65 metres of 6.53 g/t gold including 16.75 metres of 8.94 g/t gold, and 4.30 metres of 16.45 g/t gold;

- Hole 86-27 intersected 41.40 metres of 3.35 g/t gold including 27.90 metres of 4.55 g/t gold, and 12.00 metres of 6.51 g/t gold;

- Majority of historic drill intersections lie within 75 metres of surface; and

[box type=”note” align=”aligncenter” ]

What’s interesting about this news is that the company is reporting results from the re-assay of core from the 1980’s and not their own drill program. Companies lucky enough to inherit old core left over from a previous operator can benefit from this previous work but must exercise caution when relying on the data: The core assays are only valuable if they can be confidently traced back to their original drill locations and depths. Holes drilled before the availability of accurate GPS devices can be difficult to accurately place and inaccurate, or missing documentation can be troublesome.

[/box]

David Wiley, President and CEO of Nighthawk commented, “The historical drill results we now have from Cass and Kim are outside of our current mineral resource estimate. We are working with the author of our technical report to undertake the necessary QA/QC steps that will potentially enable us to include these results in the next update of our mineral resource estimate. Regarding the Share Consolidation, we are confident this step will position Nighthawk for the next stage of growth. Through the support of our dedicated shareholder base of well-known mining professionals we have assembled a truly bona-fide gold camp in a stable Canadian jurisdiction. Over the balance of this year and on into 2015 we anticipate steady news flow as we continue to de-risk and advance the Indin Lake Gold Property.”

[box type=”note” align=”aligncenter” ]

The company is hoping they can include these assay results in their resource estimates and will be using their independent Qualified Person to evaluate the data and perform the necessary QA/QC. The re-assay itself wouldn’t likely be in question, but the reliability of the core locations would be. Remember that reporting of technical results was not regulated in the 1980’s and NI 43-101 did not exist.

[/box]

Historic Drilling and Results

The Cass deposit, hosted within a gabbroic intrusion, and the Kim deposit, hosted within a mafic volcanic rock package, represent high priority, yet underexplored deposit types within the Indin Lake Gold Camp. Data recently compiled from the two deposits includes over 32,000 metres of 1986, 1987 and 1995 drilling. Much of this core is preserved on-site and will be selectively re-logged and re-sampled in 2014.

Highlights from 1986 drilling (18 holes) are presented for the Cass deposit (Table 1), defining broad zones of near surface gold mineralization with significant grade and continuity. Intersection widths, shallow depths (majority of intersections lie within 75 metres of surface) and continuity of mineralization are believed to be conducive to open pit mining methods. These results are historic in nature and Nighthawk has not independently verified the results; consequently they should not be relied upon. Results from the remaining historic holes will be released as they are finalized.

[box type=”note” align=”aligncenter” ]

They plan to do more re-logging and re-assaying. Core logging involves the physical examination and documentation of the drill core by a geologist or geo-tech.

[/box]

| Table 1. Historic 1986 Drill Results from Cass | |||||

| Hole I.D. | From (m) |

To (m) |

Length* (m) |

Grade g/t Au |

|

| C86-05 | 21.70 | 25.80 | 4.10 | 3.49 | |

| 47.00 | 66.50 | 19.50 | 4.10 | ||

| including | 57.00 | 62.00 | 5.00 | 8.19 | |

| C86-06 | 27.30 | 43.70 | 16.40 | 2.54 | |

| 76.25 | 80.85 | 4.60 | 5.74 | ||

| C86-08 | 44.90 | 54.00 | 9.10 | 2.29 | |

| C86-09 | 39.00 | 49.00 | 10.00 | 2.97 | |

| including | 39.00 | 42.00 | 3.00 | 7.89 | |

| C86-11 | 53.00 | 72.00 | 19.00 | 3.31 | |

| including | 54.90 | 67.50 | 12.60 | 4.02 | |

| C86-13 | 56.90 | 64.50 | 7.60 | 4.14 | |

| C86-14 | 54.20 | 66.50 | 12.30 | 3.03 | |

| including | 58.00 | 63.60 | 5.60 | 4.82 | |

| C86-18 | 18.85 | 33.40 | 14.55 | 3.42 | |

| including | 25.20 | 33.40 | 8.20 | 5.49 | |

| 38.70 | 65.35 | 26.65 | 6.53 | ||

| including | 40.80 | 57.55 | 16.75 | 8.94 | |

| including | 40.80 | 45.10 | 4.30 | 16.45 | |

| including | 50.85 | 57.55 | 6.70 | 9.47 | |

| C86-19 | 53.80 | 67.60 | 13.80 | 4.74 | |

| including | 62.66 | 66.00 | 4.00 | 10.04 | |

| 78.80 | 94.40 | 15.60 | 2.98 | ||

| including | 92.00 | 94.40 | 2.40 | 7.00 | |

| C86-20 | 39.80 | 55.20 | 15.40 | 4.42 | |

| including | 44.50 | 53.20 | 8.70 | 6.71 | |

| including | 48.70 | 53.20 | 4.50 | 8.77 | |

| C86-20B | 41.70 | 59.50 | 17.80 | 3.56 | |

| including | 50.00 | 55.50 | 5.50 | 6.98 | |

| 99.65 | 127.01 | 27.45 | 3.97 | ||

| including | 100.30 | 111.00 | 10.70 | 6.97 | |

| C86-27 | 48.10 | 89.50 | 41.40 | 3.35 | |

| including | 61.60 | 89.50 | 27.90 | 4.55 | |

| including | 75.00 | 87.00 | 12.00 | 6.51 | |

| C86-33 | 102.95 | 119.05 | 16.10 | 4.64 | |

| including | 107.55 | 118.05 | 10.50 | 6.61 | |

| C86-34 | 97.30 | 134.15 | 36.85 | 5.67 | |

| including | 102.60 | 118.90 | 16.30 | 10.08 | |

| including | 109.10 | 118.90 | 9.80 | 14.05 | |

| C86-35 | 109.55 | 129.70 | 20.15 | 3.38 | |

| including | 113.05 | 117.15 | 4.10 | 6.65 | |

| C86-37 | 108.60 | 124.00 | 15.40 | 2.45 | |

| C86-38 | 136.30 | 167.10 | 30.80 | 2.46 | |

| including | 158.10 | 163.50 | 5.40 | 5.57 | |

| C86-40 | 129.10 | 144.90 | 15.80 | 3.46 | |

| including | 135.20 | 144.90 | 9.70 | 4.49 | |

* Lengths are reported as core lengths. True widths are unknown at this time.

[box type=”note” align=”aligncenter” ]

The results are generally shallow and low grade which is what we might expect in this area. Given the expenses and challenges of operating up north, a low grade deposit will have to be huge in order to attract the required investment to bring it online. This is likely why Nighthawk has accumulated such a huge land position.

[/box]

Cass Gold Deposit

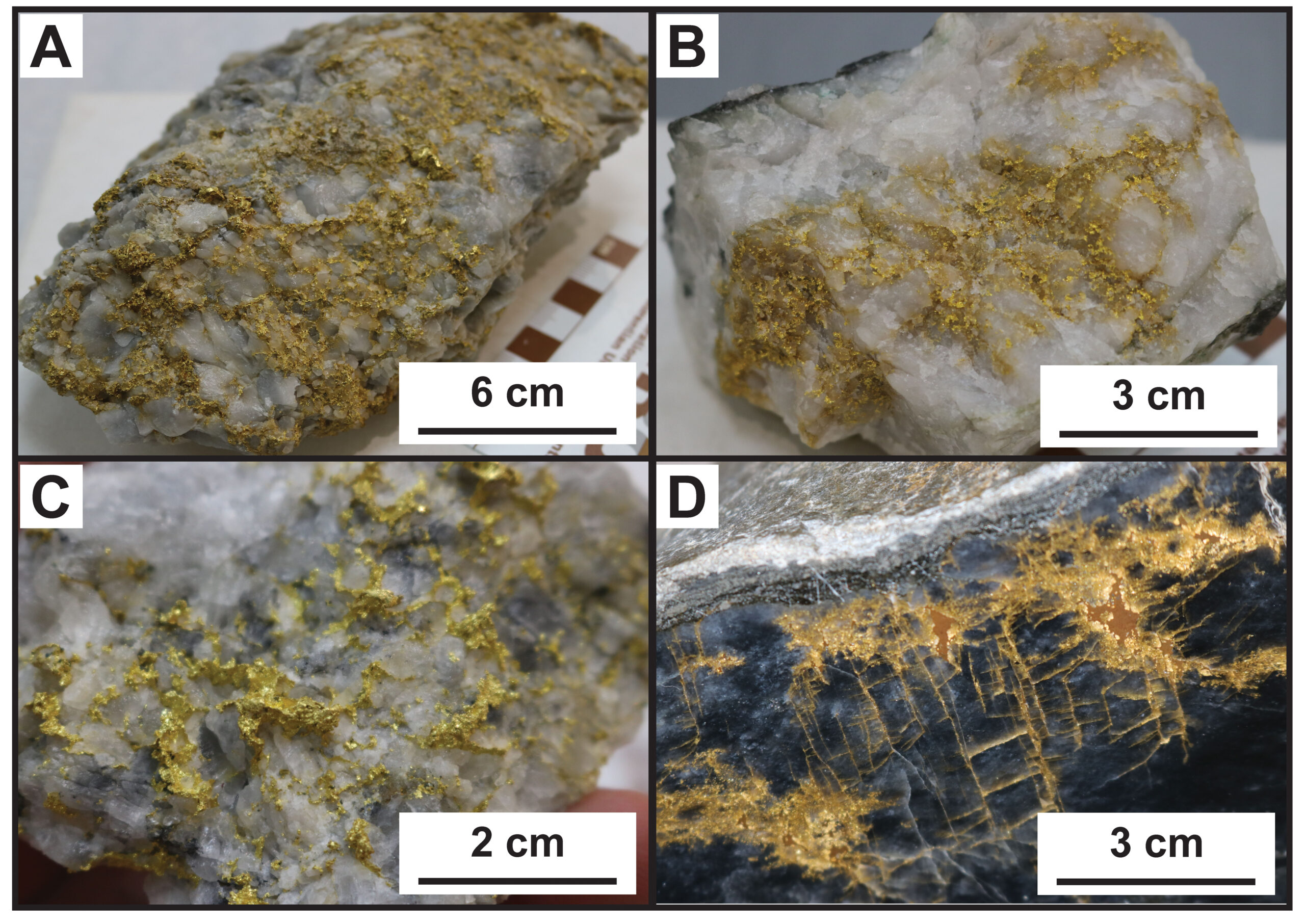

The Cass deposit is connected by road to Nighthawk’s Colomac Gold Property located 20 kilometres to the northeast. Mineralization is characterized by stockwork quartz-carbonate veins with minor pyrite, pyrrhotite and arsenopyrite within a northeast trending intrusion. Approximately 13,500 metres of historic drilling traced the mineralization over a strike length of 360 metres and to a depth of 210 metres. The deposit remains open in all directions.

[box type=”note” align=”aligncenter” ]

Prospectors looking for gold have traditionally looked for “dirty” quartz veins like those described above. While a clean-looking white or near-translucent quartz vein is generally barren, a dirty quartz vein with minor sulfides and iron-stained carbonates can be prospective for gold. The impurities indicate a more complex (i.e. metal-bearing) fluid composition associated with the hydrothermal activity that emplaced the vein.

[/box]

In the mid 1990s, Royal Oak planned to develop the Cass deposit by means of an open pit operation and process the ore at its Colomac Mill, however the company closed its Colomac operation before production was achieved from the deposit.

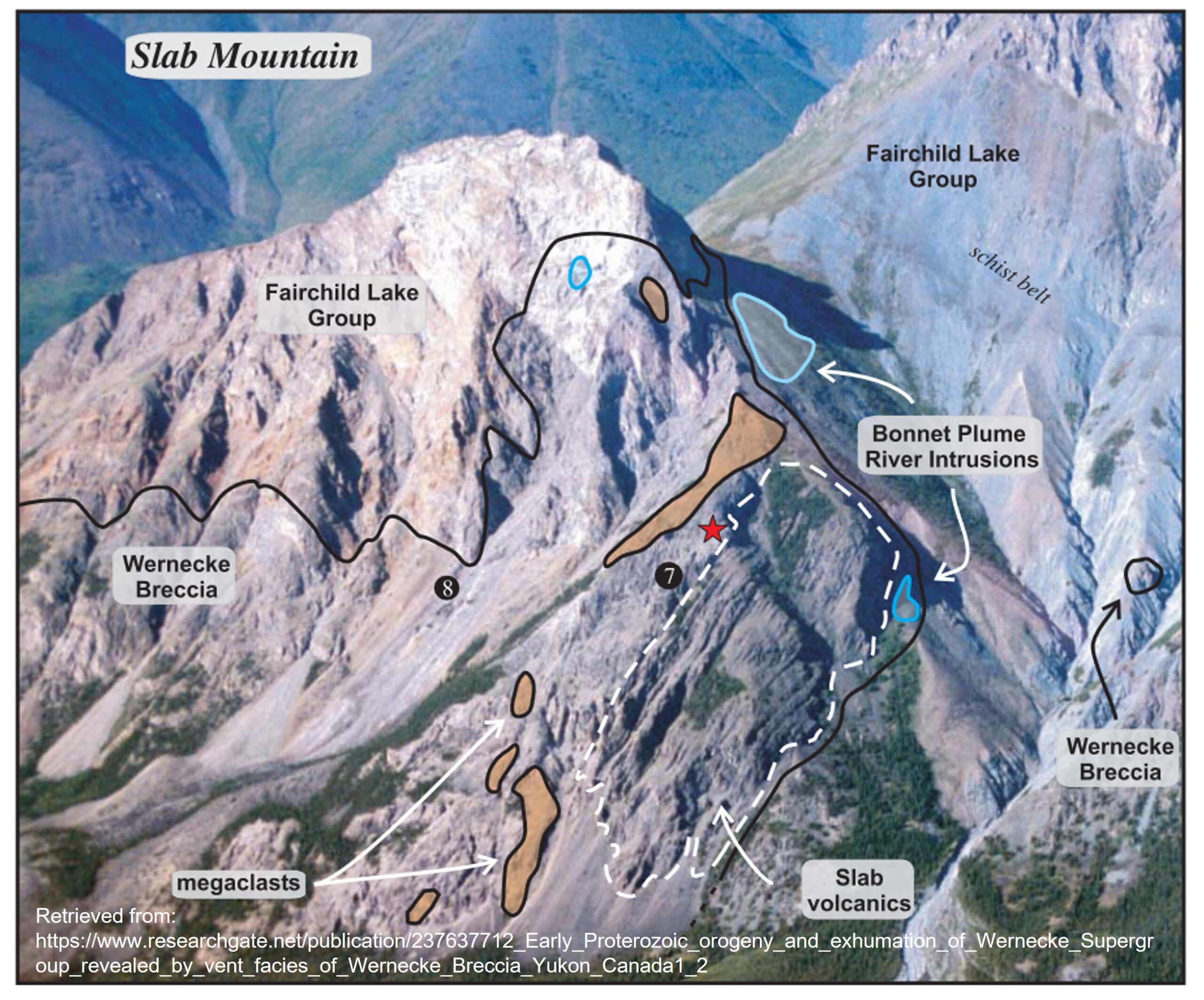

The Cass style of mineralization points to the largely untested potential for discovery of significant gold mineralization in other gabbroic bodies such as those hosting the under explored and nearby Raspberry and Albatross gold occurrences. In addition, similar showings have been located throughout the Indin Lake Gold Belt and represent priority exploration targets to be assessed in the upcoming 2014 field program.

[box type=”note” align=”aligncenter” ]

Gold showings in this area seem to occur in a variety of host rock types, but are more commonly associated with late hydrothermal activity affecting these rocks. In this case the host rock is a high temperature igneous intrusive rock (“gabbroic bodies”), but in other parts of the property gold is hosted in volcanic and sedimentary rocks.

[/box]

In December 2013, Nighthawk optioned four mining leases from Geomark Exploration Ltd. (“Geomark”), a wholly owned subsidiary of Pine Cliff Energy Ltd. The agreement encompasses not only the Kim and Cass gold deposits (Figure 1) but several other prospects.

About Nighthawk Gold Corp.

Nighthawk is a Canadian-based exploration company focused on acquiring and developing gold mineral properties in the Northwest Territories. Its primary land position covers 229,791 acres or 930 square kilometres in the Indin Lake Gold Camp and includes an Inferred Mineral Resource estimate of 39.815 million tonnes with an average grade of 1.64 g/t gold for 2.101 million ounces gold using a cut-off grade of 0.6 g/t gold.

The technical aspects of this press release have been reviewed by Michael Byron, Ph.D., P.Geo., Chief Geologist and Director for Nighthawk, who is the “Qualified Person” as defined by NI 43-101 for this project.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]