Exploration for mineral deposits is hard. Promising geochemistry can lead nowhere, geophysical anomalies can remain anomalous, alteration zones can get misidentified, misplaced or were never there in the first place. Drills can crap out meters before the target depth. If all these are overcome and you are lucky enough to drill a hot drill hole, then can it be done again? More than once, a hot drill hole turns out to have been place just right to hit the sweet spot, and never again over the thousands of meters that follow are the results as good as they first were.

I was reminded of this phenomena while reviewing GoldQuest Mining Corp’s (TSX-V:GQC) Romero project in the Dominican Republic. The initial results came out in summer of the 2012, in what was the Indian summer of the commodities boom: 231 meters grading 2.4 g/t gold, with 160 m grading 2.9 g/t gold and 0.62 % copper from 104 m to 264, and bottoming in mineralization. Like an electric shock, here was another company that looked like Aurelian, or Reservoir Minerals (which came out with it’s stunner on the Cukaru Peki deposit that same summer), and the markets went wild. However, by the end of the year things had cooled and the stock price reverted to the mean. What happened? Several things, but the essential issue was that the markets had priced in another Pueblo Viejo, a 35 million oz gold deposit hosted in a similar geological setting, and when it turned out to be something smaller the markets rapidly lost interest. Yet as the world turns, the markets appetite for massive deposits with huge resources has waned, and could a small high grade deposit that makes money be now worth looking at?

Location & Ownership

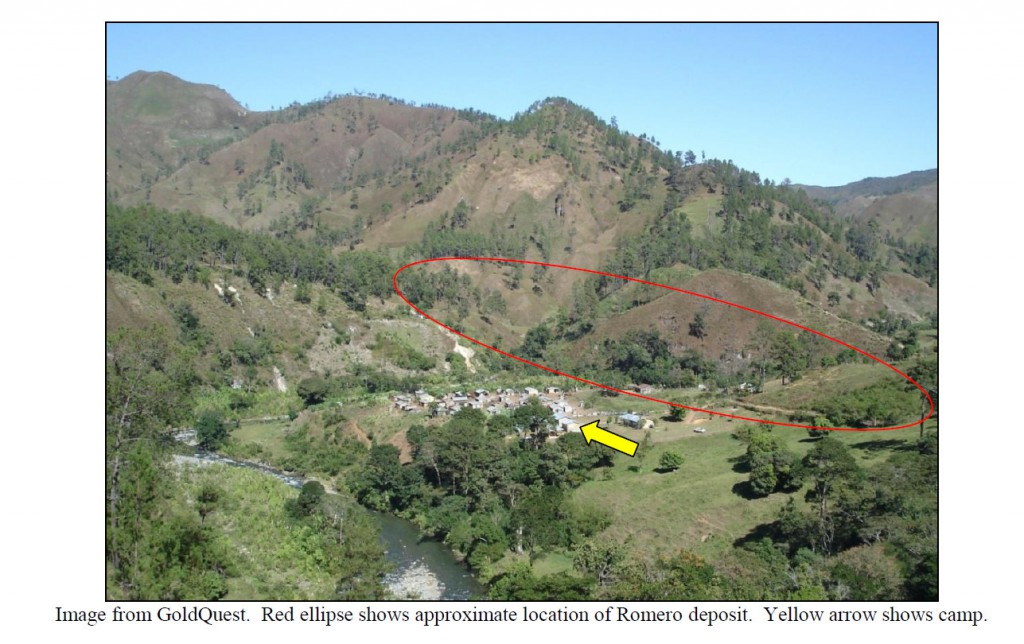

The Romero Project is located in the Dominican Republic, 165 west kilometres from the capital Santo Domingo on the south side of the Cordillera Central, at an elevation of 1000 metres. Access is  by either helicopter or unpaved road, to the small village of Hondo Valle where the company has set up a base camp. The concession is 100% owned by Goldquest, with a 1.25% NSR to Goldfields.

by either helicopter or unpaved road, to the small village of Hondo Valle where the company has set up a base camp. The concession is 100% owned by Goldquest, with a 1.25% NSR to Goldfields.

Geological Setting

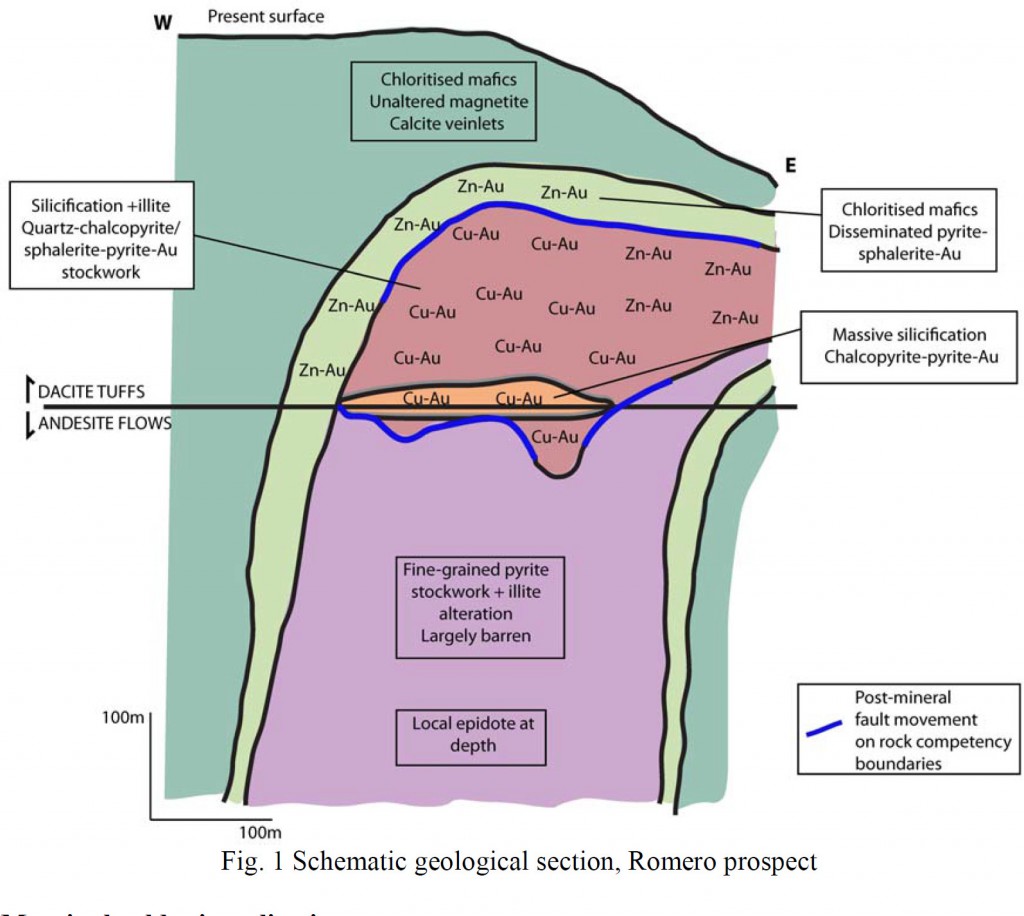

The Dominican Republic is a part of the Greater Antilles Arc, a Cretaceous to Paleogene Island arc complex that includes Cuba, Hispaniola and Puerto Rico formed by the collision between the Caribbean and North American plates. In the area of the Romero project the Tireo formation, a series of Calk-Alkaline volcanics and sediments formed in the Early Cretaceous and was uplifted and deformed by left lateral transpression from the Miocene onward. In the project area the geology is dominated by volcanic rocks (rhyolites, andesites and dacites) with minor limestone. The mineralization itself is concentrated in dacitic tuff-breccias (rocks made up of previously broken-up volcanic rock), that overlie a large package of andesites. The dacites are overlain by a possible rhyolite flow dome, which may be related to the mineralization.

The deposit is hosted in two zones, Romero and Romero south, and alteration with anomalous mineralization connects them. Minor mineralization is exposed under the barren caprock, but the deposits are by and large, blind deposits with little or no surface expression. The style of mineralization has been classified as intermediate sulfidation based on the phyllic/propylitic alteration suite. The bulk of the resource (90%) is located in the Romero deposit, with 10% in the Romero South.

The Mineralization is dominated by copper-gold at the core but grades distally to zinc-gold dominant. The core mineralization is composed of chalcopyrite-pyrite-gold with increasing sphalerite (zinc sulfide) moving away from the core zone. Alteration is dominated by silicification- illitization and pyrite, with a large pyritic stockwork underlying the main zone of mineralization. The mineralization and alteration show distinct zonation with grading from essentially unaltered chlorite-calcite altered rock to chlorite-pyrite- clay with zinc-gold to silicified-illitized rock with quartz chalcopyrite-pyrite, copper-gold-silver veins and finally a zone of massive sulfide-silica at the core of the deposit. Minor alteration facies include a hematite-silica zone, that possibly indicates a redox boundary and a package of limestone overlying the deposit that has been bleached from maroon to grey.

The Mineralization is dominated by copper-gold at the core but grades distally to zinc-gold dominant. The core mineralization is composed of chalcopyrite-pyrite-gold with increasing sphalerite (zinc sulfide) moving away from the core zone. Alteration is dominated by silicification- illitization and pyrite, with a large pyritic stockwork underlying the main zone of mineralization. The mineralization and alteration show distinct zonation with grading from essentially unaltered chlorite-calcite altered rock to chlorite-pyrite- clay with zinc-gold to silicified-illitized rock with quartz chalcopyrite-pyrite, copper-gold-silver veins and finally a zone of massive sulfide-silica at the core of the deposit. Minor alteration facies include a hematite-silica zone, that possibly indicates a redox boundary and a package of limestone overlying the deposit that has been bleached from maroon to grey.

The deposit appears to be stratabound with the highest grade mineralization concentrated at the boundary between the dacites tuff breccias, and the underlying andesite. Sillitoe (2013) hypothesized that this is due to the rapid cooling as the hydrothermal fluids from the feeder zone interacted with the an ancient aquifer that was present in the dacite breccias. He also contended that the barren pyrite (iron sulfide) stockwork beneath the deposit is the feeder zone for the main zone of mineralization based on location and the presence of occasional chalcopyrite-pyrite-quartz veins.

Resources & Potential

Currently the global resource stands at 19 million tonnes of 2.63 g/t Au, 0.63% Cu with 0.29% Zn and 3.7 g/t Ag Indicated, with another 10 Million tonnes Inferred for both Romero and Romero South. This works out to slightly over 1.6 Million ounces Gold with substantial base metal credits. With the inferred tonnage added in, the total number of Gold ounces is over 2.3 million. Importantly Romero, although a blind (unexposed at surface) deposit is not a deeply buried deposit and under current conditions, costs for exploration and development have come down far enough to make it attractive to proceed with development.

The management of GoldQuest feel the same way have started the process moving the project through the Preliminary Economic Assessment (PEA) to pre-feasibility to a full blown feasibility study. They are also continuing their exploration of the central cordillera signing a data sharing agreement with a co-explorer and pushing ahead with their own exploration.

The PEA completed earlier this year, proposed a nine-year underground mine at an average production rate of 912,500 tonnes per year (2,500 tonnes per day). This would target the higher grade zone with an average grade of 4.02 g/t gold and 0.81% copper. This would leave the bulk of the resource at Romero unmined and Romero south untouched, but it has a very tasty NPV of $355 million based on a 6% discount rate, a pre-tax internal rate of return (“IRR”) of 46% and finally a Life-of-mine (“LOM”) all-in sustaining costs (“AISC”) of $572/oz gold equivalent, well below the current gold price and very attractive to any producer looking to lower their higher cost older mines. Finally in a nod to the current requirements for a social licence as well as positive economics the mine plan is low impact, small footprint plan with unusual elements such as an absence of cyanide.

Further Reading

- Comments on Geology and Exploration of the Romero Gold-Copper Prospect and Environs, Las Tres Palmas Project, Dominican Republic By Richard H. Sillitoe, 2013 (Company PDF)

- Preliminary Economic Assessment Technical Report on the Romero Project, Dominican Republic, 2015 (Company PDF)

- The Metallogenic Evolution of the Greater Antilles, 2011 (Academic PDF)

Subscribe for Email Updates