The discovery of significant gold in relatively shallow oxidized material could be a definite bonus to Gold Standard. Some early stage cash flow from the processing of oxidized material may help with funding further developments.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Please view the full release here.[/box]

First core hole intersects 56.1m of 1.47 g Au/T gold including 7.3m of 5.66 g Au/T

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Oct. 2, 2013) – Gold Standard Ventures Corp. (TSX VENTURE:GSV)(NYSE MKT:GSV)(NYSE Amex:GSV) (“Gold Standard” or the “Company”) (www.goldstandardv.com) today released results from its first core hole drilled into the Bald Mountain Au-Cu target which could have important economic consequences for the Company’s 100%-owned Railroad Project in the Carlin Trend.

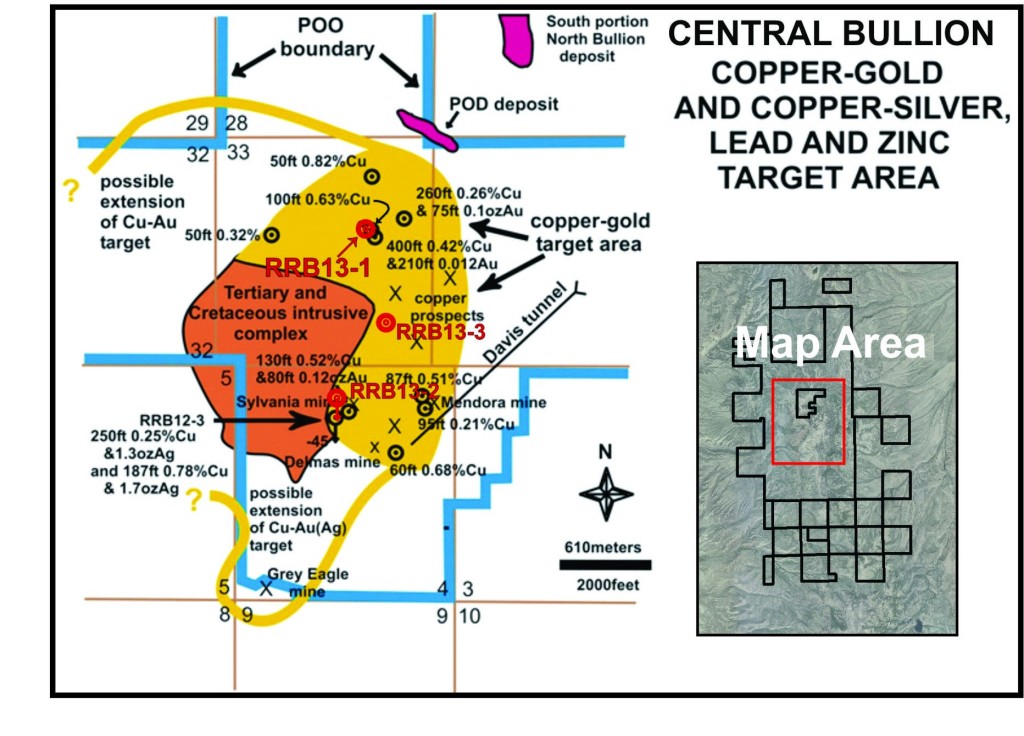

[box type=”note” align=”aligncenter” ]We’ve included location maps showing the location of the the Bald Mountain target (Central Bullion Au-Ag-Cu Targets) within the Railroad Project area. Bald Mountain is located only 1500 metres southwest of the North Bullion gold discovery that we recently reviewed. The Railroad Project area lies within the gold-rich Carlin Gold Trend of Nevada, USA.[/box]

Vertical core hole RRB13-1 intersected 56.1 meters of 1.47 g Au/T, including an internal interval of 7.3 meters of 5.66 g Au/T. Importantly, the gold intercept is hosted entirely in oxidized hornfels breccia and represents the most significant oxidized gold mineralization found to date in the northern Railroad project area. Gold in oxidized mineralization can typically be recovered using less expensive methods than non-oxidized (sulphide) material.

[box type=”note” align=”aligncenter” ]Gold in oxidized mineralization is usually easy and cheaper to extract because the weathering of sulfides effectively liberates the minute gold particles from sulfide mineral grains. This exposes more particles to the cyanide and/or acid solution during extraction, which in turn allows more gold to be dissolved. When trapped in sulfides, roasting of the mineralized material is normally required to free the gold. This requires energy, which is an additional cost best avoided.

The discovery of significant gold in relatively shallow oxidized material could be a definite bonus to Gold Standard. Some early stage cash flow from the processing of oxidized material may help with funding further developments.[/box]

Immediately below the gold intercept, RRB13-1 intersected a separate copper zone returning 23.3 meters of 0.4% copper as well as narrower but high-grade intercepts of other base metals and silver.

[box type=”note” align=”aligncenter” ]The base metal assemblage, in particular the relatively low grade but reasonably thick copper-rich interval, discovered in drill hole RRB13-1 supports the porphyry-style deposit hypothesis. However, what needs to be kept in mind is that this copper-rich zone may be due to enrichment caused by near-surface ground water processes. If this is true, then the deeper primary mineralized material could be of a much lower grade or localised within thin veins/zones.[/box]

Highlights:

- RRB13-1 (located about 1500 meters southwest from the North Bullion gold discovery), the first hole drilled by Gold Standard into the Bald Mountain Au-Cu target, was designed to provide an early-stage core test of a porphyry Cu-Au-type target opportunity indicated by historical shallow reverse circulation holes. This high priority target opportunity became available for drilling when the exploration Plan of Operations (POO) was approved and finalized in December, 2012. (Please see drill hole location map below.)

- Significant intercepts in RRB13-1 include 56.1 meters of 1.47 g Au/T, including an internal interval of 7.3 meters of 5.66 g Au/T . Immediately below the gold intercept, the hole intersected a separate zone of 23.3 meters grading 0.4% copper. The gold and copper mineralization is open in all directions.

- The gold and copper mineralization appears to be entirely within non-calcareous, oxidized material which could ultimately be amenable to simple cyanidization and/or acid leaching extraction.

- In addition to the gold and copper mineralization, four intercepts of silver with base metals were encountered in RRB13-1 including a 1.5 meter intercept of 763.8g g Ag/t, 1.6%Cu, 11.8% Pb and 2.43% Zn. The implications of these intercepts are being evaluated.

Key observations:

- Prior, shallow historical drilling in the area used RC rigs; therefore, the character and qualities of the host rock type, and the style and distribution of mineralization, remained largely unknown.

[box type=”note” align=”aligncenter” ]Reverse circulation or RC drilling results in samples consisting of powder and small rock chips. Structural information such as the orientation of any faults, joints and bedding planes is not preserved during RC drilling. The style and distribution of mineralization, such as whether it occurs in veins or is disseminated or dispersed is difficult to tell when looking at RC chip samples.[/box]

- Known primarily as a base metal and silver camp, the historical Central Bullion area, in which Bald Mountain is located, now appears to be emerging also as an important gold opportunity.

- Further core drilling is required to determine the orientation and expand the extent of the newly-discovered Bald Mountain oxide gold mineralization.

- 1200 meters to the southwest, RRB13-2, a 65 meter, vertical, deeper offset follow-up to RRB12-3, was recently completed and assays are pending.

- A third hole, RRB13-03, in the Central Bullion area will commence shortly, at a target called Steve’s Camp, approximately 600 meters south of RRB13-01.. This hole is designed to test an area between the Cu-Ag Skarn drilled at the end of last year (see news release of January 22, 2103) and the newly discovered Bald Mountain Au-Cu intercept.

Please go to http://goldstandardv.com/5xp141/drilllocationv2.jpg to see Central Bullion Target Area Map.

[box type=”note” align=”aligncenter” ]Here is a location map showing the location of drill holes in the Central Bullion target area.[/box]

Dave Mathewson, Gold Standard`s Vice President of Exploration, stated: “We are excited by this discovery of gold in oxide material at Bald Mountain as well as the multi-element potential of the broader Central Bullion area. We have recently expanded our surface sample coverage and are now looking at a target area for copper, gold and silver with a diameter of four kilometers.”

[box type=”note” align=”aligncenter” ]This large target area needs to be reduced in size to reduce the number of future drill holes and associated exploration costs. Detailed examination of geological, geophysical and geochemical data sets should reveal high priority targets within this broader region.[/box]

Please see table below for detailed Intercepts for RRB 13-1.

[box type=”note” align=”aligncenter” ]For mines in the Carlin Trend of Nevada, grades of 0.5 g/t are mineable using an open pit and heap leach method. Some of these grades are pretty low, even by Carlin standards, but there appears to be some accessory value with other metals.[/box]

| Drill Hole RRB13-01 |

Intercept (m) | Thickness (m) | Au Grade (g/t) | Other Ag, Cu, Pb, Zn, ETC. |

| 206.4-262.5 | 56.1 | 1.47 | 6.5 g Ag/t | |

| Including | 212.6-219.9 | 7.3 | 5.66 | |

| 260.9-296.0 | 35.1 | 0.17 | 6.8 g Ag/t | |

| 0.31% Cu | ||||

| 0.15% Zn | ||||

| Including | 269.8-293.1 | 23.3 | 0.40% Cu | |

| 451.5-452.4 | 0.9 | 0.11 | 95 g Ag/t | |

| 0.03% Cu | ||||

| 1.72% Pb | ||||

| 0.21% Zn | ||||

| 472.1-473.6 | 1.5 | 0.62 | 763.8 Ag/t | |

| 1.60% Cu | ||||

| 11.75% Pb | ||||

| 2.43% Zn | ||||

| 523.6-524.2 | 0.6 | 0.26 | 281 g Ag/t | |

| 0.29% Cu | ||||

| 5.37% Pb | ||||

| 1.08% Zn | ||||

| 533.5-536.1 | 2.6 | 0.29 | 45.3 g Ag/t | |

| 0.029% Cu | ||||

| 0.70% Pb | ||||

| 0.46% Zn |

*note: the gold intervals reported in the above table are based on a 0.200 g Au/t cutoff. Weighted averaging has been used to calculate all reported intervals. The reported gold intervals may, or may not represent true thicknesses and, or widths. In general, the gold distribution within these large, complex breccia bodies tends to be irregular and will require additional drilling to establish true widths.

[box type=”note” align=”aligncenter” ]As usual, only apparent widths/thicknesses are given early on in an exploration drilling program. This is done until more is known about the size, shape and orientation of the mineralization. Below is fairly typical statement about Gold Standard’s QA/QC program.[/box]

Sampling Methodology, Chain of Custody, Quality Control and Quality Assurance:

All sampling was conducted under the supervision of the Company’s project geologists and the chain of custody from the drill to the sample preparation facility was continuously monitored. Core was cut at the company’s facility in Elko and one half was sent to the lab for analysis and the other half retained in the original core box. A blank, quarter core duplicate or certified reference material was inserted approximately every tenth sample. The samples are delivered to ALS Minerals preparation facility in Elko. The samples are crushed and pulverized and sample pulps are shipped to ALS Minerals certified laboratory in Vancouver. Pulps are digested and analyzed for gold using fire assay fusion and an atomic absorption spectroscopy (AAS) finish on a 30 gram split. All other elements are determined by ICP analysis. Data verification of the analytical results includes a statistical analysis of the duplicates, standards and blanks that must pass certain parameters for acceptance to insure accurate and verifiable results.

The scientific and technical content and interpretations contained in this news release have been reviewed, verified and approved by Steven R. Koehler, Gold Standard’s Manager of Projects, BSc. Geology and CPG-10216, a Qualified Person as defined by NI 43-101, Standards of Disclosure for Mineral Projects.

ABOUT GOLD STANDARD VENTURES – Gold Standard Ventures is focused on the acquisition and exploration of gold projects in North Central Nevada. Gold Standard currently holds a portfolio of projects totaling approximately 40,000 acres of prospective ground within North Central Nevada and the Walker Lane of which 18,130 acres comprise the flagship Railroad Gold Project on the productive Carlin Gold Trend.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]

Subscribe for Email Updates