Typically, gold deposits along the Carlin Trend have large volumes and low grades, around 1 g/t. What makes this discovery really interesting is the potentially large volume of above-one-gram material and an apparently thick high grade zone.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Please view the full release here.[/box]

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Sept. 19, 2013) – Gold Standard Ventures Corp. (TSX VENTURE:GSV)(NYSE MKT:GSV)(NYSE Amex:GSV)(“Gold Standard” or the “Company”) (www.goldstandardv.com) today released results of two additional core holes drilled into the North Bullion gold deposit on its 100% controlled Railroad Project on the Carlin Trend, Nevada. The results confirm the existence of a high-grade gold zone in the lower breccia and also expand the size of the larger, above-one-gram mineralized envelope surrounding the high-grade zone.

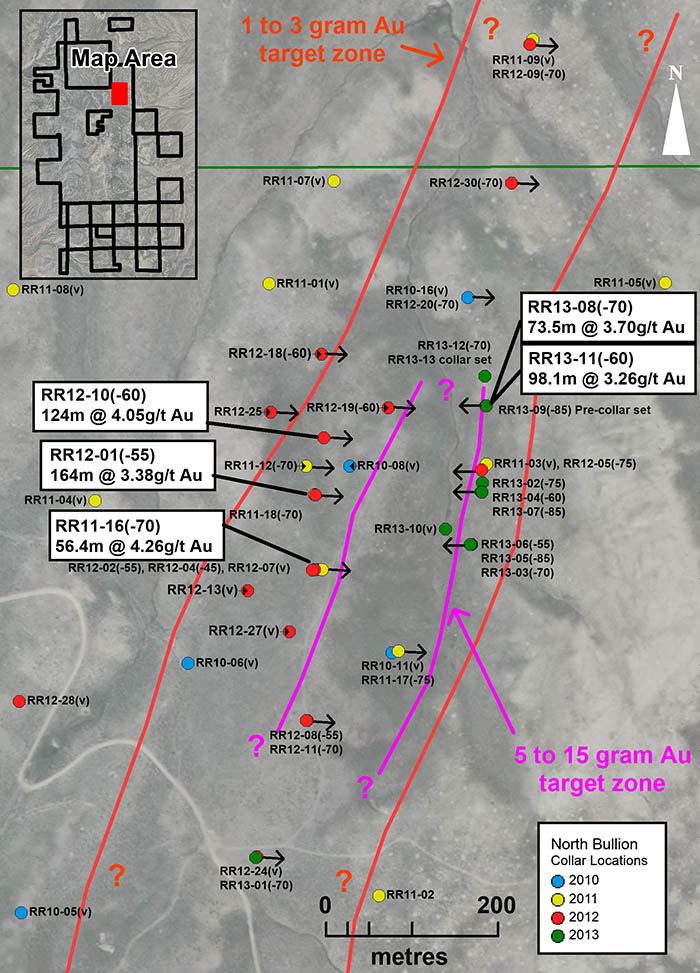

[box type=”note” align=”aligncenter” ] We’ve included a location map showing the location of the Railroad Project. Located on the Carlin Gold Trend in Nevada puts this project in one of the most prospective localities on Earth.[/box]

Highlights:

- New drill hole RR13-11 intersected 98.1 meters of 3.26g/T of gold including, 17.1 meters of 9.98 g/T. 13-11 is located 70 meters west of previously drilled and reported hole RR13-08, that intersected 75 meters of 3.67 g/T of gold at essentially the same depth (about 275 meters below surface).

- The high grade mineralization encountered in 13-8 and 13-11 is essentially open in all directions.

- Drill hole RR13-12, in progress, is a 50 meter offset to the north of 13-8 and 13-11.

- New drill hole RR13-10, located approximately 150 meters south of 13-08 & 11, intersected 35 meters of 1.82 g/T in the upper breccia and 70.7 meters of 0.55 g/T in the lower breccia.

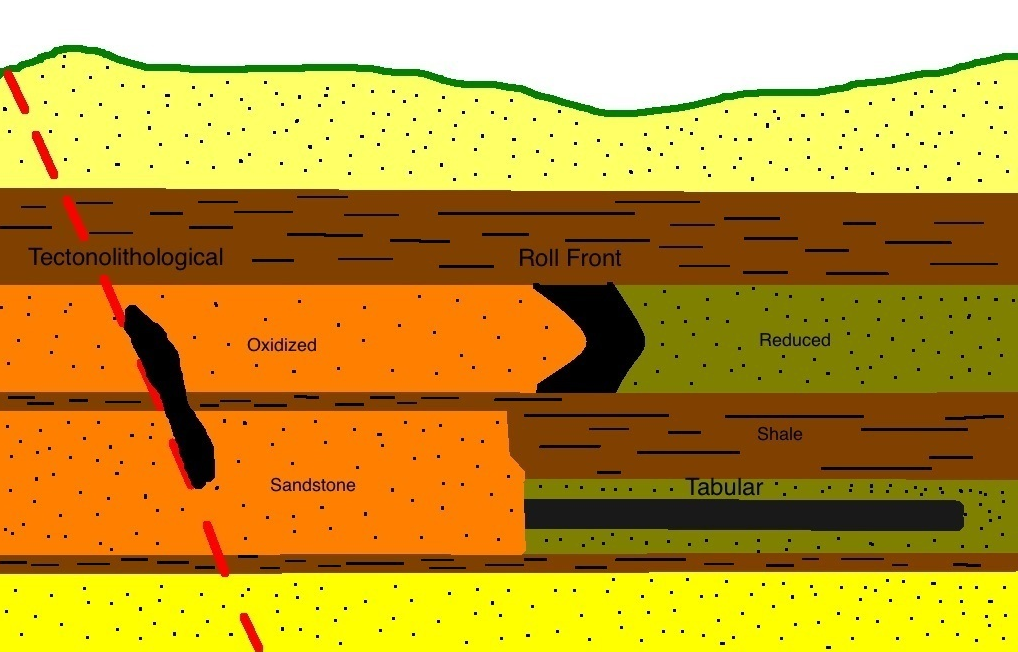

[box type=”note” align=”aligncenter” ]Gold within breccia deposits tends to be well dispersed compared to gold in quartz veins. Correspondingly, grades are normally much lower in breccia deposits compared to in quartz veins. High grades within breccias are unusual, so this discovery by Gold Standard is very interesting. It suggests that hydrothermal fluid flow has been repeatedly focused in this area resulting in upgrading over numerous episodes. These high grades also suggest that this area is proximal to a possible even higher grade feeder zone.[/box]

Key observations:

- 13-11 and 13-08 confirm continuity of high-grade gold in the extensive, lower, flat-tabular, collapse breccia body; which is analogous host material for many large Carlin-style deposits. In Carlin, lateral continuity and uniformity of mineralization and alteration within this breccia, as we see in these two holes, is exceptionally positive and bodes well for additional extensions of this mineralized zone and the potential for similar zones elsewhere in the North Bullion target zone and the Bullion Fault Corridor.

[box type=”note” align=”aligncenter” ]Gold Standard claims that the breccia body is flat lying. If this proves correct then the interval thicknesses reported here could be close to their true thicknesses. Such thicknesses with high grades points to a potentially large mineral occurrence.[/box]

- Combining the high-grade intervals encountered within the lower breccia host in 13-08 and 13-11 with the high-grade intervals in the upper breccia as found in RR11-16, 12-01 and 12-10 extends the North Bullion high-grade zone a further 50 meters to 250 meters, within a much larger envelope of above-one-gram material which is now 1000 meters (1km) long and averages 300 meters wide. Both the high-grade zone and the larger mineralized envelope remain open in multiple directions.

[box type=”note” align=”aligncenter” ]Typically, gold deposits along the Carlin Trend have large volumes and low grades, i.e. around 1 g/t. What makes this discovery really interesting is the potentially large volume of above-one-gram material and an apparently thick high grade zone.[/box]

- Further drilling is in progress to discover extensions to the lower breccia high-grade zone of mineralization and additional mineralization within the North Bullion target zone.

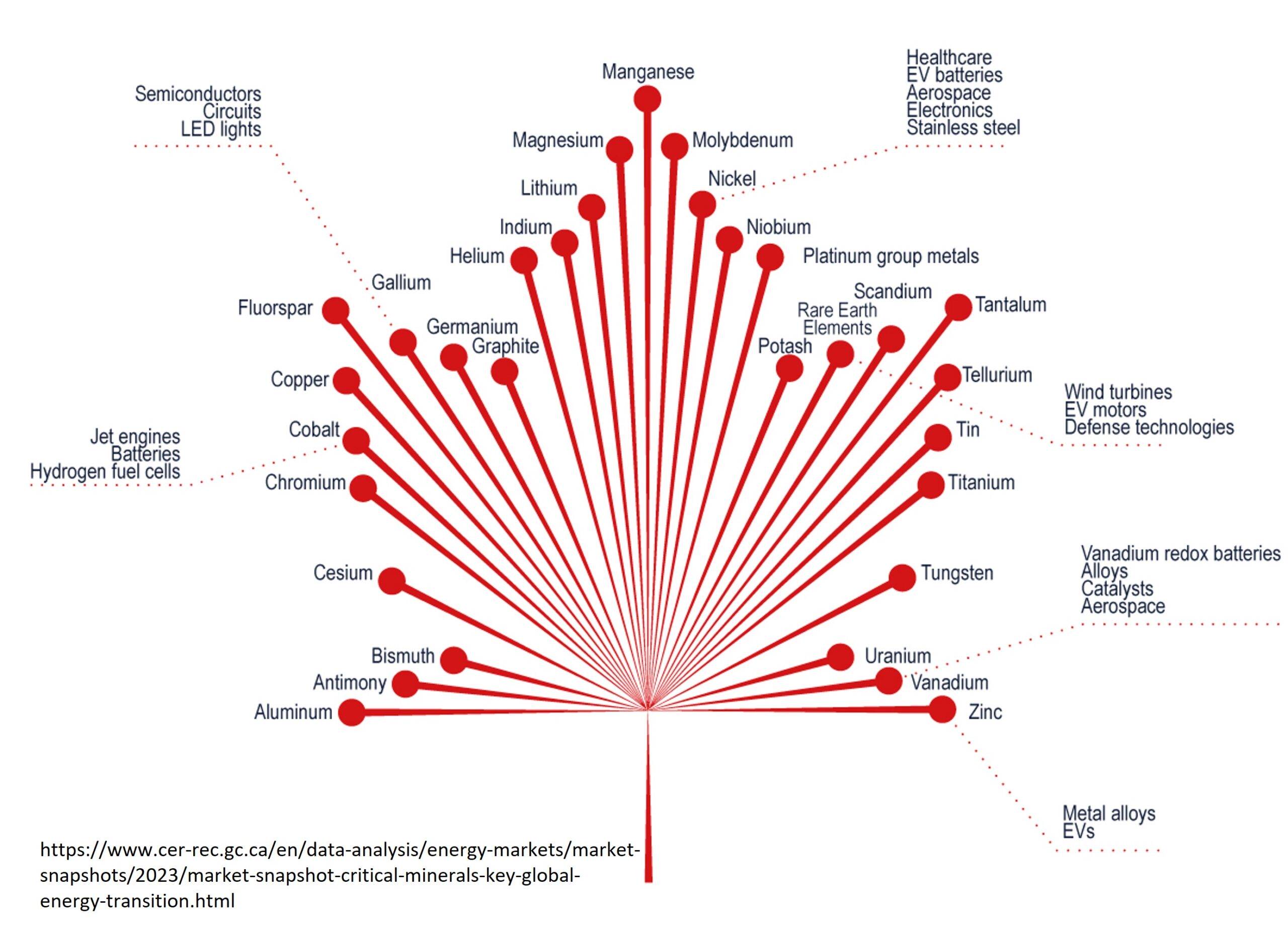

- Exploration drilling is also being conducted along the 10 kilometer long, north-south-trending Bullion Fault Corridor that hosts the North Bullion deposit. Drill targets have been identified by a combination of gravity, CSAMT, surface geochemistry, and mapping.

[box type=”note” align=”aligncenter” ]The use of controlled source audio-frequency magnetotellurics (CSAMT) is a good choice for finding the location of silica-rich, potentially high-grade feeders zones within the lower grade breccia body.[/box]

Gold Standard commenced Phase 2 definition drilling of the North Bullion gold deposit in February, 2013. Prior drilling, designed for discovery purposes, consisted generally of a combination of vertical holes and east-directed holes fanned toward the hidden structures comprising the Bullion Fault Corridor. The North Bullion deposit, discovered in late 2010, is fairly typical of the Carlin-style, footwall-model deposits where mineralization is best developed near a major flanking structure. Historically, better mineralization is encountered up to several hundred feet from the structure. The original east-directed holes effectively discovered the deposit and served to provide some characterization of the gold mineralization. Phase 2, westerly-oriented drill holes 13-02 through 13-11, were designed to establish dimensions, provide additional definition to the mineralization, and also provide a better test of the lower breccia mineralization opportunity.

Dave Mathewson, Gold Standard’s Vice President of Exploration, stated, “We are increasingly confident that the North Bullion gold deposit represents a major Carlin-style discovery within the large, prospective district-scale, multiple target setting of our Railroad project. We continue to explore for and expand mineralization at North Bullion. Discovery of uniformly thick, high grade mineralization in the lower breccia zone is a very positive development and lends favorably to the discovery of similar zones and additional high grade extensions to what we have discovered to date. We are also applying what we have learned elsewhere along the very prospective and essentially unexplored 10 kilometer long Bullion Fault Corridor now fully controlled by Gold Standard. We recently completed CSAMT (Controlled source audio magneto-telluric) survey coverage, geologic mapping and extensive additional surface sampling along the Bullion Fault Corridor – only a small portion of which has been previously tested by drilling. Surface geochemistry and geology, combined with the gravity and CSAMT data, have identified several compelling, untested target opportunities toward the south within the Bullion Fault Corridor target zone.”

Please see table below for detailed Intercepts for North Bullion Fault Zone. (Please see drill hole location map at http://goldstandardv.com/5xp141/nbdrilling-09-13.jpg.)

[box type=”note” align=”aligncenter” ]The downloaded map is shown below. The location of the high grade zone within the lower grade region is shown on the map.[/box]

[box type=”note” align=”aligncenter” ]The drill results show wide intercepts with moderate grades. Included within these wide intervals are reasonably thick zones of high grade material. This analysis still shows that the deposit holds great promise.[/box]

| Drill Hole RR13-08 |

Intercept (m) | Thickness (m) | Au Grade (g/t) | |||

| 175.9-179.9 | 4.0 | 0.34 | ||||

| 192.1-200.0 | 7.9 | 3.77 | ||||

| Including | 195.1-200 | 4.9 | 5.62 | |||

| 205.3-230.8 | 25.5 | 1.89 | ||||

| 303.6-377.1 | 73.5 | 3.67 | ||||

| Including | 336.9-344.5 | 7.6 | 12.07 | |||

| Including | 352.1-364.3 | 12.2 | 6.93 | |||

| 384.1-416.1 | 32.0 | 0.99 | ||||

| Including | 389.0-396.9 | 7.9 | 3.12 | |||

| 451.5-453.0 | 1.5 | 0.75 | ||||

| 486.6-489.3 | 2.7 | 1.58 | ||||

| RR13-09 | Precollar Set | |||||

| RR13-10 | Intercept (m) | Thickness (m) | Grade (g/t) | |||

| 163.7-166.8 | 3.1 | 0.93 | ||||

| 171.6-174.3 | 2.7 | 0.51 | ||||

| 197.9-198.8 | 0.9 | 0.86 | ||||

| 209.1-244.2 | 35.1 | 1.82 | ||||

| Including | 224.7-230.8 | 6.1 | 6.34 | |||

| 299.7-370.4 | 70.7 | 0.55 | ||||

| 434.5-435.7 | 1.2 | 0.45 | ||||

| 438.0-439.5 | 1.5 | 0.55 | ||||

| RR13-11 | Intercept (m) | Thickness (m) | Grade (g/t) | |||

| 295.7-297.2 | 1.5 | 0.58 | ||||

| 301.8-304.9 | 3.1 | 0.41 | ||||

| 313.4-411.6 | 98.2 | 3.26 | ||||

| Including | 322.2-327.4 | 5.2 | 5.04 | |||

| Including | 354.2-371.3 | 17.1 | 9.98 | |||

| RR13-12 | In Progress | |||||

| RR13-13 | Precollar Set | |||||

*note: the gold intervals reported in the above table are based on a 0.250 g Au/t (0.007 oz Au/st) cutoff. Weighted averaging has been used to calculate all reported intervals. The reported gold intervals may, or may not represent true thicknesses and, or widths. In general, the gold distribution within these large, complex breccia bodies tends to be irregular and will require additional drilling to establish true widths.

Sampling Methodology, Chain of Custody, Quality Control and Quality Assurance:

All sampling was conducted under the supervision of the Company’s project geologists and the chain of custody from the drill to the sample preparation facility was continuously monitored. Core was cut at the company’s facility in Elko and one half was sent to the lab for analysis and the other half retained in the original core box. A blank, quarter core duplicate or certified reference material was inserted approximately every tenth sample. The samples are delivered to ALS Minerals preparation facility in Elko. The samples are crushed and pulverized and sample pulps are shipped to ALS Minerals certified laboratory in Vancouver. Pulps are digested and analyzed for gold using fire assay fusion and an atomic absorption spectroscopy (AAS) finish on a 30 gram split. All other elements are determined by ICP analysis. Data verification of the analytical results includes a statistical analysis of the duplicates, standards and blanks that must pass certain parameters for acceptance to insure accurate and verifiable results.

[box type=”note” align=”aligncenter” ]It looks like they have their QA/QC covered.[/box]

The scientific and technical content and interpretations contained in this news release have been reviewed, verified and approved by Steven R. Koehler, Gold Standard’s Manager of Projects, BSc. Geology and CPG-10216, a Qualified Person as defined by NI 43-101, Standards of Disclosure for Mineral Projects.

ABOUT GOLD STANDARD VENTURES – Gold Standard Ventures is focused on the acquisition and exploration of gold projects in North Central Nevada. Gold Standard currently holds a portfolio of projects totaling approximately 40,000 acres of prospective ground within North Central Nevada and the Walker Lane of which 18,130 acres comprise the flagship Railroad Gold Project on the productive Carlin Gold Trend.

[toggle title=”We’ve skipped some of the boilerplate. You can read it in here.” state=”close” ]

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) nor the NYSE MKT accepts responsibility for the adequacy or accuracy of this news release.

On behalf of the Board of Directors of Gold Standard,

Jonathan Awde, President and Director

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, included herein including, without limitation, statements about our current drill plans are forward looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: operational risks associated with mineral exploration; unanticipated geological formations, fluctuations in commodity prices; title matters; and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com) and with the SEC on EDGAR (available at www.sec.gov/edgar.shtml). Furthermore, the existence of gold deposits on nearby properties is not necessarily indicative of the mineralization on our properties. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances.

[/toggle]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]

Pingback: Gold Standard Testing Copper-Gold Targets on Bald Mountain | Geology for Investors