Fruta Del Norte, is one of the largest, highest grade undeveloped gold deposits currently in existence and was also the single most exciting exploration success story since of the new millennium. It had all the ingredients that make Junior mining so seductive, a massive high grade gold-silver discovery in a remote jungle, a wild ride on the stock price from $0.40 to over $40.00 and a takeout by a major at a premium. It also epitomized the crash with a greedy government bringing in a huge windfall tax, massive writedowns, following the collapse of the commodity prices, and final the shelving of the project for the foreseeable future and a 10 Million ounce gold deposit being valued at $0. Now like a phoenix the deposit has risen from the ashes with a new team and new optimism.

Location & Ownership

The deposit which is located in the jungles of Eastern Ecuador, near the Peruvian border, is within an 86,000 hectare property that hosts numerous other gold showings. The property is reachable by a 40 kilometre gravel road from a paved highway.

It was discovered by Aurelian Resources in 2006, Aurelian was acquired by Kinross in 2008, who then sold 100% of it to Lundin Gold (TSX:LUG), a new gold company founded by Lucas Lundin, in 2014.

Geology

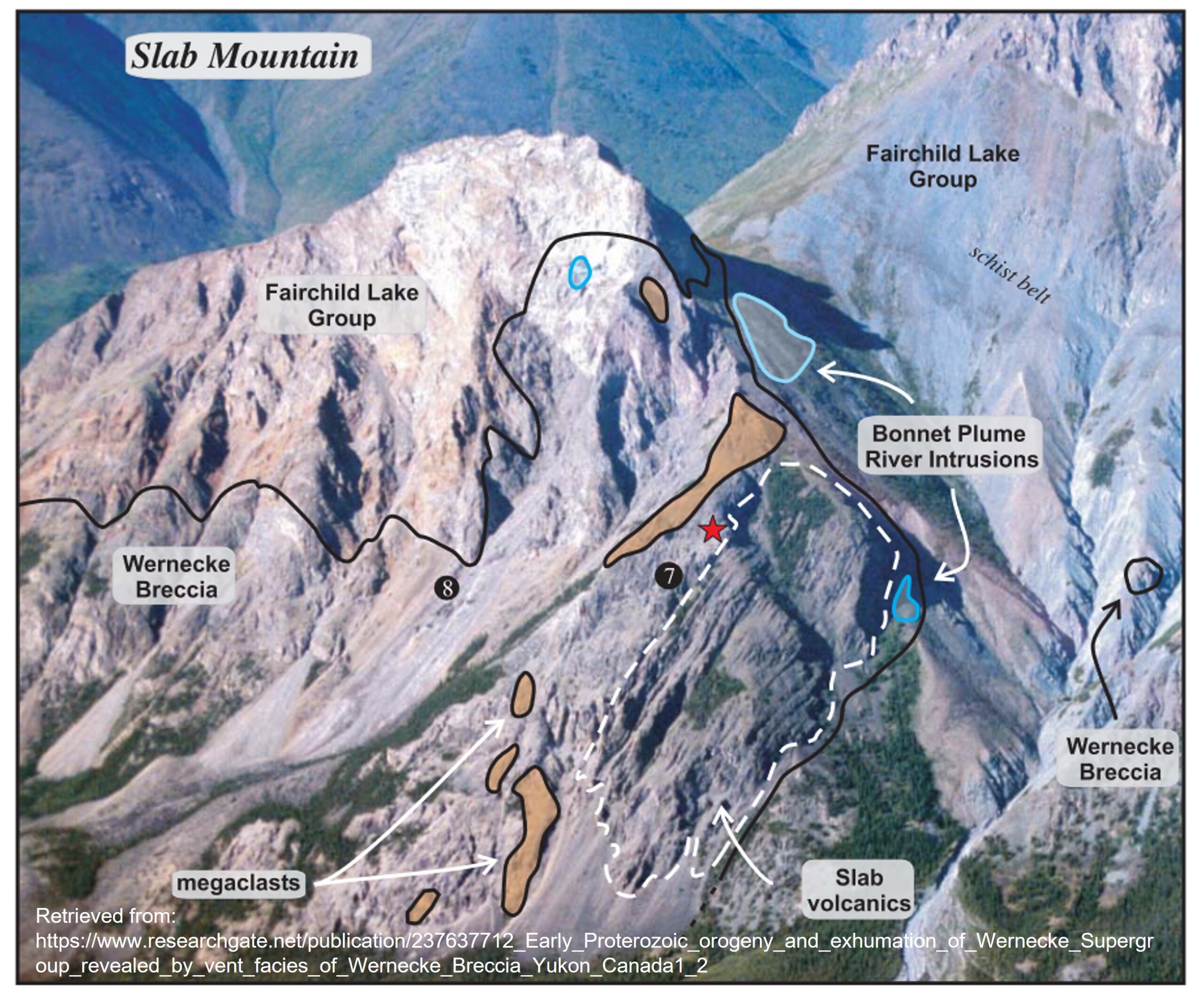

The Fruta Del Norte deposit is a blind (invisible from the surface) and is considered an intermediate sulfidation system which means that it was deposited from mildly acidic waters. The “sulfidation” refers to the impregnation of the rock with sulfide, hence the more sulfides, the more “acid” the fluid that deposited the mineralization was. Structurally the deposit is located in a small basin formed by the regional strike-slip fault. This fault was active during the emplacement of the deposit and then contributed to its rapid burial, and preservation. The deposit itself is hosted in breccias and quartz-sulfide veins created by a paleo-hotspring, much like in modern New Zealand at Rotarua.

It is a Jurassic age deposit and it appears to be related to the intrusion of the Zammora batholith which is the roots of a continental magmatic arc, that formed as South America moved west during the breakup of Pangea. As the South America moved away from Africa, it began to subduct the oceanic plate to the west, which created melting that drove the magmatism and development of the deposit.

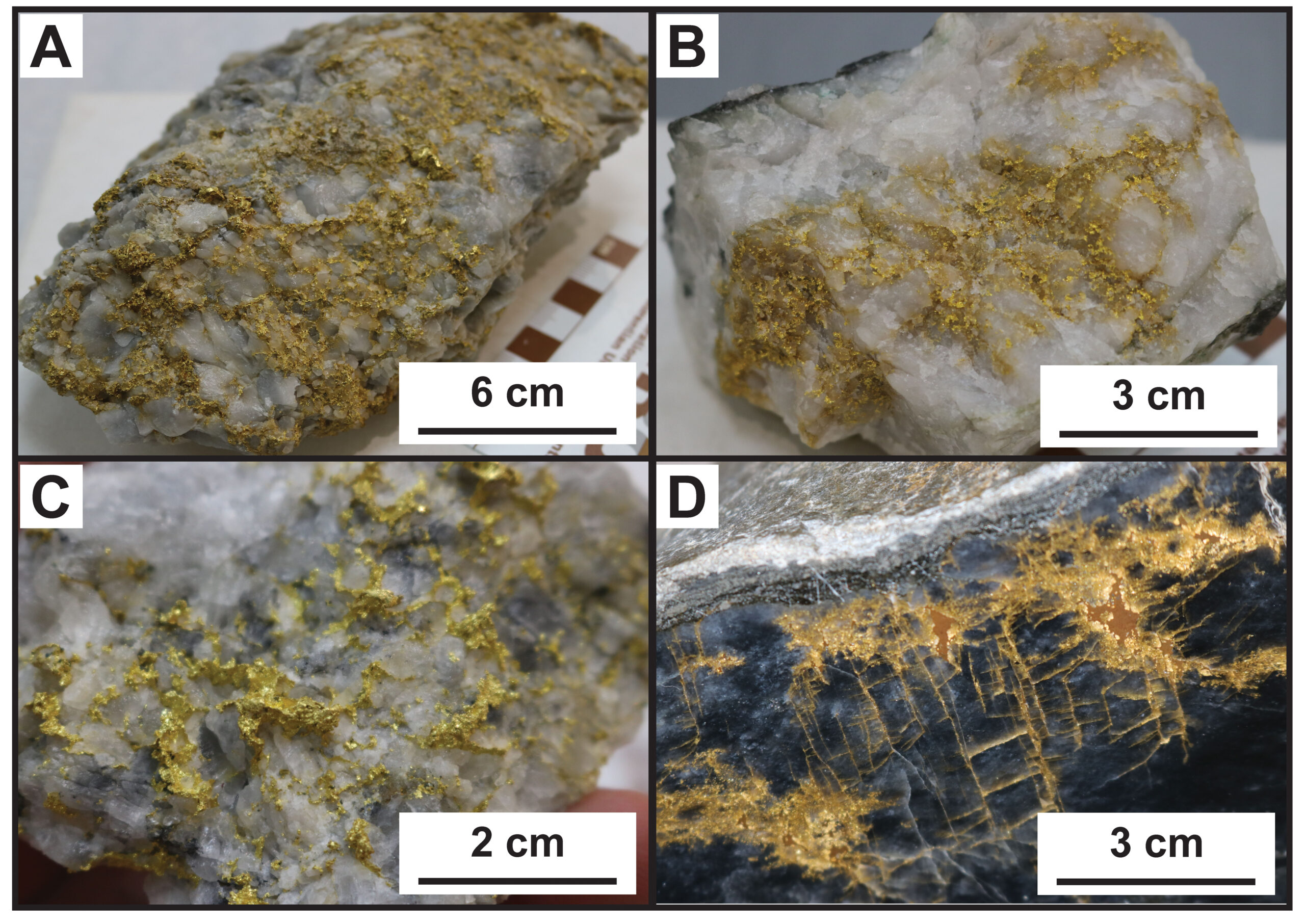

Mineralization is a mixture between native gold and silver salts with minor base metal sulfide such as sphalerite and chalcopyrite. The mineralization is concentrated in the veins where openings created opportunities for the waters to boil off depositing their metallic load. The gold itself ranges from invisible to large visible veins and is dominantly (60%) “free milling” or not being in solid solution within a sulfide mineral.

Current reserves and resources stand at 23.5 million tonnes at an average grade of 9.59 g/t Au and 12.9 g/t Ag for a total of 7.26 million ounces of gold and 9.73 million ounces of silver. Inferred Mineral Resources are estimated to total 14.5 million tonnes at an average grade of 5.46 g/t Au and 2.55 g/t Ag for a total of 2.55 million ounces of gold and 5.27 million ounces of silver

Story

As mentioned above the discovery and subsequent history of the Fruta Del Norte deposit was a microcosm of the promise of the industry, and it’s fall from grace. The deposit was discovered by Aurelian resources in 2006, testing a blind Induced Polarization anomaly which had been passed over at first to look at other mineralization. Down to the last few dollars in the treasury, 3 holes were drilled in early 2006 with two intersecting only alteration and the third hitting 237 metres of 4.14 g/t gold and 8.5 g/t silver. Patrick Anderson Aurelian’s president at the time takes up the story “We were nearly out of money…We had no audience. The phone calls weren’t being returned. That was very frustrating,” …. “I checked (the assay results). Re-checked them. Called up the lab to make sure there weren’t any errors,” Anderson recollects. “I was terrified, terrified that we screwed up somehow.” (from an interview in Mining Markets May 2009). It was not a screw up and the market reaction was instantaneous and rapidly propelled the stock up from under a dollar to over $40 in a few months. From this wild visions of wealth began to grow in people’s eyes, as Patrick Anderson tell it “ There was this 200 Club group of shareholders who were all going to hold on until the stock reached two-hundred dollars. They had sold themselves on this dream of another rocketing share price….” There were other more serious players who saw a gold mine as well. In early 2008 the Ecuadorean government introduced a 70% commodity based windfall tax, and revoked hundreds of concessions. It then followed that up by suspended all exploration and development across the country to give it time to formalize a mining law. This had a chilling effect on the stock price to say the least.

In 2008 amid much acrimony the gold mining major Kinross acquired Aurelian for $1.2 Billion dollars, and set about the arduous task of negotiating with the Ecuadorean government to develop the deposit. Despite coming close in 2011, a collapsing gold price, the intransigence of the Ecuadorean government, and overextension elsewhere put Kinross in an unworkable position and facing severe retrenchment, they walked, writing down the deposit to $0 and taking a $720 million hit to the balance sheet. They also pitched their CEO out the window for good measure. At the time it was symbolic of the many ills plagueing the mining industry.

Now out of the ashes a new company has come along to try and develop the deposit. Ecuador shocked by Kinross’s decision to walk seems to have reconsidered its position. The vanguard of mining exploration high level visionaries such as Lucas Lundin have decided the time is right to make a move. Will the deposit see the light of day? Is this a bellweather that the industry so desperately needs? Will the mining industry follow? Questions abound that only time can answer and I eagerly await to write the next chapter of this fascinating deposit.

Read More

http://www.lundingold.com/s/home.asp

http://business.financialpost.com/2013/06/11/why-kinrosss-gamble-in-ecuadors-fruta-del-norte-failed/

http://blog.milesfranklin.com/the-only-major-gold-discovery-in-a-decade-gone-goodbye

http://www.miningmarkets.ca/news/effin-anderson/1000229419/?&er=NA

Subscribe for Email Updates