Investing in the mining industry has its risks, but it can also lead to great rewards. The same can be said for option agreements.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

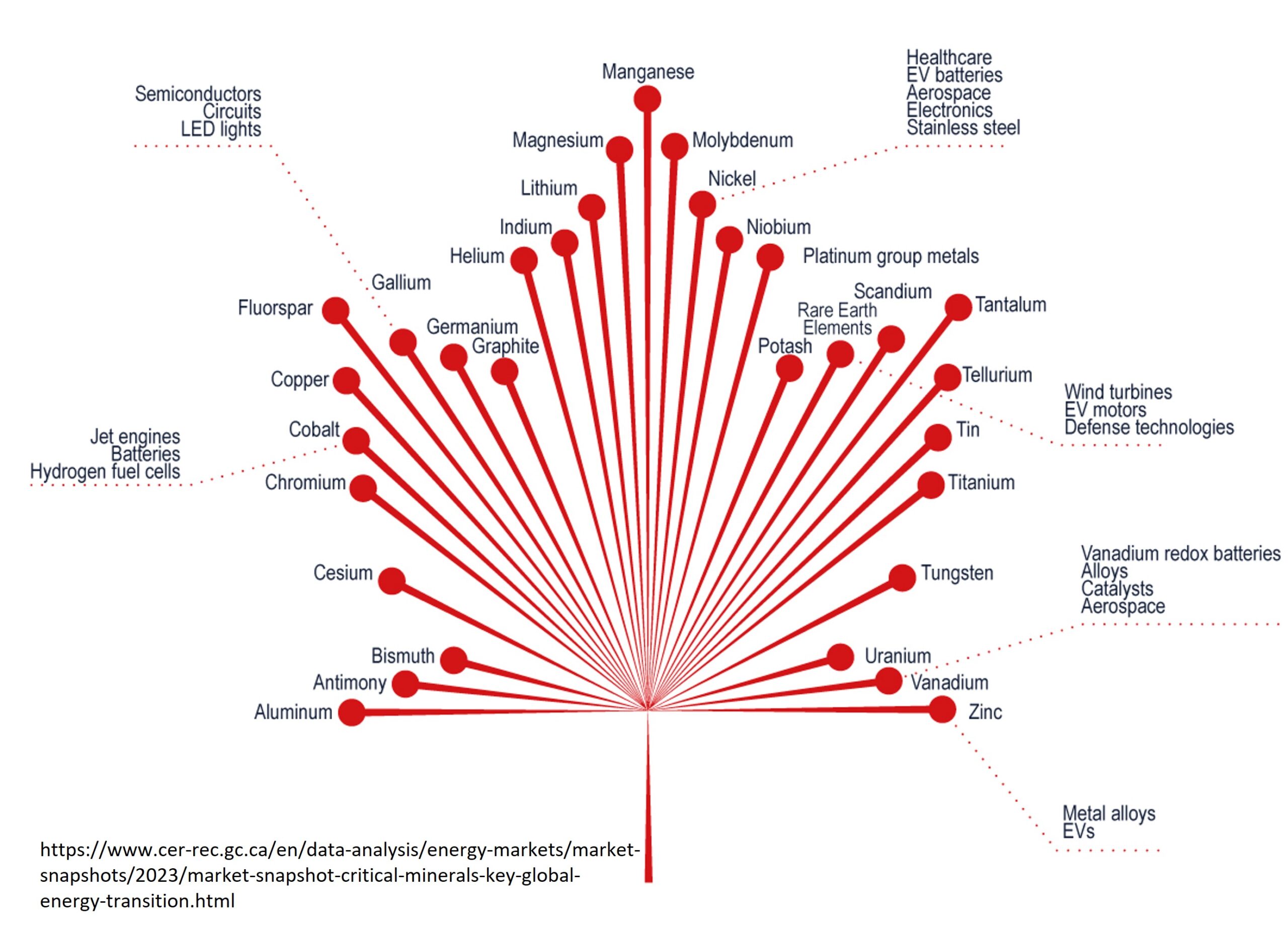

MONTREAL, QC–(Marketwired – June 16, 2014) – Adventure Gold Inc. (TSX VENTURE:AGE) and GFK Resources (TSX VENTURE: GFK) wish to announce the initial results of the 2014 exploration diamond drilling program on the Casa-Cameron project. The program totaling 9,000 metres of drilling, of which the Phase 1, has been completed on the Florence property outlined two gold zones over at least 1.5 kilometre along strike and up to 300 metres at depth. The gold zones are associated with a large alkaline intrusive complex along the Casa-Berardi – Cameron Gold Trend (CBCGT). The Florence property is located 23 kilometres north of the town of Lebel-sur-Quevillon, about 70 kilometres east of the Sleeping Giant mine and mill and about 60 kilometres southwest of the Bachelor mine and mill.

[box type=”note” align=”aligncenter” ]This particular release gives us the opportunity to talk a little about option agreements. Adventure Gold is a junior exploration company based out of Quebec, Canada who actively explores within the Abitibi-Greenstone belt, an historic gold-producing district. GFK resources is another junior mining company based out of Nova Scotia, Canada. Adventure Gold and GFK resources signed an option agreement in December 2013 for GKF to act as a pursuant of the Casa-Cameron Project. This news release is reporting on the results from the first phase of drilling which began March 3rd. The “Florence Property” is part of the larger Casa-Cameron Project.

These days, its tough to raise money for exploration and many companies are optioning property for whatever they can get. Often, a commitment to do some work on a property is enough to seal the deal. In this case, Adventure Gold seems to have made a pretty lucrative deal with GKF. The company will get $250,000 plus 2,000,000 shares of GFK at a minimum. GFK is obligated to spend between $1.5 and $2.0 million on exploration within the next year or so and follow up with further cash payments and expenditures if they want to continue. In all, the deal could be worth $10 million plus to Adventure. If GFK successfully advances the project it will benefit both firms. If they cannot or do not continue to meet the project milestones, the property will revert back to Adventure’s control.

GFK resources has a fairly strange history. The company used to be known as Zim Gold before acquiring Deco Creative Group (an internet development company) and changing their focus from an exploration company to Internet Development (known as Noise Media) in 2001. In January 2008 the company reverted back to mineral exploration and re-branded as GFK Resources. (I’d say mining and the internet have nothing in common, but who are we to argue?)

[/box]

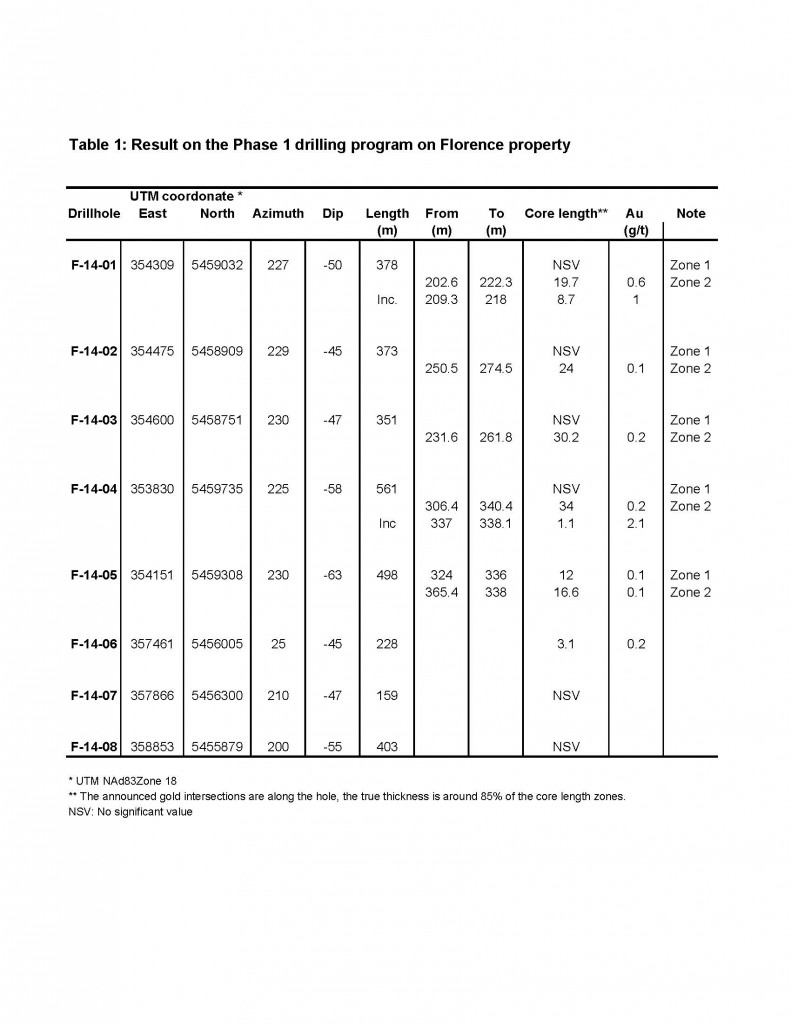

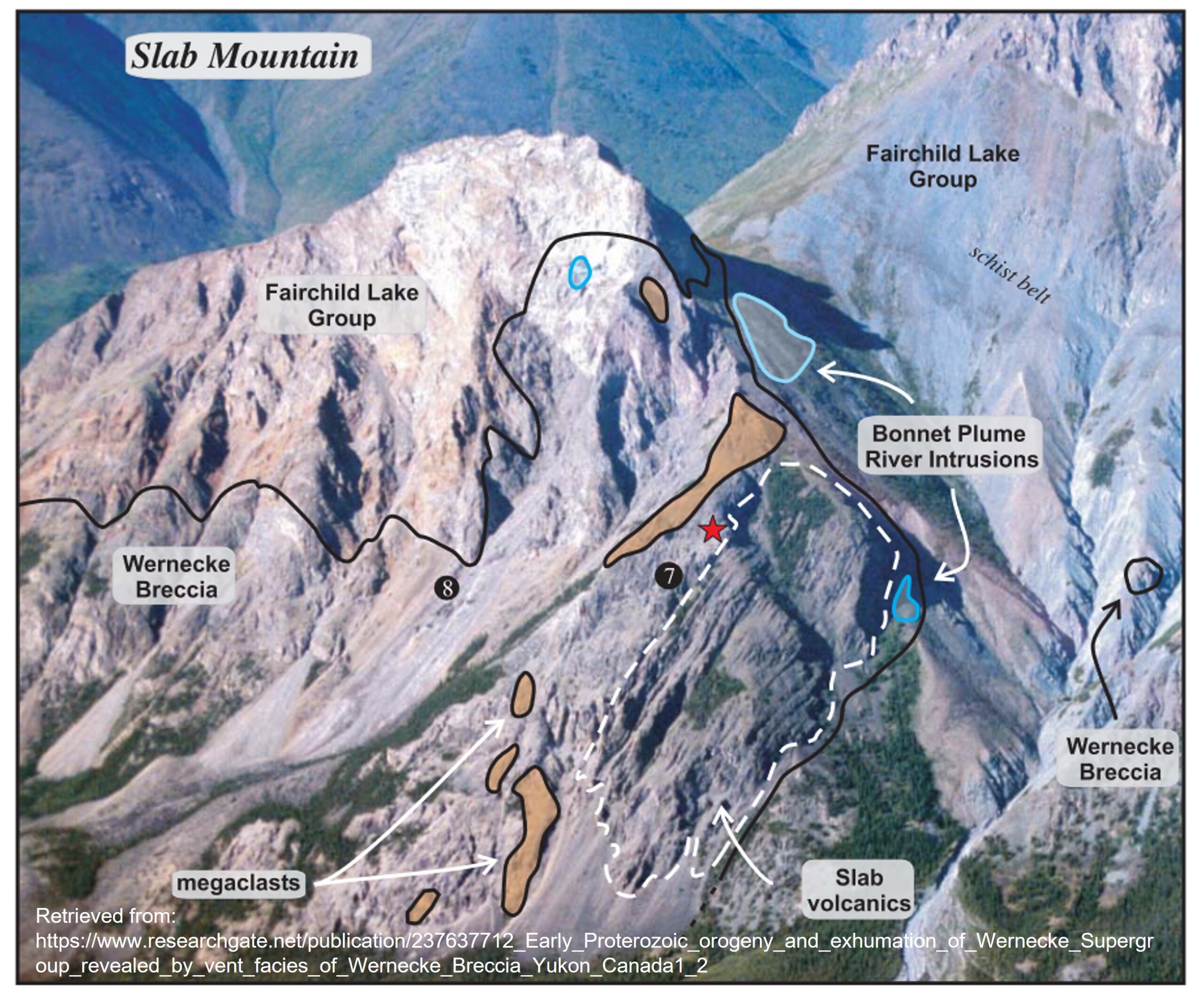

The Phase 1 drilling program on the Florence property consisted of eight (8) diamond drill holes totaling 2,951 metres (Figure 1). The first five (5) drill holes were designed to test the Chieftain gold deformation over a strike length of 1.5 km around a 200 to 300 metres depth (Figure 2). Three (3) other holes tested Induced polarization (IP) and Megatem (EM) anomalies in the area of new gold showing discovered by Adventure Gold (7.0 g/t and 3.2 g/t Au in grab samples). Drilling confirmed the presence of a large gold system associated with two major gold deformation zones up to 45 metres in thickness. The best intersect returned 0.6 g/t Au over 20 metres including 1.0 g/t Au over 9 metres in hole F-14-01 at a 160 metre depth. Other results are presented in Table 1.

[box type=”note” align=”aligncenter” ]The company is making use of a number of geophysical survey methods including downhole IP and Megatem. Geophysical instruments can be lowered down fresh drill holes to measure electrical and magnetic properties of the rocks. This is often referred to as “downhole geophysics”. Induced Polarization (IP) surveys are can be useful for identifying zones of potential chargeability and in situations where the mineralization is dispersed (instead of continuous), IP is a method of choice. Alteration halos in these gold deposits may contain finely dispersed sulfides such as pyrite that may contain gold, or lead to areas of high grade gold mineralization. IP surveys use the ground as a sort of battery to test for these dispersed metallic minerals. A Megatem is an airborne geophysical survey method used to measure the electrical and magnetic properties of the rock. [/box]

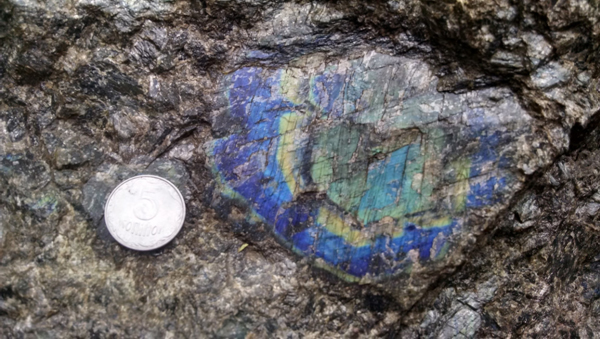

The two gold deformations zones are characterized by a large alteration envelop of carbonate, chlorite and hematization and intruded by deformed metric alkaline dykes. Gold is associated with hematite-silica-albite alteration (Pictures 1 and 2) generally located in the central part of the deformation zone. The gold system remains open laterally and at depth. The south-east extension remains untested by drilling for over five (5) kilometres where several promising untested IP anomalies have been outlined (Figures 1 and 2). Additional fieldwork is scheduled this summer to evaluate IP anomalies and to formalize new drilling target. Additional drilling is required to adequately evaluate this large gold system.

“Initial drilling program on the Florence property confirmed the presence of a large alkaline gold system typical of many gold mining camps in the Abitibi Greenstone Belt. All the key geological features are there and further exploration work is definitively warranted,” stated Marco Gagnon, President and CEO of Adventure Gold.

“The confirmation of a 1.5 kilometre gold trend on Florence is proof that this is a significant system with all the indicators of a major gold deposit. We are pleased to be involved in this project, and we look forward to the commencement of the upcoming phases of fieldwork,” stated Patrick Fernet, CEO of GFK Resources.

[box type=”note” align=”aligncenter” ]Although the drill results appear very low grade, gold is present along some reasonably thick intervals and some of those intervals are fairly decent considering the shallow depth. The company will need to use this information to help them develop their deposit model and plan future drilling. We also need to keep in mind that these drill results don’t’ reflect the true thickness of the mineralization. [/box]

Other Casa-Cameron properties exploration work

Additional geophysics (IP and Mag) and prospecting work is scheduled for this summer. A total of 33 line-kilometres of IP will be completed on Casagosic, Bell-Vezza and Sinclair-Bruneau properties, 90 km of ground magnetics on Vezza North, Vezza Extension, and Sinclair-Bruneau properties and 40 days of prospecting work on Florence and Bachelor Extension properties. The next 3,000 metres drilling program is slated to begin in August on the Vezza North property to test kilometre-scale gold deformation zones with historical gold values of 11 g/t Au over 4 metres and 4.5 g/t Au over 3.4 metres within a zone grading 2.1 g/t Au over 8.5 metres between 100 to 200 metres of the surface and open in all direction.

[box type=”note” align=”aligncenter” ]Adventure Gold and GFK resources plan on completing further exploration on other claims within it’s Casa-Cameron Project including ground magnetics. These types of surveys are useful for detecting the presence of magnetic minerals such as pyrrhotite and magnetite which may be associated with gold. [/box]

The Casa-Cameron Project

The Casa Cameron Project includes nine (9) gold Properties (436 mining claims): (1) Casagosic, (2) KLM, (3) Vezza North, (4) Vezza Extension, (5) Bell-Vezza, (6) Sinclair-Bruneau, (7) Florence, (8) Céré-113 and (9) Bachelor Extension (see Press Release dated March 3, 2014 and the web site). The Properties are located north of La Sarre, Amos and Lebel-sur-Quevillon, in the northwest region of the province of Quebec and they are accessible all year long by paved and gravel roads. GFK and AGE have an agreement pursuant to which GFK has acquired the option to earn between 51% or 100% interest in AGE’s Casa-Cameron project covering an area of 231 km² (see Press Release dated December 12th, 2013).

The Properties straddle segments of the major Casa-Berardi/Cameron gold break between the Casa-Berardi Gold Mine (proven reserves of 1.0 Mt at 5.7 g/t Au for 185,200 ounces and probable reserves of 7.2 Mt at 5.2 g/t Au for 1.2M ounces for a total of proven and probable reserves of 8.2 Mt at 5.3 g/t Au for 1.4M ounces; measured resources of 1.8 Mt at 5.9 g/t Au for 340,600 ounces and indicated resources of 9.0 Mt at 3.7 g/t Au for 1.1M ounces for a total of measured and indicated resources of 10.8 Mt at 4.1 g/t Au for 1.4M ounces and inferred resources of 3.4 Mt at 5.5 g/t Au for 601,300 ounces – Hecla Mining (formerly Aurizon Mines), NI 43-101, March 31, 2014) and the Bachelor Gold Mine (also currently in operation by Metanor Resources with proven reserves of 193,100 Mt at 8.3 g/t Au for 51,750 ounces and probable reserves of 650,700 t at 7.1 g/t Au for 148,400 ounces for a total of proven and probable reserves of 843,800 t at 7.4 g/t Au for 200,200 ounces and inferred resources of 426,100 t at 6.5 g/t Au for 89,400 ounces – Metanor Resources, NI 43-101, April 26, 2011). All the Properties contain known gold-bearing zones and most of them are also strategically located adjacent and on strike to significant gold mines or deposits. However, at their exploration stages, the Properties have had insufficient exploration to define mineral resources and despite their strategic locations it is uncertain if further exploration will result in delineating mineral resources.

[box type=”note” align=”aligncenter” ]The Casa-Cameron project is between a large structural corridor known as Casa-Beradi/Cameron gold trend and host to several producing mines. But even in this press release GFK resources and Adventure Gold have to remind the reader that this project is in a very early exploration stage and it is unknown whether further exploration will result in an estimated resource. [/box]

Very few exploration programs using up to date technology have been completed on the Properties from the 1990’s to 2008, prior to their acquisition by Adventure Gold. Gold exploration work conducted by Adventure Gold since then returned very encouraging results and many valuable drill targets were outlined (see the Company’s press release dated June 11, 2013 and the technical report (the “Report”) filed by GFK on SEDAR in connection with the transaction and prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”)). As described in the Report, the geological setting of the Casa-Cameron properties appears to be very favorable for the identification of new high-grade gold-bearing structures or bulk-style ore deposit. Past exploration work did not entirely test the numerous gold occurrences and many positive historical drilling intersections warrant follow-up drilling. In addition, recent geophysical surveys outlined also quality drilling targets. The authors of the Report recommend significant exploration work including a 21,000-meter drilling program (see the Report available on AGE’s website).

Quality control

Mr. Jules Riopel, Vice-President Exploration and Acquisitions of Adventure Gold and Denis Chenard, P.Eng. of GFK Resources act as the qualified persons (as defined by NI 43-101) and have reviewed and approved the scientific and technical information in this press release. Adventure Gold is acting as the field operator for the exploration work on the Casa-Cameron project during the first option as per the agreement between AGE and GFK.

During the ongoing drilling program, assay samples were taken from the NQ core and sawed in half, with one-half sent to Agat Laboratory, a commercial laboratory and the other half retained for future reference. A strict QA/QC program was applied to all samples; which includes insertion of mineralized standards and blank samples for each batch of 20 samples. The gold analyses were completed by fire-assayed with an atomic absorption finish on 50 grams of materials. Repeats were carried out by fire-assay followed by gravimetric testing on each sample containing 3.0 g/t gold or more.

[box type=”note” align=”aligncenter” ]Note the company’s QA statement. Quality Assurance/Quality Control (QA/QC) programs are important for ensuring the accuracy of reported assay results.

As of writing Adventure Gold’s stock is currently trading at $0.18, down from it’s 52-week high of $0.25. Seven months ago, GFK resources stock was trading at a 52-week high of $0.43 and is currently trading at $0.23. Investing in the mining industry has its risks, but it can also lead to great rewards. The same can be said for option agreements. Although the knowledge of the property advances, it could either benefit or potentially damage a property’s reputation. It’s a gamble and it will be interesting to see who comes out the real “winner”. Bad drill results could lead to either the owner or both parties being tied to a “valueless” property. Good drill results might leave the pursuant the victor and lead to a rally in stock value.

[/box]

Profile

Adventure Gold Inc. is a mineral exploration company focused on discovering and developing high-quality gold deposits in the Abitibi region located in eastern Canada – one of the richest gold mining areas in the world. Adventure Gold has become, in a few years, an important player in the mineral exploration industry with one of the best portfolios of exploration properties along the main gold-bearing structures of the Abitibi Greenstone Belt. The Company is exploring mainly close to gold mines where mining production infrastructure is already in place, which distinguishes it from several other exploration companies. Adventure Gold’s exploration team consists of mining professionals having worked previously for well-established producing companies, who understand industry challenges. The Company owns 100% of the rights on its two main projects namely: Val-d’Or East and Detour Quebec.The Val-d’Or East flagship project encompasses the Pascalis-Colombiere property where Cambior Inc. (now IAMGOLD) produced gold between 1989 and 1993 at the Beliveau Mine. Close to the former mine, Adventure Gold recently discovered a significant new gold system containing 770,000 gold ounces at 2.63 g/t in the inferred resource category (SGS Canada Inc., NI 43-101 Technical Report Mineral Resource Val-d’Or East Property filed on Jan. 4th, 2013) and is actively working on its development. With a total of 74.0M shares issued and close to 10% owned by the management, Adventure Gold is well-positioned to benefit its shareholders.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]